Archive

Letter to the editor – Bill English admits immigration driving economy

.

.

from: Frank Macskasy <fmacskasy@gmail.com>

to: Dominion Post <letters@dompost.co.nz>

date: 12 June 2017

subject: Letter to the editor.

The Editor

Dominion Post.

On 16 June last year, then-Finance Minister, Bill English attributed our growth to “other sectors” of the economy;

“Despite the dairy sector continuing to be under pressure, other sectors are performing well and contributing to an overall solid rate of economic growth.”

He never acknowledged the role played by massive immigration in our so-called “economic growth”. To do so would admit that our “growth” was artificial and unsustainable, and putting pressure on housing and social services.

As Labour unveiled it’s new immigration policy this week, English was forced to concede;

“A 30,000 reduction in migration right now will stall the economy, it’ll deprive businesses of the skills they need to enable them to make the investments they want to make, to grow New Zealand. “

It’s official: our “growth” is an illusion.

Like a “sugar hit” from junk-food, immigration is not really energising our economy. On 18 March last year, English admitted that real national disposable income-per-capita fell by 0.4%. Again, he put the blame anywhere but at immigration;

“You’ve got a big drop in national income, because dairy prices are down.”

Again he let slip;

“At the same time you’ve had surprisingly high migration numbers. So it’s not surprising that when you work the figures you get a drop in national disposable income.”

Like Auckland’s ballooning house-bubble prices, economic “growth” based on migration is a mirage. Eventually those balloons will burst and we’ll be left to tidy up National’s nasty mess.

It beggars belief how National ever gain it’s reputation for “sound economic stewardship”.

.

-Frank Macskasy

.

[address and phone number supplied]

.

.

.

References

Fairfax media: Labour unveils plans to stop foreign students’ ‘backdoor immigration’ rort

Radio NZ: Incomes dropping despite GDP growth, English admits

Fairfax media: New Zealand’s economic growth driven almost exclusively by rising population

.

.

.

.

This blogpost was first published on The Daily Blog on 14 June 2017.

.

.

= fs =

Letter to the editor – Bill English dives head first into the cover-up cess-pool

.

.

from: Frank Macskasy <fmacskasy@gmail.com>

to: Listener <letters@listener.co.nz>

date: 4 April 2017

subject: Letters to the editor.

The editorThe Listener

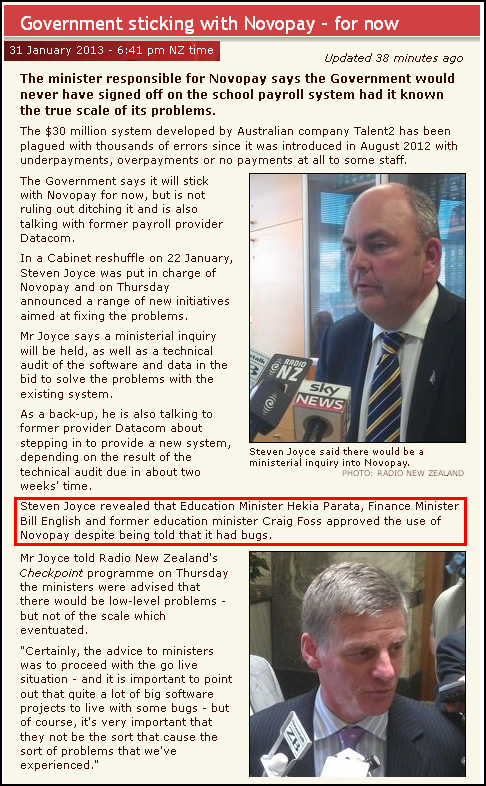

.On 3 April, our esteemed Prime Minister, Bill English, announced that there would be no independent commission of inquiry into allegations of civilian deaths, injuries, and deliberately destroyed homes in a SAS-led raid in Tirgiran Valley in 2010. It was also alleged that a prisoner was handed over to Afghan security forces where torture was a well-known interrogation technique.

English’s excuse;

“After considering [that] briefing, [General Keating’s] letter to [Defence Minister] Gerry Brownlee and viewing video footage of the operation, I’ve concluded there is no basis for ordering an inquiry.”

I trust the facts as presented.”

English’s explanation for refusing an impartial inquiry defies credulity.

In effect, an instigator of an alleged crime – the NZ Defence Force – was asked to provide a reason to avoid an inquiry. The NZDF duly complied.

What did English expect, a full admission of wrong-doing by New Zealand forces in Tirgiran Valley? A written, signed confession?

Is this to be the new standard of accountability from National? That any allegations of impropriety is put to alleged offenders; they deny wrong-doing; and English accepts said denials without question?

Let us not forget that on 21 March, the NZDF responded to allegations of civilian deaths and injuries at Naik and Khak Khuday Dad with a flat-out denial;

“The investigation concluded that the allegations of civilian casualties were unfounded.”

Six days later, Defence Force chief, Tim Keating admitted “possible” casualties;

“Subsequent information, received after Operation Burnham indicated that civilian casualties may have been possible […] The investigation team concluded that civilian casualties may have been possible due to the malfunction of a weapon system.”

Both statements are currently viewable on the NZDF website.

By resisting calls for an inquiry, English has implicated himself in a possible cover-up.

There is no other way to interpret his words...-Frank Macskasy

.

[address and phone number supplied]

.

Appendix

Email addresses for newspapers for other budding letter-writers wanting to express their demand for a Commission of Inquiry. (Maximum word-length stated in brackets)

Daily Post (250 words)

editor@dailypost.co.nz

Dominion Post (200 word limit)

letters@dompost.co.nz

Listener (300 word limit)

editor@listener.co.nz

NZ Herald (200 word limit)

editor@herald.co.nz

Otago Daily Times (150 words)

odt.editor@alliedpress.co.nz

The Press (150 words)

letters@press.co.nz

Southland Times (250 words)

letters@stl.co.nz

Sunday Star Times (150 word limit)

letters@star-times.co.nz

Waikato Times (200 words)

editor@waikatotimes.co.nz

.

.

.

References

Radio NZ: ‘No basis’ for Afghan raid inquiry – PM

New Zealand Defence Force: NZDF Response To Book

New Zealand Defence Force: Speech notes for Press Conference on Operation Burnham (p6)

Previous related blogposts

Letter to the editor – Commission of Inquiry, NOW!

.

.

.

This blogpost was first published on The Daily Blog on 5 April 2017.

.

= fs =

Letter to the editor – Commission of Inquiry, NOW!

.

.

from: Frank Macskasy <fmacskasy@gmail.com>

to: Dominion Post <letters@dompost.co.nz>

date: 31 March 2017

subject: Letter to the editor.The EditorDominion Post

.Since the release of Nicky Hager and Jon Stephenson’s “Hit and Run” on 21 March, the public has been treated to denials and conflicting information from the NZDF.

On 21 March, the NZDF responded to allegations of civilian deaths and injuries at Naik and Khak Khuday Dad with this statement on their website;

“The investigation concluded that the allegations of civilian casualties were unfounded.”

Six days later, Defence Force chief, Tim Keating stated;

“Subsequent information, received after Operation Burnham indicated that civilian casualties may have been possible […] The investigation team concluded that civilian casualties may have been possible due to the malfunction of a weapon system.”

Both statements are currently viewable on the NZDF website. They are irreconcilable.

Journalists Hager and Stephenson have presented considerable evidence to back up their investigation findings, including death certificates for those killed in the SAS-led raid.Bill English has refused to undertake a commission of inquiry for reasons that remain unclear.

Until an Inquiry is held, there exists a cloud of suspicion hanging over the NZDF, and the SAS. This is not good enough, especially as there is ample evidence innocent people may have been killed.

What more does Mr English need to warrant an inquiry?

.

-Frank Macskasy

(Address and phone number supplied)

.

Appendix1

.

.

.

.

Appendix2

Email addresses for newspapers for other budding letter-writers wanting to express their demand for a Commission of Inquiry. (Maximum word-length stated in brackets)

Daily Post (250 words)

editor@dailypost.co.nz

Dominion Post, (200 word limit)

letters@dompost.co.nz

Listener (300 word limit)

editor@listener.co.nz

Otago Daily Times (150 words)

odt.editor@alliedpress.co.nz

The Press (150 words)

letters@press.co.nz

NZ Herald (200 word limit)

editor@herald.co.nz

Southland Times (250 words)

letters@stl.co.nz

Sunday Star Times (150 word limit)

letters@star-times.co.nz

Waikato Times (200 words)

editor@waikatotimes.co.nz

.

.

.

References

New Zealand Defence Force: NZDF Response To Book

New Zealand Defence Force: Speech notes for Press Conference on Operation Burnham (p6)

.

.

.

.

This blogpost was first published on The Daily Blog on 1 April 2017.

.

.

= fs =

The Mendacities of Mr English – The covert agenda of high immigration

.

.

Context

Bill English was recently caught on-the-spot when challenged why National was permitting high immigration at a time when unemployment was still high, and rising.

Make no mistake, National has opened the floodgates of immigration because it is an easy way to artificially stimulate the economy. This was pointed out in May 2011, by then-Immigration Minister, Jonathan Coleman, who trumpeted the contribution made by immigration to economic growth;

“All of us have a vested interest in immigration and I’m pleased to share with you some specific actions the Government is taking to enhance Immigration’s contribution to the economy, service improvement and changes to business migration.

[…]

…I’m confident that you will acknowledge the partnership approach that Immigration is now taking to provide tangible improvements to help support New Zealand’s economic growth.

[…]

Considering the economic challenges the country faces, lifting immigration’s economic contribution takes on more importance.”

Justifying the need for high immigration to generate economic growth, Coleman cited “New Zealand [going] into deficit in 2009 after several years of surpluses and the economic situation has been compounded by the September and February earthquakes” and unsustainably “borrowing $300 million dollars a week to keep public services ticking over“.

Coleman admitted that “If we were to close off immigration entirely by 2021… GDP would drop by 11.3 per cent“. He revealed that, “new migrants add an estimated $1.9 billion to the New Zealand economy every year“.

Easy money.

The downside to high immigration has been to put strain on critical services such as roading and housing, and reduce demand for locally trained workers to fill vacancies. There is a downward pressure on wages, as cheaper immigrant-labour is brought into the workforce.

As Treasury pointed out in June last year;

“There is a concern that recently there has been a relative decline in the skill level of our labour migration. The increasing flows of younger and lower-skilled migrants may be contributing to a lack of employment opportunities for local workers with whom they compete.”

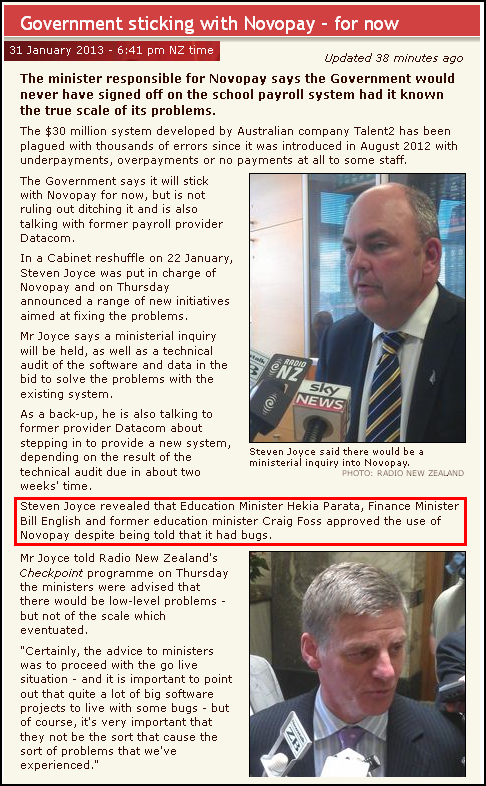

Faced with increasingly negative indicators from high immigration, English was forced to explain why we were seeing high immigration at a time of rising unemployment;

.

.

English’s response was predictable if not offensive.

.

Playing National’s Blame Game

As per usual strategy, English defaulted to National’s strategy of Default Blame-gaming. When in trouble;

- Blame the previous Labour government

- Blame ‘welfare abuse’/Release a ‘welfare abuse’ story in the media

- Blame Global Financial Crisis or similar overseas event

(If the trouble is Auckland-centered, Default #4: Blame Auckland Council/RMA/both.)

This has been the pattern of National’s policy to shift blame elsewhere for it’s consistently ineffectual policies;

.

.

The Blame Gaming was applied recently to National’s appalling do-nothing record on housing;

.

.

Resorting to Deflection #2, English had the cheek to blame young unemployed for our high immigration level;

“One of the hurdles these days is just passing the drug test … Under workplace safety, you can’t have people on your premises under the influence of drugs and a lot of our younger people can’t pass that test.

People telling me they open for applications, they get people turning up and it’s hard to get someone to be able to pass the test – it’s just one example.

So look if you get around the stories, you’ll hear lots of stories – some good, some not so good – about Kiwis’ willingness and ability to do the jobs that are available.”

His comments on 27 February were echoing previous, similar sentiments in April last year, when he again abused unemployed workers as “hopeless”;

.

.

Quite rightly, English’s comments were condemned by many. English admitted that his comments were based solely on “anecdotal evidence” . This is the worst form of evidence possible as absolutely no confirmation by way of actual, real data is involved. “Anecdotal evidence” panders to prejudice – a difficult thing to shift even when real evidence proves to the contrary.

Real evidence surfaced only a day after English made his slurs against the unemployed, when it was revealed that out of over 90,000 (approx) welfare beneficiaries, only 466 failed pre-employment drug tests over a three year period. That equates to roughly to 155 failed tests out of 30,000 per year.

Government figures show beneficiaries have failed only 466 pre-employment drug tests in the past three years.

[…]

The Ministry of Social Development said the 466 included those who failed and those who refused to take the test.

Some failed more than once.

The ministry did not have the total figure for how many tests were done over the three years, but said there were 32,000 pre-employment drug tests in 2015.

Those 466 over a three year period consisted of (a) those who failed the test, (b) those who refused to take the test, and (c) some failing more than once.

Put another way, 155 failed tests out of 30,000 per year equates to half a percent fail rate.

Which means that 99.5% of beneficiaries are clean, according to MSD’s own collected data.

There was further confirmation of low fail rates from another media story. On the same day as the Ministry of Social Development released it’s data on failed drug tests, The Drug Detection Agency revealed that fail-rates were as low as 5%;

While the rate of positive tests has remained at about 5 percent, the company is doing more tests and therefore failing more people, said its chief executive, Kirk Hardy.

“We’ve seen an increase overall in our drug testing and we now, annually, conduct about 144,000 drug tests,” he said.

Looked at another way, 95% of the workforce was clean.

Which simply confirms Bill English to be the typical manipulating, lying, politician that the public so consistently distrust and despise.

However, English has his own sound reasoning for blaming welfare beneficiaries for this country’s immigration-caused problems. He has to do it to obscure the two reasons why National has opened the tap on immigration as far as they can possibly get away with…

.

Cargo-cult Economics

Remember that in May 2011, then-Immigration Minister, Jonathan Coleman revealed;

“If we were to close off immigration entirely by 2021… GDP would drop by 11.3 per cent“.

A 11.3% fall in GDP would have pushed New Zealand into a deep recession, matching that of the early 1990s.

This was especially the case as only a few years ago the economy was suffering with an over-valued New Zealand dollar. Manufacturing and exports had slumped;

.

.

Combined with the multi-billion dollar Christchurch re-build, mass-immigration was National’s “quick-fix” solution to boosting the economy. It might cause problems further down the track, but those were matters that National could address later. Or better still, leave for an incoming Labour-Green government to clean up the resulting socio-economic mess.

This is quasi-cargo-cult economics, 21st century style.

.

The Not-so-Free-Market

In Coleman’s May 2011 speech, he also referred – indirectly – to the second rationale for opening the floodgates of mass-immigration;

“If we were to close off immigration entirely by 2021… The available labour force would drop 10.9 per cent“

This was critical for National.

A crucial tenet of free market capitalism (aka neo-liberalism) is that the price of labour (wages and other remuneration) should be predicated on supply and demand;

The higher the wage rate, the lower the demand for labour. Hence, the demand for labour curve slopes downwards. As in all markets, a downward sloping demand curve can be explained by reference to the income and substitution effects.

At higher wages, firms look to substitute capital for labour, or cheaper labour for the relatively expensive labour. In addition, if firms carry on using the same quantity of labour, their labour costs will rise and their income (profits) will fall. For both reasons, demand for labour will fall as wages rise.

Note the part; “At higher wages, firms look to substitute capital for labour, or cheaper labour for the relatively expensive labour“.

Mass immigration may or may not supply cheaper labour per se, but more people chasing a finite number of jobs inevitably “stabilises” or even drives down wages, as migrants compete with local workers. As pointed out previously, this is precisely what Treasury warned off in June last year;

“There is a concern that recently there has been a relative decline in the skill level of our labour migration. The increasing flows of younger and lower-skilled migrants may be contributing to a lack of employment opportunities for local workers with whom they compete.”

National is wary of wages rising, thereby creating a new wage-price inflationary spiral, reminiscent of the 1970s and 1980s. English said as much on TVNZ’s Q+A in April 2011;

Guyon Espiner: “Can I talk about the real economy for people? They see the cost of living keep going up. They see wages really not- if not quite keeping pace with that, certainly not outstripping it much. I mean, you said at the weekend to the Australia New Zealand Leadership Forum that one of our advantages over Australia was that our wages were 30% cheaper. I mean, is that an advantage now?”

Bill English: “Well, it’s a way of competing, isn’t it? I mean, if we want to grow this economy, we need the capital – more capital per worker – and we’re competing for people as well.

[…]

Well, it is a good thing if we can attract the capital, and the fact is Australians- Australian companies should be looking at bringing activities to New Zealand because we are so much more competitive than most of the Australian economy.

[…]

Well, at the moment, if I go to Australia and talk to Australians, I want to put to them a positive case for investment in New Zealand, because while we are saving more, we’re not saving more fast enough to get the capital that we need to close the gap with Australia. So Australia already has 40 billion of investment in New Zealand. If we could attract more Australian companies, activities here, that would help us create the jobs and lift incomes.”

National is circumventing their own neo-liberal ideology by importing large numbers of workers, to drive down wages (or at least permit only modest growth).

In times of scarce labour, wages should grow. Demand. Supply.

This is the counter to recessionary-times, such as the 2008 Global Financial Crisis, when wages remain static, or fall, due to heightened job losses and rising unemployment. Supply. Demand.

But National is subverting the free market process by ‘flooding the labour market’ with immigrant labour. The price of labour cannot rise because National has interfered with the process of supply by widening the field of the labour market. The labour market is no longer contained with the sovereign borders of our state.

This reveals “free market economics” to be a fraud. It is permitted to work unfettered only when it benefits the One Percent, their business interests, and their ruling right-wing puppets.

The moment there is a whiff that the “free market” might benefit workers – the goal-posts are shifted. (Just ask Nick Smith about shifting goal-posts.)

The game is fixed. The dice are loaded. We cannot hope to beat the House at their game.

Time to change the game.

Inevitable Conclusion

Welfare beneficiaries. Drugs. Drug testing. It was never about any of those.

The real agenda is for National to create a false impression of economic growth and reign-in wage growth, through immigration. Anything which threatens to expose their covert agenda is to be countered. Especially before it becomes fixed in the public consciousness.

Welfare beneficiaries are very useful as National’s go-to scapegoats. Or herring of a certain hue…

.

.

Postscript: A case of REAL workplace drug abuse

Meanwhile, in what must constitute the worst case of workplace drug abuse, took place on 14 June 1984;

.

.

…Muldoon had made up his mind. In one of the biggest miscalculations in our political history he decided that he would go to the country. At 11.15pm a visibly intoxicated Muldoon made his announcement to waiting journalists.

.

.

.

References

NZ Herald: Beyond the fear factor – New Kiwis can be good for us all

Fairfax media: NZ unemployment jumps to 5.2 per cent, as job market brings more into workforce

Fairfax media: New Zealand’s economic growth driven almost exclusively by rising population

Beehive: Immigration New Zealand’s contribution to growing the economy

NZ Herald: Budget 2016 – Feeling the Pressure

NZ Herald: Treasury warns of risk to jobs from immigration

TV3 News: Bill English blames unemployment on drug tests

Radio NZ: Employers still struggling to hire NZers due to drug use – PM

Radio NZ: Farmers agree Kiwi farm labourers ‘hopeless’

Radio NZ: Tens of thousands drug-tested, hundreds fail

Radio NZ: Drug use not the whole worker shortage story – employer

NZ Herald: Willie Apiata our most trusted again

Radio NZ: Exporters tell inquiry of threat from high dollar

Wikipedia: Cargo cult economics

Economics Online: The demand for labour

TVNZ: Q+A – Guyon Espiner interviews Bill English – transcript

Radio NZ: Unemployment rises, wage growth subdued

Statistics NZ: When times are tough, wage growth slows

Fairfax media: Shock rise in unemployment to 7.3pc

TVNZ: Frontier Of Dreams – 1984 Snap Election

Additional

TV3 News: Government gets thumbs down on housing

Other Blogs

The Standard: English hammered on druggies smear

Previous related blogposts

Election ’17 Countdown: The Promise of Nirvana to come

When National is under attack – Deflect, deflect, deflect!

National under attack – defaults to Deflection #2

National under attack – defaults to Deflection #1

.

.

.

.

This blogpost was first published on The Daily Blog on 5 March 2017.

.

.

= fs =

The Mendacities of Mr English – Social Services under National’s tender mercies

.

.

Context

.

On 25 January, as Radio NZ returned to it’s normal broadcasting schedule (and putting away it’s dumbed-down “summer programming” until next December/January), John Campbell had his first interview with John Key’s replacement, Bill English.

Campbell raised several issues with English; the US withdrawal from the TPPA; the Pike River mine disaster; and the housing crisis. At this point, English made this staggering claim;

@ 5.58

“We’ve got a government actually with a good record on addressing, in fact, some of the toughest social issues. There may be disagreement over means by which we’re doing it, ah, but our direction is pretty clear. And you know over, certainly heading into election year we think that the approach the government’s developed around social investment, around increasing incomes is the right kind of mix – “

English’s bland assertion that “government actually with a good record on addressing, in fact, some of the toughest social issues” is at variance with actual, real, mounting socio-economic problems in this country.

.

Key indicator #1: Unemployment

.

The latest HLFS unemployment stats show an increase from 4.9% to 5.2% in the December 2016 Quarter. However, in all likelihood, the unemployment numbers are actually much, much, higher since Statistics NZ arbitrarily altered the way it calculated what constituted unemployment.

On 29 June 2016, Statistics NZ announced that it would be changing the manner in which it defined a jobseeker;

Change: Looking at job advertisements on the internet is correctly classified as not actively seeking work. This change brings the classification in line with international standards and will make international comparability possible.

Improvement: Fewer people will be classified as actively seeking work, therefore the counts of people unemployed will be more accurate.

The statement went on to explain;

Change in key labour market estimates:

-

Decreases in the number of people unemployed and the unemployment rate

-

Changes to the seasonally adjusted unemployment rate range from 0.1 to 0.6 percentage points. In the most recent published quarter (March 2016), the unemployment rate is revised down from 5.7 percent to 5.2 percent

-

Increases in the number of people not in the labour force

-

Decreases in the size of the labour force and the labour force participation rate

The result of this change? At the stroke of a pen, unemployment fell from 5.7% to 5.2% for the March 2016 Quarter (and subsequent Quarters).

If the “current unemployment figures” from Stats NZ are reported as “5.2%’, they may well be back to the original March 2016 figure of 5.7%, before the government statistician re-jigged definitions.

.

Key indicator #2: Housing

.

– Home Ownership

According to the 1984 NZ Yearbook, in 1981 the number of rental dwellings numbered 25.4% of housing. 71.2% were owner-occupied. Nearly three quarters of New Zealanders owned their homes.

Home ownership reached it’s maximum height in 1991, when it stood at 73.8%. Since then, it has steadily declined.

By 2013 (the most recent census survey), the numbers of rental dwellings had increased to 35.2% (up 33.1% in 2006). Home ownership had decreased to 49.9% (down from from 54.5% in 2006). If you include housing held in Family Trusts, the figure rises to 64.8% of households owning their home in 2013, down from 66.9% in 2006.

Whether you include housing held in Family Trusts (which may or may not be owner-occupied or rented out), home ownership has fallen steady since the early 1980s.

Renting has increased from 25.4% to 35.2%.

More and more New Zealanders are losing out on the dream of home ownership. Conversely, more and more of us are becoming tenants in our own country.

As Bernard Hickey from Interest.co.nz said in December last year;

Nearly two thirds of the 430,000 households formed since 1991 are tenants.

Think about that for a moment. It is a stunning revelation of how the young and the poor have been hit the hardest by the changes in New Zealand since the mid-1980s, and on an enormous scale.

It means two thirds of the kids born in those families grew up in rental accommodation, and more than 80% of those are private rentals (although the Housing NZ homes are often no better). That means they often grew up in mouldy, damp, cold and insecure housing. It’s true that some homes occupied by their owners are also below par, but it’s a much lower proportion and owners have the option to improve their homes through insulation and ventilation.

The NZ$696 billion increase in the value of New Zealand’s houses to NZ$821 billion between 1991 and 2015 means the 64% of owners in live-in houses have also had plenty of financial flexibility to improve those houses. Renters have had no access to that wealth creation and are not allowed to put a pin in the wall, let alone put in a ventilation system or some batts in the ceiling. The take-up for the Government’s home insulation and heating subsidies were vastly higher among home-owners than they were for landlords.

Those 284,000 renting households formed since 1991 have also often been forced to move schools and communities and all the roots that build families because New Zealand’s rental market is so transient.

[…]

It illustrates the scale of the fallout from that collapse in home ownership from 1991. Not only has it handicapped the education, health and productivity of a entire generation of New Zealanders, but it is set to magnify the likely growth in pension and healthcare costs of our ageing population. And that’s before the wealth and income inequality effects.

.

– Affordability

In 2016, the 13th Annual International Demographia International Housing Affordability survey rated New Zealand as one of the most unaffordable housing markets in the world;

The most affordable major housing markets in 2015 are in the United States, with a moderately unaffordable Median Multiple of 3.9, followed by Japan (4.1), the United Kingdom (4.5), Canada (4.7), Ireland (4.7) and Singapore (4.8). Overall, the major housing markets of Australia (6.6), New Zealand (10.0) and China (18.1) are severely unaffordable. (p2)

[…]

In New Zealand, as in Australia, housing had been rated as affordable until approximately a quarter century ago. (p24)

A 2014 report by the NZ Institute for Economic Research stated the “the average house price rose from the long-run benchmark of three times the average annual household income to six times“;

.

.

The NZIER report refers to several reasons for increasing housing prices; slow supply of land; demographic demand (from ‘Baby Boomers’); and investor demand caused by lack of a capital gains tax. Interestingly, the Report also refers to an “over-supply of finance”;

The loosening of financial standards and rising household debt relative to income has happened over a long period of time. The increase in indebtedness has coincided with rising house prices relative to incomes. This suggests that increased household indebtedness has at least partly contributed to the increasing price of homes. (p14)

Prior to Roger Douglas de-regulating the banking/finance sector, New Zealand banks could only lend depositor’s funds as mortgages.

As a result, mortgage money was “tight”, and scarcity helped keep house prices down. Vendor’s expectations were kept “in check” by scarcity of bank funds. Prior to the mid 1980s, Vendor’s Finance (by way of a Second Mortgage) were commonly-used financial tools to assist house-owners to sell and buyers to complete a purchase.

Once the banking sector was opened up, and monetary policy relaxed, cheap money flooded in from overseas for banks to on-lend to house-purchasers. As property investor, Ollie Newland vividly explained in the 1996 TV documentary, Revolution;

“I got a phone call from my bank manager to say some bigwigs were coming up from Wellington to have a chat with me. I thought it was just one public relations things they do. I had a very small office, it wasn’t much bigger than a toilet cubicle, and those five big fellows crowded in with their briefcases and books and they sat on the floor and the arms of the chairs – I only had one chair in the place – and stood against the walls. Their first words to me were, we’re here to lend you money. As much as you want. For somebody like me, and I’m sure it’s the same for everybody else, to suddenly be told by the bank manager that you could have as much money as you want, help yourself, that was a revelation. We thought we had died and gone to heaven.”

Unfortunately, the side affect of this was to increase vendor’s expectations to gain higher and higher prices for their properties. Combined with recent high immigration, and a lack of a comprehensive capital gains tax, and the results have been troubling for this country;

.

.

As well as increasingly unaffordable housing, we – as a nation – are sitting on a trillion-dollar fiscal bomb.

Think about that for a moment.

Little wonder that in September last year, the Reserve Bank issued the sternest warning yet that we were headed for impending economic mayhem;

A sharp correction in house prices represents a key risk to the financial system, and one that is increasing the longer the current boom in house prices persists. A severe downturn in house prices could have major implications for the banking system, with over 55 percent of bank loans secured against residential property. Moreover, elevated household debt levels and a growing exposure of the banking system to investor loans could reinforce a housing downturn and extend reductions in economic activity, as highly indebted households are forced to reduce consumption and sell property.

As with many other individuals, institutions, organisations, business leaders, left-wing commentators, media, political pundits, political parties, the NZIER was (and still is) calling for a comprehensive capital gains tax to be implemented.

Even then, this blogger suspects we may be too late. National (and it’s predecessor, to be fair) have left it far to late and the economic horse has well and truly bolted.

Even a Capital Gains Tax at 28% – New Zealand’s current corporate tax rate – may be insufficient to dampen speculative demand for properties.

Meanwhile, the dream of Kiwis owning their own homes continues to slip away.

Depressingly, New Zealanders themselves have permitted this to happen.

.

– State Housing

If the Middle Classes and their Millenial Offspring are finding it hard to buy their first home, think of the poorest families and individuals in our communities. For them, social housing consists of packing multiple families into a single house; living in an uninsulated, drafty, garage; or in cars.

Last year, the story of mass homelessness exploded onto our media and our “radar” as New Zealanders woke up to the reality of persistent poverty in our cities;

.

.

Although on occassion, the mainstream media found them themselves in embarrassingly ‘schizophrenic’ situations as they attempted to reconcile reporting on our growing housing crisis – whilst raising advertising revenue by promoting “reality” TV programmes that were far, far removed from many people’s own disturbing reality;

.

.

According to UNICEF;

295,000 New Zealand kids are living beneath the poverty line, which means they are living in households where income is less than 60% of the median household income after housing costs are taken into consideration.

One way to alleviate poverty is to provide state housing, at minimal rental, to families suffering deprivation. Not only does this make housing affordable, but also strengthens a sense of community and reduces transience.

Transience can have deletarious effects on families – especially on children – who then struggle with the stresses of losing friends; adjusting to new neighbourhoods, and new schools.

A government report states that transience for children can have extreme, negative impact on their learning;

Nearly 3,700 students were recognised as transient during the 2014 year. Māori students were more likely to be transient than students in other ethnic groups.

[…]

Students need stability in their schooling in order to experience continuity, belonging and support so that they stay interested and engaged in learning.

All schools face the constant challenge of ensuring that students feel they belong and are encouraged to participate at school. When students arrive at a school part-way through a term or school year, having been at another school with different routines, this challenge may become greater.

Students have better outcomes if they do not move school regularly. There is good evidence that student transience has a negative impact on student outcomes, both in New Zealand and overseas. Research suggests that students who move home or school frequently are more likely to underachieve in formal education when compared with students that have a more stable school life. A recent study found that school movement had an even stronger effect on educational success than residential movement.

There is also evidence that transience can have negative effects on student behaviour, and on short term social and health experience

Writing for The Dominion Post, in April 2014, Elinor Chisholm and Philippa Howden-Chapman pointed out the blindingly obvious;

Continuity of education and supportive relationships with teachers are critical for children’s educational performance.

“Churn” is not good for educational performance or enrolment in primary health care, where staff can ensure children are properly immunised and chronic health problems can be followed up.

It was for this reason that, in our submission on the Social Housing Reform Bill late last year, we strongly recommended that families with school- age children should be excluded from tenancy review.

Secure tenure and stability at one school would allow children the best chance of flourishing. In high- performing countries such as the Netherlands, children are explicitly discouraged from changing schools in the middle of the school year.

The bill had announced the extension of reviewable tenancies to all state tenants (new state tenants had been subject to tenancy review since mid- 2011). However, the housing minister, as well as the Ministry of Business, Innovation and Employment, had made clear that the disabled and the elderly were to be excluded from tenancy reviews.

In our submission, we acknowledged the Government for recognising the importance of secure tenure.

People who are compelled to move house involuntarily can experience stress, loss, grief and poorer mental health. Housing insecurity is also associated with poorer physical health.

National’s policy of ending a state “house for life”; increased tenancy reviews for state house tenants, coupled with the sale of state houses, is inimical to the stabilisation of vulnerable families; the well-being of children in those families; and to communities.

In 2008, Housing NZ owned 69,000 rental properties.

By 2016, that number had dropped significantly to 61,600 (plus a further 2,700 leased). National had disposed of some 7,400 properties.

Between 2014 and 2016, at least 600 state house tenants lost their homes after “reviews”.

This, despite our growing population.

This, despite John Key’s own family having been provided with the security of a state house, and Key enjoying a near-free University education.

This, despite John Key, ex-currency trader, and multi-millionaire, admitting in 2011 that New Zealand’s under-class was growing.

.

Key indicator #3: Incomes & Inequality

.

In June 2014, Oxfam reported on New Zealand’s growing dire child poverty crisis;

The richest ten per cent of New Zealanders are wealthier than the rest of the population combined as the gap between rich and poor continues to widen.

Oxfam New Zealand’s Executive Director Rachael Le Mesurier said the numbers are a staggering illustration that the wealth gap in New Zealand is stark and mirrors a global trend that needs to be addressed by governments in New Zealand, and around the world, in order to win the fight against poverty.

“Extreme wealth inequality is deeply worrying. Our nation is becoming more divided, with an elite who are seeing their bank balances go up, whilst hundreds of thousands of New Zealanders struggle to make ends meet,” said Le Mesurier.

Figures for the top one per cent are even more striking. According to the most recent data, taken from the 2013 Credit Suisse Global Wealth Databook, 44,000 Kiwis – who could comfortably fit into Eden Park with thousands of empty seats to spare – hold more wealth than three million New Zealanders. Put differently, this lists the share of wealth owned by the top one per cent of Kiwis as 25.1 per cent, meaning they control more than the bottom 70 per cent of the population.

Oxfam New Zealand’s Executive Director, Rachael Le Mesurier, was blunt in her condemnation;

“Extreme inequality is a sign of economic failure. New Zealand can and must do better. It’s time for our leaders to move past the rhetoric. By concentrating wealth and power in the hands of the few, inequality robs the poorest people of the support they need to improve their lives, and means that their voices go unheard. If the global community fails to curb widening inequality, we can expect more economic and social problems.”

A 2014 OECD report placed New Zealand as one of the worst for growing inequality;

.

.

Not only was inequality a social blight, but according to the report it impacted negatively on economic growth;

Rising inequality is estimated to have knocked more than 4 percentage points off growth in half of the countries over two decades. On the other hand, greater equality prior to the crisis helped increase GDP per capita in a few countries, notably Spain.

According to the OECD assessment, income inequality had impacted the most on New Zealand, with only Mexico a close second;

.

.

The OECD Report went further, making this “radical” observation;

The most direct policy tool to reduce inequality is redistribution through taxes and benefits. The analysis shows that redistribution per se does not lower economic growth.

The statement went on to “qualify” any suggestion of socialism with a caveat. But the declaration that “analysis shows that redistribution per se does not lower economic growth” remained, constituting a direct contradiction and challenge to current neo-liberal othodoxy.

In August 2015, former City Voice editor, and now NZ Herald social issues reporter, Simon Collins revealed the growing level of child poverty in this country;

The Ministry of Social Development’s annual household incomes report shows that the numbers below a European standard measure of absolute hardship, based on measures such as not having a warm home or two pairs of shoes, fell from 165,000 in 2013 to 145,000 (14 per cent of all children) last year, the lowest number since 2007.

Children in benefit-dependent families also dwindled from a recent peak of 235,000 (22 per cent) in 2011, and 202,000 (19 per cent) in 2013, to just 180,000 (17 per cent) last year – the lowest proportion of children living on benefits since the late 1980s.

But inequality worsened because average incomes for working families increased much faster at high and middle-income levels than for lower-paid workers.

The net result was that the number of children living in households earning below 60 per cent of the median income after housing costs jumped from a five-year low of 260,000 in 2013 to 305,000 last year, the highest since a peak of 315,000 at the worst point of the global financial crisis in 2010.

In percentage terms, 29 per cent of Kiwi children are now in relative poverty, up from 24 per cent in 2013 and only a fraction below the 2010 peak of 30 per cent.

In September 2016, Statistics NZ confirmed the widening of income inequality from 1988 to 2015, between households with high and low incomes;

- In 2015, the disposable income of a high-income household was over two-and-a-half times larger than that of a low-income household.

- Between 1988 and 2015, the income inequality ratio increased from 2.24 to 2.61.

.

.

The neo-liberal “revolution” took place from the mid-to-late 1980s. Hardly surprisingly, the rise in income inequality takes place at the same time.

Income inequality dipped from 2004 when Labour’s “Working for Families” was introduced.

However, income inequality worsened after 2009 and 2010, when National cut taxes for the rich; increased GST (which impacts most harshly on low-income families and individuals); and increased user-charges on essential services such as prescription fees, ACC levies, court fees, etc. Increasingly complicated WINZ requirements for annual re-applications for benefits and complex paperwork may also have worsened the plight of the country’s poorest.

Despite all the promises made by the Lange government; the Bolger government; and every government since, our neo-liberal “reforms” have not been kind to those on low and middle incomes.

.

Key indicator #4: Child poverty

.

According to Otago University’s Child Poverty Monitor in 2014;

Child poverty has not always been this bad – the child poverty rate in the New Zealand many of us grew up in 30 years ago was 14%, compared to current levels of 24%.

Thirty years prior to 2014 was the year 1984. David Lange’s Labour Party had been elected to power.

Roger Douglas was appointed Minister of Finance. The Member for Selwyn, Ruth Richardson, was also in Parliament, taking notes.

The term “trickle down” entered our consciousness and vocabulary. It promised that, with tax cuts; privatisation; winding back state services; and economic de-regulation, wealth would trickle down to those at the bottom of the socio-economic ladder.

How is that working out for us so far?

.

.

So much for the “aspirational dream” offered to us by “trickle down” economics.

.

Key indicator #5: The Real Beneficiaries

.

In June last year, Radio NZ reported the latest survey of household wealth by Statistics NZ. It found;

“…the country’s richest individuals – those in the top 10 percent – held 60 percent of all wealth by the end of July 2015. Between 2003 and 2010, those individuals had held 55 percent. The richest 10 percent of households held half of New Zealand’s wealth, while the poorest 40 percent held just 3 percent of total wealth.”

.

.

Following hard on the heels of the Stats NZ report, Oxfam NZ made a disturbing revelation;

.

.

Three years after her previous public warning, Oxfam New Zealand’s, Rachael Le Mesurier, was no less scathing. Her exasperation was clear;

“The gap between the extremely wealthy and the rest of us is greater than we thought, both in New Zealand and around the world. It is trapping huge numbers of people in poverty and fracturing our societies, as seen in New Zealand in the changing profile of home ownership.”

National minister, Steven Joyce responded. He was his usual mealy-mouthed self when interviewed on Radio NZ about the Oxfam report;

“There’s always inequality but again you have got to look at those reports carefully because in that report a young medical graduate who has just come out of university would be listed as somebody who is in the poorest 20 per cent because they have a student loan.They’ll pay that student loan off in about four years and they’ll be earning incomes of over $100,000 very quickly.

So although they’re in those figures today, they won’t be in those figures in five years’ time.”

Which appears to sum up the National government’s head-in-sand attitude on child poverty and income inequality.

Economist, Shamubeel Eaqub, though, had a different “take” on the issue and warned;

“Every time we see a new statistic on inequality, whether it’s in terms of income, opportunities or wealth, it shows very clearly that New Zealand is being ripped apart by our class system.”

When economists begin to issue dire social warnings, you know that matters have taken a turn for the worse.

So where does that leave our New Dear Leader Bill English with his insistence that “we’ve got a government actually with a good record on addressing, in fact, some of the toughest social issues”?

English’s assertion to John Campbell on Radio NZ, on 25 January, (outlined at the beginning of this story) makes sense only if it it is re-phrased;

“We’ve got a government actually with a good record on addressing, in fact, some of the toughest wealth-accumulation issues. There may be disagreement over means by which we’re doing it, ah, but our direction is pretty clear. And you know over, certainly heading into election year we think that the approach the government’s developed around private investment, around increasing incomes for the wealthiest ten percent is the right kind of mix – “

Not a very palatable message – but vastly more truthful as income inequality continues to wreak appalling consequences throughout our communities and economy.

Otherwise, English appears to reside not so much in the Land of the Long White Cloud, but in the Realm of Wishful Thinking.

.

.

.

References

Radio NZ: Checkpoint – Bill English on the challenges of his first month as PM

Scoop media: Unemployment rate rises to 5.2 percent as labour force grows

Statistics NZ: Household Labour Force Survey – Revisions to labour market estimates

NZ 1984 Yearbook: 3A – General Summary – Census of population and dwellings 1981 (see “Tenure of Dwelling”)

Statistics NZ: Owner-Occupied Households

Statistics NZ: 2013 Census QuickStats about national highlights – Home Ownership

International Demographia: 13th Annual International Housing Affordability

NZ Institute for Economic Research: The home affordability challenge

Monetary Meg: What is vendor finance?

Radio NZ: NZ immigration returns to record level

NZ On Screen: Revolution

NZ Herald: New Zealand residential property hits $1 trillion mark

Reserve Bank: Regulatory Impact Assessment of revised LVR restriction proposals September 2016 – Adequacy Statement

The Guardian: New Zealand housing crisis forces hundreds to live in tents and garages

Fairfax media: One in 100 Kiwis homeless, new study shows numbers quickly rising

Al Jazeera: New Zealand’s homeless: Living in cars and garages

NZ Herald: Homelessness rising in New Zealand

Radio NZ: Homeless family faces $100k WINZ debt

TV3 News: The hidden homeless – Families forced to live in cars

TV1 News: Housing crisis hits Tauranga, forcing families into garages and cars

UNICEF: Let’s Talk about child poverty

Education Counts: Transient students

Dominion Post: Housing policy will destabilise life for children

NZ Herald: State housing shake-up – Lease up on idea of ‘house for life’

Radio NZ: Thousands of state houses up for sale

Housing NZ: Annual Report 2008/09

Housing NZ: Annual Report 2015/16

Fairfax media: Nearly 600 state house tenants removed after end of ‘house for life’ policy

NZ Herald: Key admits underclass still growing

Oxfam: Richest 10% of Kiwis control more wealth than remaining 90%

NZ Herald: 300,000+ Kiwi kids now in relative poverty

Statistics NZ: Income inequality

Law Society: Civil court fee changes commence

Fairfax media: Prescription price rise hits vulnerable

Salaries.co.nz: ACC levies to increase in April 2010

Radio NZ: Thousands losing benefits due to paperwork

Scoop media: Health Issues Highlighted in Child Poverty Monitor

NZ Herald: Hungry kids foraging in pig scraps ‘like the slums of Brazil’

Fairfax media: Damp state house played part in toddler’s death

NZ Herald: More living in cars as rents go through roof

NZ Doctor: Tackle poverty to fight rheumatic fever

Radio NZ: 10% richest Kiwis own 60% of NZ’s wealth

Fairfax media: Wealth inequality in NZ worse than Australia

Radio NZ: Steven Joyce responds to Oxfam wealth inequality report

Additional

Dominion Post: Kids dragged from school to school

Other Blogs

The Standard: John Key used to be ambitious about dealing with poverty in New Zealand

Previous related blogposts

Lies, Damned lies and Statistical Lies

Lies, Damned lies and Statistical Lies – ** UPDATE **

National exploits fudged Statistics NZ unemployment figures

2016 – Ongoing jobless tally and why unemployment statistics will no longer be used

CYF – The Hollowing Out of a State Agency

The Mendacities of Mr Key # 18: “No question – NZ is better off!”

Foot in mouth award – Bill English, for his recent “Flat Earth” comment in Parliament

The Mendacities of Mr English – Fibbing from Finance Minister confirmed

Rebuilding the Country we grew up in – Little’s Big Task ahead

.

.

.

.

This blogpost was first published on The Daily Blog on 7 February 2017.

.

.

= fs =

Foot in mouth award – Bill English, for his recent “Flat Earth” comment in Parliament

.

.

“I won’t be wanting to see any hint of arrogance creeping in… One of the big messages I’ll be wanting to give incoming ministers and the caucus is that it is incredibly important that National stays connected with our supporters and connected with the New Zealand public.“ – John Key, 22 September 2014

.

It appears that Finance Minister, Bill English did not get the memo from Dear Leader Key’s office: “Dont get arrogant!”

On 29 June, near two years after Key’s warning, Bill English’s cockiness has landed him in deep, fetid water when he responded to a question from Labour’s Grant Robertson in Parliament;

Grant Robertson: “Does he agree with the statement of Pope Francis I that “Inequality is the root of social evil”, given that inequality has risen in New Zealand on his watch, and is it not time he got back to confession?”

Hon Bill English: “… There is no evidence that inequality in New Zealand is increasing. “

A day later, interviewed by an exasperated Guyon Espiner, English again denied that inequality was increasing in this country. English’s tortuous mental and verbal gymnastics to deny rising inequality was utterly unconvincing and judging by the tone of his own voice, he wasn’t convincing himself either;

.

.

English’s assertion that inequality in New Zealand is not rising beggars belief, when nearly every metric used has come precisely to that conclusion.

From the Salvation Army, last year;

.

.

The Children’s Commissioner reported on increasing child-poverty, rising by 45,000 over a year ago to now 305,000 children now live in poverty;

.

.

Statistics NZ’s report on the problem was unequivocal – “Between 1988 and 2014, income inequality between households with high incomes and those with low incomes widened“;

.

.

1988 – When Rogernomics began in earnest. What a surprise.

Interestingly, income inequality fell slightly in 2004, when Working for Families was introduced by the Clark-led Labour Government. Working For Families was the same policy derided by then-Opposition Finance spokesperson, John Key, as “communism by stealth“.

From the last bastion of “radical marxism”, the OECD, came this damning report on rising inequality in New Zealand impacting on our economic growth;

.

.

The Report stated that “rising inequality is estimated to have knocked more than 10 percentage points off [economic] growth in Mexico and New Zealand“.

And even our Dear Leader once admitted that New Zealand’s “underclasses” was growing;

.

.

So, is everybody – including Bill English’s boss – wrong?!

Is Bill English the sole voice-in-the-wilderness trying to spread The Truth, whilst everybody else – including faraway OECD – is wrong?!

Or has he run foul of Dear Leader’s prescient warnings not to become arrogant?

Enjoining the poor to ignore hunger and simply “Let them eat cake” did not work out well for a certain person 223 years ago. Bill English may not lose his head over his obstinate refusal to see the world around him – but he may lose the election next year.

So for Bill English, on behalf of those who are low-paid; homeless; unable to afford to buy a home; unemployed; poor; and will be spending tonight in a car or an alleyway, I nominate Bill English for a Foot In The Mouth Award;

.

.

.

.

References

NZ Herald: Election 2014 – Triumphant PM’s strict line with MPs – Don’t get arrogant

Parliament Today: Questions & Answers – June 29

Radio NZ: Porirua family can only afford biscuits (audio)

Fairfax Media: Child poverty progress ‘fails’, Salvation Army says

Radio NZ: A third of NZ children live in poverty

Statistics NZ: Income inequality

MSD: Future Directions – Working for Families

NZ Herald: National accuses Government of communism by stealth

OECD: Trends in Income Inequality and its impact on economic growth

NZ Herald: Key admits underclass still growing

Newstalk ZB: Demand for food banks, emergency housing much higher than before recession

Additional

Office of the Children’s Commissioner:

Previous related blogposts

When National is under attack – Deflect, deflect, deflect!

State house sell-off in Tauranga unravelling?

The Mendacities of Mr English – Fibbing from Finance Minister confirmed

Why is Paula Bennett media-shy all of a sudden?

Park-up in Wellington – People speaking against the scourge of homelessness

.

.

.

.

This blogpost was first published on The Daily Blog on 5 July 2016.

.

.

= fs =

Unemployment, Christchurch, dairy prices – Bill English confirms blogger’s analysis

.

.

Leg #1: Treasury reported in 2012, on the Christchurch re-build;

The Canterbury rebuild is expected to be a significant driver of economic growth over the next five to ten years. The timing and speed of the rebuild is uncertain, in part due to ongoing aftershocks, but the New Zealand Treasury expects it to commence around mid-to-late 2012.

Leg #2: The Reserve Bank, in 2014, on our Dairy sector;

The New Zealand dairy industry is experiencing prosperous times, continuing the strong growth in export earnings of the past eight years. Animal numbers and prices have increased and on and off farm productivity growth has been impressive. And the future looks bright. There seem to be important structural reasons behind the rise in dairy prices that should continue into the medium term.

Leg #3: Steven Joyce, Associate Minister of Finance, this year, on the Auckland housing boom;

“Closer to home, the Reserve Bank … highlights several factors continuing to support growth domestically, including robust tourism, immigration, the large pipeline of construction activity in Auckland, and, importantly, the lower interest rates and the depreciation of the New Zealand dollar.”

There we have it – the three basic “legs” comprising National’s economic development policy. One is predicated on fluctuating international market-prices; another is an unsustainable property boom funded by billions borrowed from off-shore; and the other is the epitomy of ‘disaster’ capitalism.

In debating the fragility and unsustainability of these three sectors of our economy, I (and other bloggers from the Left) have pointed out time and again the transitory nature of the dairy sector boom; the Christchurch re-build boom; and the Auckland property market boom. Acolytes of the so-called free-market – ever dedicated to their quasi-religious right-wing notions – have dismissed our warnings.

On 4 November, the National government’s Finance Minister and sheep farmer, Bill English, made a statement in Parliament that has backed up our dire warnings – albeit somewhat late in the day;

“Of course, if unemployment was a direct choice of the Prime Minister of New Zealand, there would be none of it. You would just decide to have none. But, of course, it is not. It is a product of the world economy and its low growth rates, and of particular circumstances in New Zealand where the rebuild in Christchurch has flattened out and there has been a drop in national income of billions of dollars from the decrease in dairy prices, which was always going to affect the number of jobs in New Zealand, and now it is happening.”

Indeed; “and now it is happening”.

Two of National’s economic stimulators are either belly-up, or in the process of falling flat.

Only the Auckland housing boom remains. When that collapses, it will be much, much worse than the depressed Dairying sector. At that precise moment, international lenders will have noticed that we have been borrowing-up-large for one helluva massive property splurge-party – and they will be wanting their money back.

All $200 billion of it.

.

.

According to Squirrel mortgage broker, John Bolton;

“People are completely oblivious of what’s going on. If you overlay what’s going on around the rest of the world, all bets are off.”

New Zealanders are about to wake up with the biggest “hang-over” since they first got trolleyed at teenagers.

Is this where I say, “I told you so”?

Will it matter by then?

.

.

.

References

NZ Treasury: Recent Economic Performance and Outlook (2012)

Reserve Bank: The significance of dairy to the New Zealand economy

Parliament Today: Questions and Answers – Sept 10 2015

Parliament: Hansards – Questions for oral answer – 2. Unemployment—Rate

Fairfax media: Mortgage debt tops $200 billion

Additional

Metro: 10 ideas that could solve the Auckland property crisis

Previous related blogposts

Labour’s collapse in the polls – why?

“The Nation” reveals gobsmacking incompetence by Ministers English and Lotu-Iiga

The Mendacities of Mr Key # 12: No More Asset Sales (Kind of)

.

.

.

.

This blogpost was first published on The Daily Blog on 7 November 2011.

.

.

= fs =

State houses – “wrong place, wrong size”?

.

.

Information released under the Official Information Act (OIA) suggests that National’s oft-repeated claim that around “one third” ( or 22,000) of state houses are in the “wrong place and wrong size” is not supported by Housing NZ’s own figures.

Various ministers, including our esteemed Dear Leader, have indicated that up to “a third” of state houses are “in the wrong place or wrong size (or ‘type’)“.

The “wrong size/wrong place” claim is the argument being used by National to advance a major sell-off of Housing NZ properties.

On 1 November, 2014, Social Housing Minister Paula Bennett said on TV3’s ‘The Nation’,

“It’s about being smart in what we’re doing. So you just look at us having the wrong houses, in the wrong place, of the wrong size..”

“Yes. As recently as just last month Housing New Zealand issued a press release that said: ‘around one third of our housing stock is in the wrong place, wrong configuration or is mismatched with future demand’.

[…]

… in fact, a third of them are the wrong size, in the wrong place, and in poor condition.”

On 28 January this year, John Key announced in his “state of the nation” speech;

“Around a third of Housing New Zealand properties are in the wrong place, or are the wrong type to meet existing and future demand.”

Housing NZ currently “manages 67,245 homes” (as at 30 June 2015). When Key, and other National ministers refer to “around a third of Housing NZ properties”, simple arithmetic translates that fraction into 22,190 homes being the “wrong size/wrong place” .

On 17 September I lodged OIA requests to Ministers Nick Smith, Paula Bennet, and Bill English. Only English was prepared to answer – and even that took 42 days (30 working days) to eventuate after a reminder was emailed to the Minister’s office.

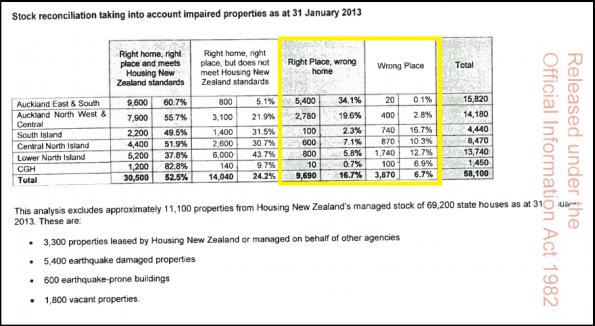

In a response eventually received on 29 October, information in the form of a chart -“Stock reconciliation taking into account impaired properties as at 31 January 2013” – was attached;

.

.

In two columns headed “Right Place, wrong home” and “Wrong Place“, the respective figures add up to 13,560. This constitutes a little over half of the “22,000” that is being bandied about by National.

I specifically asked Bill English; “How many [state houses] are the “wrong size“ and in what manner are they the “wrong size“? “Do they have too many rooms; too few rooms?”

English replied;

“In general terms, Housing New Zealand has a shortage of smaller two bedroom homes and

larger family homes and a surplus of three bedroom homes, with the exception of Auckland

where there is a demand for homes of all sizes. The type or configuration of particular

properties may also affect demand making them difficult to let.”

English totally ignored the direct question “How many [state houses] are the “wrong size“. He either does not know, or is unwilling to admit the number. “In General terms” is not a specific quantity.

Furthermore, English says that “Housing New Zealand has a shortage of smaller two bedroom homes and larger family homes and a surplus of three bedroom homes, with the exception of Auckland where there is a demand for homes of all sizes.”

Unsurprisingly, the 2014/15 Housing NZ Annual Report confirms the high demand for housing in Auckland;

“Across the country we also have too many three-

bedroom properties, while demand has grown for smaller

one- or two-bedroom homes or for much bigger homes.

Demand for homes in the Auckland region is high and

more Housing New Zealand homes are needed.” (p22)

Yet, the chart referred above (“Stock reconciliation taking into account impaired properties as at 31 January 2013“) states that there are 8,180 houses in the Auckland region that are supposedly “Right Place, wrong home” and a further 420 that are in the “Wrong Place” – 8,600 in total.

This would appear to contradict the Minister’s assertion that “there is a demand for homes of all sizes” throughout Auckland. Both cannot be right.

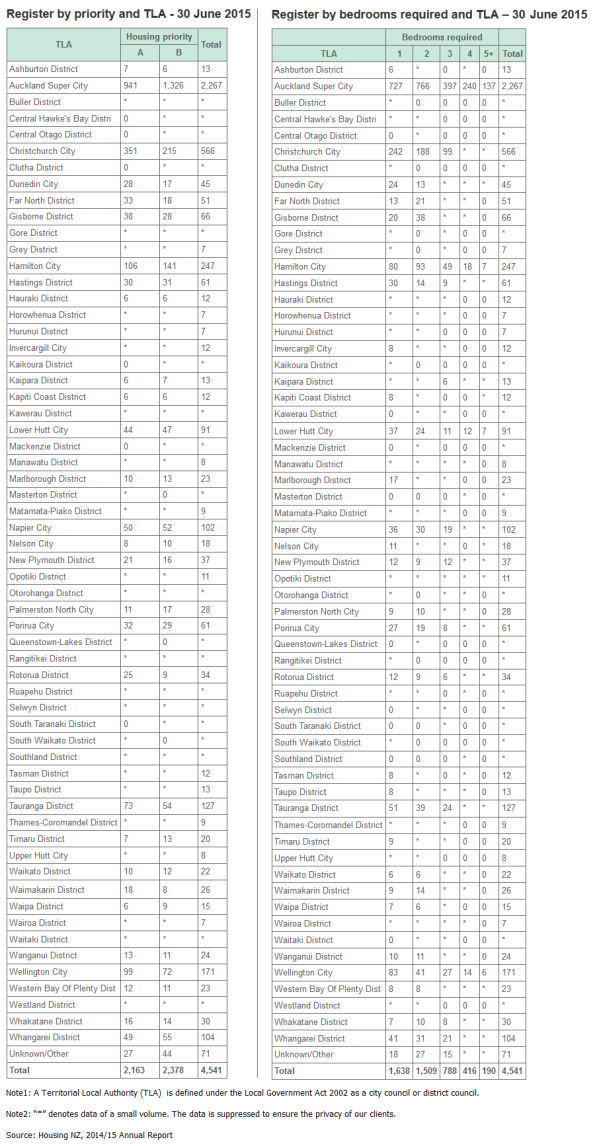

This contradiction is further compounded by the fact that, as of 30 June, there were 2,267 people on the waiting list in the Auckland City area;

.

Even where houses have been the wrong size, Housing NZ has been undertaking a programme to add extensions, or entire new, smaller dwellings on larger sections;

“Overcrowding is an issue that affects many of our

tenants’ health and wellbeing, especially in Auckland,

where there is high demand for larger homes. Our

bedroom extensions programme is helping to meet

demand from the social housing register in Auckland

by converting three-bedroom homes into four- and

five-bedroom homes. Adding an extra one or two

bedrooms (and another bathroom where necessary)

means more of our tenants are living in appropriately

sized and healthier homes. During 2014/15 we

completed bedroom extensions to 247 homes.Our existing land in Auckland will also house more small

families, couples and single people in need. We are

building new two-bedroom homes on Auckland sections

that are big enough to have another dwelling. During

2014/15 we built an additional 107 two-bedroom units

on existing Housing New Zealand sections, which also

included making improvements to the existing homes

where these were required.“(p23)

If we substract the 8,600 homes in the Auckland region, from Housing NZ’s original estimate of 13,560 (see above chart), this leaves 4,960 houses “wrong place/wrong size”.

Nearly five thousand homes supposedly in the “wrong place/wrong size” category in Auckland – and there are still 2,267 people on Housing NZ’s waiting list in Auckland City. How is that feasible?

I further enquired from English; “Could you please explain what the term “wrong size, in the wrong place” actually refers to? Where are they situated that are considered the “wrong place“?”

English replied;

“In 2011 Housing NZ carried out an assessment of it’s future projected stock

requirements for the purpose of forward planning, based on its future use of intention of its

properties and informed by demand forecasting. This assessment was not intended to reflect

current demand at a point in time…[..]

The analysis identifies some properties as being the wrong home, not specifically the wrong

size.”

It is worthwhile noting English’s comment that “Housing NZ carried out an assessment of it’s future projected stock requirements for the purpose of forward planning, [but] this assessment was not intended to reflect current demand at a point in time”.

The apparent purpose? According to English’s 29 October statement to me;

“This relates to the number of bedrooms that a property has and also includes

properties that are wrongly configured to meet demand for social housing.“

“Social housing” is National’s code for private providers.

The 2011 Housing NZ assessment of it’s “future projected stock” appears to have been designed to meet the needs of “social housing”, aka private providers.

In respect to answering my question “Where are they situated that are considered the “wrong place”?”, English’s response was vague and lacked any informative value (as did many of his answers);

“A property being in the wrong place refers to the location of the property in relation

to demand. On a regional basis, there are areas of general low demand. However, some of

Housing New Zealand’s properties may be in locations with high concentrations of state

housing or existing social issues that may contribute to them being difficult to let or

result in a high turnover of tenants.”

There were no geographical locations; no cities or towns; no suburbs given. The statement in itself is meaningless twaddle with a vague reference to “some of Housing New Zealand’s properties may be in locations with high concentrations of state housing or existing social issues”.

Where these “wrong places” might be is anyone’s guess.

My follow-up question – “How many areas have been designated “wrong places”?” – was ignored entirely.

In an effort to drill down and assess where houses might be in the “wrong place”, I asked English; “where houses are in a particular “wrong place”, how many people are on HNZ waiting lists in those same “wrong places”?

The purpose of this question was straight-forward. Where demand for housing is high in a given region, it seems inconceivable that any properties in that same region would be in the “wrong place”. Auckland being a prime example.

I wanted to know how many other regions had high numbers on their waiting lists – whilst also having houses in the “wrong place”.

According to the above chart, the following regions designated as having houses in the “wrong places” have the following numbers of houses attached to them;

Auckland: 420

South Island: 740

Central North Island: 870

Lower North Island: 1,740

“Community Group Housing”: 100

Total: 3,870

Because of the (deliberate?) vagueness of English’s response, we have no way of knowing where, for example, the South Island’s supposed 740 houses are located in the “wrong place”.

It is difficult to understand why the Minister could not be more precise.

If the “wrong size/wrong place” issue is real, then National must have hard data, with supporting numbers, identifying where state houses are located in the “wrong place”. This information should be on-file; readily accessible; and easily released to interested parties. Then again, my OIA lodgement to Minister English took 30 working days (including one “request” for an extension) to complete.

Perhaps such data does not exist.

According to Housing NZ itself, every district within it’s authority has people on their waiting list;

.

.

There is no district recording zero-need.

I asked English; “What replacement houses are being built to replace those that are the “wrong size”, and how many rooms will they have? More? Less?” and “Where Housing NZ houses are in the “wrong place” – will new State houses be built in exactly the same place?”.

The Minister responded;

“Housing New Zealand’s Asset Management Strategy provides for the redevelopment of its

land holdings in order to align the typology, location and size of its portfolio with demand.

As a result, it is building more two, four and five bedroom properties. Where there is low

demand, Housing New Zealand will look to sell surplus properties and reinvest the proceeds

into providing homes in areas of high demand.“

As outlined above, Housing NZ has a current programme of adding bedrooms to existing three bedroomed houses, and, where the land is big enough, adding two bedroom houses onto an existing built-up section.

English’s reference to selling “surplus properties” is troubling, as we are still none-the-wiser where such properties exist. Especially when all Housing NZ districts have people on waiting lists.

As for English’s assertion that “Housing New Zealand will look to sell surplus properties and reinvest the proceeds into providing homes in areas of high demand” – Paula Bennett was not willing to give that assurance on 1 November last year, speaking on Q+A.

Which leads on to the last question I put to the Minister; “If HNZ houses that are in the “wrong place” are sold/given away to community organisations – what will make those houses suddenly become in the “right place”?”

Because if it’s in the “wrong place” when owned by Housing NZ – why would it suddenly be in the “right place” owned by someone else?

The Minister’s response was baffling;

“The Government has no plans to offer Housing New Zealand properties that have been

identified as being in the ‘wrong place’ to community housing providers. In Tauranga and

Invercargill for example, the areas identified for initial potential transfers of social

housing properties from Housing New Zealand to community housing providers, MSD’s purchasing

intentions anticipate stable demand. Following a transfer, any new provider would receive

both the properties and a contract with MSD to continue to provide social housing.”

That statement appears to be at complete variance with this undated Beehive document, headed “Social Housing Reform Programme – Media Qs and As“;

SOCIAL HOUSING REFORM PROGRAMME – Media Qs and As

“Around one third of the $18.7 billion Housing New Zealand portfolio is in

the wrong place or of the wrong type to meet this need.”[…]

“To help community housing providers grow, there will be sales of

Housing New Zealand properties and we will involve these providers

in the redevelopment of Crown land…”[…]

“Details will be determined after national engagement, including

with community housing providers and iwi,over coming months.

Providing we can achieve better services for tenants and fair

and reasonable value for taxpayers, we will look to sell

between 1,000 and 2,000 Housing New Zealand properties over

the next year.”[…]

“15. Will properties being sold be tenanted, and if so what

happens to the tenants?In most cases where houses transfer to a community housing

provider, the properties will have tenants. The new owners

will continue providing social housing with the income-

related rent subsidy.”[…]

“Look at selling between 1,000 and 2,000 Housing New Zealand

properties for continued use as social housing, run by approved

community housing providers. These providers might buy

properties on their own or go into partnership with other

organisations lending them money, contributing equity, or

providing other services.”

The document specifically refers to the sale of state housing, that are “the wrong place or of the wrong type“, to community service providers.

And in Parliament, on 24 March, Bill English himself made reference to the sale of “wrong place” Housing NZ properties to Community providers;

“In the first place, Housing New Zealand has an ongoing sales

policy, and often it is selling houses that we do not need or

that are in the wrong place, or some of them have just become

unsuitable to be lived in and cannot be upgraded at reasonable

cost. In respect of the transactions that are coming up over

the next 6 months or so, there is a process of testing what

the real values of those houses are. For instance, many

community providers believe those houses are not up to date

on maintenance, and therefore are overvalued when they are

valued as if they can be sold for the best price on the day

in the location that they are in. Those are exactly the things

we are having discussions about over the next few months.”[…]

“Neither property developers nor community housing providers

are compelled to buy houses off the Government. If they do

not want to do that—if they do not want to manage the tenants

or own the stock, which may be the wrong size in the wrong

place—then they certainly do not have to do that.”

Which creates doubt over English’s assertion that “the Government has no plans to offer Housing New Zealand properties that have been

identified as being in the ‘wrong place’ to community housing providers”.

So if Housing NZ properties that are in the “wrong place” are sold to community housing providers – as confirmed by Minister English on at least two occassions – what will transform those “wrong place” houses into “right place” houses?

Very little of National’s “wrong size/wrong place” proposition makes sense – unless viewed through the lens of raising revenue by way of partial asset-sales.

That is the only thing that makes any sense of this issue.

The only reason that the “wrong size/wrong place” meme has worked for National thus far is that very few (if anyone) has delved behind the phrase to check it’s validity.

Perhaps it is time this issue was scrutinised more carefully?

The apparent fudging of Bill English’s response to my OIA request, in itself, speaks volumes.

Postscript

On 29 October, I wrote to Bill English expressing my dissatisfaction with his response to my OIA lodgement;