.

.

As the rest of the world was perceived to be “going to hell in a handbasket with an out-of-control pandemic; ructions in Europe as Britain copes with “Brexit” chaos; Trumpism in the United States climaxing with the 6 January mob-led coup attempt in Washington’s Capitol; a deadly resurgent covid19 outbreak in Victoria, Australia (at time of writing); Russia continuing to harass and murder political dissidents with impunity; China cracking down brutally on Hong Kong and it’s Uighur minority; and global temperatures continuing to rise as Humans blithely pump CO2 into the atmosphere – New Zealanders were spectators to our own issues, dramas, and problems…

ACT

The not-so-surpising winner from last year’s general election, ACT increased it’s Party Vote from 13,075 in 2017 to 219,030 and adding nine more MPs to David Seymour’s up-to-now-One-Man-Band operation.

But before ACT supporters and other sundry right-wingers and free-marketeers rejoice with little Happy Dances, it bears remembering that their resurgence came – for the most part – from a dysfunctional National Party.

ACT’s success came from cannibalising it’s larger counterpart, much like the Green Party’s support (11.06% Party Vote) in the 2014 general election came at ther expense of their Labour cousin (27.48% Party Vote).

Oh, and gun-nuts who – like children throwing a temper tantrum at having to surrender their lethal toys – went looking for a sympathetic, slightly-bonkers, “uncle” who would pander to their sense of spoiled entitlement.

The combined right wing vote for National and ACT collapsed from 44.9% in 2017 and 47.15% in 2014, to 33.2% last year. Hardly cause for celebration for ACT Party strategists.

There was no resurgent right. Only a sloshing-around of disaffected National supporters, gun nuts, and assorted climate change denying numpties.

Unless Mr Seymour is blinded by his (temporary) electoral gains, he and his colleagues must be nervously aware that his fortunes are possible only while National is a lame-duck party in turmoil, with an unelectable Leader.

Election 2020

MMP was designed primarily for two purposes:

- To make representation fairer (“coat-tailing” notwithstanding), especially for smaller parties that, until 1996, had been locked-out of Parliament (Social Credit being an aberation for FPP),

- To deny either of the two main parties unbridled power without checks and balances to deter wild policy swings (eg; 1984 neo-liberal “reforms”).

Last year, voters in Aotearoa New Zealand had other ideas as covid19 changed the rules by which our economy; tourist industry; international travel, and even social patterns operated.

As will be explored under the heading “National”, approximately two thirds of voters not only supported the current goverrnment’s action to protect Fortress Aotearoa – but seemed determined to keep Judith Collins and the National Party well away from anything resembling power.

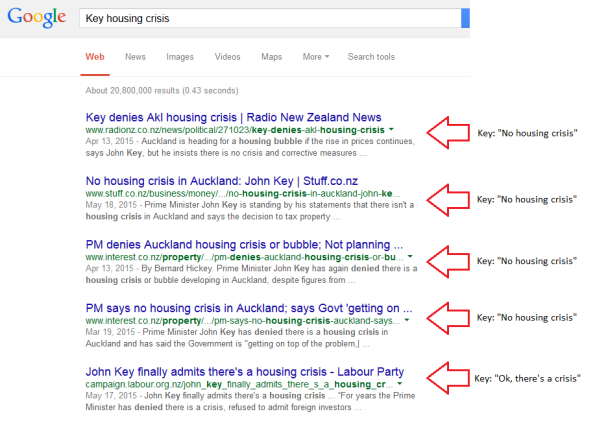

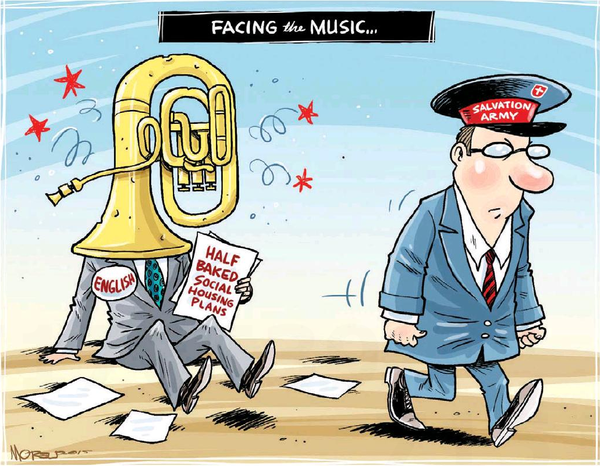

Housing

Aotearoa New Zealand has had housing problems since colonisation became a ‘thing’ in this country. Reading an account of housing shortages in the late 1930s/40s could be taken almost word-for-word for our current housing situation;

Meanwhile, full employment with higher wages and overtime meant increased demand for existing houses. In 1942 the shortage was officially estimated as 20 000. Workers came to the cities for war jobs, wives came to be near their husbands in camps. With prices rising and expected to rise still further, house buying was both a sound investment and a tempting speculation, though rent controls curbed quick fortune-making to some extent. At Wellington, where sites were limited, building costs high and where government employees had multiplied rapidly during the past few years, the demand was particularly strong. As early as February 1941, a Wellington land agent stated that flats had come to stay, that but for the Fair Rents Act land agents could sell 70 per cent more houses than they were selling and that low deposits of £200 or £300 were becoming scarce. In November 1941, an agent declared, ‘We are not facing a first-class housing crisis. We are past that stage’; another spoke of an avalanche of buyers and of house dealers buying for cash, renovating cheaply and making £400 to £500 on each deal.

In July 1942, another agent said that if he had them, he could let 30 houses or flats in two or three hours, a state of affairs which he feared was going to be chronic. Already, those concerned with the rehabilitation of servicemen were troubled by the gap of several hundred pounds between the value of a house and its inflated ‘scarcity value’.

At Auckland in May 1942 there was talk of a boom; land agents for several weeks had been exceptionally busy and house values were rising. A suburban home, which 12 months earlier would have changed hands at £1,300, sold for £1,525 within 24 hours of being placed on the market; a house sold by the builder for £1,750 was sold again six weeks later for £2,500. There were many cash sales and otherwise the minimum deposit was often one-third of the purchase price. In Dunedin sales were brisk, with houses long regarded as unsaleable changing hands. At New Plymouth, prices which 12 months earlier would have been far too high were paid without hesitation; 60 persons had applied to rent one house; 46 wanted a small house at £1 5s a week, 16 applied for another at £2 2s a week.

It can reasonably be argued that the housing crisis in the late 30s/40s was due in large part to a post-Depression economic lag, and shortage of raw materials and labour as we faced the onslaught of Nazi German and Imperial Japanese war machines.

But it then follows that there is little reason why – in an age of plenty and 21st century automation – we are eighty years later faced with a similar crisis.

Whatever the reasons – and we are well versed with most of them – housing remains one of the top three priorities for the Labour government.

One of the alleged reasons for our housing shortage has been the RMA which has been blamed for slowing down or stifling permitting and construction of new housing.

We should be wary of throwing out, wholesale, the Act. It has protections that deter inappropriate urban “development” that we may come to regret, as instanced by one particular block of flats on Mt Victoria, Wellington.

Urban sprawl is also an unintended consequence to uncontained development. By 2019, around 200 horticulture growers in Auckland had ceased to operate as their fertile land was re-zoned “Residential”. This included some of the best volcanic arable land in and around Pukekohe.

As grower David Clark pointed out in June 2019;

“I used to farm that block. That was a very highly productive bit of soil, that.

The previous National government passed it all off as a special housing area and we lost all of that [land]. That’s a shame. That should never have happened.

It was good productive elite soil, but it’s not now. You can never get it back once all that infrastructure and housing’s gone on there. It’s gone forever.”

Horticulture New Zealand CEO, Mike Chapman, warned;

“It makes sense to protect growing hubs close to our main population centres. They not only provide food that contributes to the physical health of New Zealanders, but also jobs, and vibrant businesses and communities.

Food and housing are competing for land and water. We need both, so now is a good time to be smart about long-term planning for food security and domestic supply.

We will not always be able to source food from other countries. Look at the extremely hot summer the northern part of the world is having and the impact it is having on food production because of drought.”

The result of losing arable land to urban sprawl would inevitably result in rising food prices, advised Deloitte New Zealand in a report commissioned by HortNZ.

Environment Minister David Parker took note of a problem that could rapidly spiral into a potential food-crisis;

“I was particularly troubled by how much of our urban growth is occurring in our irreplaceable highly productive land. Even in a country as lucky as New Zealand we only have limited quantities of these high-class soils.

We have to ensure we have enough land to build the houses people need, but we must protect our most productive areas too.”

As with all human activities, we should cautiously wary of unintended consequences.

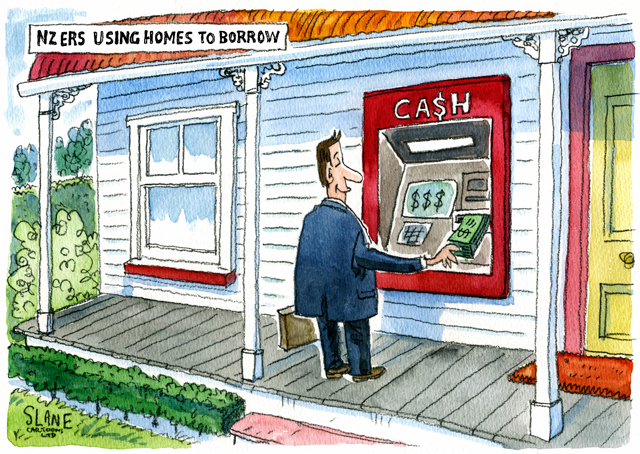

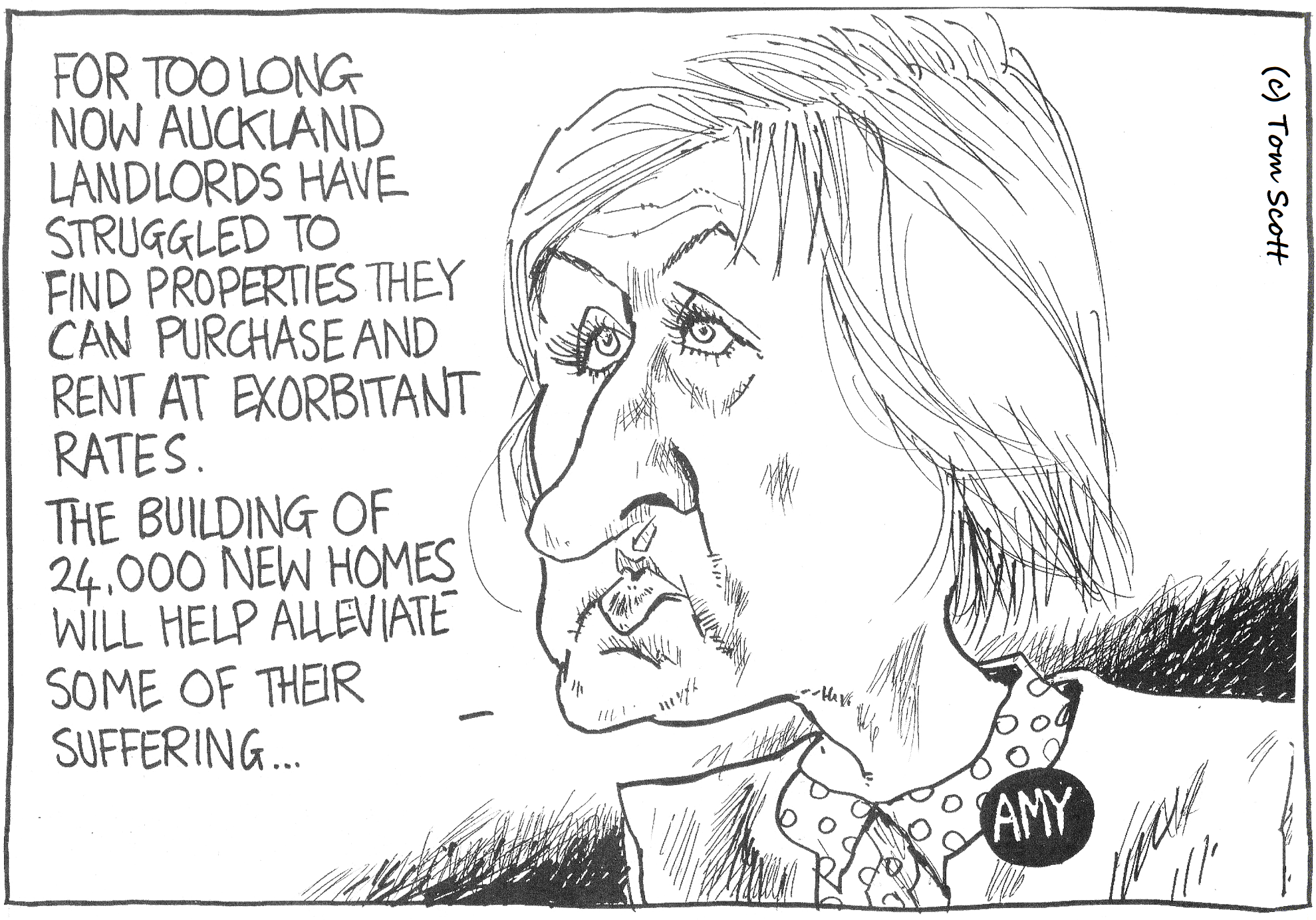

Ballooning housing prices are forcing first home owners to pay ever-increasing amounts to get a roof over their heads.

Whereas the median house price in Aotearoa New Zealand for a property was $495,000 in 2017, by 2020 the median price had risen to $725,000.

In Auckland, media houses prices surged from 800,000 in 2017 to $1,000,000 last year.

For first home owners these stratospheric prices are barely manageable because of historically low interest rates.

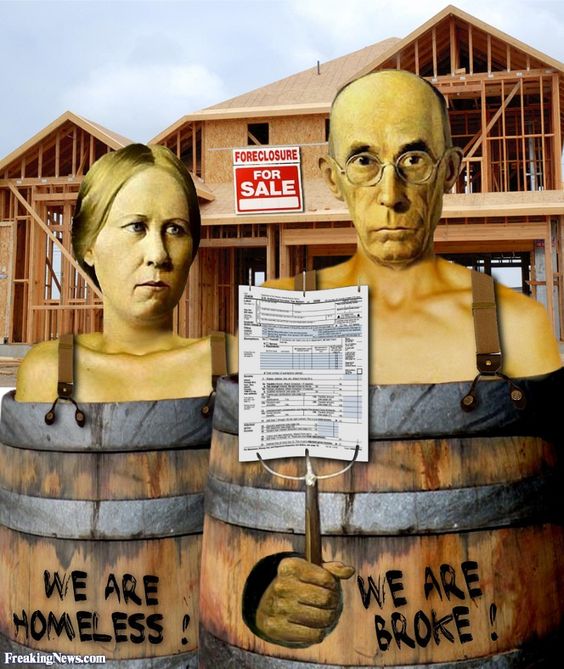

This constitutes a silent time-bomb that will detonate when/if interest rates start to rise again. It will result in forced mortgagee sales the likes of which we have not seen since the housing market collapse in the USA in the 2007/08 Global Financial Crisis;

Simultaneously, the US government of the day under President Bill Clinton elected to begin running budget surpluses. This had the effect of reducing the stock of US government-issued “safe assets” as the state began to pay down its debt. This created an incentive — though not the obligation — for the private sector to meet this demand for “safe assets” by creating some of its own. Thus we come back to mortgage securities.

The authors’ of the latest paper write that “the boom in securitisation contributed to channel into mortgages a large pool of savings that had previously been directed towards other safe assets, such as government bonds”. As Frances Coppola points out, this misstates what was actually going on. The inflow of capital was not “channelled” into the US mortgage market but, rather, it created the demand that gave banks a reason to continue extending mortgage loans into the system.

And here’s where the story gets really interesting. The more credit the banks provided through the mortgage market, the more money consumers had available to pay for goods and services (including, for example, clothes and toys produced in China). This spending then fed the current account surpluses in emerging markets, which flooded back into the US in search of safe assets that would provide a steady stream of income.

So the credit market created what looked like a self-fulfilling cycle where banks issued mortgages, that money was spent on goods and services in the US, which provided the cash for emerging economies to buy the mortgage-backed securities that were then created. Glad that’s clear.

And this is what happened — real home prices increasing by roughly 40% to 70% between 2000 and 2006…

[…]

…the scale of the housing boom had already increased the system’s vulnerabilities, and had been exacerbated by the Clinton administration’s decision to run budget surplus. In the end as borrowers were maxing themselves out, a hit to future incomes was almost inevitable and with it a correction in the housing market.

The full article above by Tomas Hirst is worth reading because there are ominous similarities between the late 2000s and what is happening now in our own housing market: too much money sloshing around, looking for safe investments, and a bubble that must ultimately burst.

Fast forward to last year;

Housing unaffordability is on the rise again, with implications for wealth inequality and deprivation. This is compounded further by the cascading economic effects of the global pandemic and unconventional manoeuvres in monetary policy that are pushing house prices higher.

If/when interest rates begin to rise, the time bomb will detonate and the housing “market correction” will be harsh.

The government-of-the-day will be forced to intervene directly, taking over debt. Otherwise the alternative will be too terrible to contemplate: images of families forced out of their homes to live in – ?

Greens

The Green Party increased its share of the Party Vote from 2017 to 2020, from 6.3 to 7.9%, increasing its Parliamentary seats from eight to ten. Unlike ACT’s cannibalising the centre-right vote from National, the Greens actually grew the centre-left vote overall.

It could be said that this was achieved by riding on the “coat tails” of a popular Prime Minister.

This blogger rejects that.

The Greens are the conscience of Parliament, if not the whole country. They are deadly serious on the critical challenges that confront us as a nation, whether it be global – apocalyptic changes caused by rising CO2 and methane levels and all its dire consequences – or social problems of a spiralling-out-of-control housing crisis and social inequality.

As our climate warms; weather patterns become more energetic; ocean acidification worsens; and ice continues to melt, more and more people are understanding that this crisis can no longer be ignored or put off to another day.

With Labour’s commanding majority in the House, it is a curious contradiction that the government needs the Green Party more than ever to maintain a solid, unwavering focus on reducing our greenhouse gas emissions.

Without the Greens, Labour risks relaxing into a cruising “business-as-usual” mode.

And we are well past anything resembling “business-as-usual”.

Labour

There is a reason for Labour’s stunning election victory last year…

It would be fair to say that the Labour-led coalition govt was tested in more ways than most governments have been in the past. The Whakaari/White Island eruption; the 15 March terrorist atrocity in Christchurch; and then covid19 hit the world.

For most people, the lockdown on 25 March was the only possible response. With no vaccine, the virus required a sledgehammer to fight it and – except for essential workers – we were told to stay home.

This blogger has documented his own personal experiences through the “Life in Lockdown” daily diary.

Not since the 1918 influenza epidemic has Aotearoa New Zealand been confronted with such an event. There was no Instruction Manual; we were learning as we went along.

Essential services stayed open; supermarkets (food); service stations (fuel); and chemists (medication). Some, like hardware stores operated a restricted service for tradespeople only, for emergencies (burst water pipes, electrical problems, etc).

Some were obviously taking the mick;

Weight-loss company Jenny Craig is defending its decision to continue operating during the lockdown, following public criticism from one of its own regional managers.

Several of the company’s employees have been touch with E Tu Union to express their frustration at the company for continuing to operate and claiming it is an essential service.

The company has since sent a statement to RNZ, saying it strongly believes it is an essential service.

Others were treating it casually, like an extended holiday. And for a tiny minority, their sense of bloated entitlement seemed to outweigh the potentially lethal nature of the crisis;

Police have become involved in a stand-off between irate residents on Great Barrier Island / Aotea and boaties anchored up in their waters for the lockdown.

The chair of the Great Barrier / Aotea Local Board, Izzy Fordham, said an estimated 50 boats were anchored in one harbour alone.

She said they were a burden on limited resources and police were investigating.

“Us locals were all trying to do the right thing, stay home, live within our bubble because if we get to the stage where we have community transmission of this disease and this sickness, goodness knows what it will do to our island.”

Fordham said the boaties were being “totally irresponsible” because they could spread coronavirus.

Even a Minister of the Crown was caught out in a class act of entitlement and plain stupidity.

But for the most part, we did as the Prime Minister cajoled us: stay home (unless an essential worker or buying essential needs); exercise locally; stay in our own bubbles.

There were “hic-cups” of course.

New Zealanders were astounded to learn that, for a long time, flight crews were exempted from quarantine after returning from international destinations;

The airline’s crews who fly internationally continue to be exempt from the strict 14-day quarantine rules for people returning to New Zealand from overseas – with the exception of Los Angeles flights.

On Monday the airline confirmed crew members had been forced to self-isolate after some staff allegedly disregarded physical distancing rules during a layover in Vancouver.

Documents obtained by Checkpoint show increasing unease and fear among flight crew staff about the exemption from isolation or quarantine, and the risk it poses to colleagues and the public.

Air New Zealand is currently operating 16 return international services a week. At the end of May it plans to add three return services a week to Shanghai to that schedule.

Then we gobsmacked to learn that MIQ front-line workers were not being tested regularly (or at all!) for covid transmission from Returnees, despite being on the pandemic battlefield frontline, and despite assurances from Ministry officials that this was a priority;

So, did the Ministry of Health ever attempt to implement a plan to test all asymptomatic border-facing workers? That remains unclear – ministry officials on Thursday refused to answer Newsroom’s detailed questions on the subject.

And MIQ staff in critical – and dangerous positions – were left without the most basic of protective equipment for their wellbeing;

Nurses at managed isolation and quarantine facilities are threatening to stop work if the government does not ensure they have access to appropriate safety equipment.

New Zealand Nurses Organisation industrial services manager Glenda Alexander said some but not all MIQ sites had a good supply and distribution of the high-quality N95 masks, and used the test fit process to ensure the masks were properly fitted.

“In other facilities they are still using the surgical masks and we are saying ‘no, that is not appropriate given the growing body of evidence that says that the virus can be transmitted through airborne contact’.”

But we muddled through.

With an equal mix of dedication from heroic front-line workers; good science from epidemiologists and other scientists; a strong collective effort by most Kiwis to “do the right thing”; and a truckload of good luck, we dodged the viral bullet on numerous occassions.

Though, as Dr Siouxsie Wiles has pointed out recently, some of our behaviour could be more cautionary. Sadly, as is the New Zealand way of doing things, something has to go wrong before we will act to remedy a critical gap in our defences.

On the non-pandemic battlefront Labour has had its wins and losses.

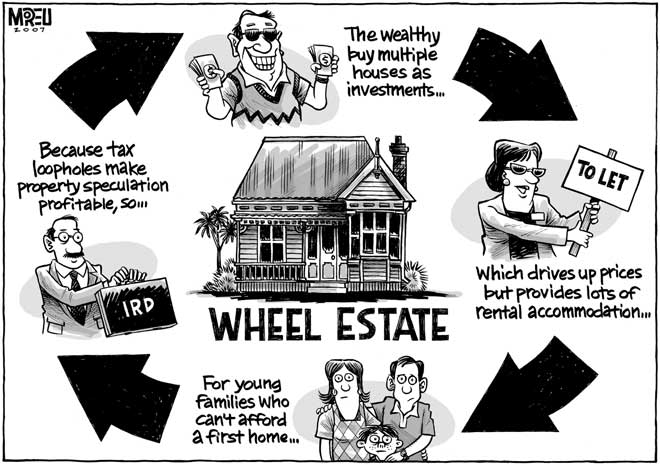

Touted as making the tax system fairer, the CGT proposal by the Tax Working Group (TWG) was dumped when coalition partner, NZ First, pulled the hand brake on the suggested reforms (see “NZ First” below), skidding 180 degrees to a full stop. As the TWG stated in it’s Final Report;

Group Chair Sir Michael Cullen says our system has many strengths but there is a clear weakness caused by our inconsistent treatment of capital gains.

“New Zealanders earning just salary and wages are taxed on their full income but we have several situations where you can earn income from gains on assets and not be taxed at all.

“All members of the Group agree that more income from capital gains should be taxed from the sale of residential rental properties. The majority of us on the Group, by a margin of 8-3, support going further and broadening that approach to include all land and buildings, business assets, intangible property and shares.

“We have judged that the increase in compliance and efficiency costs is worth it if we can reduce the biases towards certain types of investments and improve the fairness, integrity and fiscal sustainability of the tax system.”

A CGT would also have been one further “bullet in the arsenal” to contain skyrocketing housing prices.

But with NZ First actively opposing meaningful tax reforms, PM Ardern was forced to dump the proposal.

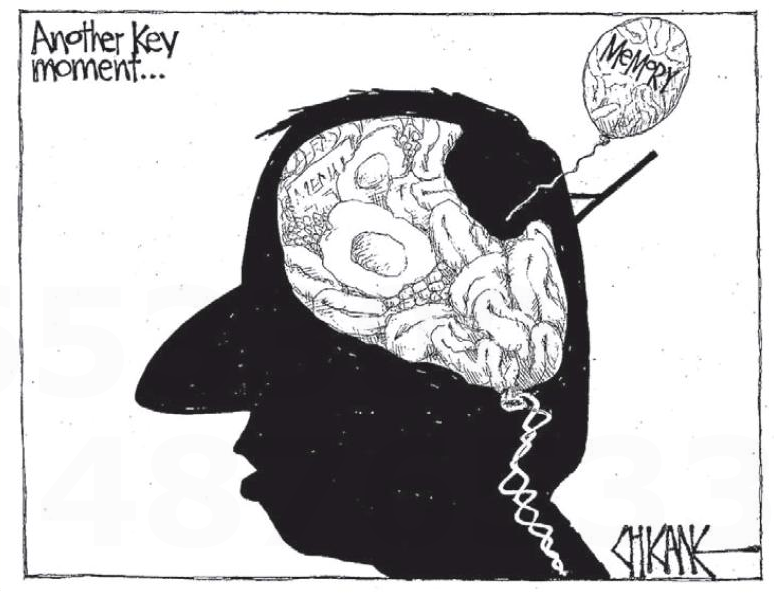

Curiously, the Prime Minister not only rejected CGT during the term of the coalition government – but for the entire duration of her leadership;

“Under my leadership, we will no longer campaign for, or implement a capital gains tax – not because I don’t believe in it, but because I don’t believe New Zealand does.”

Not only has she locked her party, and any future Labour-led government while she is PM, but she has played well and truly into the hands of National and their property-owning base, as journalist Henry Cooke pointed out with grim, relentless logic;

Yet Ardern wanted the issue off the table for upcoming elections and staked her career on the promise – much like Key when he said he would resign before raising the super eligibility age.

But National are never going to stop attacking Labour on tax. Ruling out CGT just opens the door for National to ask Ardern to rule out every possible other tax in existence, and when the Prime Minister is smart enough not to handcuff herself forever, National will tell voters that the party is keen to fish into your pockets.

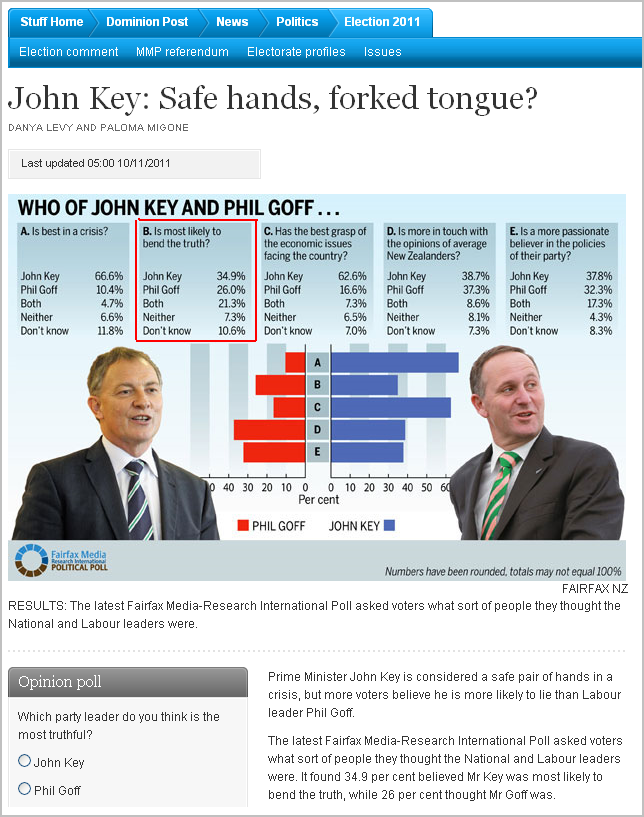

Labour’s second greatest achievement (after successfully leading us through the Covid Crisis) has been to out-do National as a sound steward of the economy. Three successive polls last year (here, here, and here) snatched the crown for economic management from National and placed it firmly on Labour.

However, in dumping the CGT, it has allowed itself to be out-manouvered by the Tories and their whining, asset-bloated, propertied-class backers. It has also shown that it is willing to allow unfairness in the tax system that, as the TWG estimated, could have raised roughly $8 billion over the first five years.

A missed opportunity Labour will regret for a long time.

Part of Labour’s plan to assist the economy through all stages of the covid lock-down was to implement a special COVID-19 Income Relief Payment. As this blogger reported on 3 September last year (re-published here from a previous blogpost);

On the 26 of May, Welfare Minister Carmel Sepuloni introduced the Social Security (COVID-19 Income Relief Payment to be Income) Amendment Bill. As RNZ reported;

The government is introducing a new relief payment for those who have lost their jobs due to Covid-19, while they find new employment or retrain.

The payment would be available for 12 weeks from 8 June for New Zealand citizens or residents who had lost their job as a impact of the virus since 1 March.

Those who apply would be required to actively seek suitable work, and take steps towards employment, including making use of redeployment or training.

It will pay $490 a week for those who lost full-time work and $250 for part time workers – including students.

The payments will be untaxed.

People with working partners may also be eligible, as long as their partner is earning under $2000 per week.

The new “income relief payment” was essentially a beefed-up unemployed benefit for workers losing their jobs due to the covid19 epidemic. It would be administered by the Ministry for Social Development.

It was passed in the House, through all three readings, in one day. Six days later, it was given Royal Assent.

The “income relief payment” differs from the usual unemployment benefit in two major areas:

- The amount of the “income relief payment” is $490 per week (tax free) – almost twice that of the regular, maximum unemployment benefit of $250.74

- Partners of post-covid unemployed receiving the “income relief payment” can still be in paid work (up to $2,000 per week!) and this does not affect the IRP. Partners of pre-covid beneficiaries earning the original, lesser unemployment benefit (net, $250.74 p/w) cannot be in paid work, or else it will affect their payments. It also attracts unwanted attention from MSD/WINZ who constantly pry into beneficiaries private lives.

The Covid Unemployed are apparently an elite, special group of beneficiaries for whom the regular payment of $250.74 – without the hassle of employed partners – was beneath their dignity.

This blatant discrimination did not go un-noticed by beneficiaries support groups and other former Green Party MPs.

[…]

As an RNZ story reported, pointing out the blinding obvious;

[University of Auckland sociologist Louise] Humpage said the early findings suggested that benefit levels need to rise.

“I think there is general consensus that benefits are too low at present and I think this Covid-19 payment is a reflection that it’s actually too low for most people.”

What an eye-rolling, unsurprising conclusion.

The two-tier benefit system – primarily benefitting middle-New Zealand – was something we might have expected from the previous National-led government. It would have been a “cunning plan” that former Social Welfare minister, Paula Bennett, might have concocted to protect middle class workers who lost their jobs and who had little inkling what surviving on welfare was really like.

The last thing National would have wanted is the middle class developing an empathetic understanding of the misery of surviving on unemployment welfare,

For Labour to promote such a scheme can only be described – at best – as misguided. At worst, it was a betrayal.

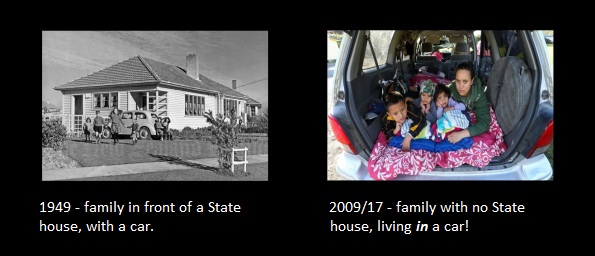

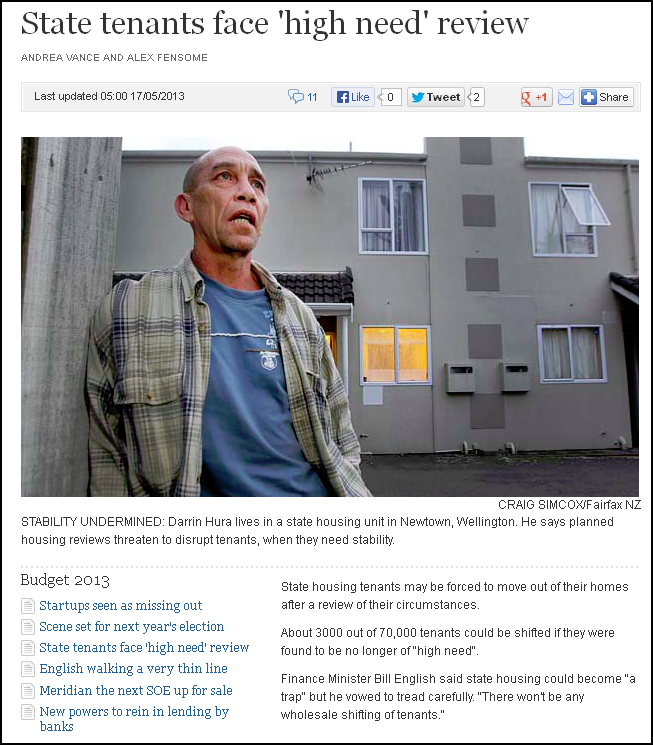

According to Kāinga Ora (formerly Housing NZ) 2016/17 Annual Report, the organisation owned (or “managed”) approximately 63,000 properties.

By 2020, that number had increased to 66,253, according to Kāinga Ora’s 2019/20 Annual Report.

The number is still far short of the 69,173 properties owned or managed by that organisation, according to their 2008/09 Annual Report.

But it is moving in the right direction, albeit at a unacceptably slow pace. The new build of state houses is certainly not keeping pace with the high numbers on the waiting list, as many families are forced out of the housing market with astronomical house prices leading to equally astronomical rents.

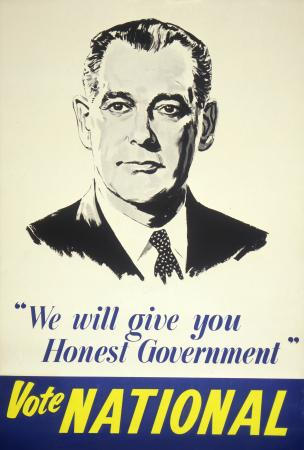

Labour is gradually undoing the mass sell-off of state houses wrought by the previous National government. (National, meanwhile, admitted it was wrong to sell off state housing, has promised no further sale of properties should it regain power – “except to state house tenants“.)

In this area, Labour can and must do better. State housing is their “bread and butter” for existence, as National’s is to support their mates in the business community.

If Labour cannot build the state houses we need, the inevitable question then arises: what good are they?

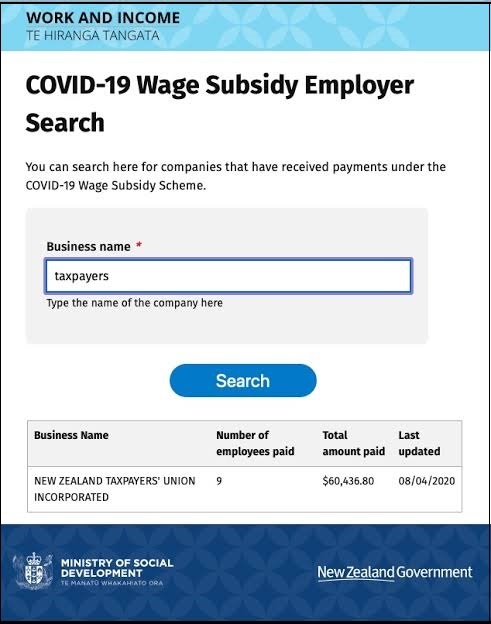

- Unemployment & the wages subsidy

Alongside closing our borders and the lockdowns, the other weapon in our arsenal to fight the pandemic was the Covid-19 Wage Subsidy. Basically it paid up to 80% of employee’s wages during the lockdowns (the subsidy is no longer being offered).

It meant that while most of the economy was frozen, businesses could still pay their staff. It relied heavily on borrowed money by the government, but one way or another, there would be a cost as the pandemic impacted on our country.

It seemed to have worked.

Prior to covid19, our unemployment stood at 4.2%. for the March 2020 Quarter.

By the September Quarter, that figure had reached 5.3%.

(Note: the June 2020 Quarter reported a fall in unemployment to 4.0%. These results are misleading, caused by the way Statistics NZ calculates unemployment. During lockdown, the data was badly skewed.)

Many businesses have since re-paid the subsidy as their accounts are better than expected following the lockdowns. One, in particular, The Warehouse, suffered bad publicity when it took the wage subsidy and then made hundreds of staff redundant whilst posting a $44.5 million profit. After considerable public and political pressure, The Warehouse announced it would repay the subsidy.

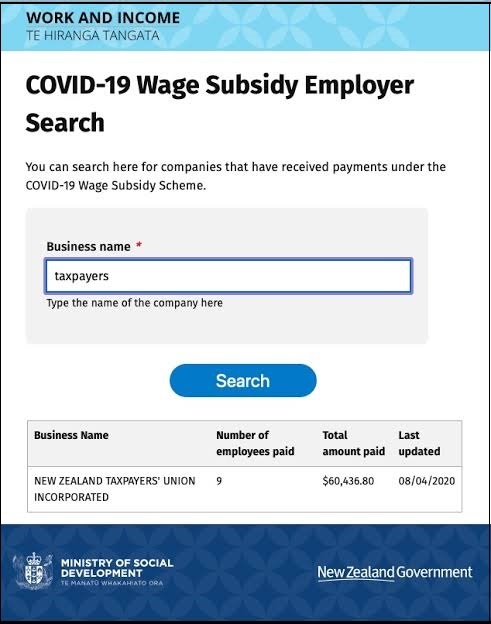

The most high-profile recipient of the wage subsidy was the so-called “Taxpayers Union“. Ostensibly a group opposed to government subsidies and “profligacy”, the TU applied for, and recieved, $60,000 in taxpayer-funded subsidy;

.

Source acknowledgement: The Paepae.

.

Predictably, the “Union” became the subject of considerable on-line derision and merciless mocking on various social media platforms. It was one of the few funny moments in the tragedy that is covid19.

Aside from saving jobs and businesses, the Wages Subsidy reminded us that far from keeping the State “out of our lives” as neo-liberals have been calling for since the 1980s – the State was our united defence against the forces of nature – in this case a deadly viral pandemic. Only the State could marshal the expertise; the financial resources; the human power; and co-ordination necessary to save lives. Only the State, through our elected representatives, could motivate and encourage people to act together and do the right thing for the greater good.

Collectivism suddenly became desirable; the neo-liberal vision of small government, not so much.

Contrast our success with that of the United States which has glorified small government and the cult of the individual. Or Sweden, which adopted a hands-off approach. Their death rates are currently 496,033 and 12,428 respectively.

New Zealands death rate still stands at 25.

Now we begin to understand the deep, under-lying reason for Labour’s stunning election results last year. For all our criticisms (of which there are plenty and well-justified), they damn well earned it.

As Senior Researcher in Politics at Auckland University of Technology, David Hall, wrote for “The Conversation” in October last year;

“In times of upset, people yearn for normality — and Ardern’s Labour Party was awarded a landslide for achieving something close to this.

[…]

This leaves us with the longstanding conundrum of what the Labour Party is and what it really stands for these days. Ardern and her colleagues are not ideologues, but no politics is without ideology — a system of ideas, values and beliefs that orients its efforts.”

If the primary priority of the current Labour-only government is to be “responsible managers” of the economy then they will be jostling for that position with their Tory counterparts. It will be a precarious position to occupy, as National’s fall-from-grace after Steven Joyce’s and Paul Goldsmith’s stuff-ups during the 2017 and 2020 election campaigns proved with dramatic effect.

Whilst being “responsible managers” is a good reputation to hold, in itself that is not Labour’s raison d’etre. Their existence, like the Green Party and ACT, is to effect change.

Labour is the party that initiated State housing; implemented unemployment and domestic purposes benefits; removed homosexuality and sex work from the Crimes Act; cut diplomatic ties with apartheid South Africa; moved Aotearoa New Zealand to be nuclear free; brought in equal pay for women legislation; and many other progressive social and economic reforms.

For the current Labour government to squander their majority in Parliament is to turn their backs on their 105 years of proud history and waste the mandate they have been given.

If Labour is too timid to act on climate change; unaffordable housing and homelessness; rampant inequality and discrimination against minorities; child poverty and low income for welfare beneficiaries; as well as guard the country against covid and act as sound stewards of the economy, then the legitimate question must arise in voter’s mind; why vote for them?

Re-election for the sole purpose of re-election is not reason enough.

.

.

References

The Wall Street Journal: The Covid-19 Death Toll Is Even Worse Than It Looks

Al Jazeera: In post-Brexit UK, quiet ports hide mounting transport chaos

The Atlantic: This is a coup

The Guardian: Victoria hotel quarantine failures ‘responsible’ for Covid second wave and 768 deaths, inquiry told

CNN: Russian opposition leader Alexey Navalny dupes spy into revealing how he was poisoned

CNBC: Hundreds arrested in Hong Kong protests, as analysts weigh in on national security law’s impact

BBC: The Uighurs and the Chinese state – A long history of discord

Reuters: Global temperatures reached record highs in 2020, say EU scientists

Electoral Commission: New Zealand 2020 General Election – Official Results

Electoral Commission: New Zealand 2017 General Election – Official Results

Wikipedia: 2014 New Zealand General Election

The Spinoff: Future Act MP held ‘climate hysteria skeptics’ meetings at high school

Victoria University: The Home Front Volume II Chapter 17 — More Shortages

RNZ: New Zealand’s most fertile land dug up for housing

Stuff media: $5.50 lettuces if fertile Pukekohe land turned into houses

Canstar: NZ property trends emerging in 2017

Scoop media: Auckland Median House Price Hits $1m Mark In October; 9 Other Regions & 28 Districts Hit Record Median Prices

Business Insider: How A US Housing Boom Became A Global Financial Crisis

The Conversation: With a mandate to govern New Zealand alone, Labour must now decide what it really stands for

Electoral Commission: New Zealand 2017 General Election – Official Results

The Guardian: Climate crisis – 2020 was joint hottest year ever recorded

Stanford News: Stanford researcher reveals influence of global warming on extreme weather events has been frequently underestimated

NIWA: Ocean acidification—what is it?

Carbon Brief: New climate models suggest faster melting of the Greenland Ice Sheet

Geonet: Whakaari/White Island

Wikipedia: Christchurch mosque shootings

RNZ: Jenny Craig defends stance as essential service

RNZ: What it means to break Covid-19 lockdown rules

RNZ: New Zealand lockdown – Great Barrier-Aotea residents irritated by boaties on shores

NZ Herald: Covid 19 coronavirus lockdown – Health Minister David Clark demoted after driving 20km to beach, breaking lockdown rules

RNZ: Air NZ silent about Covid-19 cases as staff fears grow over quarantine exemption

Stuff media: Coronavirus – How the Government botched border testing for Covid-19

RNZ: Covid-19 – MIQ nurses threaten to stop work if N95 masks not supplied

RNZ: ‘Dumb good luck’ no outbreak after Covid-19 community case – health expert

Newshub: Siouxsie Wiles slams Air NZ for still serving food

Tax Working Group: Tax Working Group delivers Final Report

NZ Herald: PM Jacinda Ardern has ruled out implementing a Capital Gains Tax while she is at the helm of Labour

Stuff media: Capital gains tax – Jacinda Ardern took a lifeboat off a ship she could have saved

Newshub: Newshub-Reid Research poll shows Kiwis trust Labour over National to run economy as Paul Goldsmith dodges blame over fiscal hole

Newshub: Newshub-Reid Research Poll: Kiwis trust Labour more than National to run the economy

TVNZ: Kiwis now trust Labour more than National to repair the economy, poll suggests

Parliament: Social Security (COVID-19 Income Relief Payment to be Income) Amendment Bill

RNZ: Relief payments for people who lost jobs due to Covid-19 announced

MSD: Jobseeker Support cut-out points (current)

RNZ: Covid income relief payment recipients fare better than those on the dole, survey finds

Kāinga Ora: 2016/17 Annual Report

Kāinga Ora: 2019/20 Annual Report

Housing NZ: Annual Report 2008/09

Stuff media: Public housing waitlist cracks 20,000 with over 2000 new households in a single month

Stuff media: National Party admits it sold too many state houses

Stuff media: Election 2020 – National promises to sell state houses, but this time only to tenants

Work and Income: Covid-19 Wage Subsidy

Statistics NZ: Unemployment rate at 4.2 percent in March quarter

Stuff media: Record jump in jobless rate to 5.3%, but NZ set to avoid unemployment disaster

The Spin-off: Why the hell has New Zealand’s unemployment rate just gone down?

RNZ: Ryman to repay $14.2m for wage subsidy

RNZ: The Warehouse Group wage subsidy repayment – Taxpayers pleased

Newshub: Coronavirus – Taxpayers’ Union gives up ‘ideological purity’, accepts $60,000 in taxpayer wage subsidies

Worldometer: Covid 19 – USA

Worldometer: Covid 19 – Sweden

National party: Restoring New Zealand’s Prosperity – Responsible Economic Management

ODT: Opinion – Joyce’s ‘fake news’ fiscal hole backfires

Stuff media: Election 2020 – National’s fiscal hole appears to double to $8 billion as Paul Goldsmith denies double count mistake

NZ History: State housing – The first state house

Te Ara: Family welfare

Stuff media: Homosexual Law Reform 30 years on – what was life like for the gay community pre-1986?

Parliament: Prostitution law reform in New Zealand

Te Ara: Political leaders – David Lange’s tour of Africa

MFAT: Taking a nuclear-free policy to the world

MSD: New Zealand Conference on Pay and Employment Equity for Women

Additional

Greenpeace: Five ways NZ will be much better if Jacinda makes good on her promise to Build Back Better

Other blogspots

The Paepae: The juxtaposition in this screen shot of the ‘NZ Taxpayers Union Inc’ astroturf lobby group receiving a government-funded subsidy makes me chortle

The Daily Blog: When will Michael Barnett stop whinging, whining and bleating? – John Minto

Previous related blogposts

Observations on the 2017 Election campaign thus far… (rima)

Life in Level 2: Two Tier Welfare; A Green School; Right Rage, Wrong Reason

2020: Post-mortem or Prologue?

2020: The History That Was – Part 1

2020: The History That Was – Part 2

.

.

.

Acknowledgement: Sharon Murdoch

.

This blogpost was first published on The Daily Blog on 15 February 2021.

.

.

= fs =