Archive

Purpose-built MIQ: National’s sums don’t add up

.

.

Parts of National’s document – to open up Aotearoa New Zealand “to the world” – has been recycled from various policy and media releases last year and more recently.

Despite demanding that the country open up to the outside world and end lockdowns by 1 December, and to “bring all New Zealanders home by Christmas“, National is still demanding that several hundred million dollars be committed to purpose-built MIQ facilities.

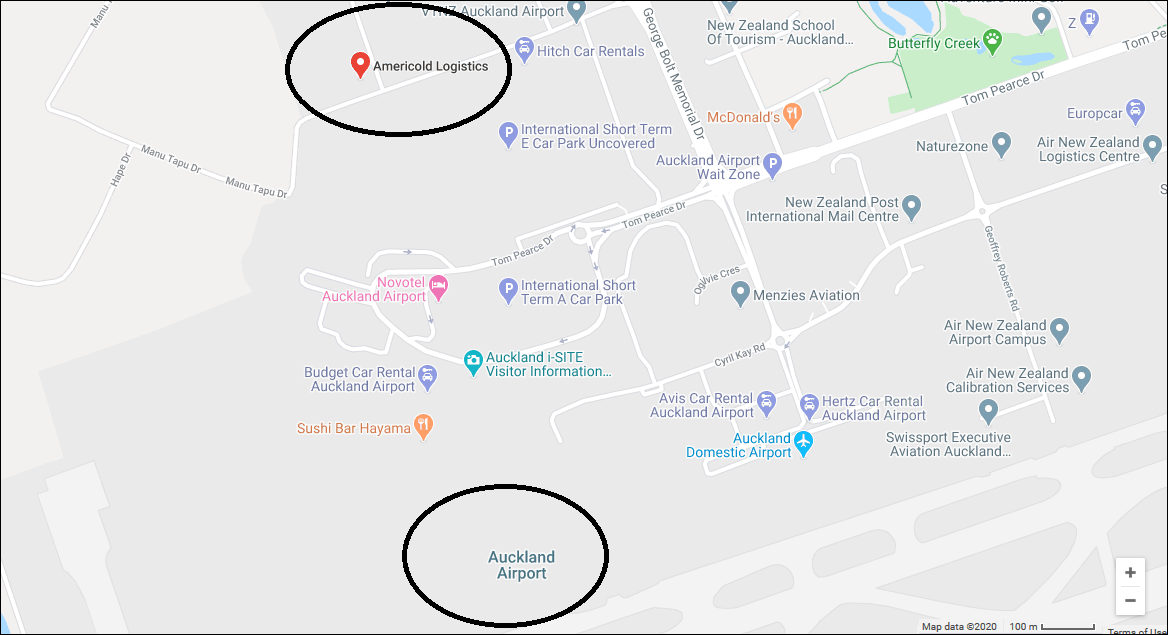

Their document, National’s plan to tackle COVID-19, end lockdowns and reopen to the world, calls for “1,000 to 1,500 permanent quarantine units and associated facilities outside of urban Auckland and close to the international airport and health and security workforce“:

.

.

It is unclear why we would need MIQ facilities if the country “opened up” to the rest of the world. With Delta’s ferocious infectiousness, putting anyone into MIQ – irrespective of whether hotels or purpose-built – becomes a pointless exercise in futility. Delta would already be endemic throughout the country; spreading like wildfire; filling our hospitals and ICU beds; and our morgues.

By that stage, MIQ facilities become redundant. (Although Returnees might actually be safer inside a facility rather than outside, protected from an infected wider population.)

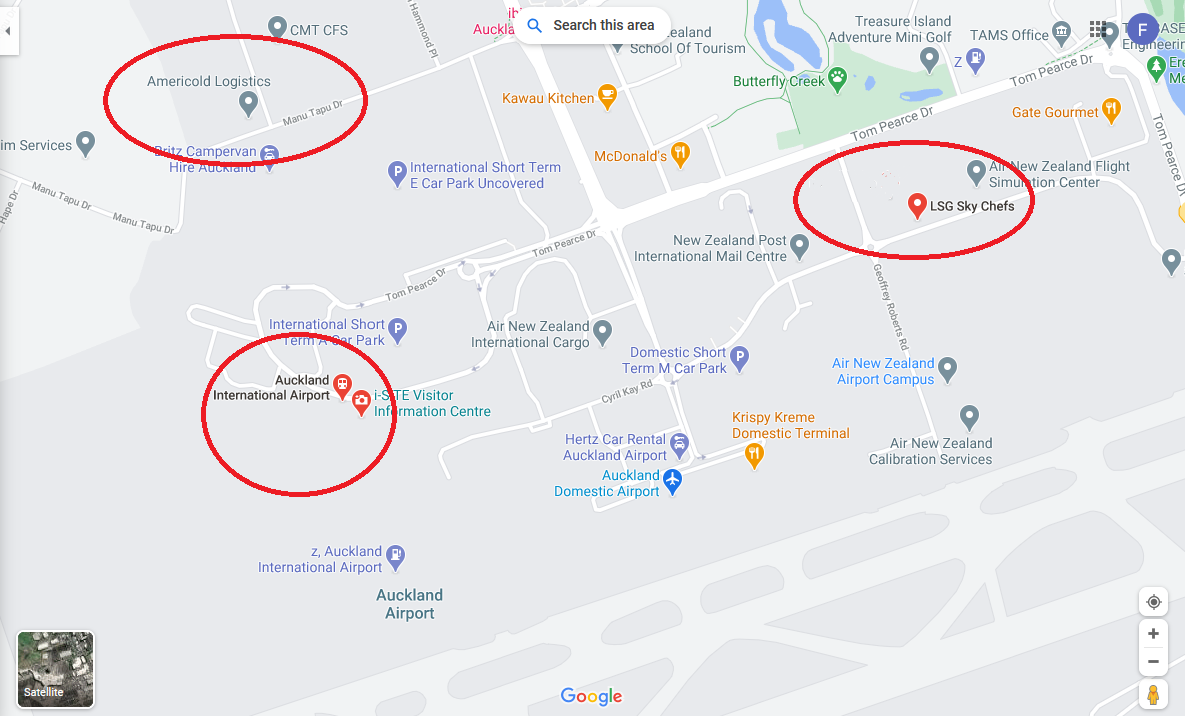

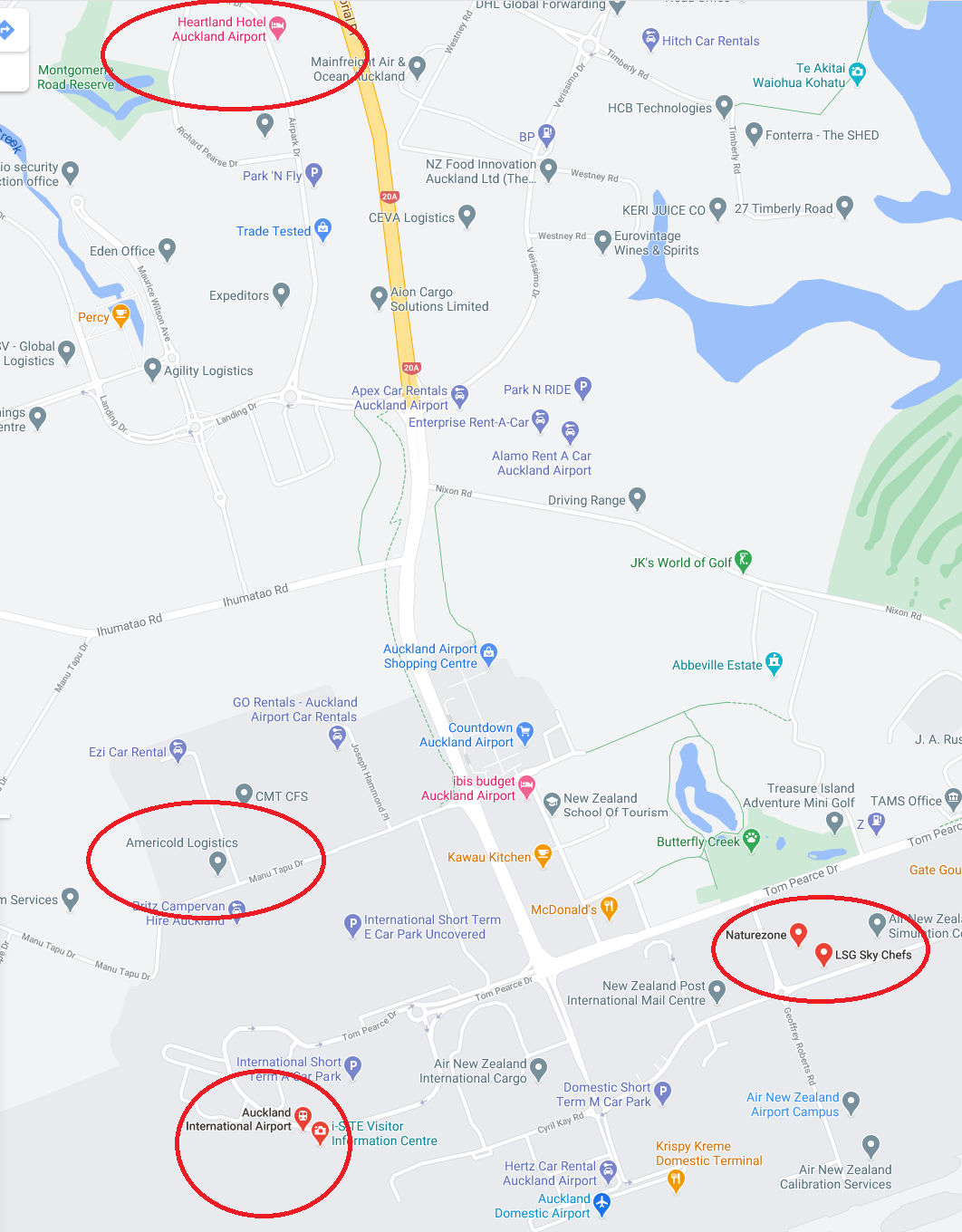

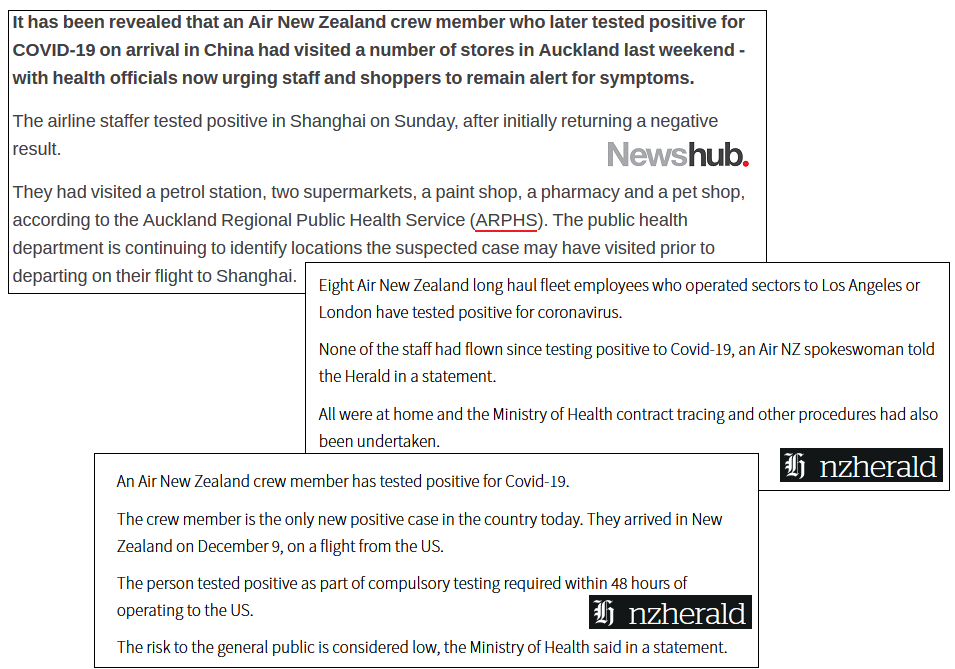

However, more to the point, National’s costing for a purpose built facility – which excludes land – is given as “estimated build cost would be circa $200 million” for “1,000 to 1,500 permanent quarantine units and associated facilities“.

It is unclear how $200 million can apply to one thousand units, or fifteen hundred units. The price must surely increase if the build increases. If not, someone is playing loose with construction costs.

It is also unclear where the figure of “$200 million” has come from.

The un-named author of National’s document quotes figures from the Victorian State Government plans for a purpose-built MIQ facility:

.

.

National references the Victorian government’s plans with this URL: www.vic.gov.au/victorian-quarantine-hub.

Except, National’s figure of $200 million – whether for 1,000 or 1,500 units – doesn’t add up.

As this blogger first reported in July this year after National first floated it’s purpose-built MIQ facility some months earlier, it was noticeable at the time that neither Mr Bishop, nor his (current) Leader, had offered any costing for such a massive project:

To provide some broad indication, a planned purpose built quarantine facility in Victoria, Australia, is estimated to cost A$15 million [NZ16 million] to design and a further “A$200 million [NZ$214 million] to build a 500-bed facility and around A$700 million [NZ$750 million] if it was scaled up to 3,000 beds”.

By comparison, Aotearoa has between 4,000 to 4,500 beds in hotels in Auckland (18), Hamilton (3), Rotorua (3), Wellington (2) and Christchurch (6).

Using the above figures, building a 4,000 bed facility would cost the country well over a billion dollars. With inevitable cost over-runs, the final figure would be anyone’s guess.

Chris Bishop also called for returnees to be paid a wage whilst self isolating;

“We think the government needs to be more generous when it comes to supporting people when they’re told to self-isolate. Earlier this year we announced a policy of the government paying people’s wages when people are ordered to self-isolate. It’s pretty sensible – if the government is saying to you “stay home” and we don’t want you at work – they should pay.”

National’s calls have not been costed – and nor would they be. The agenda from the Opposition is not to demand a more effective Managed Isolation and Quarantine system. Instead, their unspoken aim is,

(A) to paint the Labour government as ineffective, for pure political point-scoring

(B) to pressure the Labour government to adopt costly policies, which would push up borrowing and debt. Caretaker Leader Collins would then wag a disapproving finger; and tut-tuttingly exclaim,

“It is irresponsible of the government continuing to spend money like it is with no thought as to where it comes from… it is ultimately the government’s decision to waste enormous amounts of money and not to actually put the focus on where it needs to be.”

Clever strategy; force your rival to spend money – then blame them for spending money.

National has now costed it’s proposed purpose-built MIQ – but the sums still do not add up.

In April this year, the Victorian government costed three options for MIQ. The first two were specifically reliant on hired, or mixed new-builds and hired, structures. Option three, purpose-built structures is closer to National’s plans.

Under heading “3.3.3 Project option 3: custom–built structures”, page 28, the Victorian government plan calls for “entirely of purpose-built structures designed to remain permanently on the site“. Furthermore:

.

.

Victoria’s plan calls for 3,000 accommodation units costing A$701.675 million;

.

.

National’s plan calls for 1,000 to 1,500 units for NZ$200 million. Let’s assume the NZ$200 million is intended for the maximum build number: 1,500.

1,500 is half of Victoria’s 3,000 accommodation units.

Halve the cost of Victoria projected price tag: A$350.68 million.

Converting that sum to NZ dollars, using Westpac’s* currency converter, A$350.68 million is roughly equivalent to NZ$359 million.

.

.

National’s costings appear to be woefully under-stated – by a factor of one-and-a-half times.

Which is unsurprising. The party of “fiscal responsibility” has a poor track record of costing its policies with any meaningful accuracy:

.

.

Tragically, the true cost of National’s policies will not be measured in dollars.

It will be measured in lives lost to a disease that, while tough to suppress and eradicate, should not be tolerated to rip through our communities.

We cannot afford a National government. Not in money; certainly not in lives.

.

* Westpac is the government’s official bank.

.

.

.

References

National: Opening Up: National’s plan to tackle COVID-19, end lockdowns and reopen to the world (p 27, 28)

TVNZ: National proposes building of purpose-built quarantine facility on Auckland’s outskirts

RNZ: National proposes reopening fully vaccinated businesses in ‘back in business’ plan

ABC News: Melbourne COVID-19 quarantine facility approved as Commonwealth, Victoria agree on site

Managed Isolation and Quarantine: Managed Isolation and Quarantine capacity

Stuff media: Covid-19 – Why the Government isn’t using purpose-built quarantine facilities

National Party: Ditch DHB merger, spend funding on medicines instead

Vic.gov.au: Alternative Quarantine Accommodation Hub Project Summary April 2021 (p 27-29)

Westpac: Currency Converter

Stuff media: Election 2020 – ‘Fair cop’ – National’s Paul Goldsmith admits to accounting mistake as Labour points out $4b hole

The Spinoff: The launch that fell down a four-billion-dollar fiscal hole

RNZ: Judith Collins downplays National’s fiscal error, defends Paul Goldsmith

Stuff media: Election 2020 – National’s fiscal hole appears to double to $8 billion as Paul Goldsmith denies double count mistake

RNZ: Explainer – How deep does National’s fiscal hole go?

Previous related blogposts

Judith Collins and National: It’s a trust thing

.

.

.

Acknowledgement: Rod Emmerson

.

Liked what you read? Feel free to share.

Have your own thoughts? Leave a comment. (Trolls need not bother.)

.

= fs =

The Virus, the Politician, and the gang member

.

.

The claim from NZ First Leader, and former MP, Winston Peters, was stunning: Harry Tam and an unknown woman had breached Auckland’s containment boundaries with falsified documents and headed north.

He told Newshub Nation host, Simon Shepherd on 9 October:

“This person came here with a gang member assigned essential worker status, falsified the reason she was coming.

[She] engaged with people at a hotel in Whangarei… and went to a marae up north which hid her from the public and dare I say it, the police. The police got a warrant to arrest her.

How he got up north, that is very difficult to understand in terms of the permit system, but he brought in, under false premises, this woman with him. The rest, sadly, is catastrophic.

I am absolutely certain of my sources, otherwise I wouldn’t be saying what I’m saying.

Let them deny it, and they won’t. But when the press was told yesterday at 6:30pm by Minister Hipkins that he didn’t, that simply wasn’t true. Frankly, we will never get through this crisis if we aren’t transparent and honest.”

An uncomfortable-looking Simon Shepherd was obviously taken aback by Mr Peters’ alllegations and perhaps he was quickly calculating how far he could go to obtain more details from the former NZ First leader.

This blogger could only guess that the show’s producer may have had their finger hovering over the Big Red Button to cut quickly to an ad break.

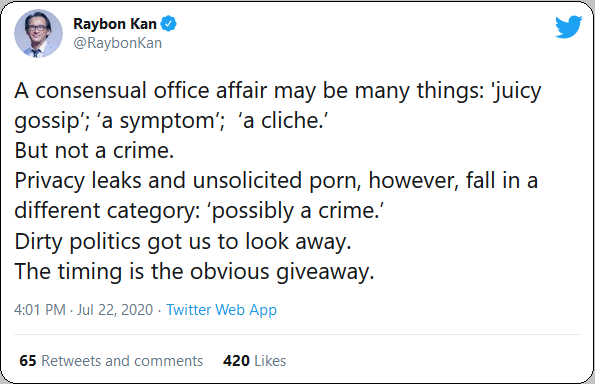

The allegations were serious: Mr Peters had accused gang leader, Harry Tam, of a serious crime. He wasn’t presenting his allegations as opinion, they were stated as fact:

How he got up north, that is very difficult to understand in terms of the permit system, but he brought in, under false premises, this woman with him […]

I am absolutely certain of my sources, otherwise I wouldn’t be saying what I’m saying.

Harry Tam denied Mr Peters’ allegation:

“If Winston said it, he needs to prove it… If he’s not going to apologise, we will need to look at legal action. I didn’t bring anyone with me. Where did he get his information from? What is his source?”

As reported by Te Ao Maori News:

Tam told Te Ao Māori News, Peters was off the mark, while he had travelled to Tāmaki under a government exemption to support efforts to get gang members vaccinated, he travelled alone and had never been to Northland since arriving in Auckland.

It would be difficult for someone as well know as Harry Tam to have been moving around Auckland without being spotted by members of the public.

His cellphone would have been picked up by cellphone towers around the region, making his whereabouts ridiculously easy to ascertain.

According to how Police are wording their search for the “other woman”, it is apparent that both travellers are women.

Harry Tam is known to be a male.

There will be fallout for Winston Peters.

His wild claims not only put himself up for being sued – but TV3/Newshub is also in the firing line.

It is eerily similar to various pro-Trump conspiracy theorists who have been sued by companies for alleging that their voting machines were “rigged” in favour of Joe Biden:

.

.

If it is correct that Mr Peters obtained his “information” from Facebook or via a conspiratorial email currently being circulated, he may be in for a shock. Such sources usually do not carry much weight in a Court of law:

.

.

This may well have been Mr Peters last appearance on any mainstream media – at least for a live interview. No media outlet will want to risk a lawsuit because of his unpredictability with extravagant, potentially defamatory, claims.

It’s a tough day at the office when a politician’s credibility falls below that of a gang member.

I hope the 24 hours news-cycle notoriety was worth it, Mr Peters?

.

.

.

References

Newshub Nation: Gang leader Harry Tam denies Winston Peters’ claims he helped infected woman breach COVID boundary, sparking Northland lockdown

Te Ao News: ‘Apologise!’ Mob leader slams Peters’ Covid, Northland allegations

Stuff media: Covid-19 – Search for contact of Northland case ‘extraordinarily frustrating’

USA Today: Fact check – False claim that Rudy Giuliani, Sidney Powell prevailed in Dominion lawsuits

Forbes: After Lawsuits Against Newsmax And OANN, Here’s Who Dominion Has Sued So Far—And Who Could Be Next

Vox: Sidney Powell gives up the game, admits Trump’s election conspiracies weren’t factual

Business Insider Australia: Rudy Guiliani admits under oath that he got some of his ‘evidence’ of alleged election fraud from Facebook

Other Blogs

Kiwiblog: Winston vs Harry

.

Acknowledgement: Guy Body

.

Liked what you read? Feel free to share.

Have your own thoughts? Leave a comment. (Trolls need not bother.)

.

= fs =

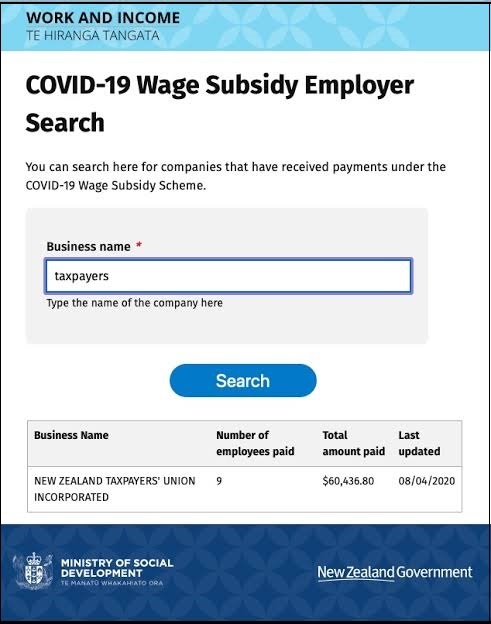

The Virus, the Bubble, and the Trap

.

.

In case people missed it, National’s de- facto 2023 election campaign was launched on 15 March this year.

The campaign – in the form of a petition to open a Trans Tasman bubble without need for MIQ – was uploaded onto National’s twitter account, and twentyfive minutes later onto Caretaker Leader, Judith Collin’s account:

.

.

Pressure mounted from the business community. The usual vocal business, tourism, and hospitality industry lobbyists made their voices heard loud and repetitively to the point of being cliched “broken records”:

.

.

Even state-owned, non-commercial RNZ was prodigious in platforming the clamour from business interests.

Voices calling for caution were few and far between. Apparently, calls for caution were not nearly as news-worthy and exciting as the prospect of re-opening our borders to our nearest neighbour after nearly a year cut off from the rest of the world.

One voice of caution came from Stuff Media’s travel journalist, Brooke Sabin. In October 2020, Mr Sabin posed five critical questions pertaining to any proposed travel bubble. One such question asked:

.

One of the key questions around a travel bubble with Australia is what happens if a community case pops up? For example, if we have flights to Adelaide and a single mystery case popped up there, would flights to and from New Zealand be cancelled? If not, would we adopt Australia’s hotspot definition and stop travel if there were more than three cases for three days in a row? The New Zealand public may find that hard to stomach, but that’s why debate is needed now, before the election, to try and settle on a risk we’re happy with.

Travellers, airlines, insurers and the tourism industry need this certainty. We could see cases pop up once a bubble is underway, and nobody quite knows at what point travel would continue, or if tens of thousands would have travel plans disrupted by widespread cancellations.

.

Events nine months later were to answer his questions, with grim, dramatic effect.

Ironically, Brook Sabin’s article was picked up and republished by a merchant banker, Fifo Capital. The financiers at Fifo obviously recognised the inherent danger posed to the Aotearoa New Zealand’s economy should covid19 – especially the highly infectious Delta Strain – break through our borders. It was a pity other businesses did not share Fifo’s wise caution.

The strident calls to open a Trans Tasman bubble succeeded.

On 6 April this year, PM Ardern announced that “quarantine-free travel between New Zealand and Australia will start on Monday 19 April“.

However, she also issued a clear, stark warning:

.

“Quarantine free travel will not be what it was pre-COVID-19, and those undertaking travel will do so under the guidance of ‘flyer beware’. People will need to plan for the possibility of having travel disrupted if there is an outbreak.”

.

It was a warning that many either did not heed or understand.

University of Auckland epidemiology professor, Rod Jackson, who recently appeared on Newshub Nation (2 October), and who has a reputation for clear, unvarnished, truth stated with crystal clarity:

.

“I’ve seen some things in the newspaper and the media about people complaining they are not being helped by the New Zealand government when they’re stuck in Australia and can’t come back.

I think that they need to suck it up, that anyone who wants to go to Australia needs to be aware that at a moment’s notice they could end up being there for weeks, if not months.”

.

Again, people took no notice.

Eighteen days late, on 23 July, PM Ardern announced the closure of the Trans Tasman bubble. The Delta Strain was spreading through Australia and the risk that a traveller could bring it back to this country – as happened in June this year – could no longer be ignored.

PM Ardern pleaded with New Zealanders:

.

“There is considerable pressure on our managed isolation facilities at the moment and my strong urging to everyone is do not travel to Australia in the next eight weeks.”

.

Returnees were put in two weeks isolation upon return to Aotearoa New Zealand, putting a strain on availability of MIQ rooms. New Zalanders were now not only trapped throughout the world, trying to get home, but thousands were now also trapped throughout Australia.

Returnees demanded access to MIQ rooms. There were insufficient rooms. Calls became strident. The media shamelessly gorged itself on amplified stories of misery, stress, and hardship. There were emotive headlines and interviews. There were clicks to be gained; advertising to sell; and careers to build.

A few in the media bucked the stampede to exploit this human crisis. Writing in his column, Q+A presenter, Jack Tame, pointed out the blindingly obvious:

.

“Remember – this is the way the bubble was designed to function. From the word go, there was risk for anyone who decided to go to Australia. You bought a ticket. You chose to travel. You assumed that risk. I actually think the people who’ve come back from New South Wales and into MIQ should consider themselves very lucky they haven’t had to pay for the privilege when everyone else does.”

.

The truth is that business and political agitation for a trans tasman bubble generated considerable media stories. Once the bubble collapsed and New Zealanders were trapped overseas, there were yet more “human interest” stories to be made. The more tragic the story, the better the headline.

24 hours a day, seven days a week, the media feasted.

Critics of the Labour government; political opportunists; those dissatisfied with travel restrictions; and detractors of the MIQ system were quick to weaponise “human interest”, “heart-string” stories for their own ends. Where reasoned argument fell short against our covid19 and MIQ policies, emotive invective took over. That weaponisation of PM Ardern’s plea to Be Kind was turned back against the government and those who understood the danger which covid19 posed to us collectively.

And then, finally, our luck well and truly ran out.

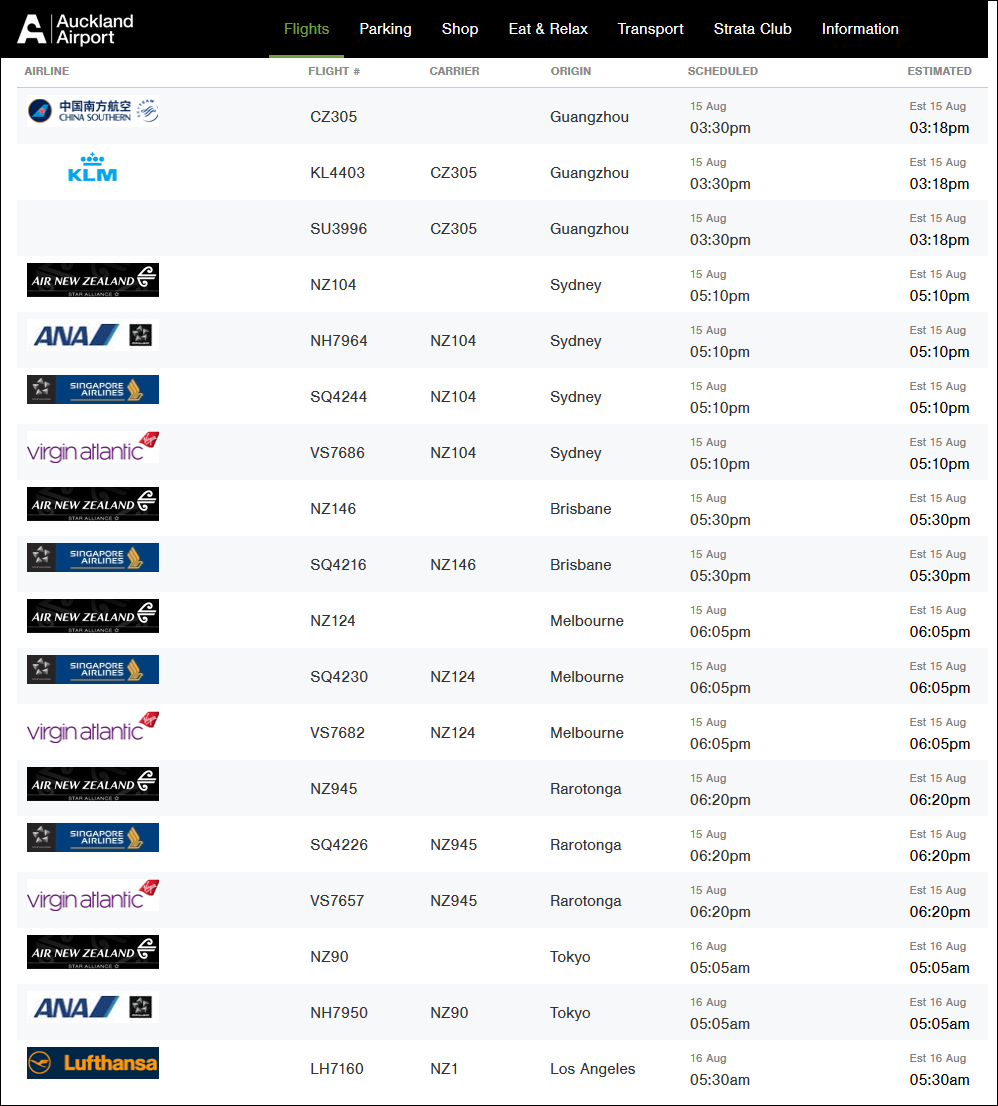

On 17 August – four months after the Trans Tasman bubble had opened – a community case of the Delta Strain was detected in one person, in Auckland. The PM wasted no time, and the entire country was thrown into Level 4 Alert lockdown at 11.59PM that very night.

Since then, Delta has infected 1,420 people. Two have tragically died (as at 6 October 2021).

The response from National, amplified by the media, has been scathing:

.

.

Every morning, afternoon, and throughout the evening, from Monday to Sunday, National and their fellow-travellers from business and right-wing media excoriated the government for the current outbreak. The relentless headlines – of which only a small sample is presented above – does not even include radio, television interviews and social media propaganda.

Demands for a Trans Tasman bubble was a carefully laid trap from National.

If the bubble was successful, Chris Bishop and National’s current (?) Leader, could loudly proclaim success and claim credit for loosening restrictions and ‘liberating’ New Zealanders from our isolation. It would be a valuable, vote-grabbing ‘coup’ to take to the 2023 general election.

“See? This is what a competent government looks like! This is what a National does! Vote for us!”

If the bubble failed, Chris Bishop and National’s current (?) Leader, could blast the government for incompetence and every other ‘misdemeanour’ imaginable.

“See? This is what an incompetent government looks like! This is what Labour does! Vote for us!”

Truly, it was a win/win, no-lose, cunning gambit.

The Government fell for the trap. Delta got loose. Country forced into lockdown. Delta all but impossible to contain.

Checkmate.

If there is a lesson for Labour, it is this: As Opposition, National can demand whatever it can dream up. But as Opposition, it has zero accountability for consequences when things go horribly wrong.

Never listen to National. They are the the party of responsibility, except when National has no responsibility.

.

.

.

References

National Party: Open the Trans Tasman Bubble Now (archived)

Twitter: National Party – Sign the Trans Tasman bubble petition

Twitter: Judith Collins – Sign the Trans Tasman bubble petition

RNZ: Tourism New Zealand forecasting billion-dollar economy boost if trans-Tasman bubble opens

Stuff media: Crack open the border, mate – Waikato tourist towns’ plea for trans-Tasman bubble

Stuff media: Tourism disappointed over delay in trans-Tasman bubble date

RNZ: Business community wants quick decision on trans-Tasman bubble

Newshub: COVID-19 – Concerns some small tourist towns will be gone before trans-Tasman bubble opens

Stuff media: Government pushed to act on trans-Tasman travel bubble

Stuff media: Covid-19 Five big problems with the proposed trans-Tasman travel bubble

Beehive.govt.nz: Trans-Tasman bubble to start 19 April

Stuff media: Trans-Tasman travel: Prepare to be stuck ‘for weeks’ if you travel under re-opened bubble, expert says

RNZ: NZ government suspends quarantine-free travel with Australia for at least eight weeks

RNZ: Australian traveller who visited Wellington has Delta variant

Stuff media: Covid-19 – A timeline of the Delta outbreak

Ministry of Health: 39 community cases of COVID-19; two border cases; more than 63,000 vaccines doses administered yesterday

Voxy: ‘Short and sharp’ lockdown will be the longest ever – Judith Collins, Chris Bishop

National: Time has run out on Government’s incoherent Covid strategy

National: Government has choices and needs to make them now

National: New Zealand at Covid crossroads

National: What is the Government’s Covid strategy?

National: No mention of Delta strain in Government plans

National: South Island should drop now to alert level 2

National: Labour has dropped the MIQ ball

Stuff media: Covid-19 NZ – Judith Collins says level 4 should be all but ruled out, Government lacks mandate to lock people down

National: Labour recklessly delayed vaccine shipments

RNZ: New level 2 rules a ‘bitter pill to swallow’ for South Island, Collins says

National: Minister won’t say how much more taxpayers will be up for

Additional

The Spinoff: New Zealand urgently needs a serious opposition leader

Al Jazeera: New Zealand grapples with Delta – and Tucker Carlson

Reference sources

MIQ: History and origins of MIQ

Covid19: History of the COVID-19 Alert System

MBIE: Managed isolation and quarantine data

RNZ: Timeline – The year of Covid-19 in New Zealand

Stuff media: Covid-19 – A timeline of the Delta outbreak

Other Blogs

The Knightly Views: Media lessons from a pandemic

The Standard: Smug hermit king

Previous related blogposts

Life in lockdown, Round Two – Day 4 – Caretaker Leader Collins, another rare mis-step

Life in lockdown, Round Two – Day 15 (@L3)

The Microbiologist, the Caretaker Leader, and some Nasty Germs

One thousand dead New Zealanders per year?

The Virus, the Media, and John Key

.

.

.

Acknowledgement: Rod Emmerson (15-21 March 2021)

.

.

Liked what you read? Feel free to share.

Have your own thoughts? Leave a comment. (Trolls need not bother.)

.

= fs =

One thousand dead New Zealanders per year?

.

.

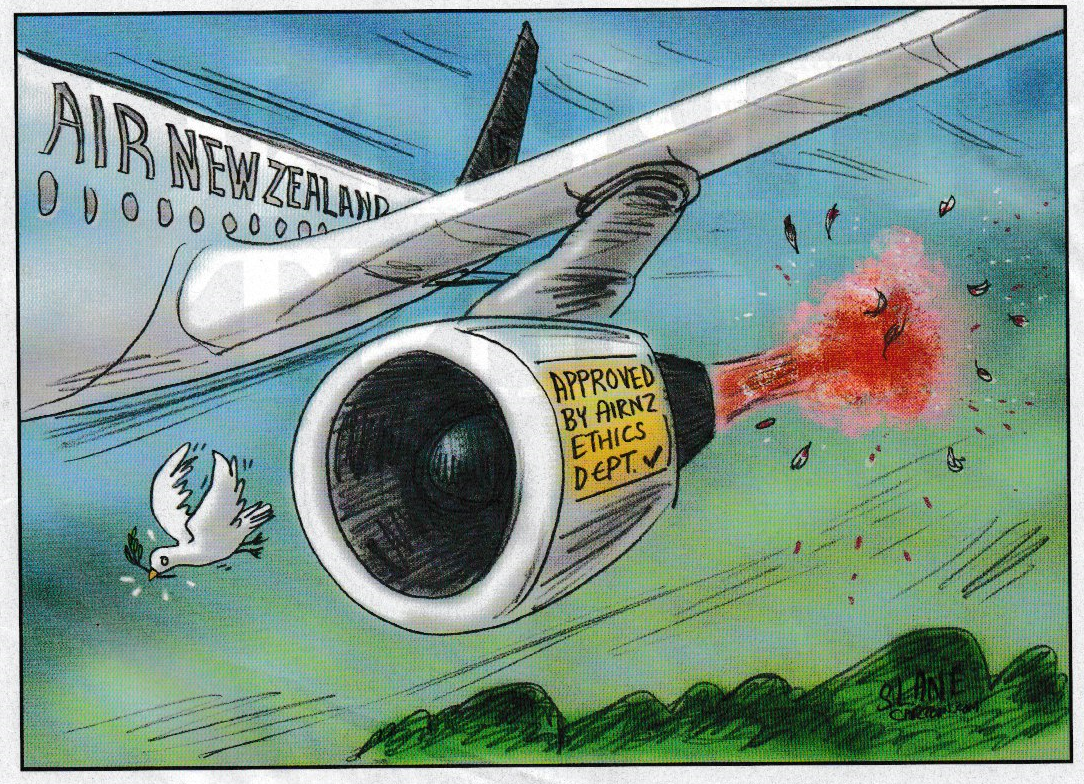

The “Plan Bers” – including assorted right-wing politicians, privileged media commentators, faux “experts”, business lobbyists, et al – have a new argument they’re recently taken to trotting out, to justify opening up Aotearoa New Zealand to covid-19:

“We already have 500 New Zealanders dying each year from influenza.”

Overseas “experts” have been just as keen to join the But What About Influenza Club, like this character from the United States, Dr Amesh Adalja, from the Johns Hopkins University’s Center for Health Security:

“We don’t want anybody to die from Covid. Covid is a vaccine preventable illness, now is a vaccine preventable death, but I think there are many tools that you can use short of a lockdown to achieve that goal and I think what we eventually want to see is decoupling of cases from hospitalisations and death. But there’s going to be some level of deaths that occur, and I think it’s interesting because in New Zealand you had around 26 or so deaths.

But in the last flu season you had 500 deaths and I just worry about that precedent, because what is New Zealand going to do for the next flu season? How do you kind of square what you’ve done for Covid for flu? When the flu deaths are 20 times higher because of those actions you’ve taken and I think this is going to be something that your society has to to think about and debate, and I think it’s an important debate to have.”

So there we have it: allowing people to die from preventable disease is worthy of “debate”.

When do we get to debate if Dr Adalja should live or die. Or his family?

In the same “debate”, hosted by Nathan Rarere on RNZ’s “First Up“, Dr Adalja called our lockdowns “as a last resort when nothing else works, and as a policy failure“.

He acknowledged that our current covid death rate was “around 26 or so deaths” (It’s currently at 27.)

Dr Adalja didn’t mention that the covid death toll of the United States – his home country – currently stands at 691,562. The US is currently experiencing 148,000 cases and 1,991 deaths reported per day.

Nor did Dr Adalja mention that the US is currently experiencing a massive resurgence of Delta Covid, with hospitals being over-whelmed. Hospital care is being rationed as staff can no longer cope:

.

.

Dr Adalja mentions none of these inconvenient truths. Out-of-control Delta surge. Hospitals forced to rational care. Rising death toll.

Not. One. Word.

But he is happy to lecture us that lockdowns are “a policy failure“.

On a recent episode of TV3’s The Nation, political report Tova O’Brien asked National’s covid spokesperson, Chris Bishop, and ACT Leader, David Seymour what number of covid-related deaths would be acceptable to open up Aotearoa New Zealand.

Chris Bishop suggested that “he would like us to get to around 85% before we start to open up“. David Seymour offered no vaccination target.

According to one report from The Lancet, at 90% vaccination rate (including under 15s), our death toll was estimated at around 1,030 per year – twice the influenza rate.

Neither had the courage nor stomach to offer an acceptable death rate.

Mr Seymour, however, did respond with a bit of Grim Reaperish ‘whataboutism’:

.

.

“Well, 30,000 people die in New Zealand every year.

The truth is that we cannot prevent all deaths. The important question here is how much more are we prepared to spend to prevent a COVID death than deaths from car crashes, deaths from cancer? Because at the moment, the money we’re spending on COVID, we can’t spend on preventing those other kinds of deaths.”

David Seymour has established a new benchmark by casually accepting the annual influenza death toll as an acceptable figure. If 500 covid-related deaths per year are also acceptable, we should look at other causal factors of death in this country, and apply the new benchmark:

David Seymour’s 500 Deaths Rule

Road toll for 2020: 320 + 180 more acceptable deaths = 500

Work Related Deaths for 2020: 66 + 434 more acceptable deaths = 500

Drownings for 2020: 74 + 426 more acceptable deaths = 500

Homicides for 2020: 142 + 358 more acceptable deaths = 500

There are probably many more categories that could have the 500 Deaths Rule applied.

If Mr Seymour can justify an increased covid death toll by pointing and demanding, “What about ‘flu?” then anything can be justified and made acceptable.

This is the benchmark set by David Seymour. Let’s call it “Seymour’s Death Rule”.

.

.

.

References

RNZ: Covid-19 debate – When should New Zealand open up its borders?

Worldometer: Coronavirus Cases – United States

RNZ: US hospitals ration care amid shortages and Covid-19 surge

Reuters: Some U.S. hospitals forced to ration care amid staffing shortages, COVID-19 surge

NPR: A COVID Surge Is Overwhelming U.S. Hospitals, Raising Fears Of Rationed Care

Vox: Americans are dying because no hospital will take them

New York Times: Idaho allows overwhelmed hospitals across the state to ration care if necessary.

Forbes: In Idaho And Other States, The Delta Covid-19 Surge Is Forcing Hospitals To Ration ICU Beds

CNN: As Covid-19 hospitalizations spike, some overwhelmed hospitals are rationing care

The Lancet – Western Pacific: COVID-19 vaccine strategies for Aotearoa New Zealand: a mathematical modelling study

Otago University magazine: Flu a major killer

Police: 2020 road deaths down on 2019

Worksafe: Fatalities

Water Safety: Water Safety Reports 2020

Police: Daily Occurrences of Crime and Family Violence Investigations

Previous related blogposts

Judith Collins and National: It’s a trust thing

The freezing cold invisible hand of neo-liberalism

Life in lockdown, Round Two – Day 4 – Caretaker Leader Collins, another rare mis-step

The Microbiologist, the Caretaker Leader, and some Nasty Germs

.

.

.

Acknowledgement: Chris Slane

.

Liked what you read? Feel free to share.

Have your own thoughts? Leave a comment. (Trolls need not bother.)

.

= fs =

The Microbiologist, the Caretaker Leader, and some Nasty Germs

.

.

The recent faux “scandal” and pile-on levelled at one of Aotearoa New Zealand’s top microbiologists, Dr Siouxsie Wiles:

.

.

— is indicative of how threatened the Right feel about the country’s covid closed borders. Despite mistakes and some slow implementation of policies, the leadership of the current government has saved lives.

First, some numbers we should not overlook:

Aotearoa New Zealand’s covid death toll currently stands at 27.

By contrast, Sweden’s death toll currently sits at 14,662. They have had 1,138,017 covid cases compared to our 3,949 .

Yet, Sweden’s population is ten million – just double ours.

It takes no stretch of the imagination to consider the impact on our health system had we even half of Sweden’s infections, hospital admissions, and death toll.

Our nearest neighbours, New South Wales (current death toll: 177) and Fiji (current death toll*: 535) also offer grim reminders where we might have ended up had it not been for our political leadership; dedicated health and MIQ border professionals; and committed scientists to lead us through this global war.

Anyone taking note of the facts would quickly realise that this is a ‘beat up’ by right-wing bloggers and the current Leader of the National party. Even some National-leaning media commentators have bought into the “scandal” narrative:

.

.

Let’s be clear. This was not a “scandal”.

“Beat up” by the Right – yes. Pile on by covid-deniers, conspiracy fantasists, misogynistic cranks, and assorted RWNJs – yes.

Scandal? Not even close.

Critics of Dr Wiles have accused her of breaking the 5 kilometre rule of travelling for exercise. Except… there is no such rule in this country. Those critics have either dim-wittedly, or deliberately, conflated our country with New South Wales. (Easy mistake to make. Both places begin with “New”. They could easily have confused us with New York.)

The rules for Aotearoa New Zealand’s Level 4 lockdown, as published on the government covid website:

Recreation and Exercise

You are allowed to leave your home or place of residence for recreation or exercise at an outdoor location in your local area that is easy to access (including by vehicle).

You’re strongly encouraged to wear a face covering and should keep a 2 metre distance from people outside your household bubble, where this is practical. You legally must not attend or organise a gathering of people.

You are not allowed to do any dangerous activities, including:

- swimming

- surfing

- scuba-diving

- water-based activities with boats (sail or motor)

- using motorised equipment

- hunting in motorised vehicles

- tramping

- flying aircrafts.

Note where it states: “including by vehicle“. Dr Wiles rode her bicycle. She also, contrary to some mischievous claims, did not enter the water.

The New South Wales rules, by contrast:

.

.

National’s Caretaker Leader, Judith Collins, was her usual measured, composed self when she described Dr Wiles’ exercise outing:

“I think she’s a big fat hypocrite, actually, and I’m sick and tired of listening to her telling everyone else what to do, and here we have the evidence that she had travelled from Freemans Bay to go and visit with her friend on the beach at Judges Bay in Parnell.

That’s about 5km, and unless she ran there – and I doubt it – then she wasn’t exercising. No masks on, sitting there on the beach, and the friend goes off for a swim. I watched that video, and I thought: big fat hypocrite.

I’m so sick of her telling us all what to do. She’s not doing it? Just do it… If those TV stations have her back on telling everyone what to do, I think we should just turn them off.”

It’s a shame Ms Collins did not approach Dr Wiles for her side of the story before attacking the much-respected microbiologist.

Dr Wiles’ comprehensive explanation of events on the day she went to the beach totally discredits Cameron Slaters blogpost. (This blogger will not link to Mr Slater’s post. It does not merit referencing. Readers can search it out if they feel so inclined. Have some disinfectant handy afterwards.)

On Twitter, Dr Wiles stated:

.

.

Several anons (usual; name/word + numbers) attempted to perpetuate the attack on Dr Wiles, but were mocked and derided by other social media users who understood that this was little more than one of Mr Slater’s ill-conceived, malevolent beat-ups.

The support for the good Doctor was clear indication that most Kiwis respect and admire the work she has done to share information and educate us about covid. She has well earned her New Zealander of the Year title, plus some:

.

.

As with death and taxes, it can be guaranteed that neither Judith Collins nor Cameron Slater will ever have to compose a “thank you” speech for winning “NZer of the Year”.

For Ms Collins to engage in a diatribe that – let’s face it – suggests that the pressures of her job; her ongoing lack of popularity; National’s stagnation in the polls; and David Seymour eclipsing her as Preferred Prime Minister – have raised questions about her emotional stability.

Ms Collins’ reference to Dr Wiles as “big, fat” is juvenile at best; Muldoon-style malevolence at worst. It is not the first time she has made snide comments based on a person’s appearance. Or even seven years ago.

Her desperation to keep her leadership rests on achieving the near-impossible: replacing the most popular, articulate, and effective leader this country has had for a long time. The pressure to succeed has seen her lashing out in ways that would be utterly unacceptable in any other part of society.

National’s more moderate MPs, hierarchy, and membership must be shaking their heads in despair at Ms Collins’ worsening irrational outbursts. They must lie awake at night wondering what the next headlines will reveal about their increasingly erratic Leader.

Several must be shaking their heads in despair that Ms Collins is once again associating with former Whaleoil blogger, Cameron Slater. They understand; no good will come of this.

The attack on Dr Wiles is a large dollop of misogynism writ large. No other virologist, microbiologist, epidemiologist, medical professional, or any scientist – who happens to be male – has been attacked as mercilessly; doggedly, and viciously as Dr Wiles.

Not one.

It is revealing that most of her attackers are men. Most are too irrational, with fragile egos, to engage in rational discourse. Dr Wiles is clearly threatening to this minority with their own intractable personal “issues”.

But politically she is also a threat to National and it’s aspirations.

This government has embraced decision-making based on science and safety. Economics comes after. Labour’s decisions have been largely successful, avoiding the over-whelming of our hospitals with covid cases; corpses stacked high in mortuaries; and a death toll in the hundreds – if not thousands.

For Plan Bers and others who want to see Labour fail, it must be galling for them to watch the government’s success thus far. Dr Wiles has been prominent, articulate, and popular in pushing the scientific framing of our covid policies. With her gender and bright pink hair, she has become an easy target for the anonymous on-line trolls and political opportunists, for sustained bullying.

But Dr Wiles is a strong woman and she understands that these people are, deep down inside, like frightened little children. Look at her reasoned, measured, gentle responses to trolls on-line and it’s like a mother reassuring a scared, anxious child during a violent lightning storm.

As another woman said so many years ago (but who holds not even a molecule of the same mana as Dr Wiles); “The lady’s not for turning“.

And as for National’s Caretaker Leader, Judith Collins? Dr Wiles will have her job after the next election. The same cannot be said for Ms Collins.

How to Fight Nasty Germs.

Far from being passive observers of the targeted harrassment of Dr Wiles, many good people are resisting. They are fighting the Germs that have tried to infect and defeat this incredible woman with their misogynistic hatred.

As reported by Stuff’s Josephine Franks (no relation):

People are donating to Dr Siouxsie Wiles’ research after the microbiologist was accused of breaking lockdown rules and called a “big, fat hypocrite” by Judith Collins.

A video of Wiles at the beach with a friend was circulated in blogs this week. It showed the pair talking on the sand without masks on, before the friend goes in the water. The clip was accompanied by accusations of rule-breaking and hypocrisy.

Wiles told Stuff this was a “really clear case of disinformation” that was spread to discredit her and disrupt the country’s collective response to Covid-19.

[…]

“It costs us about $250 to test each fungus, and we’ve over 10,000 fungi to test, so your support could help us discover more of these life-saving medicines,” the donation page reads.

People have been posting screenshots of their donations on Twitter with messages of support for Wiles.

“Donation made to a hard-working, intelligent and patient lady who has gone to great lengths to keep us all informed,” one said.

“Thank you Dr Siouxsie for your amazing work!” another read.

Some dedicated their donations to Judith Collins after the National leader called Wiles a “big, fat hypocrite” in reference to the video.

Wiles was unfazed by the insult, saying: “I get that comment every day, so it’s nothing new. Fat shaming someone who was exercising was kind of ironic, really.”

.

.

Make a donation (whether $5 or $500 – the amount matters nought); take a screen shot; and post it on @JudithCollinsMP (Twitter) or @judithcollinsmp (Facebook).

Like… this:

.

.

This is the best way to fight germs – whether the microscopic variety or equally unsavoury, two legged specimens. As the American saying goes, “Don’t get mad. Get even.”

And we support a fine scientist in her work to beat Germs.

You just can’t get “revenge” more delicious than that.

.

.

(* Fiji’s death troll is likely to be under-reported.)

.

.

.

References

ODT: Collins calls Dr Siouxsie Wiles ‘a big, fat hypocrite’

Stuff media: Covid-19 – Dr Siouxsie Wiles warns of ‘disinformation’ after claims she was caught breaking lockdown rules

ODT: Dr Wiles hits back at accusations she broke lockdown rules

Worldometers: New Zealand Coronavirus

Worldometers: Sweden Coronavirus

NZ Herald: Covid 19 Australia: NSW, Victoria outbreaks grow – Queensland dodges lockdown

Worldometer: Fiji Coronavirus

NZ Herald: Judith Collins’ leadership flagging before Dr Siouxsie Wiles scandal

Covid19.govt.nz: Permitted movement within Alert Level 4 – recreation and exercise

NSW Government: Greater Sydney restrictions

Newshub: Siouxsie Wiles hits back at Judith Collins over ‘big fat hypocrite’ jibe

Twitter: @SiouxsieW – beach walk – 10.9.21

NZAwards: New Zealander of the Year 2021

RNZ: Judith Collins – Obese people must take responsibility for ‘personal choices’

Stuff media: Collins jumps in ‘racist’ clothes-fight

Stuff media: Covid-19 – Donations fly in for Dr Siouxsie Wiles’ research after Judith Collins calls her a ‘hypocrite’

Auckland University: Beating the Superbugs

Twitter: @ConanMcKegg – National are goong after her for purely political reasons – 12.9.21

ABC: Medical experts say a third of Fiji’s COVID-19 deaths may be unreported

Additional

The Spinoff: New Zealand urgently needs a serious opposition leader

Other Blogs

The Standard: Dirty Politics does not work any more

Previous related blogposts

A fitting response to National MP’s recent personal attacks on Metiria Turei (Feb, 2014)

New Clothing Standards set by National Party (Feb, 2014)

.

.

.

Acknowledgement: Weston Frizzell

.

Liked what you read? Feel free to share.

Have your own thoughts? Leave a comment. (Trolls need not bother.)

.

= fs =

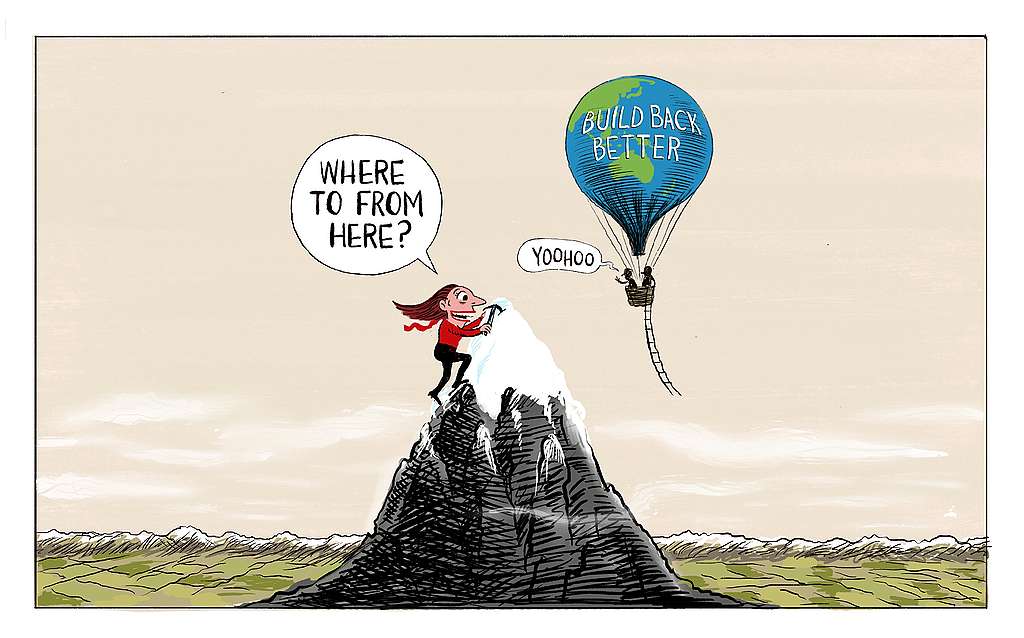

Life in lockdown, Round Two – Day 4 – Caretaker Leader Collins, another rare mis-step

.

.

21 August: Day 4 of living in lock-down…

No report from this blogger of what has been happening around the Wellington region. Being a day off, I am staying at home. Plenty of housework and reading to catch up on.

Meanwhile…

Day’s beginning.

Current covid19 cases: 31

Cases in ICU: –

Number of deaths: –

Today’s Eyebrow-Raiser.

Caretaker Leader Judith Collins on pointless sniping from the sidelines…

“I think we’re very wise to sit back and wait a little while before we go charging into full Opposition mode.

I think one of the problems we have is if people see us as constantly sniping away from the sidelines and not putting up very good policies… then we’ll go the way of traditional Opposition which is further down, and that’s not something we want to do.”

Also Caretaker Leader Judith Collins, on the sidelines…

“We are in lockdown because the government did not act with urgency to protect New Zealanders. Their complacency and inability to ensure supply and delivery of the vaccine roll-out has left New Zealanders as sitting ducks; completely vulnerable to the Delta variant when it inevitably got into the community.

It is not enough for the prime minister to lock us in our homes and speak from the podium once a day. New Zealanders don’t need sermons, we need vaccines in arms right now.”

She just can’t help herself.

At a time when we are facing an even worse crisis with a vastly more transmissable mutation of covid – the Delta Strain – the nation needs calm leadership. Sniping from the sidelines is a distraction already-stressed New Zealanders will not welcome, nor thank.

Let’s not forget that the Delta Strain came from Sydney.

Let’s not forget who put pressure on the government to open a Trans Tasman “bubble” with a petition.

.

.

Let’s not forget who seems to have conveniently forgotten that petition.

.

.

She got what she wanted. The consequences were inevitable. Now she’s sniping from the sidelines the government isn’t cleaning up the mess she – in part – is responsible for.

.

#CaretakerLeaderCollins

.

By Day’s End.

Current covid19 cases: 51

Cases in ICU: –

Number of deaths: –

So ended the fourth day of our journey to beat this thing.

.

.

.

.

References

RNZ: Covid-19 update – 11 new cases in the community, including three in Wellington

Newshub: Judith Collins wants National to avoid ‘constantly sniping away from the sidelines’ as it rebuilds

RNZ: Covid-19 – National criticises government’s handling of latest outbreak

Newsroom: Sydney returnee likely source of Covid outbreak

National Party: Sign the Trans Tasman bubble petition

Twitter: Judith Collins – Trans Tasman Bubble Petition

RNZ: Covid-19 update – 21 new community cases in New Zealand today

Previous related blogposts

National: Demand the Debate. Also National: No, not like that!

Judith Collins and National: It’s a trust thing

.

.

.

Acknowledgment: Sharon Murdoch

.

Liked what you read? Feel free to share.

Have your own thoughts? Leave a comment. (Trolls need not bother.)

.

= fs =

The freezing cold invisible hand of neo-liberalism

.

.

Genesis Energy CEO Marc England

.

Following the power brown-out through the north island on Monday night – something that supposedly happens only in developing or marxist nations and not developed free market economies – Genesis Energy, chief executive, Marc England was interviewed on RNZ’s Checkpoint by Lisa Owen.

.

.

Trying to ascertain where responsibility lay for power cuts ping-ponged between Transpower and Genesis Energy until Mr England made this astounding admission;

“We don’t have any legal or regulatory accountability for security of supply in New Zealand, our only accountability is to be sure we can supply our customers.”

To emphasise the point; the CEO of one of our main electricity gentailers; currently 51% State-owned/49% privatised; formerly a 100% state owned enterprise; and prior to that, part of the Electricity Corporation of New Zealand has formally expressed his company’s zero obligation for “any legal or regulatory accountability for security of supply in New Zealand“. His only concern was “to be sure we can supply our customers“.

Let that sink in for a moment: ““We don’t have any legal or regulatory accountability for security of supply in New Zealand“.

That is where the splitting up of state electricity generation and retailing; partial privatisation; and the so-called “free market” has led us: “We don’t have any legal or regulatory accountability for security of supply in New Zealand”.

Being a commercial entity, the sole purpose of all gentailers is to return a dividend to shareholders.

It can do that any number of ways but it has no “regulatory accountability for security of supply in New Zealand“. It’s only “regulatory accountability” is to it’s shareholders. End of.

If it can achieve higher dividends by reducing power generation and thereby pushing up prices by virtue of scarcity – then that is it’s priority.

Not to New Zealand.

Not to customers.

But to shareholders.

It is noteworthy that since part-privatisation in 2014, Genesis Energy has not built any further power generation. There are no incentives for it (nor any other gentailer) to do so. To generate more electricity would increase supply and drive down prices. By keeping generation static – especially in moments of high demand – it can drive up prices.

Electricity consumers can expect prices rises in months to come.

Welcome to the logical – if insane – conclusion to the neo-liberal experiment.

The only solutions are;

- Regulation by government to force gentailers to build more renewable energy generation (geothermal, solar, hydro, tidal, and wind).

- Re-nationalise.

- Close close all coal-burning at Huntly and elsewhere.

Otherwise, New Zealanders can expect more-of-the-same: static or reduced generation; rising prices; brown outs.,

Otherwise, as Mr England stated with crystal clarity: “We don’t have any legal or regulatory accountability for security of supply in New Zealand”.

The free market has spoken.

.

Caretaker Leader Judith Collins

.

Responding to the power brown-outs on Monday night, National’s caretaker leader, Judith Collins made these two asinine posts on Twitter;

.

.

.

Note the time-stamps on both: 9.05PM and 9.06PM.

Ms Collins would have had no understanding why the brown-outs were occurring. In fact, for much of the affected areas, they were still in darkness. So no one knew what was happening or why.

Yet, that did not prevent Ms Collins from posting two childish “digs” at the government.

This is indicative of her personality; vindictive and willing to lash out.

It is clear that with each successive political poll, as her standing among voters continues its downward trajectory, she is becoming more desperate. And more erratic.

This woman is not fit to be Prime Minister. She is barely suitable as party Leader for National.

#CaretakerLeaderCollins

#NationalNotFitToGovern

.

.

.

References

RNZ: Checkpoint – Power outages – Genesis CEO says Energy Minister scapegoating, but Woods has questions

Wikipedia: Genesis Energy

Wikipedia: Electricity Corporation of New Zealand

Wikipedia: Genesis Energy – Power Stations

Twitter: Judith Collins – Thanks Labour – 9.05PM – Aug 9, 2021

Additional

RNZ: UN sounds ‘code red for humanity’ warning over irreversible climate impact

Other Blogs

No Right Turn: The electricity market screws us again

The Standard: When We Needed Electricity, it Was Shut Off

Previous related blogposts

Judith Collins wins a Hypocrisy Award

Politics through a crystal ball, palmistry, or chicken entrails?

History Lesson – Tahi – Electricity Sector “reforms”

The Vote, Electricity, and Sex! (That’ll grab your attention!)

Labour, Greens, NZ First, & Mana – A Bright Idea with electricity!

Do National Party supporters prefer higher electricity prices?

.

.

.

Acknowledgement: Dylan Horrocks

.

Liked what you read? Feel free to share.

Have your own thoughts? Leave a comment. (Trolls need not bother.)

.

= fs =

National: Demand the Debate. Also National: No, not like that!

.

.

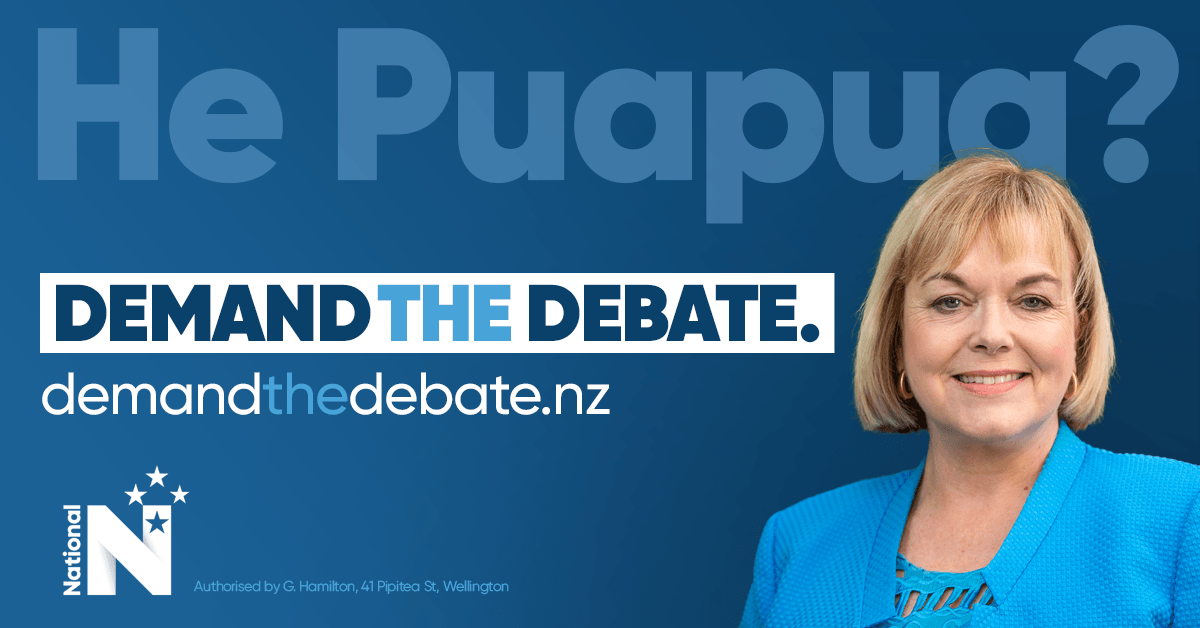

Up until recently, National’s Caretaker Leader, Judith Collins, has pushed her party’s #DemandTheDebate rhetoric – implying that the current government has somehow, mysteriously, successfully stopped the entire country from debating “important issues”.

The party’s billboards screamed “Demand the Debate”, with Ms Collins’ glaring at us with her forced, Bond-villain-style smile:

.

.

.

Social media wits were quick to take the p*ss. National’s efforts were mercilessly lampooned:

.

.

The entire exercise was more a desperate attempt to remain relevant in New Zealander’s lives and control the narrative rather than any real call for debating issues.

It was telling that the real issues – covid/border controls, housing, health, climate change, poverty – were all missing from the billboards. These are issues National wanted buried. Their history of inaction on these points left them vulnerable to public questions demanding:

“Wait, what? Just what the hell were you doing during your nine years in government?”

But nowhere is National’s lukewarm commitment to debating issues more apparent than their recent appalling mistreatment of their own youth wing, the Young Nationals.

As Henry Cooke reported for Stuff media:

.

.

The Young Nats had the temerity to question their Elders, calling for National MPs to vote to send the Conversion Practices Prohibition Legislation Bill to Select Committee for public consultation and – debate.

Instead, not only did National MPs vote against debating the Bill at Select Committee – but their Justice Spokesperson, Simon Bridges, railed against transgender and non-binary people:

“It is important that we consider sexual orientation and gender identity or expression separately. Sexual orientation requires no medical intervention, whereas when it comes to gender identity/expression, parents are naturally concerned about being able to make decisions about their children being given puberty blockers and hormones .”

Just another normal day for cis heterosexual men (and a few women, sad to say) determining the sexuality of other people when really, it’s none of their damned business. Are we re-litigating the 1986 Homosexual Law Reform and Marriage Equality debates all over again?

Mr Bridges, et al, we do not get to “consider [other peoples’] sexual orientation and gender identity or expression separately“. We can consider our own sexuality – that’s it.

The Young Nats – though hardly expressing unqualified, fulsome support for the Bill – made it crystal-clear:

.

.

One has to wonder – where are the Free Speech warriors leaping the the defence of the Young Nats? (Indeed, at least one supposedly staunch proponent of free speech has roundly condemned the Young Nats for their simple request for an open debate at Select Committee.)

Not only did the National Party conference condemn their own youth wing (not a very smart move, as they are potentially the future of the National Party), but they called for at least one head to roll:

.

.

Meanwhile, incumbent Peter Goodfellow, was re-appointed President of the National Party – despite his considerable over-weight baggage notwithstanding.

Meanwhile, the ACT Party – whilst expressing reservations about some aspects of the Bill – still did the right thing and voted to send it to the Select Committee. As Party Leader David Seymour explained:

“We’re gonna vote for it at the first reading because we believe that people deserve to have a say at select committee.”

ACT has also been recently criticised for allowing a Parliamentary venue to be used by a transphobic group. At the time, Mr Seymour also supported their right to debate:

“Speak Up For Women has a right to conduct what is a legitimate debate without being subject to intimidation.”

Regardless of what one may think of ACT’s policies or the so-called “Speak Up for Women” (and this blogger has no time for either) – David Seymour has proven his principled stand on free speech.

Whereas National has demonstrated a clear lack of integrity; shifting principles, and willingness to engage in double standards dependent on which way the political winds are blowing. (This criticism does not extend to Young Nationals who have shown themselves the real adults in the room.)

A simple message to National: “demanding the debate” has zero credibility when an opportunity arises to debate – and they dodge it.

The clock is ticking on Judith Collins’ erratic leadership.

.

#NationalNotFitToGovern

.

(But give the #YoungNats a crack at it, eh?)

.

.

.

References

Stuff media: National Party members vote to rein in board and seat-hopping MPs

Parliament: Conversion Practices Prohibition Legislation Bill

RNZ: ACT, National warn of conversion therapy bill ‘risk’

Twitter: Young Nats – Conversion “Therapy” – 10.29am Aug 5 2021

TVNZ: Goodfellow remains National Party president, Carter resigns

Newshub: National creates two versions of election review, one with ‘gory details taken out’

The Spinoff: David Seymour to host controversial Feminism 2020 event in parliament

Additional

Newshub: National MPs defend vote against conversion therapy Bill, despite saying they support a ban

Forbes: This Is Where LGBTQ ‘Conversion Therapy’ Is Illegal

Other Blogs

The Jackal: Calling all transphobes

Previous related blogposts

Apartheid in Aotearoa New Zealand – yes, it does exist

Fairfax media and Kiwiblog revise incorrect story denigrating trans-people

Anti-trans activists fudge OIA statement – Report

The Abigail Article; Martyn Bradbury’s Article, and My Response

Judith Collins and National: It’s a trust thing

The Shifting Faces of Simon Bridges

Acknowledgement

Thanks to Alice for proofreading. Much appreciated!

.

.

.

.

Liked what you read? Feel free to share.

Have your own thoughts? Leave a comment. (Trolls need not bother.)

.

= fs =

The Shifting Faces of Simon Bridges

.

.

I played with your trust, in the political game

Oh baby, baby

Oops, you think I’m here for you

That I’m sent from above

I’m not that competent” – Apologies to Britney Spears

.

Part of youth and young adulthood is the propensity to make mistakes. We all make those mistakes, some trivial and forgotten in a swirling fog of time and dimmed memory – some not-so-trivial and which eventually come back to haunt us.

It’s what we learn from those mistakes that ultimately matters. For most, those mistakes serve as a lesson: don’t do it again. There are bad consequences.

For others, those lessons seem to be a wasted exercise in life-experiences.

Case in point, Simon Bridges, National MP. Current MP for Tauranga and National’s spokesperson for Justice. In the Key/English administration, he held portfolios for Economic Development, Transport, Communications, Energy & Resources, Labour, Associate Finance and Leader of the House. One of his most notorious acts was to criminalise protests against deep sea oil prospecting by foreign corporations.

(Five years later, the Ardern-led government banned new deep sea oil prospecting anyway.)

Mr Bridges is also remembered for his opposition to marriage equality in 2013. His heterosexual chauvinism was blatant;

“I don’t think it’s the biggest issue Parliament is going to deal with anytime soon. It looks very likely to pass.

I have voted against it really for a couple of reasons. The first is all the feedback I am getting from my electorate makes it clear the majority of people of Tauranga are against it.”

Secondly, I think more than being a legal matter marriage is a deeply cultural, historical and religious institution built up over a very long time.

I wouldn’t change it lightly.”

Came the vote on the Marriage (Definition of Marriage) Amendment Act 2013, he was one of fortyfour MPs who cast their ballot against allowing gays, lesbians, and transgender people to marry.

It appears that his comment as a young man in 1994;

“Oh I know him, actually he was a teacher of mine at school. How do I feel about him being gay? To be honest I’m not really into homosexuality, but I suppose if he’s going to come out and say it, I suppose it takes a bit of guts.”

— was still very much prevalent in his life.

By 2019, Mr Bridges appears to have moved on from his ill-concealed homophobia. Firstly he admitted his comments had been immature;

“Look obviously I was a very young, silly young guy. It’s an incredibly long time ago, my views have changed.”

He then conceded that his voting decision on marriage equality had been an error of judgement;

“I would change my vote today. New Zealand has moved on and so have I.” Admitting, “We all move on and we’ve got a law that’s working well.”

Interestingly, it was “New Zealand that had moved on“, dragging Mr Bridges and other “no”-voting MPs along for the ride. More on this point shortly.

Unfortunately, Mr Bridges’ assertion that “my views have changed” appears to have been short-lived or premature. His statement in Parliament, opposing the banning of conversion “therapy” (Conversion Practices Prohibition Legislation Bill) was one Giant Leap for A Man – back to the 1950s;

“National supports the core intention of this thought. People should be free to be who they want to be and to love who they want to love. There is one major sticking point, however, which means that although we want to be supportive, we are opposing this law until it is amended. It is very clear in Kris Faafoi’s interview on Newstalk ZB with Heather du Plessis-Allan, and any plain reading of this bill, that good parenting will be criminalised —

— facing up to five years—it is exactly what it is saying—imprisonment for being parents to children under 18. The members opposite yell at me, but that is what Kris Faafoi said on Newstalk ZB, and it is wrong.

Parents should be allowed to be parents and to explore sexuality and gender with their children. But under this law, if a mum tells her 12-year-old son or daughter, “Taihoa, before you go on puberty blockers or other hormone treatment, wait till you’re 18.”, that mum will be breaking the law. National believes there must be an exemption for parents.”

He then proceeded to veer off on a tangent regarding transgender people, de-transitioning, and puberty blockers, whilst citing a case from the UK. They were talking points straight out of the transphobic minority hate-group, the so-called “Speak up for Women“.

It was as if the “very young, silly young guy” was standing in Parliament spouting the same homophobic/transphobic rubbish from which he had claimed to have resiled.

How many times can Mr Bridges express chauvinistic views against the LGBTQI+ and then expect an apology afterwards to be taken seriously?

How many “free passes” does a person get for making the same mistake over and over again?

Mr Bridges has accepted the need to ban conversion “therapy” when he opened his Parliamentary speech; “National supports the core intention of this thought. People should be free to be who they want to be and to love who they want to love.“.

Indeed.

So the question then arises, how can Mr Bridges and his National Party parliamentary colleagues, ban a practice; making it illegal; and admitting it is ineffective; but still permit parents to engage in the very same practice that would be illegal and ineffective?

The ‘logic’ of this escapes me.

It is akin to banning child abuse – but allowing parents to engage in child abuse.

It lowers the value of a child from being a human being and reduces them to property. Like a table or a car or a TV set.

It should be remembered that pet owners do not have the right to abuse their pets. Heavy fines and even jail terms await pet owners found abusing their companion animals.

So in effect, if parents are exempt from the Conversion Practices Prohibition Legislation Bill, Mr Bridges has elevated the rights of pets above children; that pets have more protection under the law than children.

Is that Mr Bridges intent?

Mr Bridges colleague, National MP, Louise Upston also confirmed National’s position on conversion “therapy”;

“National wants to support this bill. We abhor conversion therapy and anything that harms or abuses, or creates issues for, any New Zealander to choose who they are, to be who they are, and to love who they choose.”

But then, again, she advocated parents having the right to practice a so-called “therapy” that has been declared ineffective and would be otherwise banned;

“I’d like to see when the bill progresses that there is clarity and a parental exemption…”

Despite headlines to the contrary, ACT was not much better. Although supporting the First Reading of the Bill, they took their opposition to the Bill a step further, supporting not just “parental rights” but religious-based intervention, as Maureen McKee clearly advocated;

“Further to this, if the family wanted to seek religious guidance, and they were, say, salvationists, they won’t get that advice; they would not even get prayer…

… ACT’s concern is that the bill, in its current format, doesn’t just step on parents and religion; it actually stomps on it. The Government would be interfering and legislating what can be said in the home, how a family is to deal with an issue, and removes their ability to seek religious guidance.”

Preventing “religious guidance” – aka conversion “therapy” is pretty much why the Bill is needed to protect young people. Allowing an exemption for so-called “religious guidance” would make the law utterly pointless. (It would be like banning drink-driving – except if you have drunk beer, wine, or spirits. Otherwise drink-driving is banned.)

The response from many ranged from disappointment to outright disgust and anger. Even the Young Nats called for their Parliamentary “elders” to support the first reading of the Bill;

.

.

National’s Caretaker Leader, Judith Collins’ response was typical Judith Collins;

.

.

Way to go, Ms Collins. Being dismissive of their Youth Wing with an arrogant “the party won’t be dictated by its youth wing” is a great way to tell your activists how much they are valued. Or, as one high profile commentator and activist from the Rainbow community put it on social media;

“Bold to start your party’s conference by telling your youth wing to fuck off”

Meanwhile, National MPs might consider scrubbing posts from their social media accounts, such as this one;

.

.

Or, like this one;

.

.

They have not “aged” well.

It beggars belief that Mr Bridges can attend Rainbow events and then make black and white declarations regarding LGBTQI+ that reflect his own bias;

“It is important that we consider sexual orientation and gender identity or expression separately. Sexual orientation requires no medical intervention, whereas when it comes to gender identity/expression, parents are naturally concerned about being able to make decisions about their children being given puberty blockers and hormones … parents should be allowed to be parents.”

For the zillionth time; conservative/right-wing politicians should stay the hell out of the lives and bedrooms of LGBTQI+ people. Conservative/right-wing politicians do not get to choose “sexual orientation and gender identity or expression separately“.

And then turn up at Rainbow events as “supporters”.

So it was perfectly understandable that Auckland Pride Executive Director, Max Tweedie, confirmed that the National Party is no longer welcome at the Auckland Pride festival. Perhaps other Rainbow event organisors may follow suit.

Without much doubt, this Bill will pass into law. Parents will not be “criminalised” for talking with their children. Organisations/groups will be prevented from engaging in dubious conversion “therapy” practices.

The shield of “religious belief” will be stripped away – as it should be. Religion should never be a cloak for bad behaviours and practices from the Medieval Ages. If it were, their adherents would still be stoning gays, adulterers, etc, to death. (To spell it out; stoning is murder. Murder is surprisingly illegal, regardless of religious belief.)

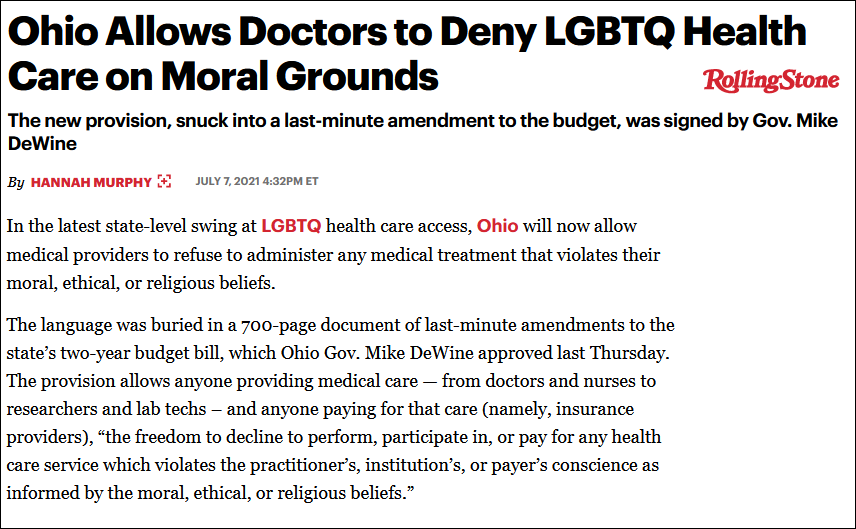

We already see numerous examples where “religious belief” is just a cloak for what would otherwise be inexcusable, bigotted behaviour;

.

.

If National feels they can pander to conservative voters and to extremist fringe groups like “Speak up for Women“, so be it. There may be a few votes in it. But not enough to become government.

Remember what Simon Bridges said?

“New Zealand has moved on.”

Indeed, the country has. But National hasn’t. It is stuck in a past that has not existed since 1986 – but the rest of us (or most of us) have moved on.

The same arguments used against Homosexual Law Reform and marriage equality have been heard before: “freedom to be a bigot in the name of religious belief”.

The same arguments against the so-called “anti-smacking” bill have been heard before: “criminalising well meaning parents who want to beat the shit out of their kids”.

All these arguments to excuse bad behaviour have been heard before. And under the bright glare of scrutiny, they were dismissed for what they are: uninformed fear mongering and cheap political point-scoring for votes.

As was pointed out above, it is inconceivable that certain behaviour can be found to be ineffective and made illegal – but for some inexplicable reason, parents should be allowed to engage in that same behaviour which is ineffective and illegal for others. That is some twisted logic right there.

This Bill will pass. And National will be left behind, it’s MPs forced to recant in years to come.

By then, the Party may have fractured, splintering into it’s constituent groups; Rural; Urban Liberals; and religious right.

But in the meantime, as Maori Party/Te Paati Māori co-Leader, Rawiri Waittiti said in the same debate where Simon Bridges declared himself on the wrong side of history (yet again);

“Tēnā koe e te Pīka. Tēnā tatou e te Whare. I’m going to be on the right side of history in this debate, and I will not wait for a valedictory speech to apologise to the rest of New Zealand!”

No more apologies, Mr Bridges.

.

.

.

.

References

Parliament: Simon Bridges

National: About Simon Bridges

Radio NZ: Govt plans hefty fines for offshore mining protests

RNZ: Parliament passes Bill banning new offshore oil and gas exploration

Sunlive: Final reading for gay marriage bill

NZ Herald: Gay marriage – How MPs voted

Newshub: ‘I’m not really into homosexuality’: Simon Bridges’ former gay views revealed

Newshub: Marriage equality, five years on – The Spinoff asks opposing MPs if they’d still vote no

TVNZ: Simon Bridges attends first Big Gay Out event, says he would now vote for marriage equality

Parliament: Conversion Practices Prohibition Legislation Bill — First Reading

NZ Herald: Act supports conversion therapy ban bill, National holding out over parental concerns

Twitter: Young Nats – Conversion “Therapy” – 10.29am Aug 5 2021

Newstalk ZB: Judith Collins – National will not be dictated by Young Nats

Twitter: Max Tweedie – Judith Collins on Young Nats – 2.38pm Aug 6 2021

Twitter: Nicola Willis – Wellington Pride – 6:01pm Mar 7 2020

Facebook: Simon Bridges attending Ending HIV Big Gay Out: 20th Anniversary

RNZ: ACT, National warn of conversion therapy bill ‘risk’

Rolling Stone: Ohio Allows Doctors to Deny LGBTQ Health Care on Moral Grounds

Twitter: @postingdad – conversion “therapy” –11.20am August 5 2021

Additional

Newshub: Marriage equality, five years on – The Spinoff asks opposing MPs if they’d still vote no

RNZ: Nights – Window on The World – People Fixing the World – LGBT community in Mombasa, Kenya

Other Blogs

Boots Theory: Laurel Hubbard is a trailblazer

Fightback: SWERF and TERF – The Red-Brown alliance in Policing Gender

No Right Turn: Ending conversion “therapy”

The Jackleman: Simon Bridges cannot be trusted

The Jackleman: Calling all transphobes

The Standard: National used to be better than this

Highly Recommended Blogpost

Postingdad: This Bill Will Pass

Previous related blogposts

Simon burns his Teal Coalition Bridges

Mining, Drilling, Arresting, Imprisoning – Simon Bridges

Letter to the Editor: Simon Bridges is a very naughty little boy!

Standard & Poor’s just sabotaged Simon Bridges’ tax bribe announcement

Simon Bridges – out of touch with Kiwi Battlers

Simon Bridges: the 15 March Christchurch massacre and winning at any cost

Simon Bridges: “No ifs, no buts, no caveats, I will repeal this CGT”

Apartheid in Aotearoa New Zealand – yes, it does exist

Fairfax media and Kiwiblog revise incorrect story denigrating trans-people

Anti-trans activists fudge OIA statement – Report

The Abigail Article; Martyn Bradbury’s Article, and My Response

Acknowledgement

Thanks to Helen for proofreading! Many thanks!

.

.

.

.

Liked what you read? Feel free to share.

Have your own thoughts? Leave a comment. (Trolls need not bother.)

.

= fs =

Farmers: “get govt off our backs!”

.

.

16 July: Farmers mounted their “Groundswell” protest throughout Aotearoa New Zealand. “Thousands” supposedly participated, driving tractors, utes, vans, trucks and any other wheeled vehicle within reach. Despite being “people of the land”, not many appeared mounted on horse-back, judging by photos;

.

.

.

The response from other New Zealanders to the farmers’ protest was less than enthusiastic and possibly did more to reinforce the perception of entitlement; refusal to accept reality, and sheer whinging, rather than any real grievance they might have.

As equity manager for 1,000-cow Canterbury dairy farm, Craig Hickman, put it, writing for Stuff media;

.

.

Curiously, despite his criticism, Mr Hickman described the “Goundswell” protest as the “very first successful farmer protest“.

Mr Hickman went on to warn “I don’t know if the Government will take any notice. Maybe it should if Labour wants to return to power unencumbered by a coalition partner” – as if re-election should always be the number one priority for a government?

Where should survival for our civilisation, and future of our species rank, for Mr Hickman?

But Mr Hickman was correct in some respects. The protest certainly attracted it’s fair share of cranks. From the deluded;

.

.

— to the bizarre;

.

.

— to the outright racist;

.

.

It was Open Field Day for the Cranks from both rural and urban communities.

One – spread widely through social media and promoted unwittingly by at least one right-wing blog – was fake;

.

.

The image had been mis-appropriated; re-branded; and used to promote the “Groundswell” event. It was actually an image of a protest from The Netherlands, two years ago.

Unfortunately for those farmers taking part, Nature had other plans in store for us…

17 July: The wildest weather to hit the South Island (and felt throughout the North as well) struck the following day. The storm battered the West Coast; flooding the top of the South Island; states of emergency declared in Marlborough and Buller; Picton, Westport, Tākaka, Collingwood, Murchison, Springs Junction and Nelson were cut off; Spring Creek and Tuamarina townships evacuated; bridges damaged and destroyed, properties flooded.

The Metservice warning was unambiguous;

.

.

… and the rest of the country would not be escaping either;

.

.

The human toll became evident very quickly;

.

.

25 July: It was against this backdrop that, nine days after the farmer protest and eight days after the storm that lashed the country, TVNZ’s Q+A current affairs programme interviewed NIWA’s principal Climate Scientist, Dr Sam Dean,

.

.

Host/Interviewer, Jack Tame prologued the interview with a frightening litany of extreme weather events over the last two months;

- record rainfall and flooding in China;

- a heatwave in Siberia resulting in wildfires;

- record temperature of 34 degrees reached in Finland and Norway near the Arctic circle;

- Antarctica reached a new record – 18 degrees celsius;

- extreme flooding in Germany and Belgium resulting loss of life;

- over a thousand people were killed during a recent heatwave in the United States and smoke pollution from American forest fires on the West Coast sent a smoky haze over New York.,

- And torrential rain causing flooding throughout the South Island here in Aotearoa New Zealand…

Against this back-drop, Jack Tame asked Dr Dean the question to which most* of us already knew the answer to;

“How much of the damage and destruction can we directly attribute to climate change, and should scientists and the media be doing more to link climate disasters with human caused climate change?”

Dr Dean was candid with his answers; climate change was not a “something-in-the-future” for us – the effects were happening very here-and-now;

“…talking about how climate change has altered the world we live in already makes it more real for people.”

Jack Tame pointed out the irony of the farmers’ “Groundswell” protest – followed the next day by a severe weather event likely to be influenced by climate change.

Dr Dean did not mince his words in response referring to the crazy events. He pointed out that we all faced consequence to our actions. He called on farmers to lead or face the consequences of regulations.

“We need to stop burning coal. We need to stop burning oil… New Zealand is importing vast amounts of coal at the moment to generate electricity and we have to stop doing that. We have to stop burning coal and polluting the atmosphere.”

He admitted to being scared as human are doing crazy things ; the rate of change was beyond anything evolution has prepared us for.

Dr Dean referred to humanity facing an existential threat.

He warned that now was the chance to keep temperature increase below 2 degrees – and not just by planting trees. He explicitly stressed the need to reduce emissions.

Otherwise we would be experiencing more severe flooding and sea level rise by fifteen centimetres within twenty years.