“Her [Kristine Bartlett ] case is the first time New Zealand’s courts have grappled with the “nurses versus firemen” debate – essentially an argument that occupations traditionally seen as “women’s work” are less valuable and, therefore, attract a lesser rate of pay.”

Archive

Capitalists in Space

.

.

Billionaire Richard Branson did it.

Also-billionaire, Jeff Bezos, did it.

Both will be the first money-hoarders into space (or sub-orbital near-space, to be more specific).

Also-also-billionaire, Elon Musk – not content with sub-orbital ‘jaunts’ – has expressed a desire to go Full Interplanetary and personally colonise Mars.

Meanwhile, as billionaires play “Captain Kirk” in their own private rocketships – it is worth noting the hardship and misery they leave behind on Planet Earth.

As of July this year, Jeff Bezos’ net worth is a staggering US$211 billion. Elon Musk is not far behind at US$180.8 billion. Richard Branson lags behind at single figures billions: US$4.8. (By comparison, New Zealand’s annual GDP, last year, was a little over US$209 billion.)

Sadly, Bezos’ workers at Amazon (which, until recently, he was CEO of), are not quite in the billionaire range. Not even millionaires.

Amazon worker’s median wage was US$29,007 last year, up US$159 from 2019. Those people work for a company that last year (2020) increased its profit by US$100 billion to US$386 billion.

So when Bezos thanked workers for paying for his flight;

“I also want to thank every Amazon employee and every Amazon customer because you guys paid for all of this.”

– the response was less than appreciative of his “gratitude”.

US representative Alexandria Ocasio-Cortez said on Twitter:

“Yes Amazon workers did pay for this – with lower wages, union-busting, a frenzied and inhumane workplace and deliver drivers not having health insurance during a pandemic. Amazon customers are paying for it with Amazon abusing their market power to hurt small businesses.”

“Jeff Bezos forgot to thank all the hardworking Americans who actually paid taxes to keep this country running while he and Amazon paid nothing.”

Satirist/comedian, Trevor Noah, on The Daily Show put Bezos’ short flight into more human context;

“Jeff Bezos was in space for 5 minutes—or as its known at the Amazon warehouse, your allotted break time for a 16-hour day”

The joy-rides by multi-billionaires who pay little tax and exploit their workers with abysmal working conditions and pathetically low wages is nothing short of an obscenity.

It is not the future we envisaged when courageous men and women like Yuri Gagarin, Valentina Tereshkova, Neil Armstrong, et al, took humanity’s first tentative steps into infinity, leaving Cradle Earth behind.

When television producer, Gene Roddenberry created “Star Trek” – perhaps the most easily recognisable TV sf series ever made – he envisaged a benign future free of war, bigotry, inequality, poverty, and greed. It was a future where human beings were free to explore their fullest potential. It was a future where we devoted our energy to looking outward, to explore the vastness of the Universe and the myriad diversity it offered.

As one of the main characters explained;

“A lot has changed in three hundred years. People are no longer obsessed with the accumulation of “things.” We have eliminated hunger, want, the need for possessions…

… the economics of the future is somewhat different. You see, money doesn’t exist in the 24th century… The acquisition of wealth is no longer the driving force in our lives. We work to better ourselves and the rest of Humanity.”

It was not a future where men with obscene hoarded wealth took joyrides into space for their own aggrandisement. It was not meant to be the future lauded by libertarian sf writer, Robert Heinlein, whose “hero” in “The Man Who Sold The Moon” was a self-serving businessman hell-bent on commercialising ownership of the Moon.

As an avid sf* reader and space enthusiast in my youth (and still am), I viewed humanity’s first baby-steps into outer space as positive for our species. Not only could we further advance our understanding and knowledge of the Universe; marvel at the beauty of what we saw with our eyes; and understand our place in the cosmos – but the very act of looking outward was uplifting to us collectively and brought out the best from us.

But when society is inward-looking it inevitably creates social division with an Us/Them culture of dis-trust. Xenophobia increases. Creativity and artistic endeavour are stifled. Groups are pitted against groups.

A society that looks outward has self-confidence. A society that ceases being outward and turns in on itself will lose that confidence and fear and anxiety will hold sway.

Think of Brexit and why so many British voters turned their backs on Europe.

Think of the United States under Donald Trump. Now think of Trumpism taking hold for another four years, followed by his spawn.

Bezo’s space jaunt was paid by his workers who are poorly remunerated and badly treated. Amazon actively prevents unionisation of its workers.

So a vulgar wealth-hoarder exploited his workers to reach for the stars.

Not content with the worst of humanity’s nature on Earth, billionaires are now taking our “darker angels” to the Heavens. This was not how visionaries intended our future to look like.

Perhaps the next time a libertarian capitalist suggests that businessmen and woman know better than governments how to spend their accumulated wealth, think of Richard Branson, Elon Musk, Jeff Bezos, et al, standing on the backs of their workers.

“I also want to thank every Amazon employee and every Amazon customer because you guys paid for all of this.” – Jeff Bezos, 20 July 2021.

“Fuck you.” – Every Amazon & other employee of billionaires, ever.

The exploration of the Final Frontier just lost some of it’s sheen.

.

.

∗ Correct abbreviation for “science fiction” is “sf”. “Sci-Fi” is considered unsophisticated colloquialism.

.

.

.

References

New York Times: What will it cost to fly Virgin Galactic to space?

Stuff media: Jeff Bezos blasts into space on board Blue Origin’s first passenger flight

Hindustan Times: Did Richard Branson really fly into space? Neil deGrasse Tyson weighs in

Axios: Elon Musk – There’s a 70% chance that I personally go to Mars

Time: Jeff Bezos Is the Richest Person Ever After His Net Worth Soars to $211 Billion

Knoema: New Zealand – Gross domestic product in current prices

Forbes: #589 Richard Branson

BBC: Jeff Bezos steps down as Amazon boss

Business Insider Australia: Amazon reveals how much it paid its median employee last year – $29,007

Forbes: Amazon’s Net Profit Soars 84% With Sales Hitting $386 Billion

Twitter: Alexandria Ocasio-Cortez – Jeff Bezos – Amazon workers – 21 July 2021

Twitter: Elizabeth Warren – Jeff Bezos – workers paid taxes – 21 July 2021

Twitter: Trevor Noah – The Daily Show – Jeff Bezos – Amazon workers – 21 July 2021

Wikipedia: Yuri Gagarin

Wikipedia: Valentina Tereshkova

Wikipedia: Neil Armstrong

Wikipedia: Gene Roddenberry

Memory Alpha: Money

Wikipedia: The Man Who Sold The Moon

CNN: The union loss at Amazon is another sign big companies have too much power

Forbes: What Entrepreneurs Really Want From Government

CNBC: What billionaires said about wealth inequality and capitalism in 2019

Twitter: @WendyCrossArt -21 July 2021

Twitter: @DanRather – 21 July 2021

Twitter: @meladoodle – 21 July 2021

Previous related blogposts

Trumpwatch – How Elon Musk can overcome Trump’s climate-change obstinacy

.

.

.

.

Liked what you read? Feel free to share.

Have your own thoughts? Leave a comment. (Trolls need not bother.)

.

= fs =

Judith Collins and National: It’s a trust thing

.

.

.

Clever strategies

.

There are firm reasons why National continually fails to gain traction with the voting public (recent Roy Morgan poll notwithstanding, as one fall does a trend not make).

The ongoing in-fighting. The revolving door on leadership changes. It’s lack of coherent policy and direction. A current Caretaker Leader who struggles to be likeable with the public. More leaks than Auckland City’s water pipes. A tarnished image as a “prudent fiscal manager”. And lingering suspicions that the Nats would prioritise business demands to re-open the borders to allow entry to migrant fruit picking workers; hospo staff; tourists; Uncle Tom Cobbly; et al.

The last two are of particular interest.

Caretaker-Leader Judith Collins has berated the current government for poor fiscal management;

“It is irresponsible of the government continuing to spend money like it is with no thought as to where it comes from at the same time as we have 4500 kids in [emergency housing] hotels.

We are a small economy, we now have about $100 billion worth of debt, up from about $50b when the govt took over, and you can blame Covid all you like but ultimately – as those reports show – there was a problem before the government took over and the government had no plan for it…

… but it is ultimately the government’s decision to waste enormous amounts of money and not to actually put the focus on where it needs to be.”

Which is so deeply ironic that it could only be at home at the bottom of the Pacific Marianas Trench.

It was only last year that then-Finance spokesperson, Paul Goldsmith promised voters a tax cut (ie, an out-and-out bribe for votes).

When asked how National could possibly fund tax cuts when every economist was predicting a recession – if not outright Depression – Mr Goldsmith struggled to provide an answer. He eventually came up with a funding solution; raiding the Covid Relief Fund;

The change would not affect the National Party’s proposed temporary tax cuts, which are being paid for by drawing down $4.9 billion of the $14 billion Robertson had set aside from Covid-19 Response and Recovery Fund for future Covid-19 policies, if needed.

When the voting public heard National’s plan, they responded en masse to hand a historic majority Labour government. It was clear that most New Zealanders wanted National nowhere near the Treasury benches. Especially Paul Goldsmith who seemed fiscally inept beyond comprehension.

The 2020 General Election did more to undermine National’s “street cred” as a “prudent fiscal manager” than at any time in recent history.

A Newshub-Reid Research poll in July last year backed up National’s fall-from-fiscal-grace in the public eye.;

The latest Newshub-Reid Research Poll asked New Zealanders which party they trust to run the economy from now on through and after COVID-19.

A clear majority – 62.3 percent – trusts a Labour-led Government under Jacinda Ardern, while just over a quarter of the country – 26.5 percent – trusts a National-led Government under Judith Collins.

So when National’s Caretaker Leader Judith Collins accused the govt of being “irresponsible of the government continuing to spend money like it is with no thought as to where it comes from” and “wast[ing] enormous amounts of money” – no one was listening.

While Ms Collins berates Labour for “continuing to spend money like it is with no thought as to where it comes from” – her Covid spokesperson, Chris Bishop, was demanding that government purpose-build isolation/quarantine facilities on “vacant land near Auckland Airport“. According to Mr Bishop;

“We still think purpose built quarantine facilities makes sense. Using hotels in downtown Auckland was a good stop gap measure last year. But hotels simply aren’t built for quarantine and isolation.”

However, it was noticeable that Neither Mr Bishop, nor his (current) Leader, have offered any costing to purpose-build such a facility.

To provide some broad indication, a planned purpose built quarantine facility in Victoria, Australia, is estimated to cost A$15 million [NZ16 million] to design and a further “A$200 million [NZ$214 million] to build a 500-bed facility and around A$700 million [NZ$750 million] if it was scaled up to 3,000 beds”.

By comparison, Aotearoa has between 4,000 to 4,500 beds in hotels in Auckland (18), Hamilton (3), Rotorua (3), Wellington (2) and Christchurch (6).

Using the above figures, building a 4,000 bed facility would cost the country well over a billion dollars. With inevitable cost over-runs, the final figure would be anyone’s guess.

Chris Bishop also called for returnees to be paid a wage whilst self isolating;

“We think the government needs to be more generous when it comes to supporting people when they’re told to self-isolate. Earlier this year we announced a policy of the government paying people’s wages when people are ordered to self-isolate. It’s pretty sensible – if the government is saying to you “stay home” and we don’t want you at work – they should pay.”

National’s calls have not been costed – and nor would they be. The agenda from the Opposition is not to demand a more effective Managed Isolation and Quarantine system. Instead, their unspoken aim is,

(A) to paint the Labour government as ineffective, for pure political point-scoring

(B) to pressure the Labour government to adopt costly policies, which would push up borrowing and debt. Caretaker Leader Collins would then wag a disapproving finger; and tut-tuttingly exclaim,

“It is irresponsible of the government continuing to spend money like it is with no thought as to where it comes from… it is ultimately the government’s decision to waste enormous amounts of money and not to actually put the focus on where it needs to be.”

Clever strategy; force your rival to spend money – then blame them for spending money.

.

Crazy incoherencies

.

National’s Deputy Leader, Dr Shane Reti, has called for the retention of Aotearoa’s system of twenty District Health Boards (DHBs);

“So far the Government has employed 25 people with a budget of $5 million to reduce the number of DHBs. But this funding will never directly benefit patients.

Rather than spending millions on the unnecessary amalgamation of DHBs, this money would be much better spent in areas that will actually help New Zealanders.”

Dr Reti’s statement was backed up by his Caretaker Leader, Ms Collins;

“We have all sorts of issues right now. Now is not the time to be restructuring in the middle of a pandemic and an inability to get vaccines out.”

Meanwhile, National’s Covid spokesperson, Chris Bishop, has condemned DHB’s role in distribution of the vaccine;

“We’ve always said that relying on the DHB to do the rollout is not a particularly great model.”

Clearly, Dr Reti, Ms Collins, and Mr Bishop don’t talk much to each other. Based on the comments of those three, the public would be confused as to what National’s policy was regarding DHBs and the vaccine roll-out.

As Former Senior Policy & Communications Strategist for PM Ardern, Clint Smith, put it in a recent ‘tweet‘;

.

.

This is called “incoherence”.

If “relying on the DHB to do the rollout is not a particularly great model” – then what use are they? Why endorse a system that cannot carry out a task that is their raison d’etre – vaccinations?

Are they opposing reform of 20 DHBs for the sake of Opposition, when they clearly have no alternative solutions of their own?

Yes, they are.

And the public have noticed.

.

Confusing irrevancies

.

#Demandthedebate is a hashtag currently trending on social media – but not quite in the way National ever intended.

.

.

Social media wits – notably on Twitter – have mercilessly lampooned the launch of National’s campaign to publicise and “debate” certain issues. The “serious” version;

.

.

The more entertaining takes;

.

.

There was more – much more. So much in fact that at last one media outlet realised what was happening and reported the hi-jacking and mass lampooning of National’s “Demand the Debate”.

The campaign has been clumsy since it released it’s initial press statement on

The Press Statement, in it’s entirety;

Leader of the Opposition Judith Collins says New Zealanders are being left out of important decisions by the Labour Government and today she has launched a campaign for Kiwis to ‘Demand the debate’.

“The Labour Government continues to make policy announcements that were never campaigned on and will have a significant impact on New Zealanders.

“From the Car Tax, cancelling promised infrastructure projects, the $785m Auckland cycle bridge, rushed law changes to deliver Māori wards, to the hastily announced oil and gas exploration ban; New Zealanders are starting to feel left out.

“At the same time more than 4000 children are left to grow up in motels, mental health services are in crisis, the Government is looking to criminalise speech they disapprove of and tell you what car you can drive.

“Let’s be clear, Labour was elected on a Covid-19 mandate and nine months later we are still waiting for border workers to be properly vaccinated and MIQ beds sit empty while migrant families wait in desperation to be reunited. We are still last in the developed world for Covid-19 vaccinations. Kiwis deserve better.

“Every week, I’m contacted by thousands of Kiwis who are worried they just don’t have a say in the future of their country anymore. They’re being kept in the dark and their questions go unanswered by Ardern’s Government. So today, we launch the first in a series of billboards on important issues that Kiwis deserve to have their say on.

“The first campaign relates to the Government’s 2019 He Puapua report. Kiwis were never told about it at the time and it was never campaigned on by Labour. It has recently been considered by Cabinet and is being consulted on with a select few New Zealanders.

“The He Puapua report contains recommendations for fundamental changes to our legal, constitutional, and democratic governance arrangements. Changes like separate health and justice systems, separate RMA rules, and separate electoral arrangements. These proposals must be taken to an election so all Kiwis can have their say.

“While they claim publicly it’s not their policy, the Labour Government has already started to implement large parts of He Puapua like Māori Wards and a Māori Health Authority, without the wide-ranging public debate that these changes deserve.

“The Government’s parliamentary majority is not a mandate for Labour to promote their ideological wish list. New Zealanders deserve a say on their country’s future and together we must demand the debate.”

As many have pointed out, National’s claim that “He Puapua report. Kiwis were never told about it at the time and it was never campaigned on by Labour“. Which is bizarre. The report was just that; a report. How could a political party campaign on a “report” that had no standing as it had not even been accepted as party policy?

Government departments create hundreds, if not thousands of reports. Campaigning on each one would be impossible.

This is desperate mischief-making taken to ridiculous levels.

Whilst mentioning the He Pua Pua report as the “first campaign”, it only hints at successive topics; “the Car Tax, cancelling promised infrastructure projects, the $785m Auckland cycle bridge, rushed law changes to deliver Māori wards, to the hastily announced oil and gas exploration ban.”

The craziest part of the press statement is this “gem”;

“The Government’s parliamentary majority is not a mandate for Labour to promote their ideological wish list…”

It’s almost as if the 2020 election never happened and Labour never won a historic 65 seat majority – the first in a MMP Parliament.

Then again, when it comes to “mak[ing] policy announcements that were never campaigned on and will have a significant impact on New Zealanders” – National has some experience in this area;

.

.

Then he raised GST.

If these are the issues that National wants to debate, they have been living in the Wellington Beltway longer than is healthy. Most people would not care greatly about these issues and a considerable number might even agree with them; eg the oil and gas exploration ban.

(Which, by the way, was announced in April, 2018 – two years before the 2020 election.)

These are not debating issues. They are not even “talking points”.

They are a lame attempt for National to be relevant.

And even here, they have failed miserably. Because very few – perhaps no more than National’s current voting base – would be greatly interested in these so-called issues. They are perhaps Issues of National Significance for National only.

The real issues confronting this country – housing; climate change; staying safe during the covid pandemic – have been all but ignored.

This is by design, not by accident. For not only does National not have anything “fresh” to offer on these issues – but it has actively contributed to one (the housing crisis) and is distrusted on another (keeping us safe from covid).

.

Callous indifference

.

When Boris Johnson announced that Britain would be easing covid restrictions by 19 July, it was met with incredulity and fear. Even as a covid was surging through the country, PM Johnson was announcing the unthinkable;

.

.

PM Johnson’s statement was nothing less than a death sentence for thousands of unvaccinated British people;

“We’re seeing rising hospital admissions and we must reconcile ourselves, sadly, to more deaths from COVID. In these circumstances we must take a careful and a balanced decision.”

It was surrender to covid and prioritisation of business over peoples’ lives;

“We have to balance the risks of the disease and of continuing with legal restrictions, with their impact on people’s lives and livelihoods.”

The stats speak for themselves; – over 31,000 new cases and 26 deaths, daily;

.

.

No wonder the interim director for Royal College of Nursing, Jude Diggins, was scathing;

“This disease does not disappear on 19 July. No available vaccine is 100% effective … Public mask-wearing is straightforward and well-established – government will regret the day it sent the wrong signal for political expediency.”

Chair of the Winton Centre for Risk and Evidence Communication at Cambridge University, David Spiegelhalter, described PM Johnson’s 19 July decision is chilling terms;

“This is an experiment, and I think we’ve got to call it that. I respect the judgments by Chris Whitty and others who say that if you’re going to do this, this is the right time to do it.”

In The Lancet, 122 scientists wrote an open letter condemning Boris Johnson and his government;

New Zealanders look aghast at covid out of control in India and Fiji; the virus taking hold in New South Wales; and then a British Prime Minister stating matter-of-factly that his country will lift all restrictions – even if it means “we must reconcile ourselves, sadly, to more deaths“.

Then they look at Jacinda Ardern and Judith Collins…

.

.

… and they wonder. They wonder if, in National’s Caretaker Leader, Judith Collins, there lurks a “Boris Johnson” waiting to throw open the doors to the rest of the world – and a virus.

With Judith Collins and National, it’s a trust thing.

.

#NationalNotFitToGovern

.

.

.

References

Roy Morgan: Is the COVID-19 ‘honeymoon’ over for PM Jacinda Ardern?

RNZ: Ardern stays firm on superannuation age after Treasury flags rising cost pressures

Stuff media: Election 2020 – ‘Fair cop’ – National’s Paul Goldsmith admits to accounting mistake as Labour points out $4b hole

Stuff media: Election 2020 – National’s fiscal hole appears to double to $8 billion as Paul Goldsmith denies double count mistake

Newshub: Newshub-Reid Research Poll – Kiwis trust Labour more than National to run the economy

Business Insider: Boris Johnson told the UK to reconcile itself to more COVID-19 deaths as the country lifts almost all restrictions amid a new surge

TVNZ News: National proposes building of purpose-built quarantine facility on Auckland’s outskirts

National Party: Our approach to COVID-19 and the vaccine roll-out

ABC News: Melbourne COVID-19 quarantine facility approved as Commonwealth, Victoria agree on site

Managed Isolation and Quarantine: Managed Isolation and Quarantine capacity

Stuff media: Covid-19 – Why the Government isn’t using purpose-built quarantine facilities

National Party: Ditch DHB merger, spend funding on medicines instead

Stuff media: Judith Collins lashes DHB overhaul as too much Wellington bureaucracy, and a ‘separatist model’

Twitter: Morning Report – Chris Bishop – vaccine rollout (RNZ: Morning Report – Chris Bishop on vaccination rollout)

Twitter: Clint Smith – 8 July 2021

Stuff media: National launches billboard campaign to ‘demand debate’ on Government policies

Newshub: ‘Pineapple on pizza? Demand the debate’: National’s new campaign parodied in memes

Scoop media: National Launch Campaign To Demand The Debate For All New Zealanders

NZ Herald; Prime Minister Jacinda Ardern bans oil exploration

Electoral Commission: 2020 General Election official results

ODT: Key ruled out GST increase in 2008

RNZ: PM defends proposed GST increase

Business Insider: Boris Johnson told the UK to reconcile itself to more COVID-19 deaths as the country lifts almost all restrictions amid a new surge

The Independent: Big majority of Britons ‘worried’ about Boris Johnson’s plan to lift all Covid restrictions, poll reveals

TVNZ: Covid-19 cases in the UK surge to highest levels in five months

Gov.Uk: Coronavirus (Covid-19) in the UK

The Guardian: New Zealand not willing to risk UK-style ‘live with Covid’ policy, says Jacinda Ardern

The Guardian: Boris Johnson to scrap most of England’s Covid rules from 19 July

Reuters: Analysis – UK PM Johnson’s new COVID gamble worries some scientists

The Lancet: Mass infection is not an option – we must do more to protect our young

The Guardian: New Zealand not willing to risk UK-style ‘live with Covid’ policy, says Jacinda Ardern

TVNZ: Judith Collins ‘very hopeful’ Covid-19 alert level restrictions will lift today

TVNZ: ‘New Zealand cannot afford any more lockdowns’ – Judith Collins

Stuff media: Covid-19 – Judith Collins says Government should look into vaccinated people skipping managed isolation

Previous related blogposts

Life in Level 1: The Taxpayer’s Coin

Life in Level 1: The Doom of National

Life in Level 2: National’s Barely Secret Agenda

.

.

.

Acknowledgement: Rod Emmerson

.

Liked what you read? Feel free to share.

Have your own thoughts? Leave a comment. (Trolls need not bother.)

.

= fs =

NZ Initiative – Bulk Funding Schools

.

.

Insanity: doing the same thing over and over again and expecting different results. – Albert Einstein.

.

On 6 July, the “NZ Initiative” – a re-branded right-wing think-tank previously known as the NZ Business Roundtable – released a propaganda-piece entitled, ‘Amplifying Excellence: Promoting Transparency, Professionalism and Support in Schools‘. The so-called “report” advocated more sly “free market” forces unleashed onto our constantly-changing education system.

The title of the “report” sneakily implies our education system is not transparent; is un-professional; and our schools un-supported.

Amongst the several vague recommendations was this one;

True to New Zealand’s self-managed school landscape, the government largely lets school boards and principals get on with leading their schools. However, in other respects, school leaders can be hamstrung by bureaucratic restrictions; for example, the Ministry prescribes how school leaders should spend parts of their teaching resource budgets.

Recommendation 6: Effective leaders should be trusted as true professionals and granted total budget autonomy to lead their schools.

“Total budget autonomy” is code for bulk-funding – a favourite agenda from the New Right.

Bulk-funding had previously been introduced as part of National’s “Ruthenasia reforms” in the 1990s. It was done away with by the Labour-Alliance government in 2000.

In June last year, then-Education Minister Hekia Parata attempted to resurrect the corpse of Bulk Funding under a new guise, “Global Funding“;

The change would set a “global budget” for each school, delivered as cash instalments for school expenses, and a credit system for salaries.

According to the documents, this would mean:

• Principals would determine the split between cash and credit, with the flexibility to make adjustments during the year.

• Unspent credit would be paid out at the end of the year and a process for recovering credit overspends would be established.

• Teaching staff salaries would be charged against the “credit” portion at an average rate.

• Non-teaching staff salaries would be charged against the “credit” portion at actual cost.

The global budget system would not be the same as the controversial bulk funding of teacher salaries that sparked protests 20 years ago, the proposal said. The documents said: “This is a significant difference from historical bulk funding proposals which would have seen schools charged the actual salary.”

The reaction was predictable, and Post Primary Teachers’ Association (PPTA) president, Angela Roberts, spoke for many when she warned;

“It is bulk funding. It is minor technicalities that make it something different, and I think it’s very cynical of the ministry to think that they can con people with a change in language.”

The schools get to decide how they spend that, how many teachers they purchase effectively and how many teacher aides. So schools will be incentivised through the averaging out to have cheaper teachers or fewer teachers because they can cash that money up.

Bulk funding was resoundingly rejected by the community 20 years ago because everybody understood the cost would be borne by the school when the government couldn’t be bothered putting more money into the system.”

Opposition to Parata’s Bulk-Funding-In-Drag plan was met with heated opposition by parents, teachers, school principals. Donna Eden, a teacher with 20 years’ education experience explained why she was so vehemently opposed to “Global Funding”;

“Teachers really don’t like bulk funding, so much so that they have been out of the classrooms meeting and rallying. And they’re talking to anyone who will listen about how our kids will be worse off.

And they will.

Why? Well, it will mean bigger classes and fewer teachers. It will mean our kids have less time with their teacher because instead of sharing him or her with 15 other children there will be 30 or more classmates needing the attention of their kaiako. It will mean less support for the kids that need it. It will mean fewer teacher aides for fewer hours.

It will likely mean untrained teachers in the classroom because they will be cheaper to pay.

It will mean winners and losers, and that, my friends, is not okay. Every child deserves the best, all of them, all over our country.

It’s simply that schools will be given a lump sum of money. And from this lump sum they will pay teachers’ salaries (which are currently centrally funded, meaning they don’t cost schools) and for everything else (think the power, water, supplies, first aid supplies, the caretaker, the office staff , support staff like teacher aides, any class room resources…)

There will be a separate pool of money for maintenance – property repairs and the like.

Why is it bad news?

[…]

Firstly, because there is no new money. It’s just moving around the money that is already there. And it’s already not enough.

For the first time ever school operations grants, the cash that keeps schools running, have been frozen.

While costs rise, this budget won’t keep up. This means cuts to what schools can offer. It will start with trimming the extracurricular stuff. It won’t stop from there.

Hekia Parata is looking to remove the caps to class sizes and the guaranteed teacher funding this brings. It will mean that classes will get bigger – they will have to in order to stay within budget.

It’s like trying to do the grocery shopping with the usual budget when you have four extra people staying for the week. It just won’t stretch; something will have to give.

If it comes down to a choice between paying the power bill and paying a teacher, it is principals and boards of trustees that will have to decide who goes. What a horrible decision to have to make.”

On 18 November last year, Parata caved to mounting public pressure and announced that National would not proceed on it’s “Global Funding” policy;

“I have therefore recommended, and Cabinet has agreed, that the global budget proposal not proceed. The global budget was a mechanism for payment, not for determining the level of funding, so this decision will not affect the core purpose of the review.”

The successor to Ruth Richardson’s Bulk Funding, Parata’s “Global Funding”, was quietly returned to the Historical Rubbish Bin of Very Bad Ideas.

Barely a year later and the NZ Initiative/Business Roundtable has attempted to breathe life back into Bulk Funding/Global Funding. This time referring to the model as ‘Total Budget Autonomy‘. (No doubt Crosky-Textor or some other tax-payer funded spin-doctor will come up with some new clever, shiny name.)

But it’s still a pig. Perhaps with a new shade of lipstick. But a pig still.

.

.

The question is, why the Neo-libs keep beating the same drum? Why keep trying to implement a policy that has been tried; failed; and almost no one wants.

More importantly, the evidence is that Donna Eden’s fears are well-based and grounded in reality.

New Zealand has had bulk-funding in another area of the State Sector – and it has proven to be a dismal failure;

.

.

Analysing budget short-falls and DHB deficits two years ago, Fairfax journalist Stacy Kirk wrote;

Specifically, [Treasury] documents say DHB underfunding will put pay increases for public sector health workers, including nurses and doctors, at risk.

Cost pressures mean DHBs have not been fully funded to cover wage increases for the 40,000 workers whose contracts are up for renegotiation shortly.

Ms Kirk reported Treasury officials as saying;

“The fiscal strategy presents some tough choices for Budget 2015, there are a number of fiscal pressures across the social sector, and Ministers will need to review options and trade-offs to determine an appropriate Budget package.”

The Treasury document that Ms Kirk quotes makes this observation on funding DHBs;

There are material cost pressures affecting the Ministry-managed NDE [non-departmental expenditure] service lines that need to be managed as part ofthis process. These cost pressures will include demographic demand growth,wage and price inflation, and other factors. As for DHBs, it is unlikely thatthese pressures can be fully funded, so we will be looking to the sector todeliver substantial efficiencies. To maintain current levels of serviceprovision, it is likely that a reasonably large injection of new funding willbe needed – in addition to the $275 million already agreed for DHBs – orMinisters will need to make choices on what services are to be altered or cut back.

Note this bit; “…cost pressures will include demographic demand growth, wage and price inflation, and other factors. As for DHBs, it is unlikely that these pressures can be fully funded, so we will be looking to the sector to deliver substantial efficiencies”.

Treasury’s admonition that “it is unlikely that these pressures can be fully funded” for DHBs is borne out by the number of Boards that are in deficit – and worsening. A forecasted $58.7 million deficit has blown out to $89.9 million. Half of DHBs either in the red, or perilously close to it;

.

.

In the case of Capital and Coast DHB – currently $28 million in deficit – it is noteworthy that there financial woes started in the mid-1990s;

In 1995-96 Capital Coast Health reported a deficit of $26m, which the following year grew to $70m. Chief financial officer Tony Hickmott said the $68m debt hole left by the construction of the regional hospital in 2008 had contributed to deficits for the past 10 years.

Increased demand for services, high labour costs, increased complexity of patients, and the increasing and ageing population had compounded the issue.

Building construction. Labour costs. Demand for services. Increased complexity. Increasing population. Each one of those factors can easily be translated into the education sector which also requires building upgrades or building entire new class-rooms; growing students rolls; increasing special-needs; and rising population due to National’s exploitation of migration to create the illusion of economic growth.

Now add Bulk Funding/Global Funding/’Total Budget Autonomy’ into the mix for schools.

How long would it be before schools found themselves in precisely the same precarious financial woes that our DHBs are currently suffering?

As things currently stand, parents/guardians are having to dip more and more into their pockets to pay “school donations”, to make up for obvious shortfalls in the Vote Education budget;

.

.

Of course, the National government still claims – without a hint of self-awareness of the Big Lie – that education is still free in New Zealand;

It’s free to go to a state school — but the school can ask for donations towards their running costs.

But at least one school – St Heliers – is unashamedly upfront in why school “donations” are necessary;

A donation is requested of parents to contribute towards the shortfall in funding from the Government.

Even with direct Ministry funding, schools are still having to make up a “shortfall in funding from the Government“. This dire situation has been compounded by National’s decision to freeze school operational funding this year;

.

.

The above Herald story goes on to report;

The targeted approach means more than 1300 schools will get less money than they would have received, had that money been used for a general increase.

The difference ranges from a few hundred dollars up to $24,000.

About 816 schools will get more, and information on a further 242 schools is suppressed for privacy reasons because fewer than five students are at-risk.

Now imagine the funding constraints that schools would have to deal with if Bulk Funding/Global Funding/’Total Budget Autonomy’ was re-introduced for their sector.

But we don’t have to imagine, do we? Because half the District Health Boards in this country have already shown us what would be in store for schools throughout the country.

Which is something that the NZ Initiative/Business Roundtable seems to have studiously over-looked when they compiled their rubbish report, ‘Amplifying Excellence: Promoting Transparency, Professionalism and Support in Schools‘.

Never under-estimate the ability of the New Right to suggest policies that that been tried, tested, and failed. Just keep repeating the experiment over and over and over again.

One day the result will be different.

Of course it will. Just ask Albert Einstein.

.

.

.

References

NBR: Roundtable and NZ Institute morph into new libertarian think tank

NZ Initiative: Amplifying Excellence: Promoting Transparency, Professionalism and Support in Schools

Victoria University: The Bulk Funding of Teacher’s Salaries – A Case Study in Education Policy

NZ Herald: New funding system for schools including a ‘global’ salary criticised

Radio NZ: Teachers fear ‘bulk funding in new guise’

The Spinoff: A teacher tells you what you need to know about bulk funding

Fairfax media: Education Minister signals end of school bulk funding and decile systems

Fairfax media: DHBs ‘considerably’ underfunded – and more deficits predicted

Treasury NZ: Treasury Budget 2015 Information Release Document July 2015

Fairfax media: DHB deficits blowing to $90m. Health sector dying ‘by 1000 service cuts’ – Labour

Fairfax media: Capital & Coast DHB’s debt hole deepens as boss admits 20 years of deficits

Fairfax media: Parents prop up schools to tune of $250m

NZ Herald: School costs – $40,000 for ‘free’ state education

NZ Herald: Parents fundraise $357m for ‘free’ schooling

NZ Herald: Parents paid $161m for children’s ‘free education

NZ Government: Education – school fees

NZ Herald: ‘At risk’ school funding revealed – with 1300 to lose out under new model

Other Blogs

Save our Schools: Parata backs down on bulk funding plans

Chris Trotter: Morbid Symptoms – Neoliberalism’s Room for Manoeuvre Keeps Shrinking

Previous related blogposts

Can we afford to have “a chat on food in schools”?

Cutting taxes toward more user-pays – the Great Kiwi Con

The Legacy of a Dismantled Prime Minister

.

.

.

.

This blogpost was first published on The Daily Blog on 15 July 2017.

.

.

= fs =

Steven Joyce rails against low mortgage interest rates; claims higher interest rates “beneficial”

.

.

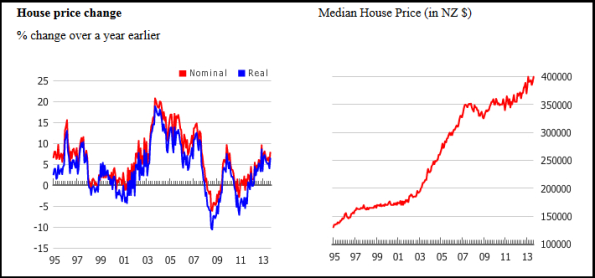

National is increasingly on the back-foot with New Zealand’s ever-worsening housing crisis. Ministers from the Prime minister down are desperately trying to spin a narrative that the National-led administration “is getting on top of the problem“.

Despite ministerial ‘reassurances’, both Middle and Lower Working classes are feeling the dead-weight of a housing shortage; ballooning house prices, and rising rents.

Recently-appointed Finance Minister, Steven Joyce, has found a new unlikely scapegoat, blaming the housing bubble and worsening housing affordability on current low interest rates. On 11 May, on Radio NZ’s Morning Report, he said;

“We have very, very low interest rates historically, and as a result that’s directly linked to how much house prices are being bid up around the world. It’s not the sole reason for why we have high asset prices around the world, it’s not just houses, it’s shares and everything else. But it is certainly one of the dominant reasons for that. And unfortunately it’s going to be a little bit of time yet before that changes, although there’s indications that this period of ultra-low interest rates that the world has seen is coming to an end. And so I think that, that, will improve affordability over time.”

Radio NZ’s Guyon Espiner reacted with predictable incredulity that Joyce was relying on interest rates rising to “improve affordability over time“.

Joyce’s finger-pointing and blaming “very, very low interest rates historically” is at variance with a speech that former Dear Leader, John Key, gave in January 2008 where he specifically indentified higher interest rates as a barrier to home ownership;

* Why, after eight years of Labour, are we paying the second-highest interest rates in the developed world?

[…]

* Why can’t our hardworking kids afford to buy their own house?

Good questions, Mr Key

Got any answers, Mr Joyce?

Because according to Statistics NZ, home ownership rates have worsened since John Key gave his highly-critical speech, nine years ago;

Home ownership continues to fall

-

In 2013, 64.8 percent of households owned their home or held it in a family trust, down from 66.9 percent in 2006.

-

The percentage of households who owned their home dropped to 49.9 percent in 2013 from 54.5 percent in 2006.

Home ownership reached a peak of 73.8% by 1991. Since then, with the advent of neo-liberal “reforms” in the late ’80s and early ’90s, home ownership has steadily declined.

Those who have benefitted have tended to be investors/speculators. In 2016, 46% of mortgages were issued to property investors/speculators in the Auckland region. Despite a watered-down, pseudo-capital gains tax, referred to as the “bright line” test implemented in October 2015, investors/speculators still accounted for 43% of house purchasers by March of this year.

The same report revealed the dismal fact that first home buyers constituted only 19% of sales.

John Key’s gloomy plea, “Why can’t our hardworking kids afford to buy their own house?” rings truer than ever.

Poorer families are fairing no better.

National’s abysmal policy to sell off state housing has left a legacy of families living in over-crowded homes; garages, and cars. This scandal has reached the attention of the international media.

From the Guardian;

.

.

From Al Jazeera;

.

.

As with our fouled waterways, we have developed another unwelcomed reputation – this time for the increasing scourge of homelessness.

But it is not just the sons and daughters of the Middle Classes that are finding housing increasingly out of their financial reach. The poorest families in our society have resorted to living in over-crowded homes or in garages and in cars.

National has spent millions of taxpayer’s dollars housing families in make-shift shelters in motels. At the behest on National ministers, WINZ have made it official policy to recoup money “loaned” to beneficiaries to pay for emergency accommodation;

.

.

National’s track record on this growing community cancer has been one of ineptitude.

In 2015, Dear Leader Key made protestations that no problem exists in our country;

“No, I don’t think you can call it a crisis. What you can say though is that Auckland house prices have been rising, and rising too quickly actually.”

He kept denying it – until he didn’t;

.

.

Unfortunately, former-and current State beneficiary, and now Social Housing Minister, Paula Bennett, apparently ‘did not get the memo’. She still denies any housing crisis in this country;

“I certainly wouldn’t call it a crisis. I think that we’ve always had people in need. So the other night on TV I heard the homeless story was second in and then the seventh story was a man who’d been 30 years living on the streets.”

Despite being in full denial, in May last year Bennett announced that National would be committing $41.1 million over the next four years for emergency housing and grants.

By April this year it was revealed that National had already spent $16.5 million on emergency accomodation. It had barely been a year since Bennett issued her Beehive statement lauding the $41.1 million expenditure, and already nearly a third of that amount has been spent.

This is clear evidence as to how far out-of-touch National is on social issues.

The stress and pressure on Ministers and state sector bureaucrats has become apparent, with threats of retribution flying. This month alone, a MSD manager and associate minister of social housing, Alfred Ngaro, were revealed to have warned critics of the government not to talk to the media;

.

.

Bennett went on to make this extraordinary statement;

“I spend the bulk of my time on social housing issues and driving my department into seriously thinking about different ways of tackling this.”

Her comment was followed on 20 May, on TV3’s The Nation, when current Dear Leader, Bill English tried to spin a positive message in National’s ‘fight against homelessness’;

“Our task has been to, as we set out three or four years ago, to rebuild the state housing stock. And that’s what we are setting out to do.”

English and Bennett’s claims would be admirable – if they were not self-serving hypocrisy.

In 2008, Housing NZ’s stock comprised of 69,000 rental properties.

By 2016, that number had fallen to 61,600 (plus a further 2,700 leased).

In eight years, National has managed to sell-off 7,400 properties.

No wonder English admitted “we set out three or four years ago, to rebuild the state housing stock“. His administration was responsible for selling off over ten percent of much-needed state housing.

No wonder families are forced into over-crowding; into garages and sheds; and into cars and vans.

Confronted by social problems, National ministers duck for cover. Especially when those same social problems are a direct consequence of their own ideologically-driven and ill-considered policies.

National ministers English, Bennett, Joyce, Nick Smith, et al are responsible for our current homelessness.

Parting thought

Left-wing parties and movement are generally proactive in identifying and resolving critical social problems and inequalities. It is the raison d’etre of the Left.

The Right seem only able to belatedly react to social problem and inequalities.

Especially when they caused it.

.

.

.

References

Interest.co.nz: PM says no housing crisis in Auckland

NZ Herald: Housing shortage growing by 40 homes a day

Fairfax media: House prices rise at an ‘eye-popping’ rate for 6 NZ regions – Trade Me

Interest.co.nz: Median rents up $50 a week over last 12 months in parts of Auckland

Radio NZ: Lessons for NZ in Australia’s Budget

NZ Herald: John Key – State of the Nation speech

Statistics NZ: 2013 Census QuickStats about national highlights

Statistics NZ: Owner-Occupied Households

Radio NZ: Homeless family faces $100k WINZ debt

Interest.co.nz: New official Reserve Bank figures definitively show that investors accounted for nearly 46% of all Auckland mortgages

Simpson Grierson: New “bright-line” test for sales of residential land

Property Club: First buyers still missing out in Auckland’s most affordable properties

The Guardian: New Zealand housing crisis forces hundreds to live in tents and garages

Al Jazeera: New Zealand’s homeless – Living in cars and garages

NZ Herald: No house, not even a motel, for homeless family

Radio NZ: Key denies Auckland housing crisis

Radio NZ: No housing crisis in NZ – Paula Bennett

Beehive: Budget 2016 – 3000 emergency housing places funded

Mediaworks: Homeless crisis costing Govt $100,000 a day for motels

Radio NZ: Emergency housing providers instructed not to talk to media

Radio NZ: Ngaro apologises for govt criticism

TV3: The Nation – Patrick Gower interviews Bill English

Housing NZ: Annual Report 2008/09

Housing NZ: Annual Report 2015/16

Previous related blogposts

Can we do it? Bloody oath we can!

Budget 2013: State Housing and the War on Poor

Budget 2013: State Housing and the War on Poor

National recycles Housing Policy and produces good manure!

National Housing propaganda – McGehan Close Revisited

Housing; broken promises, families in cars, and ideological idiocy (Part Tahi)

Housing Minister Paula Bennett continues National’s spin on rundown State Houses

Another ‘Claytons’ Solution to our Housing Problem? When will NZers ever learn?

Government Minister sees history repeat – responsible for death

Housing Minister Paula Bennett continues National’s spin on rundown State Houses

Letter to the Editor – How many more children must die, Mr Key?!

National under attack – defaults to Deflection #1

National’s blatant lies on Housing NZ dividends – The truth uncovered!

.

.

.

Problem…

.

.

Solution.

.

.

This blogpost was first published on The Daily Blog on 21 May 2017.

.

.

= fs =

2017 – Ongoing jobless tally

.

.

Continued from: 2016 – Ongoing jobless tally

By the numbers, for this year;

.

Events

.

January

- Gateway Housing Trust: 7 redundancies

- Pumpkin Patch: 560 redundancies

February

- Westland Milk: unknown

- Wellington City Council: 17 redundancies

- Solid Energy/Spring Creek Mine: unknown

- Cadbury Dunedin: 380 redundancies

- The Warehouse: 130 redundancies (est.)

- ABB: 59 redundancies

March

- Credit Union South: 8 redundancies

- Marcs and David Lawrence: 44 redundancies

- Suncorp: 100 redundancies (est.)

- Auckland Libraries: 74 redundancies

- TVNZ: unknown – t.b.a.

April

Otago University: unknown

May

- Silver Fern Farms: up to 370 redundancies

.

Unemployment Statistics* at a Glance

.

.

(* See caveat below)

.

Caution: Official Unemployment Statistics

.

On 29 June 2016, Statistic NZ announced that it would be changing the manner in which it defined a jobseeker. This so-called “revision” would materially affect how unemployment stats were counted and reported;

.

.

Change: Looking at job advertisements on the internet is correctly classified as not actively seeking work. This change brings the classification in line with international standards and will make international comparability possible.

Improvement: Fewer people will be classified as actively seeking work, therefore the counts of people unemployed will be more accurate.

The statement went on to explain;

Change in key labour market estimates:

- Decreases in the number of people unemployed and the unemployment rate

- Changes to the seasonally adjusted unemployment rate range from 0.1 to 0.6 percentage points. In the most recent published quarter (March 2016), the unemployment rate is revised down from 5.7 percent to 5.2 percent

- Increases in the number of people not in the labour force

- Decreases in the size of the labour force and the labour force participation rate

When Statistics NZ ‘re-jigged’ its criteria for measuring unemployment in June, unemployment dropped from 5.7% to 5.2% (subsequently revised again down to 5.1%).

All unemployment data from Statistics NZ should therefore be treated with caution. Unemployment is likely to be much higher than Statistics NZ figures indicate.

.

.

.

References

Statistics NZ: Household Labour Force Survey – Revisions to labour market estimates

Statistics NZ: Labour Market Statistics – June 2016 quarter

Trading Economics: New Zealand Unemployment Rate to January 2017

Previous related blogpost

Lies, Damned lies and Statistical Lies

National exploits fudged Statistics NZ unemployment figures

Lies, Damned lies and Statistical Lies – ** UPDATE **

2016 – Ongoing jobless tally and why unemployment statistics will no longer be used

.

.

.

The Mendacities of Mr Key # 19: Tax Cuts Galore! Money Scramble!

.

.

In troubled times, we are community

.

On 14 October, eight hours after two massive 7.8 earthquakes simultaneously rocked the entire country, our Dear Leader John Key made an impassioned (for him, it was impassioned) appeal to the people of Aotearoa on Radio NZ’s ‘Morning Report‘;

.

“The one thing I’d we’d just say to New Zealanders at the moment is stay close to your family and friends. Make sure you listen to the radio and listen to the best information that you’re getting. And if you do have certainly older neighbours or family, if you could go in and check up on them that would be most appreciated. Because there will be people feeling genuinely alone.“

.

It was an appeal to a sense of community that is rarely made by right-wing governments or their leaders. It was a tacit acknowledgement that No Man or Woman is an Island that that only by acting collectively can human beings survive and improve their own circumstances and for their children.

Unfortunately, a week later, Key’s sense-of-community-spirit was returned to it’s hermetically-sealed casket and re-buried alongside cryo-capsules containing New Zealand’s Once-Egalitarian-Spirit and International-Independent-Leadership-On-Moral Issues.

.

National dangles the “carrot”

.

On 21 November, Key announced that tax cuts were once again “on the table” and Little Leader/Finance Minister, Bill English confirmed it.

With a statement that was more convoluted than usual, Key said;

“We’ve identified from our own perspective if there was more money where would be the kinds of areas we want to go, not what is the make up … for instance, of a tax or family package, what is the make up of other expenditure we want?

Tax is one vehicle for doing that, it’s not always the most effective vehicle for doing that for particularly low income families.”

Tax could be effective higher up the income scale, but lower down it was not that effective because base rates were low or it was very expensive.

Over the fullness of time we’ll have to see whether we’ve got much capacity to move.

Making sure they can keep a little more of what they earn or get a little bit more back through a variety of mechanisms is always something we can consider. It could be a mix, yes.

In the end it’s about equity for New Zealanders and about .. having a rise in their standard of living, and there’s a number of ways you could deliver that.”

Key has once again dangled a billion-dollar carrot in front of New Zealanders as the country heads towards next year’s election.

.

National’s previous election “carrots”

.

During the 2008 General Election, as the Global Financial Crisis was impacting on our own economy, Key was promising tax cuts. In May 2008, he said;

“But in 2005 we promised tax cuts which ranged from about $10 to $92 a week, roughly $45 a week for someone on $50,000 a year.

“I described it as a credible programme of personal tax cuts and I’m committed to a credible programme of personal tax cuts,” he said.

Questioned on whether National’s tax cuts programme of 2005 was credible today given the different economic circumstances, Mr Key said: “Well, I think it is.”

“I believe that an ongoing programme of personal tax cuts that delivers the sort of magnitude that we’ve had in the past is potentially possible.

At the time, then Labour’s Finance Minister, Michael Cullen described National’s tax-cut-bribe as ‘reckless‘.

By October 2008, as NZ Inc’s economic circumstances deteriorated, Treasury issued dire warnings that should have mitigated against any notions of affordable tax-cuts;

John Key has defended his party’s planned program of tax cuts, after Treasury numbers released today showed the economic outlook has deteriorated badly since the May budget. The numbers have seen Treasury reducing its revenue forecasts and increasing its predictions of costs such as benefits. Cash deficits – the bottom line after all infrastructure funding and payments to the New Zealand Superannuation Fund are made – is predicted to blow out from around $3 billion a year to around $6 billion a year.

Key’s government won the 2008 election and proceeded with tax-cuts in 2009 and 2010.

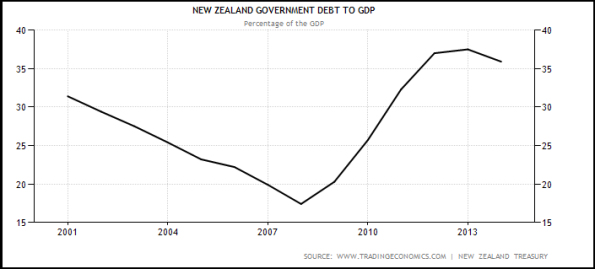

Predictably, government debt – which had been paid down by the Clark-Cullen government – ballooned as the recession hit New Zealand’s economy and tax revenue fell;

.

.

Key himself estimated tax cuts to be worth between $3 or $4 billion.

In 2008, New Zealand’s core government debt stood at nil (net)

Current government debt now stands at $62.272 billion (net).

.

.

Nature intervenes in National’s “cunning plan” for a Fourth Term

.

According to Dear Leader Key, estimates for the re-build of earthquake damage in and around Kaikoura; State Highway One, and the rest of the South Island is likely to be at least “a couple of billion dollars“.

.

The repair bill from Monday’s earthquake near Hanmer Springs is estimated to be billions of dollars. Photo: RNZ / Rebekah Parsons-King

.

Finance Minister Bill English has hinted the cost may be much more;

“The combination of significant infrastructure damage in Wellington, obvious damage in Kaikoura – all roading and rail issues – this is going to add up to something fairly significant. We also know that those estimates change over time.”

No wonder Labour leader Andrew Little was less than impressed at tax cuts being mooted. Echoing Michael Cullen from eight years ago, he condemned the irresponsible nature of Key’s proposal;

“Well this is crazy stuff, I mean in addition to a government having $63 billion worth of debt it is yet to start repaying, and you’ve got a billion dollars extra each year just in the cost of superannuation.

Now we have another major civic disaster that is going to cost in terms of repairs. I do not see how John Key can say tax cuts are justified in the present circumstances.”

.

National spends-up large on new prison beds

.

On top of which, English announced last month that National was planning to spend over $2.5 billion on new prison beds. He questioned whether tax cuts were affordable with such looming expenditure;

Finance Minister Bill English has warned an announcement today of plans for an extra 1,800 prison beds will reduce the room for the Government to consider tax cuts before next year’s election.

English told reporters in Parliament the extra beds would cost NZ$1 billion to build and an extra NZ$1.5 billion to run over the next five or six years.

“It will have an impact because it is a very large spend and, two or three years years ago, we probably thought this could be avoidable,” English said when asked if the extra spending would make it harder for the Government to unveil tax cuts and other spending before the next election.

“It’s all part of this rachetting up of tougher sentences, tighter remand conditions, less bail and taking less risk with people who commit serious offenses,” he added.

Asked if that meant there would be less room for tax cuts, he said: “I wouldn’t want to judge that because it is a bit early, but certainly spending this kind of money on prison capacity is going to reduce other options.”

.

The inevitable cost of tax-cuts

.

As billions more is wasted on prisons, money spent on health, education, housing, and other social services is being frozen; cut back, or not keeping pace with inflation.

This has resulted in appalling cuts to services such as recently experienced by 96-year-old Horowhenua woman, Trixie Cottingham;

.

.

Other social services have also been wound back – as previously reported by this blogger;

.

.

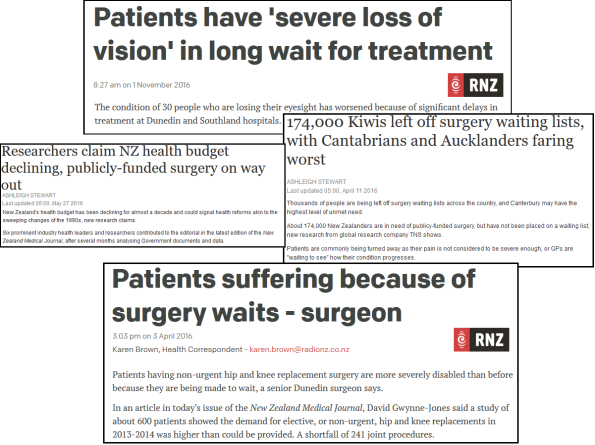

Cuts to the Health budget have resulted in wholly predictable – and preventable – negative outcomes;

.

.

A critic of National’s under-funding of the health system, Phil Bagshaw, pointed out the covert agenda behind the cuts;

New Zealand’s health budget has been declining for almost a decade and could signal health reforms akin to the sweeping changes of the 1990s, new research claims.

[…]

The accumulated “very conservative” shortfall over the five years to 2014-15 was estimated at $800 million, but could be double that, Canterbury Charity Hospital founder and editorial co-author Phil Bagshaw said.

Bagshaw believed the Government was moving away from publicly-funded healthcare, and beginning to favour a model that meant everyone had to pay for their own.

“It’s very dangerous. If this continues we will slide into an American-style healthcare system.”

As the public healthcare system faces reduction in funding – more and New Zealanders will be forced into taking up health insurance. In effect, National is covertly shifting the cost of healthcare from public to private, funding the public/private ‘switch’ through personal tax-cuts.

Tax dollars have previously been allocated to social services such as Education or Health. By implementing tax cuts, those “Health Dollars” become “Discretionary Dollars”; Public Services for Citizens becomes Private Choice for Consumers.

And we all know how “well” that model has worked out in the United States;

.

.

(Yet another) Broken promise by Key

.

But equally important is that, in promising to spend the government surplus on tax-cuts, Dear Leader Key has broken yet another of his promises to the people of New Zealand.

In July 2009, National suspended all contribution to the NZ Superannuation Fund. At the time Bill English explained;

“The Government is committed to maintaining National Superannuation entitlements at 66 per cent of the average wage, to be paid from age 65.

[…]

The suspension of automatic contributions will remain until there are budget surpluses sufficient to fund contributions. Under current projections, the Government is not expected to have sufficient surpluses for the next 11 years.

[…]

Once surpluses sufficient to cover automatic contributions return, the Government intends to contribute the amount required by the Fund formula.”

“We’re managing government spending carefully, the economy is improving a bit faster than we expected, and that means it’s six years instead of 10 years until we start making contributions to the fund. If the economy picks up a bit faster again, we’ll get to that point sooner.”

In 2011, John Key said;

“Once we’re back to running healthy surpluses, we’ll be able to auto-enrol workers who are not members of KiwiSaver, pay down debt and resume contributions to the Super Fund.”

“The Government’s target is to return to surplus by 2014-15 so that we will then have choices about repaying debt, resuming contributions to the New Zealand Superannuation Fund, or targeting more investment in priority public services.”

“It remains our intention that contributions will resume once net debt has reduced to 20 percent of GDP, which is forecast for 2020.”

In 2014, English told Patrick Gower;

“… In this Budget we will have a paper-thin surplus , I mean we’ll just have a surplus but that’s the beginning of a series of surpluses and that means we have choices. And there’s a lot of choices. We’ve got the New Zealand Super Fund to resume contributions, an auto-enrolment for KiwiSaver, paying off debt more quickly, something for households to help them along. Those are choices that New Zealand fortunately will have if we have a growing economy and we stick to being pretty careful about our spending.”

In 2015, Key and English issued a joint statement saying;

“Through Budget 2015, the National-led Government will…

[…]

Reduce government debt to less than 20 per cent of GDP by 2020/21 when we can resume contributions to the NZ Super Fund.”

In October this year, English said;

“There has not been any broken commitment regarding the Superannuation Fund. We have said for some time that when the Government returns to a sufficient budget surplus and can contribute genuine savings rather than borrowing, National will resume contributions to the New Zealand Superannuation Fund. The straightforward issue is that even when the Government shows surpluses under the operating balance before gains and losses measure, it does not always have cash surpluses until those accounting surpluses get reasonably big.

[…]

I remember that Sunday in 2009 in vivid detail, in fact, and constantly go back to it. The Government has outlined its position many, many times since 2009, and when there are sufficient surpluses and when we have debt down to the levels we think are prudent, which is 20 percent of GDP by 2020, then we will resume contributions, which we would like to do.”

In every year since National ceased contributing to the NZ Super (“Cullen”) Fund, both Key and English have reiterated their committment to resume payments when government books returned to surplus.

By hinting at tax cuts instead, Key and English have broken their promises, made over a seven year period.

Even their “qualifyer” of resuming contributions “when we have debt down to the levels we think are prudent, which is 20 percent of GDP by 2020” becomes untenable with their hints of an election-year tax-cut bribe.

By cutting taxes instead of paying down debt, resuming contributions to the NZ Super Fund is pushed further out into the dim, distant future.

The very suggestion of tax cuts is another potential broken promise. What’s one more to add to his growing list of promises not kept?

After all, there is an election to be fought next year.

Since National has not thought twice at under-funding the Health Budget, it certainly does not seem troubled at using tax-cuts as an election bribe, and undermining this country’s future superannuation savings-fund for selfish political gain.

Muldoon did it in 1973 – and got away with it.

Carrot, anyone?

.

.

.

References

Radio NZ: Morning Report – John Key urges New Zealanders to look out for their neighbours

Radio NZ: Morning Report – Key not ruling out tax cuts despite billion-dollar Kaikoura bill

Radio NZ: Morning Report – Government not ruling out tax cuts despite $1B Kaikoura bill

Fairfax media: John Key reveals plans for ‘tax and family’ package, but quake might affect plans

NZ Herald: National’s 2005 tax cut plans still credible – Key

Beehive: National ignores inflation warning

NZ Herald: Key – $30b deficit won’t stop Nats tax cuts

NZ Treasury: Financial Statements of the Government of New Zealand for the Year Ended 30 June 2010 – Debt

Fairfax media: $4b in tax cuts coming

NZ Treasury: Fiscal Indicator Analysis – Debt as at 30 June 2008

NZ Treasury: Financial Statements of the Government of New Zealand for the Year Ended 30 June 2016

Radio NZ: Earthquake’s billion-dollar bill won’t compare with Chch

Radio NZ: PM ‘irresponsible’ to talk tax cuts after quake – Labour

Interest.co.nz: English says NZ$1 bln capital cost and NZ$1.5 bln of operating costs for extra 1,800 prison beds reduces room for tax cuts

Radio NZ: Checkpoint – DHB threatens to cut off 96-year-old’s home help in Levin

Dominion Post: Women’s Refuge cuts may lead to waiting lists

NZ Herald: Govt funding cuts reduce rape crisis support hours

TV1 News: ‘Devastating news for vulnerable Kiwis’ – Relationships Aotearoa struggling to stay afloat

Radio NZ: Patients have ‘severe loss of vision’ in long wait for treatment

Fairfax media: Researchers claim NZ health budget declining, publicly-funded surgery on way out

Radio NZ: Patients suffering because of surgery waits – surgeon

Fairfax media: 174,000 Kiwis left off surgery waiting lists, with Cantabrians and Aucklanders faring worst

Fortune: How the U.S. Health Care System Fails Its Sickest Patients

NZ Super Fund: Contributions Suspension

Beehive: New Zealand Super Fund – fact sheet

Fairfax media: English signals earlier return to Super Fund payments

Scoop media: John Key’s Speech to Business New Zealand Amora Hotel Wgtn

Parliament Today: Questions and Answers – November 7

TV3 News: $23 billion in NZ Super Fund

Throng: Patrick Gower interviews Finance Minister Bill English on The Nation

Beehive: Budget 2015

Scoop: Hansards – Questions and Answers – 18 October 2016

Fairfax media: Compulsory super ‘would be worth $278 billion’

Additional

The Standard: The great big list of John Key’s big fat lies (UPDATED)

Other Blogs

The Standard: The eternal tax-cut mirage

Previous related blogposts

“It’s one of those things we’d love to do if we had the cash”

The Mendacities of Mr Key #3: tax cuts

The consequences of tax-cuts – worker exploitation?

Plunket and the slow strangulation of community organisations

The cupboard is bare, says Dear Leader

An earthquake separates John Key and ‘The Iron Lady’, Margaret Thatcher

.

.

.

.

This blogpost was first published on The Daily Blog on 27 Novembr 2016.

.

.

= fs =

2016 – Ongoing jobless tally and why unemployment statistics will no longer be used

.

.

Continued from: 2015 – Ongoing jobless tally

So by the numbers, for this year;

.

Events

.

January

- Gameloft: 150 redundancies

- ROA Mine: 20 redundancies

- NZ Bus: 200 redundancies (t.b.c)

February

- Fairfax media: 70 redundancies

- Prime Range Meats: 130 redundancies

- Stonewood Homes: 85 redundancies

- Dick Smith Electronics: 430 redundancies

March

- Wellington Hospital: 40 redundancies

- Solid Energy: 41 redundancies

- Bathurst Mining: 25 redundancies

- NZ Post: 500 redundancies

April

- Ministry of Justice: 100 redundancies

- Fisher & Paykel: 186 redundancies

- Cavalier Carpets: 65 redundancies

- Countdown Waihi: 41 redundancies

May

- Fuji Xerox: 40 redundancies

- General Cable: 62 redundancies

June

- Bathurst Resources Ltd: 8 redundancies

- Westport Harbour: 8 redundancies

- Holcim Cement: 105 / 150 redundancies

July

- Napier City Council: 78 redundancies

- Countdown: unknown

August

- Westpac: 72 redundancies

- Ministry of Primary Industries: 49 redundancies

- Waikato SPCA: 12 redundancies (?)

- Otago University: 20 redundancies

October

- Pumpkin Patch: 57 redundancies

- Ministry of Justice/Maori Land Court: 26 redundancies (tbc)

- BNZ: 500 redundancies (tbc)

November

- General Cable: 170 redundancies

- Lincoln University: 51 redundancies

- EQC: 400 redundancies

.

Statistics

.

This blogger previously reported how Statistics NZ recently implemented a so-called “revision” which would materially affect how unemployment stats were counted and reported;

.

.

On 29 June 2016, Statistic NZ announced that it would be changing the manner in which it defined a jobseeker;

Change: Looking at job advertisements on the internet is correctly classified as not actively seeking work. This change brings the classification in line with international standards and will make international comparability possible.

Improvement: Fewer people will be classified as actively seeking work, therefore the counts of people unemployed will be more accurate.

The statement went on to explain;

Change in key labour market estimates:

- Decreases in the number of people unemployed and the unemployment rate

- Changes to the seasonally adjusted unemployment rate range from 0.1 to 0.6 percentage points. In the most recent published quarter (March 2016), the unemployment rate is revised down from 5.7 percent to 5.2 percent

- Increases in the number of people not in the labour force

- Decreases in the size of the labour force and the labour force participation rate

The result of this change? At the stroke of a pen, unemployment fell from 5.7% to 5.2%;

.

.

And on-cue, National was quick to capitalise on Statistics NZ’s figure-fudging;

On 2/3 July, TV3’s The Nation, Dear Leader Key told Corin Dann;

“The unemployment rate in New Zealand is now falling pretty dramatically.”

On 8 August, Key was quoted on Interest.co.nz;

“On the other side, we need these people in an environment where unemployment is 5.2% and where growth is still very, very strong. You’ve just got to be careful when you play around with these things that you don’t hamstring certain industries that need these workers.”

On 12 August, in Parliament, English also gleefully congratulated himself on the “fall” in unemployment;

“The Reserve Bank is forecasting an increase of about 1 percent more growth in the economy over the next 3 years, compared with what it thought 3 months ago. It is forecasting that unemployment is going to continue falling from 5.2 percent this year to 4.5 percent by 2019 and that job numbers will increase by more than 2 percent on average over the next 2 years. A significant component of that, of course, will be the construction boom, where thousands of houses will be built over the next 2 or 3 years. These forecasts are in line with Treasury’s forecast for the labour market and show an economy that is delivering more jobs, lower unemployment, and real increases in incomes when in many developed countries that is not happening.”

The latest Statistics NZ (soon to be re-branded Ministry of Truth) unemployment figures showed another “fall”. The unemployment rate for the September 2016 Quarter is now purportedly 4.9%;

.

.

Can that figure – 4.9% – be trusted?

When Statistics NZ “re-jigged” its criteria for measuring unemployment in June, unemployment dropped from 5.7% to 5.2% (subsequently revised again to 5.1%);

.

.

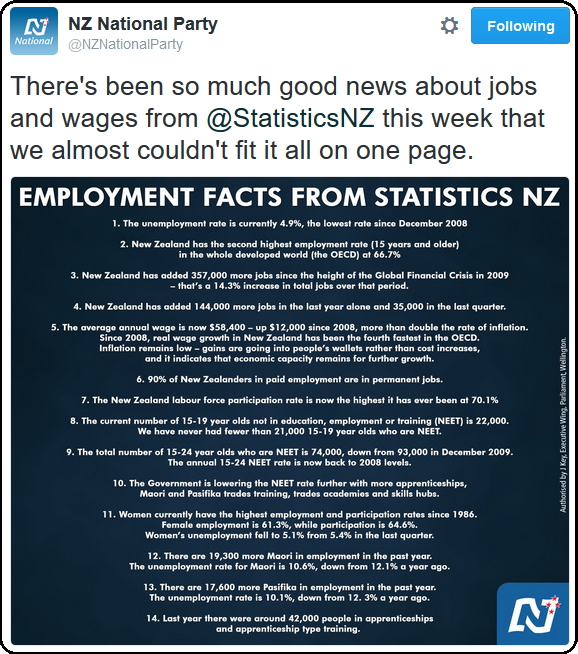

Predictably, National were quick to once again exploit the September statistics, as their Twitter-feed showed on 2 November;

.

.

And three days later;

.

.

It’s all nonsense, of course – made worse by Statistics NZ’s other dodgy criteria used when considering their definition what constitutes being “employed”;

Employed: people in the working-age population who, during the reference week, did one of the following:

- worked for one hour or more for pay or profit in the context of an employee/employer relationship or self-employment

- worked without pay for one hour or more in work which contributed directly to the operation of a farm, business, or professional practice owned or operated by a relative

Statistics NZ’s mis-representation of our “low unemployment” environment has gone largely unnoticed and unchallenged. No one in the mainstream media has picked up on the questionable data;

This meant the size of the labour force rose 33,000 and unemployment fell by just 3,000 to 128,000. The unemployment rate fell to 4.9% from a revised 5.0% in the June quarter. This was the lowest unemployment rate since the December quarter of 2008. Unemployment has fallen by 7,000 over the last year and is up 1,000 from two years ago. – Interest.co.nz