Archive

Tips from Paula Bennett on how to be a Hypocrite

.

.

Recent comments by Paula Bennett regarding introducing tipping to New Zealand are more revealing of National’s contempt for workers than most realise.

On 22 May, Bennett was reported as promoting tipping for reasons that – on the face of it – sound reasonable, but are questionable;

“ If you receive excellent service, you should tip. I don’t think that tipping should be mandatory in New Zealand, but I do think that we shouldn’t tell people not to tip when they come here, which we did for a while.

People will enjoy their work more and get paid more – it’s plus plus plus.I don’t want us to turn into that mandatory tipping for people just to survive, but I do think if we reward good service it’s going to make everyone smile a bit more.”

“Smile a bit more”? “People will enjoy their work more”?

Perhaps in Bennett’s narrow world, hermetically-sealed in Parliament with her ministerial salary; perks; golden superannuation; and tax-payer-funded housing.

To put Bennett’s comments into some context, in March 2012 NZ Herald journalist, Fran O’Sullivan gave us a glimpse of her privileged life;

My sense is that Bennett always knew how to work the system to her advantage – and good for her. Let’s face it, at the time she went on to the domestic purposes benefit in 1986, knowing how to rort the system was a national sport.

[…]

At just 17, she gave birth to her only child, a daughter she named Ana. Just two years later, she got a Housing Corporation loan to buy a $56,000 house in Taupo. All of this while on the domestic purposes benefit.

[…]

Bennett was also fortunate in getting a training allowance to go to university when her daughter was 8. Her backstory suggests that she was still on a benefit while studying.

The Training Incentive Allowance that paid for Bennett’s university education meant she was not lumbered with any of the $15 billion debt that 728,000 other Kiwi students are now facing. Her tertiary education was free.

This would not be a problem – except that one of Bennett’s first acts on becoming social welfare minister was to remove the same Training Incentive Allowance that she used to put herself through University;

.

.

Evidently, Bennett’s working life was “too exhausting” and she made a “career move” back onto the DPB;

“ Then I pretty much fell apart because I was exhausted. I went back on the DPB.”

In opting to chuck in her paid job and return to the DPB, she became an oft-parroted cliche that many on the Right – especially National/ACT supporters – often accuse welfare beneficiaries for.

From being an on-again-off-again beneficiary on the DPB, in 2005 Bennett became a beneficiary of the Parliamentary Service and she entered Parliament on the National Party List.

Today, as Deputy PM, the tax-payer is responsible for meeting her $326,697 p.a. salary, plus free housing, and other perks.

It would be a fair guess that Bennett does not require tipping to make up her weekly pay packet, to meet the necessities of life that many other New Zealanders find challenging in the 21st Century;

.

.

In 2007 – and for the following five years – the former Dear Leader, John Key, constantly made eloquent speeches on raising the incomes of New Zealanders;

“We think Kiwis deserve higher wages and lower taxes during their working lives, as well as a good retirement.” – John Key, 27 May 2007

“We will be unrelenting in our quest to lift our economic growth rate and raise wage rates.” – John Key, 29 January 2008

“We want to make New Zealand an attractive place for our children and grandchildren to live – including those who are currently living in Australia, the UK, or elsewhere. To stem that flow so we must ensure Kiwis can receive competitive after-tax wages in New Zealand.” – John Key, 6 September 2008

“I don’t want our talented young people leaving permanently for Australia, the US, Europe, or Asia, because they feel they have to go overseas to better themselves.” – John Key, 15 July 2009

“Science and innovation are important. They’re one of the keys to growing our economy, raising wages, and providing the world-class public services that Kiwi families need.” – John Key, 12 March 2010

“We will also continue our work to increase the incomes New Zealanders earn. That is a fundamental objective of our plan to build a stronger economy.” – John Key, 8 February 2011

“The driving goal of my Government is to build a more competitive and internationally-focused economy with less debt, more jobs and higher incomes.” – John Key, 21 December 2011

“We want to increase the level of earnings and the level of incomes of the average New Zealander and we think we have a quality product with which we can do that.” – John Key, 19 April 2012

Who would have thought that Key’s goal of raising wages would be achieved… with tips.

It speaks volumes about National’s disconnect with the working men and women of this country, that the best that our generously paid Deputy Prime Minister can come up with is that raising wages should be dependent on the largesse of others.

Is this the essence of National’s ambition for New Zealanders? That not only should we be tenants in our own country –

.

.

– but that we should be paid as such?

On 18 April, our new Dear Leader, Bill English announced a $2 billion pay increase for under paid care and support workers in the aged and residential care sector.

However, there appears to be a ‘fish hook’ in the much trumpeted announcement;

“ Cabinet today agreed to a $2 billion pay equity package to be delivered over the next five years to 55,000 care and support workers employed across the aged and residential care sector.”

The pay increase will be “delivered over the next five years“.

On 22 April I wrote to Health Minister Coleman asking, amongst other things;

To date, Minister Coleman’s office has put off replying, stating that his office was busy and “response times vary between 4 – 6 weeks but also depend on the Minister’s schedule and availability“. (More on this later.)

Perhaps aged and residential care sector workers should ask for tips in the meantime, from their clients?

According to the website Numbeo.com, New Zealand wages have not kept pace with our nearest neighbour;

.

.

Former Dear Leader Key’s grand ambition of matching Australia’s income levels have remained illusory.

In fact, despite heightened economic activity through immigration and the Christchurch re-build, wages have remained suppressed. As Head of Trade Me Jobs, Jeremy Wade, said in April this year;

“ We’re seeing small increases in average pay across growth industries such as Construction and Customer Service, but overall wages aren’t matching demand.

The number of roles advertised has exploded in recent months which in turn means that the average number of applications per role has dropped 13 per cent on this time last year. Job hunters can be more selective, which makes it harder to fill these roles.

Some employers have looked to immigration channels to address this shortage. Immigration alone won’t correct the shortfall, though it may be suppressing wage growth… ”

“Immigration… may be suppressing wage growth“.

There is no “may” about it. Immigration is suppressing wage growth. The simple laws of market supply & demand dictate that in times of “low” unemployment, wages will rise as the supply of workers does not meet demand.

This is not some marxist-leninist tenet. This is core doctrine of the Free Market;

The law of supply and demand is the theory explaining the interaction between the supply of a resource and the demand for that resource. The law of supply and demand defines the effect the availability of a particular product and the desire (or demand) for that product has on price. Generally, a low supply and a high demand increases price, and in contrast, the greater the supply and the lower the demand, the lower the price tends to fall.

The only way that the price of labour can be suppressed is to increase the supply of labour. National has opened the floodgates of immigration, increasing the number of workers, and hence the price of labour has remained suppressed (also incidentally fuelling increasing housing demand, ballooning prices, and construction in Auckland).

There is a grim irony at play here.

National has exploited high immigration to generate economic activity and National ministers continually boast to the electorate that they have boosted economic activity;

“ Despite the dairy sector continuing to be under pressure, other sectors are performing well and contributing to an overall solid rate of economic growth.” – Bill English

“ We are the fifth fastest growing economy last year in the developed world. That’s unexpected.” – Steven Joyce

“ That’s why the good economic growth we’re seeing with rising incomes and a record number of jobs available is the best way this Government can help New Zealanders. ” – Paula Bennett

“ The New Zealand economy is diverse and dynamic. Strong GDP and job growth, together with the impact of technology, is driving change in every sector.” – Simon Bridges

But the same immigration that has generated that economic “growth” has also suppressed wages. National’s exploitation of high immigration to pretend we have “high economic growth” may have worked. But the unintended consequence of suppressed wages is now starting to haunt them.

What to do, what to do?!

Enter Paula Bennett and her desperate plea for New Zealanders to tip each other.

Unfortunately, tipping each other is simply a band-aid over low wages. In the end, like a pyramid scheme, the money-go-round of tipping fails to generate long term wage increases and we are back at Square One: low paid jobs and no prospects for improvement.

To compensate for chronic low wages, Labour introduced Working for Families in 2004. This became a means by which the State subsidised businesses to ensure that working families had some measure of a livable income.

Bennett’s lame suggestion – tipping – does not even pretend to come close to Labour’s solution.

Perhaps that is because National are in a quandry; cut back immigration to raise wages? That would wind back economic growth. Increase immigration to boost economic growth – and have wages stagnate.

This is what results when a political party with the unearned reputation of being “good economic managers” is revealed to being a fraud. Their short-term, unsustainable, “sugar-hit” policies eventually catch up with them.

Here’s a tip for you, Paula; saying silly things in election year is not helpful.

.

.

.

References

Fairfax media: Deputy PM Paula Bennett calls for more tipping

NZ Herald: Fran O’Sullivan – Bennett knows about life on Struggle St

NZ Herald: Student loan debt – 728,000 people owe nearly $15 billion

NBR: Bennett cutting a benefit that helped her – Labour

NZ Herald: Bennett rejects ‘hypocrite’ claims

NZ Doctor: Bennett denies women same education support she had

Scoop media: John Key – Speech to the Bluegreens Forum

Beehive: Key Notes – Boosting Science and Innovation

Beehive: John Key – Speech from the Throne

Fairfax media: Key wants a high-wage NZ

NZ Herald: PM warns against Kiwis becoming ‘tenants’

TVNZ News: Cabinet agrees to $2 billion pay equity package for ‘dedicated’ low-paid care workers

Numbeo: Cost of Living Comparison Between Australia and New Zealand

Trade Me: New Zealand job market booming but wages languish

Investopedia: Law Of Supply And Demand

Fairfax media: Record migration sees New Zealand population record largest ever increase

Fairfax media: New Zealand’s economic growth driven almost exclusively by rising population

Radio NZ: Billions for infrastructure reflects booming economy – Joyce

Fairfax media: Minister Paula Bennett – Challenge to house more people on taxpayer dollar

Kapiti Coast Chamber of Commerce: Minister of Economic Development Announces New Economic Data Tool

Wikipedia: Working for Families

Additional

The New York Times: Why Tipping Is Wrong

The Huffington Post: 9 Reasons We Should Abolish Tipping, Once And For All

Wikipedia: Paula Bennett

Other Bloggers

Martyn Bradbury – Paula Bennett’s call to tip is National’s new plan to subcontract out lifting wages without raising minimum wage

The Standard: Tipping vs fair wages

Previous related blogposts

Paula Bennett shows NZ how to take responsibility

Letter to the Editor: Was Paula Bennett ever drug tested?

Hon. Paula Bennett, Minister of Hypocrisy

Housing Minister Paula Bennett continues National’s spin on rundown State Houses

Why is Paula Bennett media-shy all of a sudden?

Health care workers pay increase – fair-pay or fish-hooks?

.

.

.

.

Hat-tip for above cartoon: Anthony Robbins

.

This blogpost was first published on The Daily Blog on 29 May 2017.

.

.

= fs =

Foot in Mouth award – Former ACT MP exposes flaw in free-market system

.

.

Meet Ken Shirley;

.

.

Most folk won’t remember who Ken Shirley was, prior to his current ‘gig’ as CEO of the Road Transport Forum (RTF), representing road transport interests since July 2010.

From 1984 to 1990, Shirley was nominally a Labour Party MP. He was closely aligned with the likes of Roger Douglas, Richard Prebble, and other right-wingers who had seized control of the party during the 1980s.

From 1996 to 2005, Shirley was an ACT Party MP. As such, he was an acolyte of the neo-liberal school of economics and a strong adherent of free market forces. Part of ACT’s policies is to scrap the minimum wage.

Indeed, to under-score ACT’s abhorrence of the minimum wage, ACT’s current leader (and sole MP), David Seymour, condemned a recent rise in minimum wage levels. On 26 February this year, Seymour was scathing;

“The new $15.25 minimum wage will hit regional employers especially hard… In Auckland, $15.25 might not sound like much, but small businesses in the regions who generally charge less will struggle to bear the cost. Hikes to the minimum wage will discourage new employment, and lead to more lay-offs and business failures.

The first employees to suffer will be young, low-skilled workers who won’t be offered a chance to prove their worth. Pulling up the jobs ladder will only add to poverty in low-income areas.

This is a wage set for the distorted Auckland economy. Why should the rest of the country have to bear the same costs?”

[Fun Fact: As a Parliamentary Under-Secretary, Seymour is currently a taxpayer-funded beneficiary on a salary of $185,098 p.a. – which equates to nearly $89 per hour. One wonders if “small businesses in the regions who generally charge less will struggle to bear the cost” of Seymour’s salary?]

But returning to Ken Shirley; as an ex-ACT member of Parliament he is still most likely an advocate for the abolition of the minimum wage.

On 5 May, Shirley was invited to be a commentator on Radio NZ’s afternoon Panel, hosted by Jim Mora;

“Ken Shirley of the Road Transport Forum discusses what’s behind logging truck crashes and what needs to be done.”

At one point in the discussion, a suggestion was made that low wages in the trucking industry is not attracting the most highly-skilled and experienced workers;

@ 7.50

Jim Mora: “How bad do you think, Ken, is this situation with truck driving?”

Ken Shirley: “Oh, the spate we’ve had in Northland is just unacceptable. There’s no excuse for roll-over[s]. We know we have some difficult roads in New Zealand with topography, Northland’s is particularly difficult.

But there’s an obligation on the drivers and the forestry companies who hire the drivers to make sure they drive to the conditions. That’s the obligation on all drivers, and the spate we’ve had is just unacceptable, and I think inevitably it seems it’s not mechanical failure, it is driver error.

Whether it’s speed, inattention, or fatigue.”

Jim Mora: “So, it’s a…what, is it a hiring of drivers problem, hiring the wrong drivers, or is it a keeping-costs down problem, Ken? What do you think?”

Ken Shirley: “Well, the two are related of course. We have a chronic shortage of H5 drivers in New Zealand. That’s the heavy combination driver, the truck and trailer. It’s a global problem, but it’s particularly severe in New Zealand at this time. We’ve had it for many years, but with the activity in the economy now, that we are currently having, there is a chronic shortage of drivers.

Many of our members throughout the country are just saying they simply cannot get drivers. And I guess inevitably, you can, in that situation, such a tight situation, out of desperation, you can perhaps hire someone who’s not as skilled as you would like or need, out of sheer necessity. But at the end of the day, there’s no excuse. This should not be happening. We’re taking it very seriously.

We’ve actually instigated a series of roll-over prevention seminars in conjunction with NZTA around the country. They started some six weeks back. And these are actually very good seminars. But we have to educate the drivers, the loaders, the dispatchers, the transport operators themselves, but we must not have this level of roll-over.”

Jim Mora: “Ken, is it the… what is it deep down? Is it the meager wages paid, as some people are saying? You’re just not attracting the skills to the industry?”

Ken Shirley: “Ah, no, you do, it’s, you know, you can have a driver error. But it’s, it’s… you have to have better training, better awareness, that has to be the answer.”

Jim Mora: “So, there was this work-force development strategy, wasn’t there, ah, put into place a wee while back to try and try to entice more people to become truck drivers because of that shortage. But what is the point of a work-force development strategy if we know what the problem basically is, which I’m interpreting as maybe a lack of training and a lack of procedures put in place in the industry – [garbled].”

After a further exchange between Jim More, Peter Elliot (one of the panelists), and Ken Shirley, the host returned the discussion to the matter of wage rates;

Jim Mora: “It does seem though, with the wage rates that we see talked about, that you might not be getting the optimum recruits for the job? Is that a fair criticism, or not?”

Ken Shirley: “Well we know that the skilled labour market across the economy, whether it’s a diesel mechanic, a skilled driver, all of of those industries are, are, reporting severe chronic shortages. And because they are so highly skilled, reliant on a high level of, of, of, experience, when there is a chronic shortage, there is a temptation to often, out of desperation [to] take what you can get. And, and, that’s, that’s when you start to get into issues that like we are seeing and that’s when you start introducing potential road safety problems.”

Jim Mora: “I understand, but would you solve your chronic shortage if you paid higher wage rates?”

Ken Shirley: “Well, indeed, and all the members I speak to want to, but there’s been a race to the bottom, it’s –

[panelist scoffing (?) noise]

… such a fiercely competive industry…”

Shirley’s admissions are astounding.

His comments appear to be a frank admission that the free market has experienced a spectacular failure on a key point in the Northland logging industry; that if there is a shortage of skilled labour, the price of that labour (heavy-truck drivers in this case) should rise – not fall – to attract skilled labour. That is a basic tenet of supply and demand in the free market system.

As the guru of free market economics, Milton Friedman put it;

“But when workers get higher wages and better working conditions through the free market, when they get raises by firm[s] competing with one another for the best workers, by workers competing with one another for the best jobs, those higher wages are at nobody’s expense. “

And Investopedia described a free labour market thusly;

Assuming there are a large number of employers in a region, or that workers are highly mobile geographically, the wages that a company will pay workers is dependent on the competitive market wage for a given skill set. This means that any company is a wage taker, which is simply another way of saying companies must pay competitive wages in order to obtain workers.

None of which seems to be happening in Northland at present.

To the contrary, logging companies – according to their own spokesperson, Ken Shirley – are engaged in a “a race to the bottom” with drivers’ wages.

To compound the problem, in April of this year, Shirley specifically opposed and condemned outright any attempt to increase the wages of drivers;

“The link between remuneration and road safety is highly questionable and as a recent PWC report highlights, the system will result in a net cost to the Australian economy of more than A$2 billion over 15 years.

It is therefore very concerning that the Labour Party here advocated for the same policy and campaigned on it during the last election.”

National awards and government-imposed orders are not the way to lift industry wage rates or make the industry safer. All they do is saddle the industry with inflexible and time-consuming obligations and additional costs.

Let’s not repeat Australia’s mistake in New Zealand. It has been proven that national awards burden the economy and cost jobs and I hope that Labour and other political parties here will accept that reality and ditch the concept once and for all.”

Shirley’s comments last month are in stark contrast to his public lamentations on Radio NZ.

Not only has the free market failed in one of it’s key tenets – but Shirley is actively opposed to raising wages by any means necessary, to attract skilled, experienced truck drivers.

This should serve as a clear lesson that the innate contradictions of the free market ideology – many of which are little more than articles of faith – will eventually become more and more apparent.

Shirley has inadvertently helped with the slow dismantling of the neo-liberal fantasy.

Appendix1

Unfortunately, knowing how the system operates in this country, it will takes catastrophic events with several tragic deaths, before the government acts on this growing problem.

That’s how we roll in New Zealand.

Over bodies.

.

.

.

.

References

Wikipedia: Ken Shirley

ACT NZ: Welfare and family

ACT NZ: Minimum wage hike whacks regional employers

Parliament: Current MPs – David Seymour

Parliament: Salaries payable under section 8 of Members of Parliament

Radio NZ: The Panel with Peter Elliott and Susan Guthrie

Good Reads: Milton Friedman

Investopedia: Breaking down ‘Demand For Labor’

Scoop media: Government imposed remuneration orders have no place in NZ

NZ Herald: Tourist dies in logging truck crash near Matamata

Additional

Road Safety Remuneration Tribunal: About road safety remuneration orders

.

.

.

.

This blogpost was first published on The Daily Blog on 10 May 2016.

.

.

= fs =

Report: Increasing the minimum wage v.s. job losses

.

.

Introduction

Labour recently announced a policy which evidence strongly indicates will impact positively on every low-wage earner in this country; families; as well as benefit small-medium businesses;

.

.

The knee-jerk reaction from Dear Leader Key and his little wannabe side-kick, Simon Bridges, was as predictable as the sun rising;

Key hit back at the announcement.

[…]

New Zealand already had the highest minimum wage relative to the average wage in the developed world, he said.

Pushing it up too too fast would cost jobs.

“It’s pretty well documented around the world that, yes, you can make changes and do that over time but if you think about the mass of employers in New Zealand they’re not the big companies like Fletcher Building or Fonterra they’re actually the hundreds of thousands of small businesses around New Zealand and they simply will employ less staff, fire people or ultimately not take on staff in the future.”

Labour Minister Simon Bridges, reiterated Key’s claims, saying the policy would hurt businesses.

“Labour’s policy to immediately increase the minimum wage to $16.25 would cost at least 6000 jobs … If you want to make people unemployed this is a good way to go about it,” he said.

So how true is it that raising the minimum wage “would cost 6,000 jobs”?

As far back as November 2011 (the previous election campaign) Key repeated the mantra that 6,000 jobs would be lost if Labour increased the minimum wage to $15 an hour.

.

.

However, those bright young things at Treasury seemed to hold a radically different view;

“The Department of Labour says the rise will cost 6000 jobs. But Treasury has a counter view; “This has not been true in the past. The balance of probabilities is that a higher minimum wage does not cost jobs.”

Indeed, according to a report on the Australian Business Insider, the notion that increasing minimum wages led to unemployment was “exploded as a myth”, after it was revealed that;

“… a November 2011 study from Barry Hirsch and Bruce Kaufman of Georgia State University and Tetyana Zelenska sheds light on how businesses respond to increases in labour costs, and the results were surprising.

The group surveyed managers of fast food restaurants in Georgia and Alabama as they contended with three annual increases in the federal minimum wage between July 2007 and July 2009.

They asked the managers if they were taking any steps to offset increases labour costs.

[…]

…only 8 per cent of managers surveyed thought that firing current employees was at all important to make up for lost wages.

Indeed, raising the minimum wage allowed management to extract more performance from current employees in more than half of all cases.

Higher labour costs weren’t only offset from cuts to total labour cost, either. Management also took several steps to increase efficiency and productivity to compensate for the higher costs… “

The Georgia State University study also asserted (page 31);

Further, our study does not find evidence of clear-cut employment losses – even

over three years and a 41% increase in the MW. Possibly over a still longer time span, or with a larger

sample of restaurants, a negative effect might appear. Discussion with owners and evidence outside our

study period suggest that negative effects may manifest through reduced store openings and increased risk

of store closings. Given this important qualification, the message from our study, along with other results

in the literature, is that employment effects in the short-to-medium run are small, perhaps near zero in

many settings, and certainly smaller than expected based solely on the competitive model. It would be

surprising (at least to us) were an important reason for this result not the behavioral dimensions of wage

setting and human resource management (e.g., discretionary effort, equity concerns, management heterogeneity)

that the standard competitive and monopsony models largely ignore.

The data

Here in New Zealand, the minimum wage has risen fifteen times since March 2000;

Previous minimum wage rates

In force from: ADULT YOUTH TRAINING 1 March 1997 $7.00 $4.20 6 March 2000 $7.55 $4.55 5 March 2001 $7.70 $5.40 18 March 2002 $8.00 $6.40 24 March 2003 $8.50 $6.80 $6.80 1 April 2004 $9.00 $7.20 $7.20 21 March 2005 $9.50 $7.60 $7.60 27 March 2006 $10.25 $8.20 $8.20 1 April 2007 $11.25 $9.00 $9.00

In force from: ADULT NEW ENTRANT TRAINING 1 April 2008 $12.00 $9.60 $9.60 1 April 2009 $12.50 $10.00 $10.00 1 April 2010 $12.75 $10.20 $10.20 1 April 2011 $13.00 $10.40 $10.40 1 April 2012 $13.50 $10.80 $10.80 1 April 2013 $13.75 $11.00 $11.00

In force from: ADULT STARTING OUT TRAINING 1 May 2013[4] $11.00 1 April 2014 $14.25 $11.40 $11.40 Notes:

-

From 2001 to 2008 the adult minimum wage applied to employees aged 18 years and over. Prior to that, the adult minimum wage only applied to those aged 20 years and over. From 1 April 2008, the adult minimum wage applies to employees aged 16 years and over, who are not new entrants or trainees.

-

The youth minimum wage applied to employees aged 16 and 17 years. From 1 April 2008, the youth minimum wage was replaced with a minimum wage for new entrants, which applies to some employees aged 16 or 17 years.

-

The training minimum wage was introduced in June 2003.

-

From 1 May 2013 the minimum starting-out wage replaced the minimum wage for new entrants and the training minimum wage for trainees under 20 years of age.

[Above chart and information-notes courtesy of MoBIE/Dept of Labour]

So how do those increases compare to our employment/unemployment rates? Let’s superimpose the dates for each increase in the adult minimum wage with numbers of employed persons. (Red vertical bars indicate increase in minimum wage. All data courtesy of Dept of Labour/MoBIE.)

6 March 2000 – Increased from $7.00 to $7.55 p/h

(Labour)

.

.

5 March 2001 – Increased from $7.55 to to $7.70 p/h

(Labour)

.

.

18 March 2002 – Increased from $7.70 to $ 8.00 p/h

(Labour)

.

.

24 March 2003 – Increased from $ 8.00 to $8.50 p/h

(Labour)

.

.

1 April 2004 – Increased from $8.50 to $9.00 p/h

(Labour)

.

.

21 March 2005 – Increased from $9.00 to $9.50 p/h

(Labour)

.

.

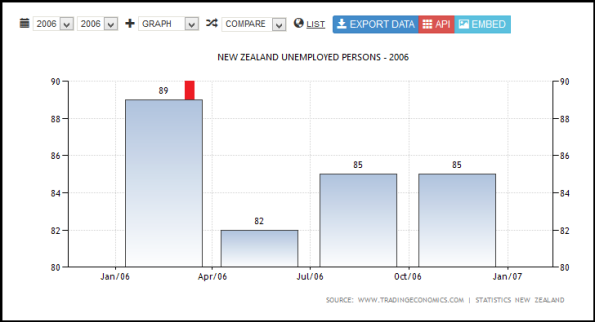

27 March 2006 – Increased from $9.50 to 10.25 p/h

(Labour)

.

.

1 April 2007 – Increased from 10.25 to $11.25 p/h

(Labour)

.

.

1 April 2008 – Increased from $11.25 to $12.00 p/h

(Labour)

.

.

1 April 2009 – Increased from $12.00 to $12.50 p/h

(National)

.

.

1 April 2010 – Increased from $12.50 to $12.75 p/h

(National)

.

.

1 April 2011 – Increased from $12.75 to $13.00 p/h

(National)

.

.

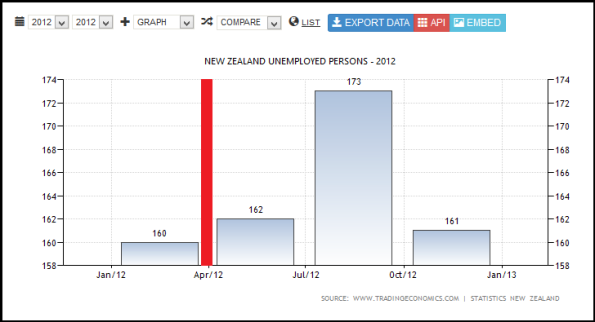

1 April 2012 – Increased from $13.00 to $13.50 p/h

(National)

.

.

1 April 2013 – Increased from $13.50 to $13.75 p/h

(National)

.

.

The above graphs reveal the following;

- In eleven out of fourteen years, numbers of employed rose after a minimum wage increase.

- Nearly all the years which show a fall in employment numbers are post-Global Financial Crisis; 2009, 2010, and 2012.

- The fall in employment numbers in 2009, 2010, and 2012, occurred post-minimum wage increases which were smaller amounts than pre-2008 minimum wage increases. Ie; 50 cents, 25 cents, and 50 cent incremental increases for respective years 2009, 2010, and 2012.

- One of those three years – 2010 – showed a drop in employment for only one Quarter before rising again.

- By contrast, increases between 2000 and 2008 range from 15 cents an hour (2001) to $1 an hour (2007) – and show continuing, sustained, employment growth.

- Employment fell in 2006, due in part to a “… slowing in growth over 2005 was largely driven by the external sector. A relatively high exchange rate and some relatively poor agricultural production seasons resulted in weak export growth, while a strong domestic economy contributed to considerable growth in import volumes. Recently, however, growth in the domestic economy appears to have eased with weakness in the household sector as growth in private consumpti on and residential investment slow. This has led to a significant slowing in import volume growth and has seen some rebalancing towards net exports following strong increases in agricultural production“.

So would increasing the minimum wage benefit every low-wage earner in this country; families; as well as benefit small-medium enterprises (SMEs)?

Why do critics – usually adherents of neo-liberal dogma and National Party ministers, supporters, and fellow-travellers – vociferously deny the advantages of raising the minimum wage?

Neo-liberals who maintain that increasing the minimum wage creates job losses see only one half of the Grand Picture. They see money flowing from employers to employees – and that’s as far as they see what is happening.

What they are missing is the second half of the Grand Picture; those employees do not bury their extra pay in the back yard, forever consigning it to the earth as compost.

Instead, employees spend their pay increases.

There are currently 54,600 workers currently on minimum wage in this country.

Increasing the minimum wage from $14.25 per hour to $16.25 per hour means an extra $80 per week for a worker (gross). That means 54,600 workers’ spending power increasing by a staggering $4,368,000 per week (gross).

That’s a whole lot of extra groceries, clothing, shoes, appliances, medication, and other essentials and consumer goods being purchased in our economy.

All of a sudden, small-to-medium businesses will have 54,600 potential customers spending an extra $227,136,000 annually(gross). Plus additional tax-revenue gained by the State. Plus less paid on welfare, as more people are employed.

Right-wingers will make the oft-parroted, plaintive cry, “But where will the money come from?”

The answer; from the productivity created by those 54,600 workers. They just get to keep more of that productivity, instead of into the bank accounts of invisible share-holders or disappear off-shore to corporate owners.

And as those 54,600 workers spend more, SMEs will sell more; which will mean higher turn-over; more profits; more investment; more jobs…

The logic is clear-cut; increasing the minimum wage increases spending power; generates more economic activity; and achieves the same goal which Key & Co used to justify their 2009 and 2010 tax-cuts;

“…The tax cuts we have delivered today will inject an extra $1 billion into the economy over the coming year, thereby helping to stimulate the economy during this recession. More important, over the longer term these tax cuts will reward hard work and help to encourage people to invest in their own skills, in order to earn and keep more money.”

If tax cuts for the rich can help “stimulate the economy“, then so can a livable wage increase for 54,600 low income earners.

It cuts both ways.

Even as Key has stated on numerous occassions,

“We think Kiwis deserve higher wages and lower taxes during their working lives, as well as a good retirement.” – John Key, 27 May 2007

“We will be unrelenting in our quest to lift our economic growth rate and raise wage rates.” – John Key, 29 January 2008

“I don’t want our talented young people leaving permanently for Australia, the US, Europe, or Asia, because they feel they have to go overseas to better themselves.” – John Key, 15 July 2009

“Science and innovation are important. They’re one of the keys to growing our economy, raising wages, and providing the world-class public services that Kiwi families need.” – John Key, 12 March 2010

“We will also continue our work to increase the incomes New Zealanders earn. That is a fundamental objective of our plan to build a stronger economy.” – John Key, 8 February 2011

“We want to increase the level of earnings and the level of incomes of the average New Zealander and we think we have a quality product with which we can do that.” – John Key, 19 April 2012

Summation

Evidentially speaking, the data above shows;

- More often than not, employment numbers rise after an increase in the minimum wage.

- Unemployment is affected by factors other than minimum wage increases (eg; Global Financial Crisis, drought, etc).

- Labour increased the minimum wage $5 per hour (2000 to 2008), and unemployment dropped to 3.4% by December 2007.

- National increased the minimum wage $2.25 per hour (2009 to 2014) and unemployment currently stands at 6% (new unemployment stats due for release on 6 August).

Key’s assertion that lifting the minimum wage would lead to “6,000 jobs lost” is therefore patently false, and electioneering with peoples’ lives.

.

References

Fairfax media: Labour pledges $2 rise in minimum wage to $16.25

TV3: Raising minimum wage won’t cost jobs – Treasury

Australian Business Insider: A 2011 Study Exploded One Of The Biggest Fears About Raising The Minimum Wage

Georgia State University: Minimum Wage Channels of Adjustment

MoBIE/Dept of Labour: Previous minimum wage rates

NZ Treasury: New Zealand Economic and Financial Overview 2007

MoBIE/Dept of Labour: Employment & unemployment – December 2007

Statistics NZ: Household Labour Force Survey: March 2014 quarter

MoBIE: Minimum Wage Review Report 2013

NZ Parliament: Tax Cuts—Implementation

Trading Economics: New Zealand Employed Persons

Trading Economics: New Zealand Unemployed Persons

Previous related blogposts

John Key’s track record on raising wages – 5. The Minimum Wage

Dollars and common sense – raising the minimum wage

Treasury’s verdict on raising the Minimum Wage?

Treasury’s verdict on raising the Minimum Wage? – Part II

.

Above image acknowledgment: Francis Owen/Lurch Left Memes

This blogpost was first published on The Daily Blog on 3 August 2014

.

.

= fs =

Radio NZ: Nine To Noon – Election year interviews – David Cunliffe

.

– Radio NZ, Nine To Noon –

.

– Wednesday 25 February 2014 –

.

– Kathryn Ryan –

.

On Nine To Noon, Kathyrn Ryan interviewed Labour’s leader, David Cunliffe, and asked him about coalition negotiations, policies, polls, and other issues…

.

.

Click to Listen: Election year interviews (27′ 50″ )

A major policy statement by David Cunliffe;

@ 22.00: “We will create incentives for private employers to be certified living wage employers, who pay the living wage to all their employees, by giving them a preference in Crown contracts.”

This will not only support firms that pay their staff properly – but will de facto give preference to local businesses to supply goods and services!

If this doesn’t motivate Small-Medium Enterprises to switch their allegiances from the Nats to Labour, I don’t know what will!

.

.

= fs =

Radio NZ: Politics with Matthew Hooton and Mike Williams – 10 February 2014

.

– Politics on Nine To Noon –

.

– Monday 10 February 2014 –

.

– Kathryn Ryan, with Matthew Hooton & Mike Williams –

.

Today on Politics on Nine To Noon,

.

.

Click to Listen: Politics with Matthew Hooton and Mike Williams (22′ 58″ )

- John Key’s meeting with Tony Abbott

- CER, Aussie supermarkets boycotting NZ-made goods

- migration to Australia

- low wages, minimum wage

- National Party, Keith Holyoake

- paid parental leave, Working for Families, Colin Espiner

- Waitangi Day, Foreshore & Seabed, deep sea oil drilling, Nga Puhi

- MMP, “coat tailing”, Epsom, Conservative Party, ACT

- Len Brown, Auckland rail link

.

= fs =

That was Then, This is Now #22 – Lowest wages vs Highest wages

.

.

This blogpost was first published on The Daily Blog on 24 January 2014.

*

.

Previous related blogpost

That was Then, This is Now #21 – Increasing Govt Charges for Services: Labour vs National

References

Fairfax Media: PM – No money for aged care workers

NZ Herald: PPTA ‘cautiously optimistic’ over school leadership changes

.

.

= fs =

Why the Remuneration Authority just doesn’t get it

.

.

When you read media stories like this, you know that Alice has company in Wonderland,

.

.

(Or is it La La Land?!)

When Remuneration Authority, chief executive John Errington says,

“Since fiscal year 2009 general salaries and wages have increased by 5.6 per cent and the Consumers Price Index has increased by 8 per cent. Parliamentary salaries . . . have increased by only 2.9 per cent. This still leaves members of Parliament receiving lower remuneration increases than the general population.“

See: IBID

For the record, the increases mean the following,

$419,300 Prime Minister ($7790 increase)

$297,400 Deputy PM ($5600)

$262,700 Crown ministers, the Speaker, Leader of the Opposition ($4900)

$158,700 Party leader base salary ($3000)

$144,600 Backbench MPs ($2800)

$52,676 average NZ wage

See: Christmas rise gives PM $3900 backpay, $150 more a week

On top of which, the increases,

- are back-dated to 1 July 2012

- exclude a $2,000 increase in 2011, and a $5,000 increase in 2011, to “compensate MPs for the loss of their international travel perk and a significant drop in their domestic travel bill”

- exclude a $24,000 a year subsidy toward their rent/accommodation in Wellington

- exclude $16,100 a year for expenses such as new luggage, flowers, gifts, memberships, and meals.

Nice work if you can get it.

Meanwhile, back in the Real World,

.

.

When the Prime Minister, our very own Dear Leader, John Key was presented with the situation of rest home workers being paid an apalling figure of around $14.61 an hour, his response was,

“Travel is one of those areas where we are looking at what we can do,” he told TVNZ’s Breakfast programme.

However, the Government could not afford to give DHBs the $140 million required to enable rest homes to pay their staff more.

“It’s one of those things we’d love to do if we had the cash. As the country moves back to surplus it’s one of the areas we can look at but I think most people would accept this isn’t the time we have lots of extra cash.

“You could certainly change the proportion of where you spend money in health. We spend about $14.5 billion in the overall health sector.

“What’s going to go to pay the increase in this area? If you said all of the increase is going to go into this area, that would be roughly $600m over the forecast period which is four years… So that would have left us $1bn for other things.

“We put the money into cancer care and nursing and various other things. On balance, we think we got that about right.”

See: PM: No money for aged care workers

Interesting that there is plenty of tax-money for subsidising businesses; rugby world cup tournaments; politician’s salaries and perks – but when it comes to the lowest paid, hardest working, people in our society – Key’s response is; ” It’s one of those things we’d love to do if we had the cash “.

Yup. It’s La La Land.

Here’s a thought; why not link the minimum wage to that of Members of Parliament?

So when politicians get a pay increase – so do those at the bottom of the economic ladder.

In fact, let’s make it a point that any increase also applies to those earning minimum wages receiving similar perks to politicians; eg; travel and food subsidies, in the form of weekly vouchers for petrol, food, and electricity.

The lowest paid people in our society might actually start looking forward to salary and perks increases for our MPs and Ministers. And MPs would have a whole new fanclub.

What are the chances?

.

*

.

Previous related blogposts

John Key’s track record on raising wages – 4. Rest Home Workers

Aged Care: The Price of Compassion

References

Fairfax media: Resthome spy hails saint-like workers

Fairfax media: PM: No money for aged care workers

Fairfax media: MPs pay rise less than other workers – authority

NZ Herald: Christmas rise gives PM $3900 backpay, $150 more a week

.

.

= fs =

Aged Care: The Price of Compassion

.

.

Rest home care workers are amongst the lowest paid in the country. At around $14-$15 an hour, they are paid a pittance for the important work they do; caring for aged New Zealanders in the twilight of their lives. They tend to our parents and grandparents, keeping them safe, clean, and offering human companionship at a time when many elderly have less and less contact with the community.

On 1 March of this year, rest home workers went on strike, campaigning to raise their wages from the pathetic $14.61 an hour they were being being. The following pics were of striking rest home workers in Upper Hutt,

.

.

.

.

.

See previous blogpost: 1 March – No Rest for Striking Workers!

A month and a half later, Ryman Healthcare – one of the largest providers for aged care in New Zealand – announced a record $84 million profit, for the year ending 31 March 2012. This was an increase of 17% on the previous financial year.

For ten years in a row, Ryman had posted record profits. Quite clearly this industry is not short of a ‘bob or three’.

Chairman Dr David Kerr said “the company faced some major challenges in Christchurch over the past 18 months given the earthquakes, and had responded with a performance which had exceeded its own targets “.

So obviously productivity was not a problem for Ryman. A 17% increase in products – in an otherwise stagnant economy and continuing global financial downturn – shows that the aged care industry is doing very nicely.

On 28 May, Human Rights Commissioner, Dr Judy McGregor, did something that few office-bound state sector workers do; she went undercover to discover for herself what kind of working conditions rest care workers put up with for $14.61 an hour,

.

.

As Dr McGregor stated,

“The complexity of the job was actually a surprise for me. It’s quite physical work, and it’s emotionally draining because you are obliged to give of yourself to other people. Saint-like women do it every day so that older New Zealanders can have a quality of life.

I’m not sure if I could have. I’m not sure I had the physical stamina and I didn’t want to hurt someone.

On any given shift you would be in charge of six, seven older people, and you would have to wake them, get them up, get them showered, get them toileted, feed them, and the whole time you were conscious that you had another five to go on your shift. It’s like working constantly to deadline.

The reliance of New Zealand, of all of us, on the emotional umbilical cord between women working as carers and the older people they care for at $13-14 an hour is a form of modern-day slavery,” she said in the report.

It exploits the goodwill of women, it is a knowing exploitation. We can claim neither ignorance nor amnesia.”

See: Ibid

National’s Associate Health Minister Jo Goodhew replied,

“It is important that we take this seriously, that we look at it carefully and we look at what we are doing and what we can do before we provide a considered response.”

However, Dear Leader Key would have none of that, and firmly squashed any suggestion of paying rest home care workers decent wages. Only a few hours after Jo Goodhew announced that this was a problem demanding that “ we look at it carefully “, her boss stated bluntly,

.

.

So there we have it. According to Dear Leader,

“It’s one of those things we’d love to do if we had the cash. As the country moves back to surplus it’s one of the areas we can look at but I think most people would accept this isn’t the time we have lots of extra cash.”

Falling in line, Goodhew, conceded that whilst aged care workers were paid at “lower end“, she rejected suggestions that they were being exploited,

“I personally don’t believe we should be describing it as modern-day slavery.”

See: Ibid

Gosh, that’s ‘big’ of her. It’s not “ modern-day slavery “.

I wonder what she’d call it?

Especially when it was announced todat that Lo! And Behold! Ryman had posted yet another profit!?!? This time a record half-yearly profit (from 1 April),

“The company added another notch to its 10-year sharemarket performance of climbing profits by posting a record half-year profit after tax of $69 million. Its share price rose 6 cents to close at $4.14.

Shareholders will receive an 18 per cent higher dividend for the half-year of 4.6 cents a share. All up, about $23 million in dividends is going to shareholders in the first half. “

See: Ryman plans cautious Aussie debut

“Since listing in June 1999, Ryman Healthcare has delivered its shareholders a total return, which includes share price appreciate and dividends, of 1,043%, or 24.3%pa. By cracking the 1000% mark (i.e. returning 10 times the original investment) brokers will, with a good deal of admiration, refer to Ryman as a’10-bagger’.” – Craigs Investment Partners

Wouldn’t it be nice if the $23 million being paid to shareholders was instead paid to the care workers who actually did the hard work?

Who is it that looks after granny and/or grandad – the “Saint-like women do it every day so that older New Zealanders can have a quality of life“?

Or some shareholders sitting on their arses and sipping chardonnay?

Here’s a thought for Middle Zealand, politicians, and Ryman shareholders; the course of Nature will not be deviated. Every one of us is growing older.

(You can see where I’m heading with this.)

There will come a time when Middle Zealand, politicians, and Ryman shareholders, and the rest of us will eventually require the services of aged care facilities.

Do we really want to be cared for by underpaid workers who may eventually give up any semblance of dedication to their job, and lose any measure of empathy for aged folk in their charge? That rest home workers may finally one days have a gutsful of being exploited?

If we want to be treated well in our twilight years – shouldn’t we first be looking after those workers who will be caring for us?

John Key sez that paying rest home care workers is “one of those things we’d love to do if we had the cash“.

Rubbish. The money is there.

It’s just going to the wrong people.

C’mon New Zealand – sort it out!

.

*

.

Previous related blogposts

1 March – No Rest for Striking Workers! (1 March 2012)

No Rest for the Wicked (23 March 2012)

“It’s one of those things we’d love to do if we had the cash” (28 May 2012)

Roads, grandma, and John Key (18 July 2012)

John Key’s track record on raising wages – 4. Rest Home Workers (11 November 2012)

Sources

Record profit for Ryman (17 May 2012)

PM: No money for aged care workers (28 May 2012)

Resthome spy hails saint-like workers (28 May 2012)

Ryman plans cautious Aussie debut (16 Nov 2012)

.

.

= fs =

John Key’s track record on raising wages – 6. Youth Rates

.

Continued from: John Key’s track record on raising wages – 5. The Minimum Wage

.

.

6. Youth Rates

.

When Labour was elected into government in 1999, replacing the highly unpopular Shipley-led National administration, one of their first actions was to radically reform the Youth Rate,

- From 2001 to 2008 the adult minimum wage applied to employees aged 18 years and over. Prior to that, the adult minimum wage only applied to those aged 20 years and over.

- From 1 April 2008, the adult minimum wage applies to employees aged 16 years and over, who are not new entrants or trainees.

- The youth minimum wage applied to employees aged 16 and 17 years. From 1 April 2008, the youth minimum wage was replaced with a minimum wage for new entrants, which applies to some employees aged 16 or 17 years.

- The training minimum wage was introduced in June 2003.

See: Dept of Labour – Previous minimum wage rates

.

.

It did not appear to unduly impact on unemployment, which consistantly tracked downward in the 2000s, until the down-turn caused by the Global Financial Crisis began to impact on our economy, in 2007/08.

On 9 October, Labour Minister Kate Wilkinson announced that National intended to introduce a new Youth Rate, to take effect in April, next year. The rate would be set at $10.80 an hour – compared to the minimum rate of $13.50 an hour currently, and would include 16 to 19 year olds.

As Scoop.co.nz reported,

“That equates to $10.80 an hour, or $432 before tax for a 40-hour week. From April next year, the ‘Starting Out Wage’ will apply to 16- and 17-year-olds in the first six months of a job, to 18- and 19-year-olds entering the workforce after spending more than six months on a benefit, or 16 to 19-year-olds in a recognised industry training course.”

See: NZ teens face $10.80 an hour youth wage rate

It is doubtful if National’s Youth Rate will actually create new jobs. More likely, a drop in youth wages will simply create more ‘churn’ in employment/unemployment numbers.

As David Lowe, Employment Services Manager for the Employers and Manufacturers Association, inadvertently revealed,

“Without an incentive an employer with a choice between an experienced worker and an inexperienced worker will choose experience every time.”

See: Starting-out wage will help young people onto job ladder

So there’s no new job for the younger worker – s/he is merely displacing an older worker. Which probably results in older workers joining the migration to Australia.

End result; a loss of skill and experience for New Zealand, and a gain for our Aussie cuzzies.

Nice one, Mr Key. Remind us when you took on the role of staff recruiter for Australia?

On top of this, we have this bizarre rationale from Kim Campbell, CEO of the Employers and Manufacturers Association, who is arguing that young people should be paid less because they have less to pay for. I kid you not.

She said,

“Remember these people are not raising a family or running a household on this money –nobody expects them to – but it does give them some money to get started on.”

Campbell’s remark are offensive on several levels.

Firstly, National’s intention to return to Youth Rates for 18 and 19 year olds, as well as 16 and 17 year olds, is simply unreasonable. These people are young adults, and those studying at polytech and University Students will soon be earning less, even while having to pay Student fees; course-costs; and living expenses like rent, food, power, and other financial committments.

Secondly, 18 and 19 year old are as able to have families as their older counterparts.

Thirdly, by what logic is it of Ms Campbell’s business that “these people are not raising a family or running a household on this money“?! It’s none of her damned business what 18 and 19 year olds spend their wages on.

Conversely, does that mean Ms Campbell will encourage companies to pay a higher, living wage,to those workers who do happen to have families?!

Yeah, right.

If National has a secret agenda to motivate more young people to head overseas, such a plan will succeed beyond their wildest dreams.

18 and 19 years olds – old enough to get married; old enough to get drunk; old enough to get killed in a warzone – but not old enough to be paid the same adult rate as a 20 year old?

National should take note; it’s true that 16 and 17 year olds can’t vote.

But 18 and 19 year olds can – and do. I bet they just can’t wait to vote at the next election.

And precisely how does this raise wages, as per Dear Leader’s promises?

Next chapter: 7. Part 6A – stripped away

.

*

.

Addendum

In June last year Prime Minister John Key said the prospect of a new youth rate was unlikely,

“I don’t think there’s a high probability. Whether we’d actually bother embarking on that it’s far too early to say.”

Source: Govt reintroduces youth wage

Ten months and one election later, preparations are under way to legislate.

Is ten months “to early to say“?

.

.

= fs =

John Key’s track record on raising wages – 5. The Minimum Wage

.

Continued from: John Key’s track record on raising wages – 4. Rest Home Workers

.

.

5. The Minimum Wage

.

From 2004 to 2008, the minimum wage rose from $9 to $12 – an increase of $3 in four years.

From 2009 to 2012, the minimum wage rose from $12 to $13.50 – an increase of $1.50 over three years.

See: Dept of Labour – Previous minimum wage rates

Last year, Labour, the Greens, NZ First, and Mana campaigned to raise the minimum wage to $15 ($16 for Mana).

When a worker at a fast-food outlet asked John Key to raise the minimum wage to $15 an hour, he rejected the proposal, saying,

“It will go up, but it won’t go up straight away.”

See: Raising minimum wage won’t cost jobs – Treasury

Yet it took only a couple of years to implement two massive taxcuts that gave hundreds, thousands, of dollars a week, to the top income earners.

Priorities, eh?

The real insult is that Key and English both admit that the minimum wage is difficult to live on.

Key said,

“Look, I think it would be very difficult for anyone to do that.”

See: Ibid

“ GUYON: Okay, can we move backwards in people’s working lives from retirement to work and to wages? Mr English, is $13 an hour enough to live on?

BILL ENGLISH: People can live on that for a short time, and that’s why it’s important that they have a sense of opportunity. It’s like being on a benefit.

GUYON: What do you mean for a short time?

BILL ENGLISH: Well, a long time on the minimum wage is pretty damn tough, although our families get Working for Families and guaranteed family income, so families are in a reasonable position. “

See: TVNZ’s Q+A: Transcript of Bill English, David Cunliffe interview

The Department of Labour claimed a rise in the minimum wage would cost 6,000 jobs.

But Treasury disagreed, saying,

“This has not been true in the past. The balance of probabilities is that a higher minimum wage does not cost jobs.”

Raising the minimum wage would certainly benefit SMEs (Small-Medium Enterprises), as low-income earners spend their entire wages on goods and services. Any rise in paying wages should be offset by increasing till-takings with customers spending more.

So it appears blatantly obvious that no good reason exists not to raise the minimum wage.

After all, in 2009 and 2010, National gave away far more in tax cuts for the rich.

And precisely how does this raise wages, as per Dear Leader’s promises?

Next chapter: 6. Youth Rates

.

.

= fs =

John Key’s track record on raising wages – 4. Rest Home Workers

.

Continued from: John Key’s track record on raising wages – 3. Ports of Auckland Dispute

.

.

4. Rest Home Workers

.

Amongst the lowest paid workers in this country, Rest Home caregivers earn around $13.61 an hour – just barely above the minimum wage of $13.50.

Human Rights Commissioner, Dr Judy McGregor, found out first-hand what the job entailed,

” Spending hours on her feet, lifting, hoisting, feeding, bathing, dressing and toileting her charges took its toll – and for just $14 an hour, the Human Rights Commission’s equal opportunities commissioner compares it to a form of modern-day slavery.

“The complexity of the job was actually a surprise for me. It’s quite physical work, and it’s emotionally draining because you are obliged to give of yourself to other people,” she said.

“Saint-like women do it every day so that older New Zealanders can have a quality of life”.”

.

.

When this was point out to John Key, the following exchange took place on morning TV,

” Key acknowledged there were problems with rural rest homes workers paying for their own travel, effectively reducing their wage below the minimum wage of $13.50 an hour.

“Travel is one of those areas where we are looking at what we can do,” he told TVNZ’s Breakfast programme.

However, the Government could not afford to give DHBs the $140 million required to enable rest homes to pay their staff more.

“It’s one of those things we’d love to do if we had the cash. As the country moves back to surplus it’s one of the areas we can look at but I think most people would accept this isn’t the time we have lots of extra cash”.”

.

.

But there seemed plenty of cash – taxpayer’s money – to give politicians some fairly generous salary increases,

.

.

And a “lack of money” certainly didn’t stop the country from spending over $200 million of public money on a sporting tournament,

” Budget blowouts have pushed public spending on the Rugby World Cup well above $200 million – without counting $555 million in stadium upgrades and $39 million in direct losses from hosting the tournament. “

See: Blowouts push public Rugby World Cup spending well over $200m

If Key was serious about raising wages, he should clearly have made the lowest paid his Number One Priority. The 2009 and 2010 tax cuts would have made an excellent opportunity to give the biggest tax cuts to the lowest paid workers.

Instead, those tax cuts went to the very top. On top of that, the rise in GST from 12.5% to 15% would have impacted the hardest on those on minimum wage.

Double whammy.

So precisely how does this raise wages, as per Dear Leader’s promises? (Or could it be that when Key promised to raise wages – he was referring to his own?)

Next chapter: 5. The Minimum Wage

.

.

= fs =

John Key’s track record on raising wages – 3. Ports of Auckland Dispute

.

Continued from: John Key’s track record on raising wages – 2. The 90 Day Employment Trial Period

.

.

3. Ports of Auckland Dispute

.

“The average income has been about $90,000, so it hasn’t been a badly-paid place. But the problem is flexibility when ships arrive and when staff get called out, how they can cope with that.” – John Key, 12 March 2012

See: Jackson pulls back from port comments

Putting aside from the myth of POAL maritime workers earning $90,000 – so what?

Even if it were true (which is doubtful) – POAL has never released the workings of how they arrived at that sum, despite requests), isn’t such a good wage precisely what Dear Leader was advocating in his quotes above?

POAL management sought to reduce costs; casualise their workforce; and compete with Ports of Tauranga for shipping business. Unfortunately, competing on costs would, by necessity, involve driving down wages.

There is also a high degree of price-fixing by shipping cartels, as was pointed out by the Productivity Commision in April,

.

.

Rather than supporting the workers, Dear Leader bought into a situation where international shipping companies were playing New Zealand ports off against each other, to gain the lowest possible port-charges. Even local company, Fonterra, was playing the game.

Here we have a situation where New Zealand workers were enjoying high wages – something John Key insists he supports – and yet he was effectively allowing international corporations to create circumstances where those wages could eventually be cut and driven down.

As with the “Hobbit Law”, our Dear Leader appears to pay more heed to the demands of international corporate interests than to fulfilling his pledges to raise wages.

Precisely how does this raise wages, as per Dear Leader’s promises?

Next chapter: 4. Rest Home Workers

.

.

= fs =

John Key’s track record on raising wages – 2. The 90 Day Employment Trial Period

.

Continued from: John Key’s track record on raising wages – 1. The “Hobbit Law”

.

.

2. The 90 Day Employment Trial Period

.

An amendment to the Employment Relations Act 2000, Section 67A, allows for employers to sack – without just cause or a chance for an employee to improve performance – within a 90 day period.

It gives unbalanced power to employers who can blackmail an employee or get rid of them at the slightest whim.

It also makes workers less willing to be mobile in the workplace. Why change jobs at the risk of being fired within 90 days of taking up a new position?

When the 90 Day Trial period was first introduced in April 2009, it applied only to companies employing 19 staff or less.

See: Will the 90 Day trial period make a difference?

By April 2011, this was extended to all companies regardless of staff numbers.

Has it helped generate more jobs as National claimed it would?

Evidence suggests it played very little part in creating employment, and indeed unemployment went up after both legislative changes,

.

So aside from empowering employers and disempowering workers, what exactly was the point of enacting this piece of legislation?

And precisely how does this raise wages, as per Dear Leader’s promises?

Next Chapter: 3. Ports of Auckland Dispute

.

.

= fs =

John Key’s track record on raising wages – 1. The “Hobbit Law”

.

Continued from: John Key’s track record on raising wages – preface

.

.

1. The “Hobbit Law”

.

On 20 October 2010, Peter Jackson released this statement to the media,

“Next week Warners are coming down to New Zealand to make arrangements to move the production offshore. It appears we cannot make films in our own country even when substantial financing is available.”

See: Warner preparing to take Hobbit offshore – Sir Peter

It was the opening shot of a public war-of-words between Jackson and his camp, and Actor’s Equity. An industrial dispute had been elevated to DefCon One, and things were about to ‘go nuclear‘.

Almost overnight, a mood of hysteria gripped the country; we were about to lose ‘Our Precious‘ movies to Eastern Europe, Mongolia, or Timbuktu.

Public panic reached levels unseen since the 1981 Springbok Tour, or the satanic child abuse-ritual stories of the early 199os. There were patriotic street marches (flaming torches were considered but rejected because of OSH concerns.) Union officials were harassed in public; vilified; and threatened with death. A well-known actress – popular up till this point – considered leaving for Australia after receiving death threats, because of her pro-Union stance.

See: And everybody take a deep breath – please

It was the nastier side of New Zealand’s collective psyche which we’ve come to be familiar with. We do ‘mob hysteria‘ very well.

John Key and National would have none of it, of course. Dear Leader acted with authoritarian style not seen outside ex-Soviet republics, African, and Middle East dictatorships.

As the Dominion Post reported,

“ The Hobbit dispute was resolved after Warner Bros executives jetted into New Zealand for a meeting with Government ministers at Mr Key’s official Wellington residence, Premier House.

After two days of tense days of talks with Warner Bros bosses, who were chauffeured around Wellington in Crown limousines, the Government agreed to a raft of measures including a $20 million tax break to keep the two Hobbit movies in New Zealand.

An agreement to change New Zealand’s employment laws clinched the deal after studio bosses and Jackson threatened to move production off-shore over a stoush with the actors union. Labour lawswere were [subsequently amended]. “

See: PM’s ‘special’ movie studio meeting

The labour law that the Dompost piece referred to was the Employment Relations (Film Production Work) Amendment Bill which made film industry workers independent contractors by default – thereby changing the definition in employment legislation of what constitutes an “employee”.

See: The Hobbit law – what does it mean for workers?

Even if the nature of your employment mirrors that of an employee with a boss who determines your hours of on-site work; supplies all your tools and work materials; dictates your workplace requirements, including meal breaks – your employer can still treat you legally as a “contractor”.

A worker under these conditions has all the obligations of an employee – but none of the rights. That same worker may be deemed a “self employed contractor” – but has none of the usual independence of a contractor.

A worker in this “limbo” has had all his/her security of employment; minimum wages; holidays; and right to collective bargaining stripped away.

In effect, for the first time in our democracy, a government has legislated away a workers right to choose. They no longer have any choice in the matter.

All done at the stroke of a pen. No consultation. It was all decided for you, whether you wanted it or not. Only a totalitarian, One Party, regime could match such dictatorial powers.

The “Hobbit Law” took precisely two days from First Reading to Royal Assent. An Olympic record in law-making.

See: Employment Relations (Film Production Work) Amendment Act 2010 – Legislative history

By 21 December 2010 – two months after Jackson had sent the entire nation into a spin with his first press release – an email dated 18 October, to Economic Development Minister Gerry Brownlee, revealed a startling new picture,

“There is no connection between the blacklist (and it’s eventual retraction) and the choice of production base for The Hobbit”.

“What Warners requires for The Hobbit is the certainty of a stable employment environment and the ability to conduct its business in such as way that it feels its $500 million investment is as secure as possible.”

See: Sir Peter: Actors no threat to Hobbit

Peter Jackson and John Key knew precisely how to pull this country’s strings and make workers and the public dance to their tune. They managed to con workers to demand losing their own rights as employees. Well played, Mr Jackson, Mr Key.

So precisely, how does this raise wages, as per Dear Leader’s promises?

Next chaper: 2. The 90 Day Employment Trial Period

See also previous blogposts:Muppets, Hobbits, and Scab ‘Unions’, Roosting chickens

Additional

Tech Dirt: The Hobbit Took $120M From Kiwi Taxpayers – Maybe They Should Own The Rights (5 Dec 2012)

Fairfax Media: To save regular earth, kill Hobbit subsidies (6 Dec 2012)

.

.

= fs =

John Key’s track record on raising wages – preface

.

.

Preface

.

By now, I think most readers of this blog (and other sources of political information) will recall certain statements made by Dear Leader over the last four years,

“We will be unrelenting in our quest to lift our economic growth rate and raise wage rates.” – John Key, 29 January 2008

See: National policy – SPEECH: 2008: A Fresh Start for New Zealand

“One of National’s key goals, should we lead the next Government, will be to stem the flow of New Zealanders choosing to live and work overseas. We want to make New Zealand an attractive place for our children and grandchildren to live – including those who are currently living in Australia, the UK, or elsewhere.

To stem that flow so we must ensure Kiwis can receive competitive after-tax wages in New Zealand.” – John Key, 6 September 2008

See: National policy – Speech: Environment Policy Launch

“I don’t want our talented young people leaving permanently for Australia, the US, Europe, or Asia, because they feel they have to go overseas to better themselves.” – John Key, 15 July 2009

See: Speech: Key – business breakfast

“Science and innovation are important. They’re one of the keys to growing our economy, raising wages, and providing the world-class public services that Kiwi families need.” – John Key, 12 March 2010

See: National policy – Boosting Science and Innovation

“We will also continue our work to increase the incomes New Zealanders earn. That is a fundamental objective of our plan to build a stronger economy.” – John Key, 8 February 2011

See: Statement to Parliament 2011

“The driving goal of my Government is to build a more competitive and internationally-focused economy with less debt, more jobs and higher incomes.” – John Key, 21 December 2011

See: Parliament – Speech from the Throne

“We want to increase the level of earnings and the level of incomes of the average New Zealander and we think we have a quality product with which we can do that.” – John Key, 19 April 2012

Key has repeated the same pledge every year since 2008. It has become a mantra, “raise wages, raise wages, raise…”.

But words are easy. What has been Key’s actual track record? How does Dear Leader’s words reconcile with his actions? What have been the results?

The following chapters give an insight into the rhetoric and reality of the National Party and it’s leader, John Key.

2. The 90 Day Employment Trial Period

8. An End to Collective Agreements

10. A New Government’s Response

.

.

= fs =

Another bare-faced lie from the ACT Party

.

.

From the ACT Party website,

“When Labour abolished the youth minimum wage in 2008, youth unemployment soared. A study by the former Department of Labour found that abolishing the youth wage resulted in a loss of up to 9000 jobs. Removing the youth minimum wage priced young people out of the market. “

See: Re-establishment of Youth Minimum Wage A Win For ACT

What nonsense. The rise in youth unemployment post-2008 was due to the 2008 Global Financial Crisis.

In February 2009, the DoL (former Department of Labour) website reported,

“Unemployment has risen across the OECD

9. Statistics New Zealand reports that New Zealand’s unemployment rate is the tenth

equal lowest of the 27 OECD nations with comparable data. The Netherlands and

Norway have the lowest unemployment rate at 2.7%, with South Korea,

Switzerland and Austria also below 4%. The OECD average unemployment rate

was 6.5%, up from 6.0% when the September 2008 quarter HLFS was released.10. New Zealand has so far not been affected as much by the global financial crisis as

some other countries. Furthermore, it is in a relatively better position due to a

strong starting point, fiscal stimulus and large decreases in interest rates. In the

United States, the unemployment rate has risen from 4.8% in February 2008 to

7.2% in December 2008, a 15-year high. Unemployment has increased in other

developed nations, particularly Ireland (to 8.2% in December 2008, from 4.7% a

year earlier) and Spain (to 14.4% in December 2008, from 8.7% a year earlier).[abridged]

15. Youth are often the most at risk during a recession and their unemployment rate is

expected to rise further over the next year. This can be attributed to them having

low levels of experience, but also because those aged 15-24 years old are two to

three times more likely to be unemployed in general. In the early 1990s recession,

the unemployment rate for 15-24 year olds rose from 13.3% in early 1990 to

19.5% in early 1992.”

Source: EMPLOYMENT AND UNEMPLOYMENT – DECEMBER 2008 QUARTER

The DoL website also stated that “Maori and Pacific workers are also expected to be affected by the downturn. These groups have a greater proportion of youth relative to Europeans and also tend to be disproportionally employed in low-skilled and semi-skilled occupations, which are often more affected in a recession“.

Does ACT have a policy advocating a lower wage rate for Maori and Pacific islanders, based on their ethnicity?

After all, if one can discrimiminate on age – why not race?

It is dishonest to lay fault with a previous government’s policy when facts point to a completely different cause and effect scenario.

ACT should learn to be a bit bit honest with the facts rather than re-writing history, Orwellian-style, to suit some confused ideology.

But then again, this is John Banks’ Party. ’nuff said.

.

.

= fs =

The betrayal of our young people

.

.

In 2007…

.

“Today, in the suburb where I grew up, I want to talk about what I consider to be an important part of The Kiwi Way. I want to talk about opportunity, and hope, and how we can bring these to some of the most struggling families and communities in New Zealand.

Part of The Kiwi Way is a belief in opportunity and in giving people a fair go.

As New Zealanders, we have grown up to believe in and cherish an egalitarian society. We like to think that our children’s futures will be determined by their abilities, their motivation and their hard work. They will not be dictated by the size of their parent’s bank balance or the suburb they were born in.

We want all kids to have a genuine opportunity to use their talents and to get rewarded for their efforts. That’s The Kiwi Way, and I believe in it. After all, I was one of the many kids who benefited from it…

… You might ask “where will the money come from?”

The fact is we are already spending millions of dollars for Wellington bureaucrats to write strategies and to dream up and run their own schemes. I want more of those dollars spent on programmes that work, regardless of who thinks them up and who runs them.”

.

Unemployment rate December 2007:

77,000 (3.4%)

.

In 2008…

.

“The National Party has an economic plan that will build the foundations for a better future.

- We will focus on lifting medium-term economic performance and managing taxpayers’ money effectively.

- We will be unrelenting in our quest to lift our economic growth rate and raise wage rates.

- We will cut taxes, not just in election year, but in a regular programme of ongoing tax cuts.

- We will invest in the infrastructure this country needs for productivity growth.

- We will be more careful with how we spend the cash in the public purse, monitoring not just the quantity but also the quality of government spending.