New Zealand First will use its influence on the next coalition Government to buy back our state-owned power companies which are being flogged off by National.

Rt Hon Winston Peters says New Zealand First is committed to buying back the shares at no greater price than paid by the first purchaser.

“State-owned assets rightfully belong to all New Zealanders but National is intent on handing them over to rich foreign investors.

“It is simply lining the pockets of the wealthy by selling off well-performing assets that already provide the Government with extremely healthy dividends.”

Mr Peters says it is only fair to alert potential investors that New Zealand First’s intention to buy back the shares will be part of any coalition negotiations.

“As things stand now, the assets will end up in foreign ownership which is an outright attack on our sovereignty. We are committed to repelling that attack.”

Archive

Winston Peters recycles pledge to “buy back state assets” – where have we heard that before?

.

.

Over the last two years (give or take), NZ First leader, Winston Peters, has stated on numerous occassions that buying back shares in the three energy SOEs (Meridian, Genesis, and Mighty River Power) will be a “bottom line” in any post-election coalition deal.

On 20 June 2012, NZ First posted this statement on their website,

The pledge was repeated on 29 November 2013;

“New Zealand First is the only political party that has said since the beginning that if the Government did go ahead with this idiotic decision, then when we are in a position to influence the next Government, we would buy back the shares at a price no more than that initially paid for them.”

On ‘The Nation‘, on 15/16 March, interviewed by Patrick Gower, Peters repeated NZ First policy that a share buy-back, at a cost no greater than the original purchase-price, was a bottom line policy for his Party;

Gower: So that means buying Genesis back?

Peters: That’s right. At no greater price than they paid for it.

Gower: And does that mean buying back the other power companies as well?

Peters: It means exactly that. That’s what our position has been for some time.

Gower: So that’s a priority for you in any negotiations?

Peters: It is a priority, and it also has the blessings in terms of economic calculations from Treasury.

Taken at face value, Peters’ committment to buy back shares in the powercos seems more comprehensive and radical than either the Greens or Labour. Neither have committed to buying back shares in Meridian, Genesis, and Mighty River Power until the government books allow it.

But, can Peters’ pledge be taken at face value?

Can he be trusted to make good on his word to (a) make a share buy-back a bottom-line in any coalition deal and (b) actually follow through?

His track record on such matters is not good.

On 27 September 1996, the then-Bolger-led National government sold the Forestry Corporation of New Zealand Ltd cutting rights to a private consortium (Fletcher Challenge Forests, 37.5%, Brierley Investments Ltd, 25%, and Chinese state-owned company, Citifor Inc, 37.5%)

This became a major election issue in the lead-up to the first MMP election in 1996, with the Alliance organising a CIR petition to halt the sale.

NZ First leader, Winston Peters, pledged to buy back the cutting rights, stating on several occasions that any government he was part of would “hand back the cheque“;

.

.

During the election campaign, Peters stated unequivocally his intentions that the privatisation of Forestry Corp would not stand under any government he was part of;

“I want to tell the Chinese buyers and I want to tell Brierleys that they had better not make any long-range plans because the day after the election is over we will be sending them an emissary to them them exactly what is going to happen, that is, that we are going to keep out promise, they can give back the asset and we will give the money back.” – Winston Peters, Otago Daily Times, 1 Feb 1997 (on pre-election statement/promise)

.

.

On 11 December 1996, Peters announced that he would be entering into a formal coalition arrangement with the National Party, to form the first MMP coalition government.

Subsequently, Peters’ pledge to “hand back the cheque” and buy back the forestry cutting rights, was ‘quietly’ dropped;

.

.

“… NZ First did not make any attempt to include in the [Coalition] agreement its policy of placing a 24.9% limit on foreign ownership of strategic assets.

Neither did they raise the NZ First promise to buy-back Forestry Corp, which was sold earlier this year to a consortium including Fletcher Challenge.” – Otago Daily Times, 16 Dec 1996

As Treasurer and Deputy Prime Minister in the National-NZ First government, Peters had ample opportunity to implement his Party’s buy-back policy. It was a promise he could have kept. And should have kept.

Instead, NZ First opted to implement National’s policy of tax cuts on 1 July 1998. With even more tax cuts promised by then-Finance Minister, Bill Birch.

This was money that Peters could have allocated and spent of re-nationalising our forests – but was instead wasted on cutting taxes, thereby reducing the ability of the coalition government to implement a buy-back, as Winston Peters had promised.

If Peters holds the balance of power after 20 September, and if he forms a coalition with either bloc, he may well carry out his promise to buy back shares in our energy utilities.

Or then again, he might not.

.

*

.

References

NZ First: NZ First Committed To Buying Back State-Owned Assets

NZ First: Our asset sales buyback promise – Radio Live Column

TV3: Winston Peters: Asset buy-back ‘a priority’

FAO.org: Devolving Forest Ownership in New Zealand: Processes, Issues and Outcomes

Treasury: Income from State Asset Sales as at 30 September 1999

Wikipedia: CITIC Group [Citifor]

Wikipedia: Referendums in New Zealand

Otago Daily Times: Alliance quits quest for forestry petition

Otago Daily Times: NZ First ignored chance to implement own policy

Otago Daily Times: NZ First opts for National

Otago Daily Times: Further tax cuts unlikely before next century

NZPA: Birch pledges more tax cuts

.

*

.

Above image acknowledgment: Francis Owen

This blogpost was first published on The Daily Blog on 16 March 2014.

.

.

= fs =

Employers and Manufacturers Association – wishing for cheaper power is not enough

.

.

Recently, EMA CEO, Kim Campbell, issued a media statement condemning the current high power prices and promises of a “price freeze” by Mighty River Power as inadequate. Campbell’s own words were that the so-called price freeze is “simply not enough”.

By the way, I refer to MRP’s price freeze as “so called” because, as CEO, Doug Heffernan stated,

“We are now confirming that for our customers there will be no increase in our energy prices for a further 15 months. However, there will likely be changes in customer pricing from April 1 due to variables over which we have no control that we pass through on our bills – such as transmission and distribution charges and any increases in metering costs due to regulatory requirements.”

With power supply clearly outstripping demand, electricity prices are now too high and should come down, the Employers and Manufacturers Association says.

“New Zealand clearly now has an excess of installed electricity capacity,” said Kim Campbell, EMA’s chief executive.

“Demand for power is well below the country’s generation capacity and its price should reduce to help stimulate New Zealand’s economic recovery and offset inflationary pressures forecast in other parts of the economy.

“At present projections the savings available to business and residential consumers would be at least $67 million a year, but we suspect it could be much more.

“Stating as Mighty River Power has, that they will not increase the electricity price for three years is simply not enough.

“The Major Electricity Users Group notes the futures price for wholesale power for the year from 1st April 2014 is 7.14 c/kWh, down 0.17 c/kWh for the year. In a competitive market this reduction would be reflected in wholesale costs which would be passed through to retail customers.

“MEUG calculates that an average household using 8,000 kWh per year would save at least $13.80 per year or $23 million for all households.

“For all businesses and residences the potential cost reductions amount to $67 million in 2014/15.

“To maximise competitiveness our electricity market structures need to ensure the lowest possible power price while signalling the right time to invest in future generation and transmission.

Unfortunately, Campbell then shoots himself in the proverbial foot by adding,

“The Labour/Greens electricity proposal to underprice our existing power assets is no answer.

“To spur on market competition businesses should seek out the best power deals at www.whatsmynumber.org.nz/mybusiness“

As I said, hasn’t that worked out well?!

So, if I understand Campbell’s stance on this problem; the LabourGreen proposal for NZ Power “is no answer“.

Instead, begging the power companies to drop their prices is Campbell’s only solution?!

Pathetic.

His “solution” is a do-nothing, beg-for-the-best, whilst New Zealanders are having to pay for higher and higher power prices.

To remind Campbell and his fellow businessmen and women; the more that we consumers pay for electricity –

.

.

– the less disposable income we consumers have to spend on their goods and services.

Without drawing a bright, pretty, picture with crayons, I can’t make that simple truism any clearer to understand.

Which is why, when the EMA joined BusinessNZ in an ideological vendetta against the LabourGreen proposal, they were not only doing consumers a grave disservice – but also slitting their own financial throats.

The. More. We. Spend. On. Power, The. Less. We. Have. To. Spend. On. Other. Goods. And. Services.

Perhaps Campbell and his supposedly astute business colleagues should re-visit their position on NZ Power?

Who knows – it might actually be good for business!

.

.

This blogpost was first published on The Daily Blog on 25 December 2013.

.

*

.

References

Otago Daily Times: Lower power prices coming says Bradford (3 June 1999)

MoBIE: Power prices

Statistics New Zealand: The history of electricity reform

NZ Herald: Labour, Greens make power promise

Scoop media: Open Letter to Labour, Greens: Please Withdraw Your Policy

TV3: Mighty River Power promises price freeze until April 2015

Scoop media: Electricity prices should come down

Fairfax media: Business urges Opposition to dump power plans

Previous related blogposts

The Politics of Power and a Very Clear Choice – Part Tahi

The Politics of Power and a Very Clear Choice – Part Rua

The Politics of Power and a Very Clear Choice – Part Toru

The Politics of Power and a Very Clear Choice – Part Wha

It’s Official, The Sky Will Fall – Phil O’Reilly

Labour, Greens, NZ First, & Mana – A Bright Idea with electricity!

History Lesson – Tahi – Electricity Sector “reforms”

.

.

= fs =

The Politics of Power and a Very Clear Choice – Part Wha

.

Continued from: The Politics of Power and a Very Clear Choice – Part Toru

.

First NZ

.

As Chris Trotter pointed out in his excellent blogpost just recently,

“ONLY STEVEN JOYCE could offer up JB Were, Woodward Partners, Milford Asset Management, First NZ Capital, and Forsyth Barr as credible critics of the Labour-Greens’ energy policy. As if these six financial institutions were ever likely to offer the Opposition parties their fulsome support!.”

Acknowledgement: The Daily Blog – No Dog In The Fight: Whatever happened To Academic Expertise?

We can add to the above list; AMP Capital, Morningstar Research, BusinessNZ, and Federated Farmers – all of which appear to be the front-line foot-mercenary-soldiers in National’s counter-attack to the Labour-Green’s NZ Power.

Minister of the Known Universe, Steven Joyce’s actual comment was,

“Financial analysts including JB Were, Woodward Partners, Milford Asset Management, First NZ Capital, Devon Funds Management and Forsyth Barr are unanimous in their condemnation. One has labelled it a ‘hand grenade’ to the New Zealand economy, while others have said it will cut the value of every New Zealanders’ KiwiSaver account and lead to rolling blackouts. ”

Acknowledgement: Scoop – Labour-Greens Power ‘Plan’ Economic Sabotage

“Rolling blackouts“?!

He left out a plague of locusts and rivers turning into blood (though with farm run-offs, these days it’s more like Rivers of Excrement).

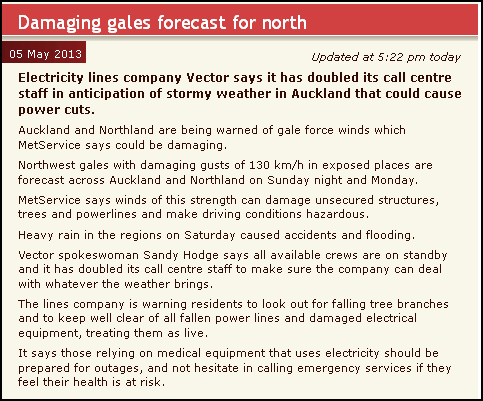

We’ve had power black-outs in the past, due to dry weather; equipment failure; shut-downs for maintenance; human error; etc. And we will continue to have unavoidable power cuts, in the future;

.

Acknowledgement: NZ Radio – Damaging gales forecast for north

.

Joyce added,

“Kiwis are deeply suspicious about the Labour-Greens announcement and its timing. It’s simply economic sabotage. ”

Hmmm, considering the high value of the New Zealand dollar’s destructive effects on our manufacturing/export sector and the 40,000 jobs that’s been lost in the last four years – if I were Joyce, I would not be too keen to bandy about charges of “economic sabotage”. National’s policies in the last few years have been more than effective in that regard,

.

Acknowledgement: Radio NZ – Exporters tell inquiry of threat from high dollar

.

It’s hardly surprising that most of the negative response has been from the financial markets and commercial firms. They are the ones with the naked vested interests.

To date, the following fear-threats have been thrown at the New Zealand public – because make no mistake, these doomsday scenarios are directed at voters, and not Labour or the Greens.

Acknowledgement: First NZ – Contact Energy – If it ain’t broke don’t fix it

Hold on.

Is First NZ is really telling the public that power prices have only risen 2.6% since 2000?!?! Well, they do qualify that with “net of line charges and after allowing for inflation”. Though why they would omit line charges seems pointless; the public are still paying at the end. “Clipping the ticket” seems the norm and impacts on the end-consumer regardless of how it is done.

Which also raises a question in my mind; why is First NZ making this assertion only now? Why did they not make the effort to rebut National’s claims when Dear Leader issued public statements like this, on 27 January, 2011,

“In the nine years Labour was in government, power prices went up 72 per cent and the Government owned 100 per cent of the assets.”

Acknowledgement: NZ Herald – Power price fears if Govt stakes go

Why did First NZ not issue public statements ‘correcting’ National’s “misrepresentations” at the time?

Why have they left it only till now, to counter the assertion that “power prices went up 72%”?

Why is a single-buyer desk for electricity sending brokerage firms into a panic? Especially, considering, that we already have single buyer-desk’s in the form of Fonterra, Zespri, PHARMAC, etc.

The answer, I submit, is fairly obvious. First NZ’s fanciful statements and assertions are part of an orchestrated litany of bullshit to scare Joe & Jane Public to run back into the cold, dead arms of Nanny Neoliberal.

The Financial Money Men, with their Federated Farmers allies, are propping up their neo-liberal stooges in Parliament. The rats are out of the woodwork, and we can see who is lined up against the best interests of the public.

Because, in the final analysis, this all boils down to money – who makes it and who gets to keep it. And because so much money is at stake, we are told that rising power bills is the price for living in a “free” market.

We’re also promised that power prices will drop. Sometime. In the future.

We just have to be patient.

Maybe another thirty years?

It will be interesting if people buy into this propaganda BS. Will voters believe the fear-mongering campaign from the money-pushers?

Or will they realise that share brokers and merchant bankers are interested only in seeing that power prices remain at stratospheric levels, to provide maximum returns for their shareholders?

Because one thing is as certain as the sun rising tomorrow; these firms are not remotely interested in our welfare. Nor in the welfare of Kiwi families being gouged with higher and higher power bills.

I’m struck senseless that so many National supporters believe that siding with the likes of JB Were, Woodward Partners, Milford Asset Management, First NZ Capital, Devon Funds Management, Forsyth Barr, Business NZ, Federated Farmers, et al, will somehow gain them some kind of ‘benefit’. Are National supporters so masochistic and blinded by their faith in the “free market” that they are willing to tolerate paying higher and higher prices for electricity?

I hope they realise that JB Were, Woodward Partners, Milford Asset Management, First NZ Capital, Devon Funds Management, Forsyth Barr, Business NZ, Federated Farmers, et al, will not pay the power bills for National supporters.

Good luck with that!

The Labour-Green coalition should welcome these attacks as an opportunity. Every time one of these money-pushing firms launches a critical attack on NZ Power – the Labour-Greens should counter with press conferences where facts, stats, and more details are presented for the public and nice, big, colourful graphic-charts presented.

Like this one, from the Ministry of Economic Development/Business, Innovation, and Employment;

.

Acknowledgement: Ministry of Economic Development/Business, Innovation, and Employment – Power Prices

.

(Note price drop around 1999. Whilst Industrial and Commercial prices fell, residential prices continued to rise. There is more to explain the 1998/99 price fall here; Statistic NZ – Electricity consumption. It had little to do with Bradford’s reforms, and more to do with competing retailers changing their methods of calculation for the CPI electricity price index and building extra generation capacity. The cost of the latter had shifted from the State and onto domestic consumers.)

Where possible, David Parker and Russell Norman should speak at engagements around the country at public meetings. (Community newspapers and other local media should be engaged, as they love anything that happens within their community.)

Invite others such as the Salvation Army, and experts such as energy-sector expert, Molly Melhuish, and Victoria University researcher Geoff Bertram, should be invited to address media events.

Invite members of the public; families, etc, to present their power bills as evidence of skyrocketing prices.

Build a Broad Front of support. Show the country that there is support for NZ Power.

People want reassurance. We need to give it to them. And we need to show them why the National and the finance sector are working in cahoots.

Because ain’t it funny that no community organisation has come out, demanding that the electricity sector remain unregulated and welcoming higher and higher prices?

And if the media aren’t presenting the full story, use progressive blogs to publish the information. We, too, can be “foot soldiers” in this struggle. (Because surprise, surprise, we too, use electricity.)

This is a war between the Neo Liberal Establishment and Progressive forces fighting to roll back thirty years of a failed experiment.

That war began on 18 April.

There is no reason on Earth why we should not win.

.

NZ First

.

I find it hard to trust NZ First. Or, to be more precise; I find it hard to trust it’s leader, Winston Peters.

His parliamentary colleagues; party members; and supporters – I have no problem with. They are people who, generally, want the best for this country and dislike the false religion of neo-liberalism as deeply as those on the Left do.

But Peters…

Peters has ‘form’. He has changed direction on numerous occassions, and I find it hard to take him at his word.

Some examples…

1.

In 1996, Winston Peters campaigned to defeat the National Government and remove it from power. His campaign statements at that time seemed unequivocal;

“Jim Anderton: Is the member going into a coalition with National?

Winston Peters: Oh no we are not.” – Parliamentary Hansards, P14147, 20 August 1996

.

“There is only one party that can beat National in this election that that is New Zealand First.” – Winston Peters, 69 & 85 minutes into First Holmes Leaders Debate, TVNZ, 10 September 1996

.

“Of course I am not keen on National. Who is?

… This is a government bereft of economic and social performance [so] that they are now arguing for stability.” – Winston Peters, Evening Post, 25 June 1996

.

“The prospects are that National will not win this election, that they will not form part of any post-election coalition.” – Winston Peters, The Dominion, 5 October 1996

.

“It is clear that this National government will use every means at its disposal to secure power… Come October 12… Two months ago I warned that the National Party would use every trick and device at their command to to retain their Treasury seats.” – Winston Peters speech to Invercargill Grey Power, 26 August 1996

.

“The Prime Minister [Jim Bolger] is not fit for the job and come 12 October he will be out. He should not get on his phone and call me like he did last time, because we are not interested in political, quisling behaviour. We are not into State treachery.” – Winston Peters, Parliamentary Hansards, P14146, 20 August 1996

.

“We believe the kind of politician depicted by Bolger, Birch, and Shipley is not to be promoted into Cabinet. As a consequence we will not have any truck with these three people.” – Winston Peters, NZ Herald, 22 July 1996

.

“We are a party that says what we mean and mean what we say, regardless of the political consequences.” – Winston Peters, Speech to public meeting, 9 October 1996

Despite Peters’ assurances, on 11 December 1996 the public woke up to this nightmare,

.

.

2.

In 1996, one of the biggest election issues was the sale of Forestry Corporation of New Zealand Ltd (cutting rights only, not the land). In 1996, the then Bolger-led National government had announced it’s intention to privatise the SOE,

In 1996, the Minister of Finance announced the government’s intention to sell its shares in the Forestry Corporation of New Zealand (formerly Timberlands Bay of Plenty). The corporation’s assets were Crown Forestry Licences to planted forests, which had expanded to 188 000 ha in the central region of North Island, processing plants in various locations, a nursery and a seed orchard.

A handful of large forestry companies and consortia submitted bids. The sole criterion was price. However, as the strength of the bids was not as great as hoped, bidders were asked to resubmit their bids. In August 1996, it was announced that the Forestry Corporation of New Zealand had been sold to a consortium led by Fletcher Challenge in a deal that valued the assets at $NZ 2 026 million.

Acknowledgement: Devolving forest ownership through privatization in New Zealand

The sale went ahead and the final sale-price was $1,600,000, to a consortium made up of Fletcher Challenge Forests (37.5%), Brierley Investments Ltd (25%) and Citifor Inc (37.5%).

Acknowledgement: Treasury – Income from State Asset Sales as at 30 September 1999

Throughout 1996, Winston Peters engaged in an election campaign to “hand back the cheque” should he and his Party be elected into a position of power,

.

Acknowledgement: (hard copy only): Evening Post, 13 August 1996

.

Acknowledgement: (hard copy only): Evening Post, 2 October 1996

.

To quote Peters, who said on 13 August 1996,

“I ask both the Labour and Alliance parties – putting politics aside for this one day – to join New Zealand First in it’s post-election pledge to reverse the sales process“.

As many who lived through the times will recall, Peters pledged to “hand back the cheque”. It was a powerful message.

But it never happened.

Peters joined in coalition with National (consigning Labour and The Alliance into Opposition) and the pledge to buy back the forests was dropped – much to the disgust of people at the time..

Sixteen years later, and Peters has made the same promise all over again. On TV3′s The Nation, on 24 June 2012, Winston Peters stated,

“The market needs to know that Winston Peters and a future government is going to take back those assets. By that I mean pay no greater price than their first offering price. This is, if they transfer to seven or eight people, it doesn’t matter, we’ll pay the first price or less. ”

Acknowledgement: TV 3 – The Nation

On 4 March this year (2013), Peters announced,

“New Zealand First will use its influence on the next coalition Government to buy back our state-owned power companies which are being flogged off by National and we are committed to buying back the shares at no greater price than paid by the first purchaser.”

Acknowledgement: Scoop – One More Quisling Moment from Key

Another quote from Winston Peters, who said in a speech to the NZ First Conference, in 1999,

“All the policies and manifestos in the world are meaningless when you cannot trust the leadership. That is what leadership is about – trust. Nobody expects leadership to be infallible. But you have a right to expect it to be trustworthy.”

Acknowledgement: (hard copy only): Speech by Rt Hon Winston Peters to the New Zealand First Conference, 18 July 1999, at the Eden Park Conference Centre

Indeed; “All the policies and manifestos in the world are meaningless when you cannot trust the leadership.”

If Peters and NZ First hold the balance of power in 2014 and choose to enter into a coalition arrangement with National – will he carry out his pledge this time?

Or will that promise be dropped and buried for political expediency and some babbled, weak excuse?

It’s happened once, before. And not too long ago.

Can he be trusted for a second time?

I am of the belief that folks can learn from their mistakes. God knows I’m made a few in my early adulthood.

Has Winston Peters learned to honour his electoral pledges and not to treat the voting public as fools? Has he learned that he betrays voters at his peril? I hope so.

Because the public exacted a fitting response to his behaviour in 2008, as he and his Party were punished and spent three years in the political wilderness (see; New Zealand general election, 2008).

More than ever, the future of this country – and the power – is in our hands,

.

.

.

Don’t screw up this time, Mr Peters.

This blogpost was first published on The Daily Blog on 6 May 2013.

.

*

.

Previous Related Blogposts

History Lesson – Tahi – Electricity Sector “reforms” (4 March 2012)

John Key: Man of Many Principles (28 Sept 2012)

Labour, Greens, NZ First, & Mana – A Bright Idea with electricity! (10 March 2013)

Additional Sources

Statistics New Zealand: The history of electricity reform

Ministry of Economic Development: Electricity Prices

NZ History Online: Dancing Cossacks political TV ad

The Treasury: Income from State Asset Sales as at 30 September 1999

References

NZPA: Splitting up ECNZ expected to cut wholesale power price (16 Dec 1998)

NZPA: Reforms aimed at business – Luxton (21 April 1999)

Otago Daily Times: Power Prices Set To Soar (12 May 1999)

Otago Daily Times: No case for regulation (24 May 1999)

Otago Daily Times: Lower power prices coming says Bradford (3 June 1999)

Otago Daily Times: Power prices to rise by up to 15.1% (29 June 1999)

Otago Daily Times: Reforms blamed for hike (13 July 1999)

Scoop: Alliance to hold Winston Peters accountable (8 Oct 1999)

NZ Herald: Peters ‘forgets’ NZ First support for power reforms (13 Aug 2008)

Fairfax: Government to seek inquiry into power price rise (30 September 2008)

NZ Herald: Put prices on hold, Brownlee tells power companies (21 May 2009)

NZ Herald: Mighty River directors’ 73pc pay rise realistic – Key (5 April 2013)

Scoop: Labour-Greens to rip up the book on electricity pricing (18 April 2013)

NZ Herald: Labour-Greens plan could work, says Vector CEO (19 April 2013)

NZ Herald: National gobsmacked at Labour idea (19 April 2013)

NZ Herald: Power plan likened to Soviet era (19 April 2013)

NZ Herald: MRP chief slams socialist’ plan (21 April 2013)

TVNZ: Q+A – Transcript of Steven Joyce interview (21 April 2013)

NZ Herald: Bernard Hickey: Power barons fail to fool the public this time around (21 April 2013)

Radio NZ: Power prices nearly double since 2000 (21 April 2013)

Other blogs

Kiwiblog: Electricity Prices

Tumeke: MANA threaten overseas investors not to buy assets – Bloomberg pick up on the story

.

.

= fs =

The Politics of Power and a Very Clear Choice – Part Toru

.

.

Continued from: The Politics of Power and a Very Clear Choice – Part Rua

.

On a more Positive Note

.

With all the scare-mongering from some quarters (National, right wing blogs, conservative media commentators), and naked threats of economic sabotage (JB Weir, Brian Gaynor, etc), there have been commentators with a more positive, up-beat assessment of the Green-Labour proposal for NZ Power.

Bernard Hickey wrote,

“But sometimes the sheer size of the profits becomes so obvious that it invites a backlash. The National Government realised the power-consuming public was nearing the end of its tether in 2008, so it acted to force more competition with its 2009 sector review and the very successful “Whatsmynumber”. It helped increase the switching rate over the past couple of years towards 20 per cent. Annual residential power price inflation halved from 8 per cent in the decade from 1998 to 2008 to 4 per cent since then.

But it is still running at quadruple the general inflation rate and it’s clear that “competition” hasn’t worked to reduce or even restrain power prices for voters, as opposed to businesses.

[…]

The SOE sales programme changed all that. It proposed handing those super profits to the richest New Zealanders in the form of shares and dividends.

That was the moment the Government and the industry crossed that red line and triggered the regulatory backlash promised this week by Labour and the Greens.”

Acknowledgement: NZ Herald – Bernard Hickey: Power barons fail to fool the public this time around

Vector chief executive, Simon Mackenzie, seemed to agree,

The electricity policy announced by the Labour and Green parties could be made to work and the current debate is overly emotive, says the chief executive of the regulated monopoly electricity and gas network owner, Vector.

Simon Mackenzie told BusinessDesk he was encouraged by the fact the proposed central purchaser system would incentivise commercially rational investment in energy efficiency, and that the Opposition parties were not pursuing direct subsidies.

He also welcomed the fact Labour was proposing to simplify regulation of lines companies, which has become enmeshed in the courts after policies Labour implemented was “not tracking as was intended,” Mackenzie said.

There was “no perfect model” for electricity systems, and other countries used similar methods to set prices and to procure investment in new power plants as demand rises. At present, new generation is procured by competing generators identifying the “next least-cost” of new generation and deciding to build it.

[…]

“The model is used in other jurisdictions. It has its pros and cons. It’s made to work.”

Acknowledgement: NZ Herald – Labour-Greens plan could work, says Vector CEO

.

Inevitable Conclusions

.

1. The term “Government-in-Waiting” is well known.

But there is a corollary to this concept.

The Green-Labour policy has not only put National on the “back foot” with the audacious nature of the plan – but has placed National Ministers – from John Key up – into a ‘No Man’s Land’ of a Government-in-Opposition role.

National finds itself faced with a policy that is so novel; so unforeseen; that their initial reactions were indignant splutterings of “North Korean school of politics”; candles; brown-outs; “United Soviet Socialist Republic of New Zealand” [sic]; threats of economic collapse; economic “sabotage”, and other doomsday scenarios.

The responses could be likened to the indignant temper-tantrums of a teenager who has been used to getting things all his/her life – and was suddenly being brought to heel by exasperated parents.

Key has said he never wants to be in Opposition again,

“I don’t think it suits me as a person. I’m not a negative person and a lot of Opposition is negative.”

Acknowledgement: NZ Herald – Key says he’ll quit politics if National loses election

Well, that is precisely where he now finds himself: the new quasi-Opposition in Parliament. The Green-Labour coalition is setting the agenda, and National can only react,

.

Acknowledgement: Sharechat – Labour-Greens plan forces government to suspend MightyRiverPower offer, amend documents

.

2. On 20 April, Labour finance spokesperson, David Parker, told TV3′s The Nation,

“It’s not like the money disappears from the economy, just that people have more money in their pockets. Instead of spending it on inflated power prices, they’re spending it somewhere else in the economy.”

Which is pretty much the rationale that National used to justify it’s fiscally irresponsible tax cuts in 2009 and 2010,

“In the short term, National’s tax package will give households confidence and some cash in their back pockets to keep the economy going and to pay down debt.”

Acknowledgement: National – Economy/Tax Policy

3. If New Zealanders could tick National in 2008 for their promised tax cuts (in 2009 and 2010, despite being unaffordable and demanding massive borrowings to fund) – then I’m sure as hell confident they’ll be ticking Labour and/or Green in 2014 (if not earlier) for cheaper electricity.

There is nothing as easy to sell to voters than giving them what was theirs in the first place. That applies equally, whether tax dollars or electricity.

Unlike the academic nature of who owns our State Assets – which for the poor underclasses means very little – everyone can understand a very simple concept of cheaper power.

Consider if those 800,000 missing-in-action, non-voters were asked the simple question; do you want cheaper electricity?

If the answer is “yes” – they need only tick the box for Labour and/or Greens.

For the Nats: game over.

Continued at: The Politics of Power and a Very Clear Choice – Part Wha

This blogpost was first published on The Daily Blog on 26 April 2013.

.

*

.

Previous Related Blogposts

History Lesson – Tahi – Electricity Sector “reforms” (4 March 2012)

John Key: Man of Many Principles (28 Sept 2012)

Labour, Greens, NZ First, & Mana – A Bright Idea with electricity! (10 March 2013)

References

NZ History Online: Dancing Cossacks political TV ad

NZPA: Splitting up ECNZ expected to cut wholesale power price (16 Dec 1998)

NZPA: Reforms aimed at business – Luxton (21 April 1999)

Otago Daily Times: Power Prices Set To Soar (12 May 1999)

Otago Daily Times: No case for regulation (24 May 1999)

Otago Daily Times: Lower power prices coming says Bradford (3 June 1999)

Otago Daily Times: Power prices to rise by up to 15.1% (29 June 1999)

Otago Daily Times: Reforms blamed for hike (13 July 1999)

Scoop: Alliance to hold Winston Peters accountable (8 Oct 1999)

NZ Herald: Peters ‘forgets’ NZ First support for power reforms (13 Aug 2008)

Fairfax: Government to seek inquiry into power price rise (30 September 2008)

NZ Herald: Put prices on hold, Brownlee tells power companies (21 May 2009)

NZ Herald: Mighty River directors’ 73pc pay rise realistic – Key (5 April 2013)

Scoop: Labour-Greens to rip up the book on electricity pricing (18 April 2013)

NZ Herald: Labour-Greens plan could work, says Vector CEO (19 April 2013)

NZ Herald: National gobsmacked at Labour idea (19 April 2013)

NZ Herald: Power plan likened to Soviet era (19 April 2013)

NZ Herald: MRP chief slams socialist’ plan (21 April 2013)

TVNZ: Q+A – Transcript of Steven Joyce interview (21 April 2013)

NZ Herald: Bernard Hickey: Power barons fail to fool the public this time around (21 April 2013)

Radio NZ: Power prices nearly double since 2000 (21 April 2013)

Other blogs

Robert Guyton: Murray Kerr on MRP

Kiwiblog: Electricity Prices

.

.

= fs=

The Politics of Power and a Very Clear Choice – Part Rua

.

.

Continued from: The Politics of Power and a Very Clear Choice – Part Tahi

.

Evidently, the sky will fall if New Zealand proceeds with Labour-Green’s NZ Power proposal…

The four Donkeys of the Fiscal Apocalypse

.

- Lack of New Infra-structure – The argument goes that without massive profits, state owned powercos will not have sufficient funds to pay for new power production or to maintain transmission lines. Really?! In which case, how on earth did we ever build up this country’s energy infra-struction in the first place???

- Brown Outs – We’ve been told we’ll have brown outs (see Collin’s Tweet above). Really?! It beggars belief how we ever got out of bed in the mornings and tied our shoelaces, prior to to introduction of neo-liberalism. What a hopeless lot we must’ve been.

- Share Falls – Yes, the sharemarket will fall if the NZ Power propopsal goes ahead. In fact, they’ve already dropped (see: Power shares keep falling). So what people like Nick Lewis, an analyst at Wellington-based brokers Woodward Partners, is telling us is that the sharemarket is dependent on the New Zealand public held to ransom by way of exorbitant power pricing? We’re subsiding the sharemarket? I wonder what reaction the share market might have if competition really worked, and drove down power prices???

- Investors abandoning NZ – Yes, for a while, the jittery bastards at Boston, Beijing, or Berlin might panic and withdraw investment funds. For about half-a-f*****g second. Then they will get over themselves and return to invest elsewhere in our economy. Such as green technology in power production – technology which can be exported overseas for a tidy profit.

The fear-mongering from National, business, conservative media commentators, and other assorted right-wing nutjobs, assumes that New Zealanders are little children who are easily frightened by shadows.

We are not (much).

.

Max Bradford and That ‘Dip’

.

After Bradford’s reforms, power prices went north, skyrocketing by a jaw-dropping 87% since 2000. If food had increased that much since 2000, there’d be wide-spread starvation in this country. And wide-spread rioting that would make the 2010 London riots pale by comparison.

Bradford, though, has insisted that his “reforms” would have worked, had the new Labour government not ‘tinkered’ with them in the early 2000s. On TV3′s “The Nation“, on 21 April, Bradford stated,

“When the competive market was allowed to work, prices fell. And, ah, between 1998 and 2002, before Labour started fiddling with the market, prices did fall. So if you let the competitive market work, then prices will either rise more slowly than otherise they would, or they fall. ”

Acknowledgement: TV3 – The Nation

On Kiwiblog, David Farrar kindly provided a graph, attempting to support Bradford’s claims,

.

Acknowledgement: Kiwiblog/Stats NZ

.

The graph is even helpfully marked with a black line and labelled “Bradford Reforms”, between 1997 and 1998.

Unfortunately, this in itself is not quite correct. Despite Bradford’s Electricity Industry Reform Act 1998 taking effect in mid-1998, the electricity sector reforms did not fully take effect until April 1999, when Contact Energy was privatised and ECNZ was split in three; Mighty River Power, Meridian, and Genesis.

In the same year – 1999 – power prices surged (see: Power prices to rise by up to 15.1%, see; Reforms blamed for hike), as Farrar’s own graph shows with crystal clarity.

But then, curiously, there is a considerable dip in 2000 and 2001, followed by a sharp, massive series of rises thereafter.

So, what happened in 2000 and 2001?

The Asian Crisis is what happened, folks.

As then-governor of the RBNZ, Don Brash reported,

“In July 1997 the Thai baht fell sharply, triggering a period of turbulence in the financial markets of East Asia. Many currencies declined p re c i p i t o u s l y, along with share markets and real estate prices.

The banking sectors of the countries most affected were severely damaged, and real economic activity fell, in some cases sharply, for the first time in decades. The direct effect on the New Zealand economy was adverse and substantial, and looks likely to continue for some time. The indirect effect, through business and household sector confidence, was also significant. The impact of the Asian situation reduced inflationary p re s s u res in New Zealand markedly.

[…]

Inflationary pressures had been slowing for some time previously, so that as far back as December 1996 monetary policy began to ease in response. Then late in 1997 and into 1998 the Asian financial crisis added to the slow-down, as growth prospects in many Asian economies, including Japan, deteriorated (see box 2). In December 1997, when easing monetary policy further, the Bank cited the likely impact of the Asian crisis on the New Zealand economy, and noted that the disinflationary impact of that crisis could become markedly worse. During 1998, this happened, and in response monetary policy was eased more aggressively still.

[…]

For New Zealand, reduced exports to the region, which previously accounted for 36% of our merchandise exports, had a negative impact on economic activity. The likely effects of the crisis were a particular focus in each of the Bank’s quarterly Monetary Policy Statements from December 1997 onwards. In the Reserve Bank’s March 1998 projections, we judged that the severity of the crisis was being underestimated by many observers. As a result the Reserve Bank eased monetary policy by more than New Zealand markets had expected.”

Acknowledgement: – Don Brash, Reserve Bank of New Zealand Annual Report 1997-1998

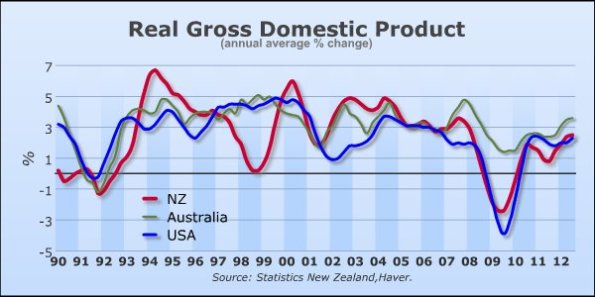

Here is the NZ Reserve Bank chart of economic growth, measuring Real Gross Domestic Product (GDP), from 1990 to 2012,

.

Reserve Bank of New Zealand – Real Gross Domestic Product, 8 January 2013

.

Note the RBNZ statement, from the above January 2013 report,

Following the 1998 “Asian crisis” New Zealand’s Gross Domestic Product (“GDP”) recovered strongly. Annual GDP growth from 2001 through to 2004 (on average) exceeded that of its major trading partners, partly as a result of strong net inward migration and associated population growth.

Acknowledgement: IBID

.

Now let’s compare the period from 1997 to 2002, on both graphs,

.

.

A closer look at the 1997 – 2002 period,

.

Acknowledgement: Trading Economics/Stats NZ – New Zealand GDP Growth Rate

.

Aside from a “dead cat” bounce in the Third Quarter of 1999, the correlation between economic activity and power prices is self-evident. The drop in electricity prices in 2000 and 2001 followed a slump in economic activity in Asia, and it’s subsequent global flow-on effects.

As PBS Frontline reported,

The Asian financial crisis that was triggered in July 1997 was a shocker. Even two years after it ended, anxiety still loomed over global financial markets. What was at the time perceived to be a localized currency and financial crisis in Thailand, soon spread to other Southeast Asian countries–including Malaysia, Indonesia and the Philippines.

By the fall of 1997, the contagion extended its reach to South Korea, Hong Kong and China. A global financial meltdown had been ignited. In 1998, Russia and Brazil saw their economies enter a free-fall, and international stock markets, from New York to Tokyo, hit record lows as investors’ confidence was shaken by the volatility and unpredictability in the world’s financial markets.

Acknowledgement: PBS – Timeline of the Crash

As the Reserve Bank stated above, “annual GDP growth from 2001 through to 2004 (on average) exceeded that of its major trading partners” – and 2001 is when power prices started to rise again.

Also worthy of attention is that the electricity CPI also drops in 2009 and 2011, during the latest Global Financial Crisis and resulting Great Recession.

Unfortunately, for reasons of their own (but which we can guess at), Mr Farrar and his National Party friends fail to point out this salient fact. The Right will mis-represent facts and re-write history to suit their own narrowly-defined ideological agenda.

Labour-Green’s NZ Power is a threat to that ideologically-based agenda.

Continued at: The Politics of Power and a Very Clear Choice – Part Toru

This blogpost was first published on The Daily Blog on 25 April 2013.

.

*

.

Previous Related Blogposts

History Lesson – Tahi – Electricity Sector “reforms” (4 March 2012)

John Key: Man of Many Principles (28 Sept 2012)

Labour, Greens, NZ First, & Mana – A Bright Idea with electricity! (10 March 2013)

References

NZ History Online: Dancing Cossacks political TV ad

NZPA: Splitting up ECNZ expected to cut wholesale power price (16 Dec 1998)

NZPA: Reforms aimed at business – Luxton (21 April 1999)

Otago Daily Times: Power Prices Set To Soar (12 May 1999)

Otago Daily Times: No case for regulation (24 May 1999)

Otago Daily Times: Lower power prices coming says Bradford (3 June 1999)

Otago Daily Times: Power prices to rise by up to 15.1% (29 June 1999)

Otago Daily Times: Reforms blamed for hike (13 July 1999)

Scoop: Alliance to hold Winston Peters accountable (8 Oct 1999)

NZ Herald: Peters ‘forgets’ NZ First support for power reforms (13 Aug 2008)

Fairfax: Government to seek inquiry into power price rise (30 September 2008)

NZ Herald: Put prices on hold, Brownlee tells power companies (21 May 2009)

NZ Herald: Mighty River directors’ 73pc pay rise realistic – Key (5 April 2013)

Scoop: Labour-Greens to rip up the book on electricity pricing (18 April 2013)

NZ Herald: Labour-Greens plan could work, says Vector CEO (19 April 2013)

NZ Herald: National gobsmacked at Labour idea (19 April 2013)

NZ Herald: Power plan likened to Soviet era (19 April 2013)

NZ Herald: MRP chief slams socialist’ plan (21 April 2013)

TVNZ: Q+A – Transcript of Steven Joyce interview (21 April 2013)

NZ Herald: Bernard Hickey: Power barons fail to fool the public this time around (21 April 2013)

Radio NZ: Power prices nearly double since 2000 (21 April 2013)

Other blogs

Kiwiblog: Electricity Prices

.

.

= fs =

The Politics of Power and a Very Clear Choice – Part Tahi

.

.

Historical Background

.

New Zealanders, by and large, are not stupid.

We can recognise a rort when we see it. And in the case of electricity prices, we see it on a regular basis in our power bills and media headlines,

.

2008

.

Acknowledgement: Fairfax: Government to seek inquiry into power price rise

.

2009

.

Acknowledgement: NBR – More profit than power for state-owned energy companies

.

2010

.

Acknowledgement: Fairfax Media – High spot prices hint at power price rise

.

2011

.

Acknowledgement: NZ Herald- Power bills set to rise up to 8pc from March

.

2012

.

Acknowledgement: Fairfax Media – Electricity prices tipped to rise steeply

.

2013

.

Acknowledgement: TVNZ – Power prices rise by average $120 nationwide

.

We all know the facts and figures by now,

- National Minister Max Bradford “reformed” the electricity sector in 1999 (see: Splitting up ECNZ expected to cut wholesale power price)

- We were promised cheaper power due to Bradford’s reforms (see: Lower power prices coming says Bradford)

- Power prices have continued to rise, increasing by 87% since 2000 (see: Power prices nearly double since 2000)

- Consumer power prices rose by 72%between 2000 and 2008 whilst inflation went up only 29% (Put prices on hold, Brownlee tells power companies)

None of Bradford’s promises came to fruition and on 27 November 1999, Bradford lost his Rotorua seat to Labour’s Stephanie Chadwick (see: Rotorua – New Zealand electorate).

.

A Bold New Plan

.

On 18 April, Labour and the Greens announced a bold new policy initiative to reign in escalating power price rises. Called NZ Power, the reform would work thusly,

Key to the proposals is the creation of a central buying and electricity system planning agency, dubbed NZ Power, which would drive down power prices because of its market power and would not be required to make a profit.

It would also be the market regulator.

“It will not just supervise the market, it will be actively involved,” said Labour’s finance spokesman David Parker, a Minister of Energy in the 1999 to 2008 Labour-led administration.

It would tender for new electricity generation, or potentially energy efficiency measures, rather than the current crop of generators competing to identify the next least costly unit of new generation when demand rises.

In some cases, industrial users would be able to contract directly with NZ Power.

Power prices would be set not by reference to the cost of the next new unit of generation, but by average costs that include the anticipated price of new generation. However, there would still be a traded market in wholesale electricity, which could reflect regional variations.

Acknowledgement: Scoop – Labour-Greens to rip up the book on electricity pricing

This new plan was the confirmation (if any was needed) that National’s grand experiment in privatisation and “competition” in the electricity sector was not working. Only fools (mostly those posting on right-wing, pro-National Kiwiblog) could possibly argue that the current system was “succeeding”.

In fact, even as far back as May 2009, National Minister Gerry Brownlee demanded that power generators put price rises on hold. He stated,

“There is something fundamentally wrong in the way in which we’re marketing electricity in New Zealand.“

Acknowledgement: NZ Herald – Put prices on hold, Brownlee tells power companies

And even the architect of this ill-conceived “reform”, Max Bradford, was reported in May 1999 in the media as planning to regulate electricity line charges,

Enterprise and Commerce minister Max Bradford is to press ahead with regulations to control electricity line charges, but sees no reason to implement regulation in the competitive end of the market.

Acknowledgement: Otago Daily Times – No case for regulation

So even National ministers reluctantly concede that the electricity sector cannot work in an unregulated “freemarket” model, and is unable to deliver the ‘golden fruits’ of de-regulation and so-called competition.

.

Carping & Criticisms

.

After the press conference on 18 April, criticism flew thick and fast from National ministers; right wing bloggers; pro-National sycophantic elements of the media, and their ideologically-wedded fellow-travellers.

On Steven Joyce’s twitter account,

.

Source: Twitter/Steven Joyce

.

Judith “Crusher” Collins added this bit of gratuitous fantasy-fear mongering,

.

Source: Twitter/IBID

.

From Simon Bridges, this little bit of muppetry,

“They may want to return to sort of United Soviet Socialist Republic of New Zealand days but National certainly doesn’t.”

Acknowledgement: NZ Herald – Power plan likened to Soviet era

It was actually the Union of Soviet Socialist Republics, Mr Bridges, not “United” Soviet Socialist Republic. Get your Evil Empires right, mate.

And anyway, most of New Zealand’s centralised planning occurred during National’s administration, from 1975 to 1984, under the late Robert Muldoon. Remember the price/wage freeze?

Mighty River Power chief executive Doug Heffernan, also called the plan “socialist” (by the way, is that a bad thing?) He declared,

“What you’ve just described is a socialist consumer model.”

Acknowledgement: NZ Herald – MRP chief slams socialist’ plan

To which I would point out to the reader,

- Heffernan benefits from a $1.49 million p.a. salary – whilst Mighty River Power keeps raising it’s power prices. So the gentleman has a vested interest in this issue.

- In February this year, Heffernan announced that Mighty River Power’s half-yearly profit has quadrupled; prices had risen by 2%; despite demand “being flat”. (see: Mighty River Power profit quadruples )

- Saying that “Mighty River Power would not have made the $1billion investment into geothermal energy that we’ve made in the last five years … The risks would have been too high” – insults our intelligence. Mighty River Power was built up by the State, with taxpayers’ money. Heffernan forgets himself; MRP is not a private company.

- And anyway, is it the role of SOE chief executives to be promoting privatisation?

Steven Joyce added to the “red menace scare”on TVNZ’s Q+A on 21 April,

“By definition, it’s socialism.

“They are not just talking about the price, they’re talking about telling the generators when they can generate, which generating assets they can use, which ones they can introduce to the markets.”

The Minister said the proposed plan would also scare off investors, with evidence of this seen late last week when the market dropped.

“On Thursday and Friday, the market dropped nearly $600 million across three companies because they said, ‘Jeez, we’re not interested in this’.”

Which is rather strange… Joyce, Bridges, Collins, Key, et al, are likening Labour-Green’s plans to “North Korean economics” or “Soviet style socialism”.

But when did the former USSR or the current North Korea ever have a share market or multi-party Parliamentaty democracy?!?!

.

.

Could it possibly be that National ministers have no intellectual, rational response to the proposed NZ Power scheme?

Could it be that they must rely on fear-mongering? Which reminds me of this,

.

Acknowledgement: NZ History Online: Dancing Cossacks political TV ad

.

Could it possibly be that National ministers are placing their faith in free market economics – vis-a-vis the partial sale of state powercos – to get prices to drop? (Which, after 14 years is yet to happen for the domestic consumer.)

Could it be that National ministers are… panicking?!

Because as NZ Herald columnist, John Armstrong wrote on 19 April,

“There may be good reasons for the seemingly constant above-inflation hikes in retail prices. But politicians have given up explaining because consumers long ago stopped listening.

All this would suggest there is fertile ground for Labour and the Greens, who yesterday foreshadowed plans to slash power prices by setting up a new agency, NZ Power, to act as a single buyer of wholesale electricity.

National was truly gobsmacked. It accused Labour of “Muldoonism”, “loony tunes” policy making and “North Korean economics”.

National accepts that at the outset there might be lower prices. But it argues the policy would distort price signals that are so vital to matching supply and demand. That could lead to power shortages. The policy would distort and even discourage investment in power generation.”

Acknowledgement: NZ Herald: National gobsmacked at Labour idea

“Gobsmacked” is about right.

And ironically enough, “Muldoonism” was a product of the National Party – not Labour. Hilarious stuff, indeed!

This is nothing less than a full-scale retreat from market-driven political orthodoxy. In effect, Labour has done the unthinkable; it has publicly announced that neo-liberalism and it’s supposed “free” market economics does not, and cannot, deliver all of society’s needs.

We get a glimpse of what it must have been like in 1989 when Mikhail Gorbachev sat down with his colleagues in the Soviet Politburo and announced to a stunned meeting,

“Comrades, our communist ideology and centralised economic system has failed.”

Mark 18 April 2013 on your calendar as the day that one of our two main Parties (or, two out of our three main Parties, if Green political support keeps increasing) renounced neo-liberal free market ideology as a failure.

There is now a clear, unequivocal difference between an increasingly right wing, ideologically-driven National, and a decidely more-leftist – but pragmatic – Labour.

And the public now has a clear choice as well, for whom to vote;

Option A (for the Blue Team): maintain the neo-liberal status quo; proceed with privatisation; and hope-like-hell that Max Bradford’s promises eventually, maybe, one day, will come true.

Option B (for the Red Team): vote for change; abandon our slavish adherence to neo-liberal dogma; and, as a side-effect, enjoy cheaper power bills.

Continued at: The Politics of Power and a Very Clear Choice – Part Rua

This blogpost was first published on The Daily Blog on 24 April 2013.

.

*

.

Previous Related Blogposts

History Lesson – Tahi – Electricity Sector “reforms” (4 March 2012)

John Key: Man of Many Principles (28 Sept 2012)

Labour, Greens, NZ First, & Mana – A Bright Idea with electricity! (10 March 2013)

References

NZ History Online: Dancing Cossacks political TV ad

NZPA: Splitting up ECNZ expected to cut wholesale power price (16 Dec 1998)

NZPA: Reforms aimed at business – Luxton (21 April 1999)

Otago Daily Times: Power Prices Set To Soar (12 May 1999)

Otago Daily Times: No case for regulation (24 May 1999)

Otago Daily Times: Lower power prices coming says Bradford (3 June 1999)

Otago Daily Times: Power prices to rise by up to 15.1% (29 June 1999)

Otago Daily Times: Reforms blamed for hike (13 July 1999)

Scoop: Alliance to hold Winston Peters accountable (8 Oct 1999)

NZ Herald: Peters ‘forgets’ NZ First support for power reforms (13 Aug 2008)

Fairfax: Government to seek inquiry into power price rise (30 September 2008)

NZ Herald: Put prices on hold, Brownlee tells power companies (21 May 2009)

NZ Herald: Mighty River directors’ 73pc pay rise realistic – Key (5 April 2013)

Scoop: Labour-Greens to rip up the book on electricity pricing (18 April 2013)

NZ Herald: Labour-Greens plan could work, says Vector CEO (19 April 2013)

NZ Herald: National gobsmacked at Labour idea (19 April 2013)

NZ Herald: Power plan likened to Soviet era (19 April 2013)

NZ Herald: MRP chief slams socialist’ plan (21 April 2013)

TVNZ: Q+A – Transcript of Steven Joyce interview (21 April 2013)

NZ Herald: Bernard Hickey: Power barons fail to fool the public this time around (21 April 2013)

Radio NZ: Power prices nearly double since 2000 (21 April 2013)

Other blogs

Kiwiblog: Electricity Prices

.

.

= fs =

Corporate Welfare under National

.

.

In case there are still one or two New Zealanders remaining who haven’t yet cottoned on to one very simple truism about National in office, let me spell it out; they are rank hypocites of the highest order.

And in case you, the reader, happen to be a true-blue National supporter, let me explain why.

In the last four years, National has been beavering away,

- slashing budgets

- sacking nearly 3,000 state sector workers

- closing schools

- attempting to close special-needs services such as Nelson’s Salisbury school

- cutting state services such as DoC, Housing NZ, Police, etc

- freezing wages for state sector workers (whilst politician’s salaries continue to rise)

- cutting back on funding to various community services (eg; Rape Crisis ands Women’s Refuge)

- and all manner of other cuts to state services – mostly done quietly and with minimum public/media attention.

In return, the Nats successfuly bribed us with our own money, giving us tax-cuts in 2009 and 2010. (Tax cuts which, later, were revealed not to be as affordable as what Dear Leader Key and Little Leader English made out – see: Key: $30b deficit won’t stop Nats tax cuts, see: Government’s 2010 tax cuts costing $2 billion and counting)

One such denial of funding for public services is an on-going dispute between PHARMAC and the New Zealand Organisation for Rare Disorders (NZORD) which is struggling desperately to obtain funding for rare disorders such as Pompe’s Disease,

.

Acknowledgement: Fairfax Media – Mum not prepared to wait and die

.

NZORD and it’s members have been lobbying National for the last four years to gain funding for much-needed medication. They are in a dire situation – this is a matter of life or death for them.

This blogger has blogged previously about their plight,

Previous related blogposts

- Priorities? (19 Oct 2011)

- Terminal disease sufferer appeals to John Key (12 Nov 2012)

- “There’s always an issue of money but we can find money for the right projects” – John Key (20 Jan 2013)

- “One should judge a society by how it looks after the sick and vulnerable” – part tahi (4 March 2013)

- “One should judge a society by how it looks after the sick and vulnerable” – part rua (4 March 2013)

- “One should judge a society by how it looks after the sick and vulnerable” – part toru (4 March 2013)

This blogger has also written directly to the Prime Minister and to Health Minister, Tony Ryall.

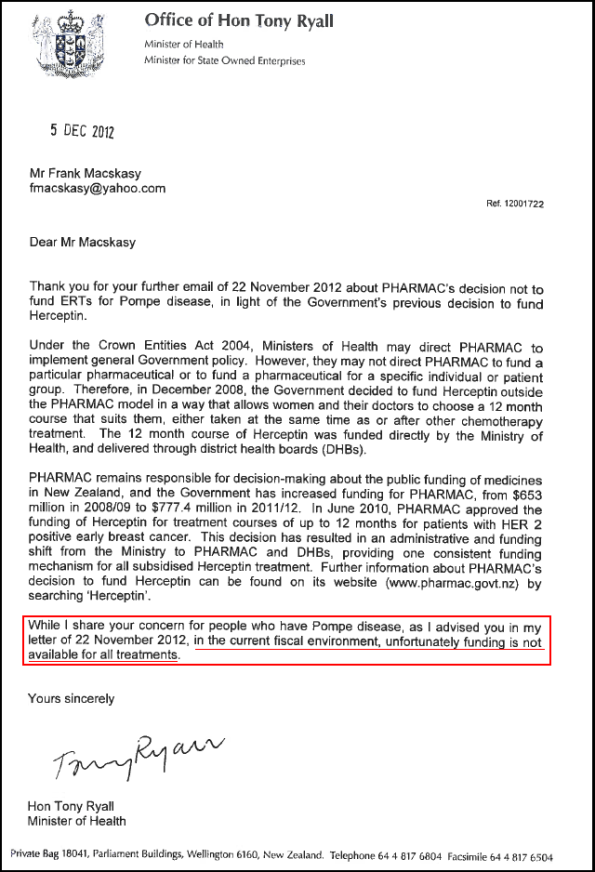

One response from Minister Ryall is presented here, for the reader’s attention,

.

.

So there we have it, folks. If you’re a New Zealander dying from a rare disease, and PHARMAC won’t fund life-saving medication – don’t expect an assistance from this rotten government. Their response will be, and I quote,

“While I share your concern [snort!!!] for people with Pompe disease, as I advised you in my letter of 22 November 2012, in the current fiscal environment, unfortunately funding is not available for all treatments.”

So “in the current fiscal environment, unfortunately funding is not available for all treatments“?!

But funding is available for;

$1 Rugby – $200 million to subsidise the Rugby World Cup (see: Blowouts push public Rugby World Cup spending well over $200m)

$2 Movies – $67 million paid to Warner Bros to keep “The Hobbit” in New Zealand (see: The Hobbit: should we have paid?) and $300 million in subsidies for “The Lord of the Rings” (see: Hobbit ‘better deal than Lord of the Rings’ – Key)

$3 Consultants – After sacking almost 3,000 state sector workers (see: 555 jobs gone from public sector) – and with more to come at DoC – National seems unphased at clocking up a mind-boggling $1 billion paid to “consultants”. (see: Govt depts clock up $1bn in consultant fees)

And on top of that, we are now faced with the prospect of a trans-national corporate – Rio Tinto – with their hands firmly around Meridian Energy’s neck, attempting to extract a greater subsidy from the SOE powerco. The story began in August last year,

.

Acknowledgement: NZ Herald – Rio Tinto seeks power deal revision

.

We know why. Despite implausible assertions to the contrary by National Ministers, Genesis Energy, and Rio Tinto executives – the partial sale of SOE powercos (Meridian, Genesis, and Mighty River Power) have made them vulnerable to the demands of Big Businesses.

Rio Tinto knows that the share price of each SOE will be predicated on marketplace demand for shares.

They know that if there is less demand for electricity, then the price of power may (note: may) drop; those SOE’s profits will drop; and the price of shares will drop.

That leaves shareholders out of pocket and National with egg on it’s face. And a whole bunch of Very Pissed Off Voters/Shareholders.

Think: Warner Bros. Think: corporate blackmail to shift ‘The Hobbit’ overseas. Think: National not wanting to risk the wrath of Peter Jackson and a thoroughly manipulated Public Opinion. Think: National looking at the 2011 election. Think: panic amongst National ministers and back-room Party strategists.

National capitulated.

This is precisely what is happening with Rio Tinto, Meridian, and National.

In the space of six and a half hours yesterday (28 March 2013), events came to a dramatic head. The following happened in one day:

9.15am:

Via a Press Release from Merdian Energy;

“Thursday, 28 March 2013, 9:15 am

Press Release: Meridian EnergyNew Zealand Aluminium Smelter’s electricity contract

For immediate release: Thursday, 28 March 2013

Meridian was approached by Pacific Aluminium, a business unit of global mining giant Rio Tinto Ltd, the majority shareholder of New Zealand Aluminium Smelters Ltd (NZAS), in July 2012, to discuss potential changes to its existing electricity contract.

Since talks began, various options have been discussed and Meridian has offered a number of changes and concessions to the existing contract.

Chief Executive of Meridian Energy, Mark Binns, says that Meridian has advised Pacific Aluminium of its ‘bottom line’ position.

“Despite significant effort by both parties there remains a major gap between us on a number of issues, such that we believe that it is unlikely a new agreement can be reached with Pacific Aluminium,” says Mr Binns.

In the event no agreement can be reached, Meridian will seek to engage with Rio Tinto and Sumitomo Chemical Company Ltd, the shareholders of NZAS, who will ultimately decide on the future of the smelter.

Meridian signed a new contract with NZAS in 2007, after three years of negotiations. This current contract commenced on 1 January 2013 and remains unaltered and binding on the parties.” – Source

To which Rio Tinto replied,

10.15am:

In a NZ Herald story,

CEO of Pacific Aluminium (the New Zealand subsidiary of Rio Tinto), Sandeep Biswas responded with,

“We believe a commercial agreement that is in the best interests of NZAS, Meridian, the New Zealand Government, and the people of Southland can be reached. We look forward to continuing productive negotiations with a view to achieving a positive outcome for all parties.” – Source

De-coding: “This ain’t over till the Fat Chick sings, and she’s nowhere to be seen. You guys better start hearing what we’re saying or this is going to turn to sh*t real fast; we’ll close our operations at Bluff; 3,200 people employed by us directly or indirectly will be told ‘Don’t Come Monday’; your Southland economy will collapse like a Cyprus bank, and National can kiss goodbye to it’s re-election in 2014. Ya got that, sunshine?”

11.15am:

That got the attention of National’s ministers Real Quick,

The Government has opened discussions with Tiwai Point aluminium smelter’s ultimate owners Rio Tinto in a bid to broker a deal after talks between the smelter and Meridian Energy reportedly broke down.

[…]

“With this in mind, the Government has been in contact with Pacific Aluminium’s international parent company Rio Tinto this week to discuss helping to bridge the gap in their positions over the short to medium term, if this could be of assistance in concluding an agreement.

“In the meantime, we understand Meridian’s existing contract with Pacific Aluminium remains in place at least until 1 January 2016 with significant financial and other obligations beyond that.” – Source

Barely two hours had passed since Meridian had lobbed a live grenade into National’s state asset sale programme, and it’s fair to say that the Ninth Floor of the Beehive was in a state of panic. It was ‘battle stations’. Red Alert. National ministers were, shall we say, slightly flustered,

.

.

12.00pm:

By noon, the markets were reacting. Though share-market analysts were attempting to down-play the so-called ‘Phoney War’ between Meridian and Rio Tinto, Devon Funds Management analyst, Phillip Anderson, remarked that,

“…the announcement had hit Contact’s share price – the company was down 3 per cent in early trading but is now down only 1.2 per cent.” – Source

If Contact’s (a fully privatised ex-SOE) share price had dropped 3% on the strength of these media stories, it is little wonder that share-market analysts were down-playing the brinkmanship being played out by Meridian and Rio Tinto. If the share-market was spooked enough, Contact’s share price would plummet, as would that of Mighty River Power – estimated to be in the $2.36 and $2.75 price-range. (see: Mighty River share tips $2.36 to $2.75).

In which case, National would be floating shares worth only a fraction of what ministers were seeking. In effect, if Rio Tinto closed down operations, Key could kiss goodbye to the partial sale of energy SOEs. They would be worthless to investors.

3.43pm:

By 3.43pm, and six and a half hours since Meridian’s press release, National had negotiated some kind secret deal with Rio Tinto. We don’t know the terms of the deal because though it is our money, National ministers don’t think we have a right to the information,

The Government is negotiating a new taxpayer-funded subsidy with Tiwai Point aluminium smelter’s owners and has all but acknowledged its assets sales programme is being used by them to get a better deal on power prices.

State Owned Enterprises Minster Tony Ryall this morning said the Government has opened discussions with the smelter’s ultimate owners global mining giant Rio Tinto in a bid to broker a deal over a variation to the existing electricity contract.

[…]

“With this in mind, the Government has been in contact with Pacific Aluminium’s international parent company Rio Tinto this week to discuss helping to bridge the gap in their positions over the short to medium term, if this could be of assistance in concluding an agreement.”

Mr Ryall indicated the Government had offered Rio Tinto “a modest amount of money to try and help bridge that gap in the short to medium term but there’s still a very big gap in the long term… We’re not interested in subsidising this business in the long term”. – Source

Ryall added,

“…they’re pretty tough negotiators and I’m sure they look at what else is happening in the economy when they make their various decisions…

…”they certainly haven’t got the Government over a barrel.”

Three questions stand out from Ryall’s statement,

- If State subsidies for electricity supply to Rio Tinto’s smelter are “short to medium term” – then what will happen when (if?) those subsidies are lifted? Will shareholders “take a bath” as share prices collapse in value?

- Does Ryall think we are fools when he states that Rio Tinto did not have the government “over a barrel” ?! Is that how National views the public – as morons?

- How much is the “a modest amount of money” that Ryall is referring to?

Perhaps the most asinine comment from Ryall was this, as reported by TVNZ,

“The electricity market is capable of dealing with all the issues relating to the smelter,” said Ryall.

Acknowledgement: TVNZ News – Talks break down over Tiwai smelter contract

Really?! In what way is “the electricity market … capable of dealing with all the issues relating to the smelter” when the government has to step in with what could be millions of dollars worth of subsidies? Is that how “the market” works?!

This blogger has two further questions to put to Minister Ryall. Both of which have been emailed to him,

.

Date: Thu, 29 March 2013, 6.43pm

From: Frank Macskasy <fmacskasy@yahoo.com>

Subject: Re: Your correspondence to Hon Tony Ryall

To: Tony Ryall <Tony.Ryall@parliament.govt.nz>Kia ora, Mr Ryall,

I am in receipt of your emailed letter to me, dated 5 December 2012, regarding the non-funding of certain medications for sufferers of Pompe Disease. Firstly, thank you for taking the time to respond to this issue in a thorough and timely way. Several of your other ministerial colleagues seem to lack that simple etiquette.

I note that, as Minister of SOEs, you have been in direct negotiations with Rio Rinto, and have offered the company subsidised electricity for the “short to medium term”.

This will no doubt cost the taxpayer several millions (hundreds of millions?) of dollars.If National is able to provide such largesse to a multi-national corporation, please advise me as to the following;

1. Why is the same subsidy for cheaper electricity not offered to ALL New Zealanders? Or even those on low-fixed incomes? Why provide a multi-million dollar subsidy just to a billion-dollar corporation when New Zealanders could do with a similar cut in their power bills?

2. In your letter to me, dated 5 December 2012, you point out that,

“While I share your concern for people with Pompe disease, as I advised you in my letter of 22 November 2012, in the current fiscal environment, unfortunately funding is not available for all treatments.”If National has millions of dollars available to subsidise multi-national corporations, them obviously your statement on 5 December 2012 that “in the current fiscal environment, unfortunately funding is not available for all treatments” – is simply not credible.

It is obvious that your government can find money when it wants to. This applies to Rugby World Cup funding, consultants, movie-making subsidies, etc.

As such, I hope you are able to find the necessary funding for medication for people suffering rare disorders.

You are, after all, Minister for Health as well as Minister for State Owned Enterprises.

Regards,

-Frank Macskasy

BloggerPS: Please note that this issue will be canvassed further on the blogsite, The Daily Blog.

.

Minister of Health. Minister for SOEs. Minister for corporate welfare.

Which ‘hat’ will Tony Ryall be wearing today?

And will he find the necessary funding to save the lives of sick New Zealanders?

This blogpost was first published on The Daily Blog on 31 March 2013.

.

*

.

References

NZ Herald: Rio Tinto seeks power deal revision (10 Aug 2012)

Scoop.co.nz: New Zealand Aluminium Smelter’s electricity contract Press Release (9.15am, 28 March 2013)

NZ Herald: Govt steps in to sort out stalled Tiwai power deal (11.15am, 28 March 2013)

NZ Herald: Tiwai stoush may affect Mighty River price (12.00pm, 28 March 2013)

NZ Herald: Govt offser Tiwai subsidy (3.43pm, 28 March 2013)

Related references

NZ Herald: Mighty River share tips $2.36 to $2.75 (20 March 2013)

Related to previous blogposts

Pharmac: The politics of playing god (16 June 2011)

$500,000 a year to keep toddler alive (5 Feb 2013)

Rare disease sufferers want pricey treatments (1 March 2013)

Rare disease takes awful toll on boy (1 March 2013)

Call for an Orphan drugs access policy to overcome Pharmac’s systems failure (28 Feb 2013)

Bill English – do you remember Colin Morrison? (4 Feb 2013)

Related Opinion

NZ Herald – Fran O’Sullivan – Govt intervention doesn’t cut mustard (30 March 2013)

.

.

= fs =

Blogger lays complaint with Commerce Commission – *UP-DATE*

.

Continued from: Blogger lays complaint with Commerce Commission

.

.

On 1 April (not an April Fools Joke) this year, this blogger laid a complaint with the NZ Commerce Commission, regarding National’s dealings with Mighty River Power and Rio Tinto’s Tiwai Pt aluminium smelter.

The complain was as follows,

.

Tony Ryall has recently announced that the NZ Government is intervening directly in negotiations between Meridian Energy and Rio Tinto (which is 80% owner of Tiwai Aluminium Smelter).

Mr Ryall has said,

“With this in mind, the Government has been in contact with Pacific Aluminium’s international parent company Rio Tinto this week to discuss helping to bridge the gap in their positions over the short to medium term, if this could be of assistance in concluding an agreement.

“In the meantime, we understand Meridian’s existing contract with Pacific Aluminium remains in place at least until 1 January 2016 with significant financial and other obligations beyond that.”

Ryall added that “all relevant information – including about the smelter electricity contract – will be reflected in the Mighty River Power offer document which is currently being finalised”.

Source: NZ Herald, Govt steps in to sort out stalled Tiwai power deal ( http://www.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=10874174)

I therefore submit the following;

(1) This appears to be a prima facie case of the NZ Government manipulating the future stock price of Mighty River Power (and other state owned powercos), by offering a subsidy to Rio Tinto.

(2) This subsidy is not available to any other company nor individual.