Archive

Mycoplasma bovis, foot and mouth, National Party, and other nasty germs

.

.

Intro

The Mycoplasma bovis crisis confronting New Zealand is a story that will be dissected and commented on for decades to come.

This was not simply a matter of a bacteria infecting cattle. This was a story on many levels; of flouted rules; a significant inadequacy of the “free market”; critical under-funding by National (no surprises there); and the best silver-lining that farmers could possibly hope for…

The ‘bovis’ hits the fan

22 July 2017: Mycoplasma bovis was first detected on dairy farms owned by the Van Leeuwen Dairy Group, near Waimate, in Canterbury. In what must rank as the Understatement of the Year, Ministry for Primary Industries (MPI) investigator, Kelly Buckle, announced;

”At the moment, we’re pretty confident it’s just on those two farms.”

By 1 August, a second dairy farm in South Canterbury had been confirmed with the infection. An ODT report stated;

The ministry was satisfied the containment measures in place were sufficient to control any spread of the disease from the properties involved.

By 29 May this year, the sobering reality of the outbreak turned earlier optimism of containment into a bleak joke;

The cull will involve 152,000 animals over 1-2 years – or an extra 126,000 on top of the planned cull to date.

[…]

The estimated costs of attempting to eradicate Mycoplasma Bovis [sic] are $886 million over 10 years, against an estimated cost of $1.2 billion to manage the disease over the long term and an estimated $1.3 billion in lost production from doing nothing.

At this point the Government believes that 37 farms have infected livestock and 192 farms in total will face stock culling – 142 in the first year.

But high-risk animal movements have been traced to 3000 farms and 858 are under surveillance.

The ease of spread of the micro-organism quickly revealed a fatal flaw in the administration of our bio-security systems.

NAIT – the system that farmers nobbled

As the infection was detected on one farm after another, it soon became apparent that dairy farmers had either ignored, or been slow to comply with the NAIT (National Animal Identification and Tracing) system of tracking farm animals.

.

.

As Alexa Cook reported for Radio NZ in December last year;

Under the National Animal Identification and Tracing (NAIT) system, all cattle and deer farmers must have stock tagged and registered, and also record and confirm any animals that are bought, sold or moved.

A March 2018 report from Radio NZ found that around half of the country’s farmers were flouting this critical process;

A review of NAIT found only 57 percent of farmers who record their animal movements, do so within the required 48 hours.

Agriculture Minister Damien O’Connor was not happy. He was moved to state the obvious;

“NAIT is an important part of our biosecurity net and it needs improvement.

Mycoplasma bovis is mostly spread through movement of infected cattle from farm to farm. This means cattle traceability between properties is critical to finding all affected animals, and stopping further infection”

O’Connor warned that farmers who ignored NAIT would face fines.

Even Federated Farmers was not impressed with the slackness shown toward NAIT. Waikato Federated Farmers meat and fibre chairperson, Chris Irons, was highly critical of his fellow farmers;

“Let’s be frank – the National Animal Identification and Tracing (NAIT) scheme is not working as well as it should, and the blame lies with farmers.

Yes, NAIT could be easier to use but that’s not an excuse for not keeping animal tracking data up to date.

There are a lot of farmers who say NAIT is waste of time and money. If you have that view then I’m sorry, but I don’t think you care about the farming industry and are probably guilty of not being compliant.

[…]

NAIT currently does a good job of tracking animals that are registered and all their movements recorded on the database. But the system is only as good as the data put into it.

Owners, sellers and third party buyers have to be diligent about recording cattle and deer movements on their NAIT accounts. The system is fit for purpose when the data is up to date, but falls down when it’s incomplete, or not entered at all.

If we have a fast moving outbreak it will be vital to have NAIT working so it’s up to all farmers to ensure they are compliant.”

Chris Irons was correct when he pointed out that “NAIT could be easier to use“. The system is clunky, with stock tags having to be manually scanned and then manually uploaded into the central system. The manual aspect of it makes the system unwieldy and easy to “set aside to do later” – if at all.

Full electronic automation would cost millions, and would raise the question of who would pay. This blogger understands MPI was never adequately budgeted for full automation.

It is unclear who would pay for NAIT to be upgraded; the Ministry or farmers?

By May this year, the full extent of farmers’ undermining of NAIT became apparent. Prime Minister Ardern did not mince her words;

“There was a system in place, it has failed abysmally and we are now picking up the pieces of that.

We want to make sure that first and foremost we deal with the issue at hand and that is Mycoplasma bovis and trying to pin down its spread and still focus on the possibility of eradication. The second question is: How do we prevent this from ever happening again?”

Biosecurity NZ’s spokesperson, Geoff Gwynn, spelled out the consequences of the failure to carry out NAIT processes;

“It’s a reality of New Zealand’s farming system that large numbers of animals are sold and moved across big distances.

This response is serving to underline just how much movement takes place and it is this, coupled with poor record keeping through NAIT that is making our job very challenging.”

In part, the spread of Mycoplasma bovis has been a crisis of farmers’ own making.

The “she’ll be right, mate” attitude simply will not cut it in an age of rapid international travel. Harmful micro-organisms and other pests can easily cross the planet and humanity’s artificial borders within days or even hours, on the back of our 21st century transport technology.

But perhaps the greatest irony is that whilst farmers had been lax sharing critical information on stock movements as per NAIT requirements – they were far less shy demanding information from MPI on what was being done to identify infected farms; eradication/containment of the microscopic invader; and compensation paid out post-haste for culled stock animals.

If farmers had complied with NAIT and provided stock transfer data in a timely and precise fashion, they might not now be in a position where they were braying for information from those same Ministry officials.

The dreaded disease whose name we dare to speak

Waikato Federated Farmers meat and fibre chairperson, Chris Irons, issued this stark warning to his fellow farmers;

“There’s too many farmers who are just ‘oh nah, just don’t want to do it’, but at the end of the day it’s got to be done because that’s the only way we’re going to be able to track any diseases.

If we get something faster than m.bovis – like foot and mouth or something – we’ve got to have a reliable system. At the moment the system is reliant on farmers doing their bit and having their records up to date.”

“Like foot and mouth or something“?!

Mycoplasma bovis is a nasty bug. There is little doubt in that. According to MPI, it is present in most other countries around the world. Only until last year, New Zealand was free of the disease. As MPI graphically described, it has multiple symptoms;

Major syndromes seen in other countries with Mycoplasma bovis include atypical mastitis in cows (both dry and in milk) – (the chance of this disease likely increases with increasing herd size), arthritis in cows and calves, atypical, difficult-to-treat pneumonia in calves, middle ear infection (otitis media) in calves, severe pneumonia of adult cows (usually rare), and abortion. All conditions are difficult to treat once the animal becomes sick.

Yet, Mycoplasma bovis is almost the agrarian version of the common cold when compared to a disease that every animal farmer must live in mortal fear of: foot and mouth (Aphthae epizooticae).

In a 2001 foot-and-mouth outbreak in Great Britain, farms were quarantined and isolated behind Police barriers;

.

.

Movement was curtailed;

.

.

Millions of stock animals were culled and incinerated on massive pyres;

.

Each of those cases meant a farm having all of its livestock killed and burned. By the time the last case was confirmed at Whygill Head Farm in Appleby, Cumbria, on 30 September 2001, more than six million sheep, cattle and pigs had been slaughtered.

.

The Guardian reported just some of the effects on British farmers and businesspeople;

The list of victims is long. At the head of it should be the nearly 3m animals slaughtered and burned, along with the 68,000 cows, sheep and pigs set to follow them on to the funeral pyres. Next on the list would be the clutch of farmers who, despite £125m already pledged in compensation, will be driven out of business by an epidemic that swept through their land as devastating as a tornado. After them, the hoteliers and restaurateurs who saw their livelihoods dry up as the world’s travellers declared Britain a medievally benighted no-go area.

The financial cost was horrendous; £3 billion to the public sector and £5 billion to the private sector.

Tourism income lost/displaced between £2.7 and £3.2 billion. It took nine months to bring foot-and-mouth under control and stop the spread.

Farmers who were not infected with foot and mouth, but still lost income through massive restrictions to livestock movement, were not compensated.

The invisible psychological effects were perhaps the worst;

The disease epidemic was a human tragedy, not just an animal one. Respondents’ reports showed that life after the foot and mouth disease epidemic was accompanied by distress, feelings of bereavement, fear of a new disaster, loss of trust in authority and systems of control, and the undermining of the value of local knowledge. Distress was experienced across diverse groups well beyond the farming community. Many of these effects continued to feature in the diaries throughout the 18 month period.

[…] The use of a rural citizens’ panel allowed data capture from a wide spectrum of the rural population and showed that a greater number of workers and residents had traumatic experiences than has previously been reported.

Despite the effects of Mycoplasma bovis, New Zealand’s meat and dairy exports are largely unimpeded.

That will not be the case if – or more likely – when foot-and-mouth reaches our shores. With tourism numbers at 3.3 million in 2015/16 and expected to reach 4.9 million visitors by 2023, it is only a matter of time when one individual carries the dreaded foot and mouth micro-organism into our country.

If 100% of New Zealand farmers are not 100% compliant with NAIT in the coming years, the nightmarish havoc wrought by a foot and mouth outbreak will be unlike anything Mycoplasma bovis has wrought.

It is a tough lesson, but the farming sector should be thankful of Mycoplasma bovis (and the person who inadvertently imported it). Whatever supernatural deities there might be have delivered a clear warning to us all.

Observe the rules. Follow the NAIT system.

No exceptions.

Or face worse consequences.

National, the Free Market and minimal-government

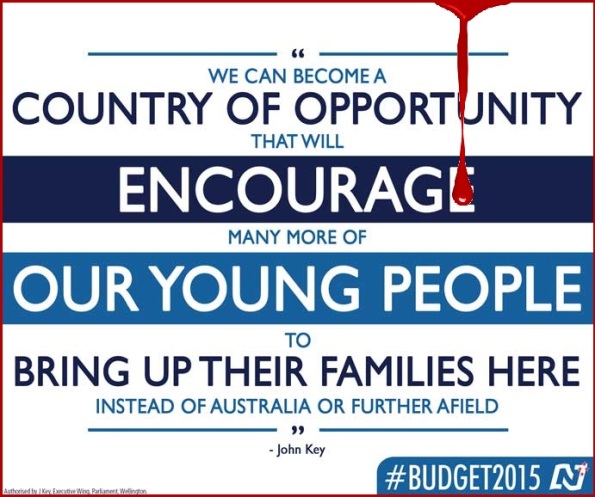

Remember this guy?

.

.

He must be feeling a bit of a right ‘wally’ right now.

As ‘Advantage‘ recently wrote for The Standard;

Remember those Morrinsville farmers who protested against our ‘communist’ Prime Minister? Those are the guys we are feeding our taxpayer dollars towards right now

A Herald report backed up the anonymous blogger’s observation;

The Government will cover 68 per cent costs and the dairy and beef industry bodies the remainder.

The estimated costs of attempting to eradicate Mycoplasma Bovis [sic] are $886 million over 10 years, against an estimated cost of $1.2 billion to manage the disease over the long term and an estimated $1.3 billion in lost production from doing nothing.

Perhaps this US cartoon best shows how those with a distrust of “big government” (or any government) in their lives suddenly have a remarkable Road-to-Damascus conversion when faced with a crisis beyond their abilities to manage;

.

.

Left to the ‘tender mercies’ of a small government, an unfettered free market, and minimal state involvement, how much could farmers expect as compensation for a disease outbreak and culling of their stocks?

Easy answer: nil. As in nothing.

They would be expected to buy their own insurance. User pays would be the rule.

Whether a farmer with an infectious disease would notify authorities (whether such “authorities” would even exist in a minimalist government is a moot point) without compensation, or any other personal benefit, would be an interesting question.

In a purist free market where everyone looks out for him/herself, what would be the incentive to act for the “greater good” of other people?

Fortunately we still have a State and the remnants of collective responsibility when faced with overwhelming circumstances.

Whether a person is a solo mother living in a State house or a farmer with a ten million dollar investment – the State exists to protect it’s citizens when faced with crisis beyond their coping abilities.

The next time farmers read a media story of a State house tenant unjustly turfed out of their home, or a welfare recipient who has been abused by WINZ until driven to suicide – they should pause for a moment. Perhaps their sympathies may now be just a little closer aligned with those at the bottom of the socio-economic heap.

National – the party of preference for most farmers – has said on multiple occasions that state assistance should be “targeted“; that tax-payers dollars should only go to those who are most-in-need (even though National then demonises those very same people-in-most-need).

In a free-market, small-government world, a minimal amount of state assistance might be channeled to the poorest of the poor. Just a barely sufficient amount to stave off starvation and prevent embarrassing piles of corpses from inconveniently cluttering up the streets. But state assistance to compensate farmers?

Forget it.

At election time, farmers should think carefully before ticking the Party box. They should ask themselves;

How small do they really want government to get?

In the meantime, our farming friend above should consider changing the text for his next sign;

.

.

A little appreciation goes a long way.

Vote Biosecurity

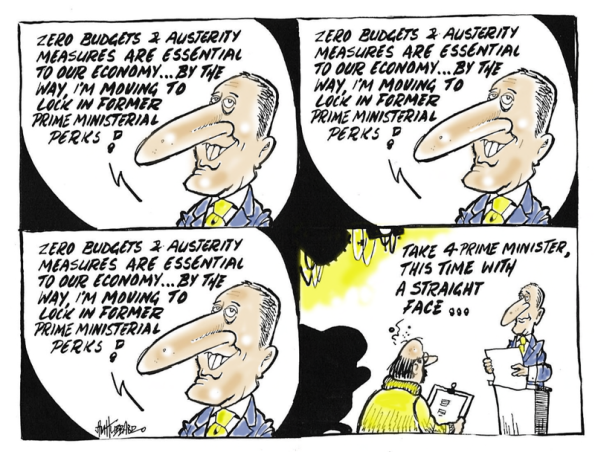

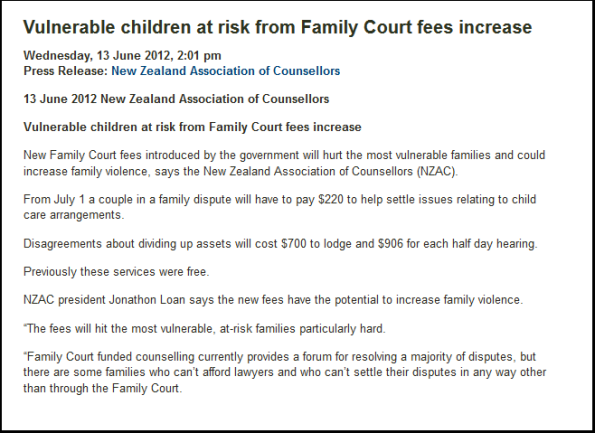

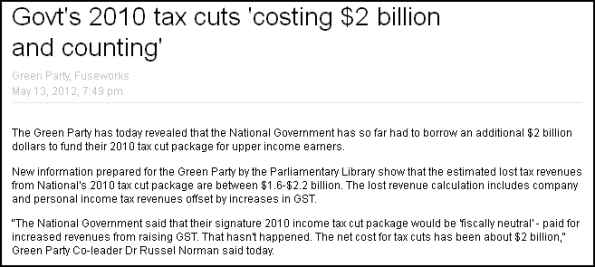

As the twin effects of the 2007/08 Global Financial Crisis and two tax cuts in 2009 and 2010 impacted on government tax revenue, National was forced to break one of its election promises. It cut back on spending and public services.

It soon became apparent that no part of the State sector would be untouched by National’s then-Finance Minister, Bill English, as Richard Wagstaff of the PSA explained;

The Public Service Association is concerned about the significant risks involved in cutting jobs at MAF Biosecurity, whose staff work on our borders protecting New Zealand’s multi-billion dollar agriculture sector from pests and diseases.

MAF Biosecurity has today announced that’s its disestablishing around 60 jobs by cutting 30 filled positions and disestablishing 30 vacant positions. MAF Biosecurity says the job cuts are in response to falling trade and passenger volumes.

“But the government is also responsible for these job losses as it cut the baseline funding for MAF Biosecurity by $1.9 million in the Budget delivered in May,” says PSA national secretary Richard Wagstaff.

“Our concern is that the New Zealand’s economy depends on our farming and horticulture industries that could be decimated if diseases like foot and mouth and fruit fly got into the country.”

“MAF Biosecurity staff work to prevent these diseases and pests from crossing our borders so it’s vital that these job cuts don’t weaken our defences in this area,” says Richard Wagstaff.

Richard Wagstaff’s stark warning became a grim reality as fruit flies, moths, the psa virus, and then Mycoplasma bovis crossed our weakened border controls.

It is difficult to make direct comparisons with some of the data from National’s Budgets. Categories were changed from the 2009 Budget to the 2010 Budget onward. Much of the budgetary allocations were “buried” with Vote Primary Industries.

However, it is clear that two overall categories can be compared;

- Border Clearance Services and Border Biosecurity Monitoring and Clearance

- The overall total of budgetary allocations to biosecurity which from 2012 onward were obtained from the Summaries of each document.

The figures appear to show a steady decline in biosecurity funding from 2008 (Labour’s Michael Cullen’s last budget) to 2014, of thirteen million dollars. This is not accounting for inflation, which would mean an even greater decline in funding levels.

.

Note A: From Budget 2012, Vote Biosecurity was merged with Vote Agriculture & Forestry, and Vote Fisheries into the Vote Primary Industries.

Note B: Linked references to Budget documents listed below..

.

Corresponding international visitor arrivals continued rising (with only a slight drop in 2009, post-GFC).

Annual imports fell post-2008,but regained steadily after 2011. By 2013, imports had all but returned to 2008 levels (not taking inflation into account).

What is clear is that biosecurity does not appear to have been adequately funded. National’s cost-cutting (until 2013 and 2014) must have impacted on our ability to monitor and prevent pest incursions.

This would appear to coincide with the appearance of several destructive pests recently;

- PSA virus in November 2010

- Queensland fruit fly in February 2015

- Red clover casebearer moth, late 2015

- Tau fly, January 2016

- Eucalyptus variegated beetle, March 2016

- Velvetleaf, March 2016

- Pea weevils, April 2016

- Culex sitiens mosquito, March 2018

Whatever “savings” National made by cutting back on biosecurity were, by definition, false economies. Once again, cuts to an essential state sector service inevitably created grave consequences.

This time for our farming sector.

The next time National promises tax cuts at election time and to make “efficiencies” to “do more with less“, this is a lesson that the farming sector should remember with some bitterness.

.

.

.

Those so-called “cost-savings” didn’t come cheap. A fact farmers should bear in mind when it comes time to cull herds exposed/infected with Mycoplasma bovis.

Acknowledgement: thank you to a certain scientist who gave her time to proof-read my article and offer constructive criticism.

.

.

.

References

Wikipedia: Mycoplasma bovis

NZ Herald: Confidence mycoplasma bovis outbreak contained

ODT: Another meeting as second farm infected

NZ Herald: MPI will face ‘don’t give a damn’ attitude on M. Bovis, farmer says

Radio NZ: Incomplete farm records slow tracking of cattle disease spread

Radio NZ: Farmers face checkpoints in effort to stop cattle disease

Fairfax media: NAIT responsibility – the buck stops with farmers

Radio NZ: M Bovis spread – Tracking system has ‘failed abysmally’ – PM

NewstalkZB: Farmer slams Govt over bovis communication

MPI: Two-page summary of Mycoplasma bovis

Wikipedia: 2001 United Kingdom foot-and-mouth outbreak

The Guardian: The news from Ground Zero – foot and mouth is winning

BBC: When foot-and-mouth disease stopped the UK in its tracks

The Guardian: A catalogue of failures that discredits the whole system

National Audit Office: The 2001 Outbreak of Foot and Mouth Disease

NCBI: Economic costs of the foot and mouth disease outbreak in the United Kingdom in 2001

MoBIE: New Zealand Tourism Forecasts 2017-2023

Radio NZ: Man still repaying debt from unnecessary HNZ meth eviction

Fairfax media: Aggressive prosecution focus at MSD preceded woman’s death, inquest told

National Party: Low income earners to subsidise homes for wealthy

National: Achievements – Social investment

NZ Herald: Food parcel families made poor choices, says Key

Mediaworks/Newshub: Labour – Key promised no job cuts, asset sales in 2008 speech

Fairfax media: Jobs expected to go in state sector cuts

Scoop media: Risks involved in cutting MAF Biosecurity jobs

NZ Herald: New Zealand fruit fly free after successful operation

MPI: Red clover casebearer moth

Mediaworks/Newshub: Crown opens case in kiwifruit claim over Psa virus outbreak

NZ Treasury: Budget 2008 – Vote Biosecurity

NZ Treasury: Budget 2009 – Vote Biosecurity

NZ Treasury: Budget 2010 – Vote Biosecurity

NZ Treasury: Budget 2011 – Vote Biosecurity

NZ Treasury: Budget 2012 – Vote Primary Industries (inclu Biosecurity)

NZ Treasury: Budget 2013 – Vote Primary Industries (inclu Biosecurity)

NZ Treasury: Budget 2014 – Vote Primary Industries (inclu Biosecurity)

NZ Treasury: Budget 2015 – Vote Primary Industries (inclu Biosecurity)

NZ Treasury: Budget 2016 – Vote Primary Industries (inclu Biosecurity)

NZ Treasury: Budget 2017 – Vote Primary Industries (inclu Biosecurity)

NZ Treasury: Budget 2018 – Vote Primary Industries (inclu Vote Biosecurity)

NZ Treasury: Budget 2012 – Introduction – Estimates of Appropriations 2012/13

Statistics NZ: Exports and imports hit new highs in 2017

Statistics NZ: International visitor arrivals to New Zealand – 2008 – 2018 (alt. link)

NZ Herald: Kiwifruit disease Psa explained

MPI: Pea weevil

MPI: Eucalyptus variegated beetle

Fairfax media: Velvetleaf, one of world’s worst weeds, confirmed on three Waikato farms

MPI: No further Tau flies found and restrictions now lifted

Radio NZ: English hints at further tax cuts

NZ Herald: Key pledges state service shake-up

Scoop media: Speech – John Key – Better Public Services

Additional

Wikipedia: Biosecurity in New Zealand

MPI: Keeping watch

Radio NZ: Failings in NZ’s stock tracking system (audio)

Radio NZ: Cattle and oysters – a catalogue of issues: Damien O’Connor (audio)

Radio NZ: One in five farmers ignoring safety regs – WorkSafe

Other Blogs

The Standard: It’s Time for a Cost-Benefit Analysis of Dairy Farming

Previous related blogposts

.

.

.

.

This blogpost was first published on The Daily Blog on 15 June 2018.

.

.

= fs =

The Mendacities of Ms Amy Adams – “hidden borrowing”?!

.

.

National is at it again; indulging in rank hypocrisy by criticising the Labour-NZ First- Green Coalition Government of policies that they themselves carried out.

This time, the National Party’s finance spokesperson, Amy Adams, has accused the Coalition Government of “hiding away debt” in SOEs. Speaking to Mediawork’s Newshub, she protested;

“…If you actually look at where Grant Robertson has hidden another six billion dollars of borrowing in Crown entities, total borrowing has actually gone up almost $17 billion. And if you look at it in that way, it’s going to take up our debt-to-GDP ratio to above the 20% target in 2022. So I think he’s being very tricky in fudging the numbers and hiding $6 billion more debt in that Crown entity space.”

Ms Adams has apparently “forgotten” that the previous National government did precisely what she is now alleging that the Coalition is doing.

By 2009, the Global Financial Crisis began to heavily impact on the National Government’s tax revenue. Except for GST, company, individual, duties, and other revenue were down;

.

.

Despite the fall in taxation and other revenue, National proceeded with it’s first tranche of tax cuts in April 2009. According to then-Finance Minister, Bill English, the 2009 tax cut represented a $1 billion loss of revenue to the National government;

“About 1.5 million workers will receive a personal tax cut, injecting an extra $1 billion into the economy in the coming year.”

This presented a serious problem for National, as it was borrowing $450 million per week, by December 2009, according to BNZ Capital economist, Craig Ebert.

This left National in dire straits. Government revenue was collapsing; borrowing was ballooning – and worse was to come. National had tax cuts planned for the following year. They would be estimated to cost government at least $2 billion in lost revenue.

National’s Cabinet came up with a novel ‘solution’: State-owned enterprises would be treated as ‘cash cows’. Each SOE would be instructed to borrow to their maximum limit and “… release all surplus capital to the shareholder as special dividends“.

In May 2009, then-SOE Minister, Simon Power, issued this letter to all relevant state owned enterprises. Note the red-highlighted portions;

.

.

.

.

(Please note that the above version differs slights from the text provided in the NZ Herald version. Some of the redactions above re-appear in the NZ Herald version.)

By November 2011, a Treasuring scoping-study revealed that Solid Energy was experiencing severe financial problems. National’s Ministers were officially advised of Solid Energy’s precarious financial state, but this would not become public knowledge until two years later, in February 2013.

By August 2015, Solid Energy was placed into voluntary administration. By March this year, the liquidation process was near to completion.

Interestingly, the Herald story announcing the final stages stages of liquidation stated only;

Solid Energy first started its downward spiral in 2013 when global coal costs plummeted, exposing its commercial error in carrying substantial debt on its balance sheet.

There was no mentioned of the tens of millions of dollars expropriated by the National government after it’s letter-of-demand from Simon Power in 2009.

Neither was there a mention of the debt levels forced upon Solid Energy;

Solid Energy’s gearing ratio [borrowings] was 13.8 per cent in 2009, but that rose to 34.4 per cent in 2010 and 41.7 per cent last year [2012].

In fact, Solid Energy was bankrupted not only because of it’s high debt levels (four times higher than in 2008/09), but because National demanded 65% of cash reserves to be paid to the government as “special dividends”, as the CCMAU document below shows;

.

.

Solid Energy had meagre cash reserves remaining when the international price of coal fell, reducing it’s income.

Neither did it help when National abruptly reneged on it’s subsidy to Solid Energy to generate bio-fuels. National implemented it’s subsidy in 2008 – and scrapped it in 2012.

That decision left Solid Energy with a bio-fuels subsidiary (Biodiesel New Zealand) that was suddenly uneconomical to produce.

Adding insult to injury, and perhaps one of former Dear Leader John Key’s worst case of misdirected blame-gaming, he lamented the collapse of Solid Energy;

“The causes of the financial crisis at Solid Energy are the usual suspects in failing businesses – too much debt, unsuccessful investments and no reserves to weather a slump in coal prices.

Prime Minister John Key’s comments yesterday indicated these problems and pointed the finger at an imprudent amount of debt and investments that have not returned any cash yet.

Key said the debt had climbed to $389 million when “typically coal companies do not have a lot of debt on their balance sheets”.

Through incompetence; election year tax bribes that sent sovereign debt soaring and government deficits ballooning; SOE management that failed to assert independence from Ministerial interference; a willingness to strip SOEs of their cash; and demanding that they ramp up their “gearing” (borrowing/indebtedness) – like a fiscal vampire, National sucked Solid Energy dry.

So that combined with the removal of biofuels subsidies and a collapse in international coal prices, the final ‘leg’ of the three-legged stool – unsustainable debt and depleted cash reserves – was enough to send Solid Energy spiralling down into bankruptcy.

It is against this backdrop of “hidden borrowing” by National, that undermined and destroyed one SOE, that Ms Adams is now accusing the Coalition government of the same thing.

National has a distinctly predictable habit of blaming it’s political opponents for behaviour that it itself is guilty off.

Accordingly, Ms Adams wins this dubious “merit award”…

.

.

Postscript: Amy Adams was elected into Parliament on 8 November 2008. She therefore shares collective responsibility for the demise of Solid Energy, along with her colleagues, Bill English, John Key, Tony Ryall, and Simon Power.

.

.

.

References

Mediaworks/Newshub: Govt not honest about debt in new Budget – Amy Adams

IRD: Revenue collected 2008 to 2017

Scoop media: Rankin -Tax Cuts 2009-2011

Scoop media: Government delivers April 1 tax cuts, SME changes

Otago Daily Times: Government now borrowing $450 million a week – claim

NBR: Key again defends tax cuts

Scoop media: Govt’s 2010 tax cuts costing $2 billion and counting

NZ Herald: Simon Power letter to SOEs, May 2009

Treasury NZ: Treasury Report T2011/2373: Solid Energy New Zealand Scoping Study Report

Fairfax media: Solid Energy in debt crisis talks

Fairfax media: Solid Energy announces voluntary administration ahead of sale

NZ Herald: Solid Energy enters final stages of liquidation process

Fairfax media: Ministers pressured Solid Energy, Parliament told

Treasury: Solid Energy Information Release March 2013 (Document 1875419)

Fairfax media: Biodiesel loses subsidy, prices to rise

NZ Herald: Solid Energy half year profit down as coal export price falls

Fairfax media: State miner to return to coalface

Additional

Other Blogs

The Standard: The real reason Solid Energy is failing

The Standard: Has John Key jumped the shark?

Previous related blogposts

Solid Energy – A solid drama of facts, fibs, and fall-guys

Solid Energy and LandCorp – debt and doom, courtesy of a “fiscally responsible” National Govt

.

.

.

.

This blogpost was first published on The Daily Blog on 21 May 2018.

.

.

= fs =

Tracy Watkins – Getting it half right on the “Decade of Deficits”

.

.

Writing in the new, tabloid compact-sized Dominon Post on 2 May, political columnist Tracy Watkins mentioned the oft-parroted cliche from the Right, the so-called “decade of deficits”;

“Labour spent years in the wilderness after the global financial crisis gave it a “decade of deficits” as its legacy.”

Watkins left out a crucial factor in National’s ongoing deficits – a fact to be pointed out;

.

from: Frank Macskasy

to: Dominion Post <letters@dompost.co.nz>

date: 5 May 2018

subject: Letter to the editor

.The Editor

Dominion Post

.Tracy Watkins’s recent opinion piece referred to “decade of deficits” as Labour’s “legacy” in 2008 (1 May). She fleetingly mentioned the Global Financial Crisis as a contributing factor. English himself called the GFC “the deepest, most synchronised recession since the 1930s”.

Nowhere did Watkins mention that Labour’s finance minister paid down this country’s government; posted eight surpluses in a row; as well as funding long-term initiatives such as Working For Families (essentially a tax cut) and NZ Super fund.

Watkins resurrected the tired old fictional trope of Labour’s “first budget is all about playing to the wider masses to show it can be trusted with the chequebook”.

What was also missing was another crucial contributing factor to the so-called “decade of deficits” – a term first coined by former PM, John Key and National’s pollster, David Farrar, in October 2008.

The missing factor were the tax cuts of 2009 and 2010, which reduced government tax revenue by several billions of dollars. The 2010 cuts alone slashed tax revenue by an estimated $2 billion pa.

A Regulatory Impact Statement from Treasury, dated 9 December 2008, warned National;

“With a deteriorating global economic out look New Zealand is expecting weaker economic growth in the next few years, resulting in slower tax revenue growth and increased government expenditure.”

National borrowed billions to make up the shortfall – in essence funding taxcuts through offshore bankers.

So who is it that cannot be “trusted with the chequebook”?

.-Frank Macskasy

[citations, address, and phone number supplied]

.

.

.

References

Fairfax: Why Labour isn’t about to fall for the ‘spend more’ honey trap

Fairfax: Tax cuts off as Govt fights recession

Kiwiblog: PREFU – Ten years of deficits

Fairfax media: Nats blame Labour for ‘decade of deficits’

Infonews: Government’s 2010 tax cuts costing $2 billion and counting

Additional

The Atlantic: Tax Cuts Don’t Lead to Economic Growth, a New 65-Year Study Finds

Previous related blogposts

That was Then, This is Now #19 – A “Decade of Deficits”

.

.

.

.

This blogpost was first published on The Daily Blog on 10 May 2018.

.

.

= fs =

Newsflash: apparently our public hospital system is in crisis?!

.

.

A NZ Herald front page headline on 22 February screamed out to anyone who cared to read – or perhaps even just happened to glance at the paper;

.

.

Written by veteran Herald political reporter, Audrey Young – the on-line version’s headline was considerably more restrained;

.

.

Regardless of headlines, the content confirmed years of media reports and countless blogposts on The Daily Blog, The Standard, and elsewhere, that New Zealand’s public healthcare system was critically under-funded; over-stretched; and staff were burning out from over-work. The story confirmed nine years of National’s gross under-funding and mis-management of the health system as successive ministers demanded that DHB managers and health-workers “do more with less”;

The Government said total health spending would be a record $16.77 billion in 2017/18 – an increase of $879 million, with an overall increase of $3.9b over the next four years.

However, the record claim does not take inflation into account, and sidesteps the fact that almost half the spending will go toward mandated wage increases as part of the pay equity settlement.

[…]

Meanwhile, mental health workers and union representatives said the funding was only a fraction of what was needed to adequately respond to demand.

Social worker Andy Colwell said he expected to see the gap between demand and funding get even worse as a result of Budget 2017.

“As a mental health worker, seeing families struggling with life-threatening situations not being seen as urgent is incredibly frustrating, and knowing it will get worse is incredibly distressing,” Colwell said.

Healthcare workers made their cries of frustration heard clearly and unequivocally;

A survey of almost 6000 paramedics, nurses, mental health workers and support staff earlier in 2017 found 90 per cent felt the healthcare system was understaffed and under-resourced.

Some said they feared burnout could be jeopardising patient safety, and 72 per cent said their workload was not reasonable.

Gordon Campbell wrote on 3 April;

Week by week, the sheer scale of the neglect to crucial social infrastructure by the Key/English government becomes apparent – and with it the size (and expense) of the problems they’ve left behind, for the Ardern government to somehow address. The mouldering walls and the decaying electricity and sewage systems at Middlemore Hospital serve as a perfect symbol of the dilapidation that’s been fostered by pressure to meet the political goals of budgetary constraint. All of it done so that John Key and Bill English could brag about being capable managers, who kept expenditure under control – as if balancing the books was an end in itself.

Meanwhile at Middlemore, the necessary investments in maintenance were being deferred – as they have has been in DHBs all around the country, in order to prop up the illusion of competence by a government always far more interested in delivering another round of tax cuts, if it possibly could. It didn’t want to hear bad news. Its managers in public health heard that, and obeyed orders.

Since National changed leaders, the same illusion has been perpetuated by Simon Bridges, who cited National’s claim to be “good economic managers” in his first statements as leader.

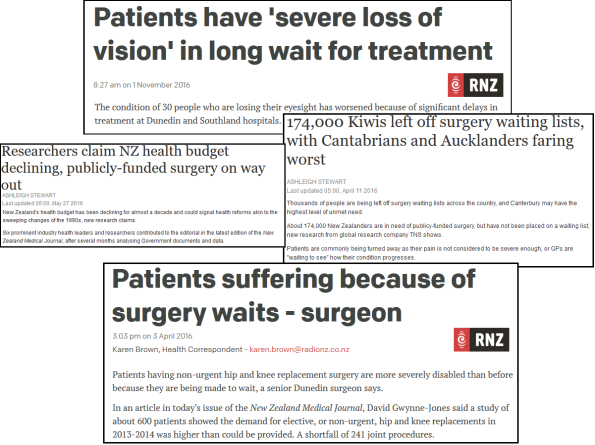

Over the last two years, Radio NZ featured a series of hard-hitting, critical stories examining growing waiting lists and worsening under-funding at the various DHBs around the country. The reports were damning;

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

This year, DHB Boards mustered the courage to disclose the full extent of under-funding. Our dilapidated hospital buildings were literally rotting from within;

.

.

On top of stretched services; lengthening waiting lists; and stressed medical staff, the full extent of the public health nightmare became apparent, as revelation after revelation was made public;

.

.

.

.

.

.

Noticeably, it was this country’s non-commercial broadcaster, Radio New Zealand, that led the steady expose on the crisis in our public health system. Other media outlets picked up on the issue, belatedly, albeit based on Radio NZ’s sound investigative reporting;

.

.

A subsequent Fairfax editorial was damning of the previous National government;

.

.

The un-named editorial writer sheeted home responsibility for this mess firmly where it belonged;

The new Government has inherited these problems from a National Government that prided itself on running a tight financial ship. Even as recently as this week, when worsening news about Middlemore appeared in the media, new National leader Simon Bridges stuck to a script about prudent financial management and passed the buck back to Prime Minister Jacinda Ardern and Health Minister David Clark.

But the responsibility for this and other problems of underfunding and general neglect in the health system really need to be sheeted home to former Health Minister Jonathan Coleman, who has already signalled his departure from politics for the private health system. Many National MPs are said to quietly blame Coleman for their 2017 election result as both health and mental health became political quagmires.

The editorial echoed Gordon Campbell’s earlier blogpost, and those of other bloggers over the last nine years. This blogger has consistently pointed out that the 2009 and 2010 tax cuts implemented by National created a fiscal hole; forced increased borrowing; and corresponding under-funding/cuts to public services;

.

.

.

As this blogger reported in January last year (2017);

A decade late, National’s ongoing cuts, or under-funding, of state services such as the Health budget have resulted in wholly predictable – and preventable – negative outcomes;

.

.

In response, National’s current, caretaker Leader, Simon Bridges attempted to mitigate his Party’s shocking record of incompetance by repeating the oft-parrotted, mythical mantra of National’s “good economic management“;

“But remember we didn’t have all the choices that this government’s blessed with from a very strong legacy from good economic management.

We had to get through a [global financial crisis,] we had to get through earthquakes.

Now we are in actually a relatively blessed period with strong surpluses, it’s for this government to look at how they do this”

Bridges seemed utterly oblivious as to why “we are in actually a relatively blessed period with strong surpluses“. Those so-called “surpluses” were at the expense of rotting hospital buildings and under-funded services and medical staff. He seemed wholly blind to the social costs incurred in National’s single-minded mania to create “surpluses”.

Bridges’ attempt to deflect to the GFC ignores the critical fact that National stubbornly proceeded with it’s reckless promises of tax cuts that – as predicted – eventually proved to be unaffordable.

Even right-wing commentator, Matthew Hooton panned Bridges’ comments on Radio NZ’s Nine To Noon political panel, saying;

“That was his worst Morning Report interview so far…”

Hooten also dismissed former Health Minister Coleman’s claims not to have been informed of Middlemore Hospital’s dire building crisis as “hopeless”.

Hooton suggested that rather than National’s 2017 election year bribe for more tax cuts, that the focus should have been on writing off DHB debts and more social spending. He believed that offering tax cuts was the reason National was no longer in government;

“That was the wrong call.”

He has a point – a point that many commentators on the Left have been banging on for nearly a decade.

It should be abundantly clear to all by now that National’s strategy of tax-cuts was simply to win votes at election time. It was a successful tactic during the 2008 election;

National will fast track a second round of tax cuts and is likely to increase borrowing to pay for some of its spending promises, the party’s leader John Key says.

But Mr Key said the borrowing would be for new infrastructure projects rather than National’s quicker and larger tax cuts which would be “hermetically sealed” from the debt programme.

[…]

National is yet to explain how it will pay for the promised larger cuts.

And they tried it on again last year;

Prime Minister Bill English is talking tax cuts – saying “something will be covered” in the upcoming Budget and any changes would take effect from April 1 next year.

“There will certainly be something covered in [May’s] Budget. Look, there’s not going to be some big sugar shock with tax cuts. We have a range of tools, we want to be able to help and support low and middle income families,” Mr English told Newstalk ZB.

Had it not been for NZ First coalescing with Labour and thew Greens, National’s planned tax cuts might well have proceeded. And the rotting buildings at Middlemore would have continued to decay; waiting lists throughout the country continued to lengthen; and increasing numbers of front-line staff burning out.

However, there is an aspect far worse than the opportunistic use of tax-cuts as electoral bribes by a National Party hell-bent on re-election at any cost.

That is that District Health boards have not made these problems public earlier.

Waiting for incoming Labour-led governments to finally ring alarm bells by announcing;

“We have been facing this for years and every year make savings or defer capital or struggle to get permission to get capital through the [Ministry of Health] capital investment committee.

– appears to be an act of cowardice.

Auckland District Health Board states that it’s “strategic priorities” are;

- People, patients and whānau at the centre.

- Values and equity underpin everything we do.

- Guarantee quality and safety.

- Get the best outcomes from our resources.

- Hold people, systems and structures to account.

Fine words. But have they been followed through?

When District Health Boards fail to make clear to central government that funding for public healthcare is inadequate; that there is a crisis in offering services in a timely fashion; that buildings and equipment cannot be kept to a high standard; that staff are over-worked and leaving in droves – then they have abrogated their duties to their communities; their employees; and to those vulnerable people who desperately seek medical assistance.

Waiting for a change in government is not a viable option.

Appropriate funding for DHB services must be the the number one duty of every Board member and Chairperson, irrespective of which hue the government-of-the-day is.

Acquiescence in the face of a Minister expecting (and demanding) a surplus from DHBs is not a viable option.

We, the public, expect our DHB Boards to look after our interests – not those of Ministers with their eye on re-election.

If DHB Boards cannot find the inner courage to speak out on our behalf, to demand appropriate funding, then they should resign. Step aside and let others do the job. After all that is said and done, people’s lives are at stake.

Silence should never be a viable option.

.

Acknowledgement

I acknowledge and thank the hard-work of Radio New Zealand staff who have brought to our attention the current abysmal state of our public health system. This is indeed the role – the raison d’être of the existence of public broadcasting. Your dedication to bring us the truth may have saved lives.

.

.

.

References

NZ Herald: Huge demand for services in Auckland stretches health system to the limit say bosses

Fairfax media: Counties Manukau district health board in financial crisis

Fairfax media: Frustration, disappointment over health funding in Budget 2017

Fairfax media: Nine in 10 healthcare workers feel understaffed and under-resourced

Radio NZ: Eye patient delays a nationwide problem – specialists

Radio NZ: Eye check-up delays: ‘Within that time, I went blind’

Radio NZ: Damning report on delayed eye appointments released

Radio NZ: Eye patients forced to sit on floor at overcrowded clinic

Radio NZ: Health Minister defends number of ICU beds

Radio NZ: Man waits five months for urgent cancer surgery

Radio NZ: ‘People will die waiting for the attention they need’

Radio NZ: Southern DHB in a ‘slow motion train crash’

Radio NZ: Dunedin Hospital surgeons operate only twice a month, surgeon says

Radio NZ: Minister refuses to apologise for ‘toxic’ DHB comment

Radio NZ: Southern DHB to implement all recommendations in scathing review

Radio NZ: ‘I had a death sentence hanging over my head’

Radio NZ: Prostate cancer patients face wildly varying wait times

Radio NZ: Southern DHB commits to clearing patient backlog

Radio NZ: Health Minister responds to ‘unacceptable’ delays at Dunedin Hospital

Radio NZ: ‘Megaclinics’ planned for Dunedin urology patients

Radio NZ: Akl DHB defends work culture, ‘rubs salt in wound’

Radio NZ: DHBs warn funding crisis may worsen

Radio NZ: Doctors push to reduce wait time for mental health patients

NZ Herald: Rot, mould and sewage at Middlemore: Health minister ‘disappointed’ he wasn’t told

RNZ: Hospital rot was ‘fully disclosed’ to board, ministry – former boss

RNZ: Hospital rot – Sewage leaks linked to 2014 outbreak

RNZ: Middlemore maintainance a ‘bloody nightmare’ – ex-manager

RNZ: Middlemore building woes worse than first thought

Fairfax: Health system underfunding worse than PM expected, as more problems uncovered at Middlemore Hospital

Fairfax media: Middlemore is a bleak symbol of health failure

Radio NZ: Patients have ‘severe loss of vision’ in long wait for treatment

Fairfax media: Researchers claim NZ health budget declining, publicly-funded surgery on way out

Radio NZ: Patients suffering because of surgery waits – surgeon

Fairfax media: 174,000 kiwis left of surgery waiting lists with Cantabrians and Aucklanders faring the worst

Radio NZ: New govt ‘blessed’ with National’s surpluses – Simon Bridges (alt.link)

Radio NZ: Political commentators Matthew Hooton and Stephen Mills (alt. link)

NZ Herald: Nats to borrow for other spending – but not tax cuts

Otago Daily Times: Tax cuts would take effect from April 2018 – PM

Auckland DHB: Who We Are

Radio NZ: DHB vacancies likely even higher than 400

Additional

NZ Medical Journal: Funding New Zealand’s public healthcare system – time for an honest appraisal and public debate

World Health Organisation: New Zealand cuts health spending to control costs

Infonews: Government’s 2010 tax cuts costing $2 billion and counting

Fairfax media: Government to urgently establish new health advisory group

Other Blogs

The Jackal: National has failed our health system

Werewolf: Gordon Campbell on Middlemore Hospital as a symptom of neglect

Previous related blogposts

12 June – Issues of Interest – User pays healthcare?

The Mendacities of Mr Key # 19: Tax Cuts Galore! Money Scramble!

Cutting taxes toward more user-pays – the Great Kiwi Con

The cupboard is bare, says Dear Leader

.

.

.

.

This blogpost was first published on The Daily Blog on 8 April 2018.

.

.

= fs =

St. Steven and the Holy Grail of Fiscal Responsibility

.

.

National’s Steven Joyce is up to his old tricks, pontificating and lecturing the new Coalition government on “fiscal correctness”…

.

.

Which called for this timely reminder to the former Minister of Finance…

.

from: Frank Macskasy <fmacskasy@gmail.com>

to: NZ Herald <letters@herald.co.nz>

date: 22 November 2017

subject: Letter to the editor.

The editor

NZ Herald.

Former Finance Minister, Steven Joyce, rails against the Coalition government’s plans to introduce a regional fuel tax for Auckland, claiming;

“Because if they controlled their costs properly they’d be able to have the sort of money, the $150 million a year that a regional fuel tax would generate, they’d have that in surplus if they just ran the council properly.

… ‘hey get your costs under control’.” (Radio NZ: “Auckland Council could avoid fuel tax – National Party”)

This is the same minister whose previous government racked up $70 billion in debt during their nine years term – exacerbated by two unaffordable tax cuts in 2009 and 2010, and increasing debt by $2 billion each year. (Scoop media: “Govt’s 2010 tax cuts costing $2 billion and counting”) In effect, National borrowed money – up to $450 million per week in 2009 – from offshore to put into the pockets of mostly top income earners.

Which made a mockery of John Key’s claim in August 2008 that National’s planned tax-cuts would be “hermetically sealed” from the rest of National massive borrowing plans. (NZ Herald: “Nats to borrow for other spending – but not tax cuts”)

Let’s hope the Auckland Council doesn’t follow National’s appalling record of “controlling their costs properly”. It would bankrupt the city.

.-Frank Macskasy[address and phone number supplied]

.

Each time the Nats open their mouths to carp about the Coalition’s reforms, it is a delight to remind them of their own pitiful track record over the last nine years. And for Steven Joyce, I offer his very own:

.

.

.

.

Postscript

It appears that Mr Joyce has taken offence at something I’ve said. The poor fragile flower has blocked me from his Twitter account;

.

.

It is highly reassuring to know that I have been noticed by those in high office. And amusing to realise just how incredibly thin-skinned they are.

My work continues.

.

.

.

References

Radio NZ: Auckland Council could avoid fuel tax – National Party

Scoop media: Govt’s 2010 tax cuts costing $2 billion and counting

ODT: Government now borrowing $450 million a week – claim

NZ Herald: Nats to borrow for other spending – but not tax cuts

Twitter: @stevenljoyce

Other blogs

Werewolf: The Myth of Steven Joyce

Previous related blogposts

Key & Joyce – competing with Paula Bennett for Hypocrites of the Year?

Steven Joyce – Hypocrite of the Week

Letter to the Editor – Steven Joyce, Hypocrite of the Year

Steven Joyce rails against low mortgage interest rates; claims higher interest rates “beneficial”

Dollars and sense – Joyce’s hypocrisy

.

.

.

.

This blogpost was first published on The Daily Blog on 25 November 2017.

.

.

= fs =

Dollars and sense – Joyce’s hypocrisy

.

.

You’d think that after the humiliation of being dumped from government, that National’s ex-Ministers would keep a relatively low profile in the next few months.

You’d think that National’s former ministers and backbenchers would be familiarising themselves with their newly-appointed roles as impotent Opposition MPs.

You’d think that National’s members of parliament would be nursing massive, Jupiter-sized hang-overs after drowning their collective sorrows at being turfed out of office by the ungrateful peasantry.

Not so.

Former Economic “Development” Minister in the Former National Government, Steven Joyce, has been busying himself critiquing the recently-elected, newly-sworn-in, Labour-Green-NZF coalition.

Even before the dust settled on the recent election; the subsequent swearing-in ceremony at the Governor-General’s residence on 26 October, and only three days since the new government ministers have barely moved into their new offices, Joyce has been making mischief like a spoiled brat.

On 30 October, Joyce demanded;

“Mr Robertson has done two long-form interviews over this weekend and yet New Zealanders are still none the wiser about the cost of the coalition’s programme and the impact on their back pockets.”

He added,

“They also have a right to know whether the new Government’s spending plans in actual dollars will match the cast-iron commitments Labour repeatedly made before the election.”

Now bear in mind that this is the same National (ex-)government that, in 2008, campaigned on tax-cuts despite the Global Financial crisis already impacting on New Zealand’s economy that year.

On 6 October 2008, Key was only too happy to dangle the tax-cuts carrot in front of a gullible electorate, to win power;

John Key has defended his party’s planned program of tax cuts, after Treasury numbers released today showed the economic outlook has deteriorated badly since the May budget. The numbers have seen Treasury reducing its revenue forecasts and increasing its predictions of costs such as benefits. Cash deficits – the bottom line after all infrastructure funding and payments to the New Zealand Superannuation Fund are made – is predicted to blow out from around $3 billion a year to around $6 billion a year.

The rest is history. National won the 2008 election. Tax-cuts were enacted in April 2009 and October 2010.

All that despite a massive budget blow-out deficit of $15.4 billion by March 2009;

.

.

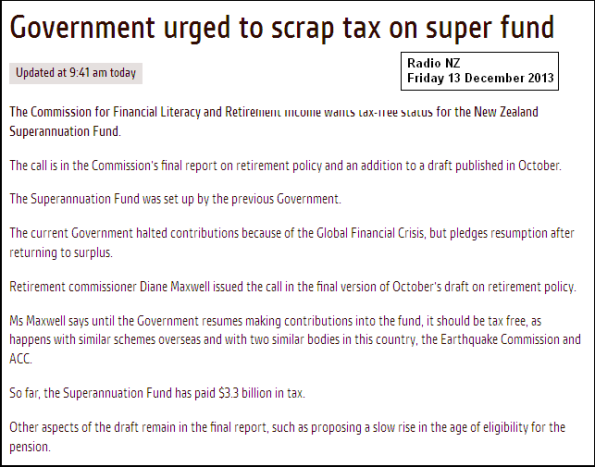

The tax cuts were (and still are!) costing us around $2 billion per year, according to figures obtained by the Green Party from the Parliamentary Library.

New information prepared for the Green Party by the Parliamentary Library show that the estimated lost tax revenues from National’s 2010 tax cut package are between $1.6-$2.2 billion. The lost revenue calculation includes company and personal income tax revenues offset by increases in GST.

“The National Government said that their signature 2010 income tax cut package would be ‘fiscally neutral’ — paid for increased revenues from raising GST. That hasn’t happened. The net cost for tax cuts has been about $2 billion,” Green Party Co-leader Dr Russel Norman said today.

“Borrowing $2 billion in 18 months to fund upper-income tax cuts is fiscally irresponsible.

“National’s poor economic decisions have led to record levels of government debt and borrowing.

“They have also broken a promise to the electorate when they said their tax cut package was going to be fiscally neutral.”

Whilst it can be justifiably argued that New Zealand’s debt increased because of the 2008 Global Financial Crisis and two Christchurch earthquakes – both of which were out of National’s control – the loss of revenue through two unaffordable tax cuts in ’09 and ’10 were of it’s own making.

Against this backdrop of gross fiscal irresponsibility, Steven Joyce has pontificated that “New Zealanders are still none the wiser about the cost of the coalition’s programme and the impact on their back pockets“.

It could also be argued that “most New Zealanders are still none the wiser about the cost of National’s tax-cuts and the impact on their social services“.

Steven Joyce lecturing the incoming coalition government on fiscal integrity and transparency would be like Robert Mugabe advising the U.N. on human rights.

Or like Steven Joyce telling the “truth” about a non-existent $11.7 billion “hole”.

.

Postscript – A letter to the Editor

from: Frank Macskasy <fmacskasy@gmail.com>

to: Dominion Post <letters@dompost.co.nz>

date: 31 October 2017

subject:Letter to the editor.

The editor

Dominion Post.

Opposition MP, Steven Joyce, has been busying himself attacking the recently elected Labour-Green-NZ First Coalition government.

Despite barely moving into their new offices on 27 October, three days later Joyce was complaining;

“…New Zealanders are still none the wiser about the cost of the coalition’s programme and the impact on their back pockets. They also have a right to know whether the new Government’s spending plans in actual dollars will match the cast-iron commitments Labour repeatedly made before the election.”

Mr Joyce should settle down and take a deep breath. The coalition government has only been sworn in since 26 October.

The new government’s policies will be better costed than National’s unaffordable tax-cuts of 2009 and 2010. Those tax-cuts cost this country $2 billion p.a. according to the Parliamentary Library.

John Key happily over-looked NZ’s growing budget deficit, as reported on 6 October 2008;

John Key has defended his party’s planned program of tax cuts, after Treasury numbers released today showed the economic outlook has deteriorated badly since the May budget. The numbers have seen Treasury reducing its revenue forecasts and increasing its predictions of costs such as benefits. Cash deficits … is predicted to blow out from around $3 billion a year to around $6 billion a year.

.

-Frank Macskasy

.

.

.

.

References

Fairfax media: Jacinda Ardern’s new government sworn in

Radio NZ: 550 staff move office at Parliament this weekend

NZCity: Ardern won’t budget on coalition costs

Mediaworks: Spending plans ‘totally affordable’ – Jacinda Ardern

NZ Herald: Recession confirmed – GDP falls

NZ Herald: Key – $30b deficit won’t stop Nats tax cuts?

Interest.co.nz: Budget deficit worse than forecast – debt blows out by NZ$15.4 bln

Infonews: Government’s 2010 tax cuts costing $2 billion and counting

Fairfax media: Which side of the fiscal hole debate are experts standing on?

Additional

Frankly Speaking: Time-line

NZ Herald: National and Labour’s nine years in charge – what the data shows

NZ Treasury: Debt

Previous related blogposts

“Less Debt and Lower Interest Rates” – Really?

Solid Energy and LandCorp – debt and doom, courtesy of a “fiscally responsible” National Govt

Observations on the 2017 Election campaign thus far… (wha)

Observations on the 2017 Election campaign thus far… (whitu)

.

.

.

.

This blogpost was first published on The Daily Blog on 1 November 2017.

.

.

= fs =

Election ’17 Countdown: Joyce – let the lolly scramble begin!

.

(Or, “Under-funded health, education, and other social services? Let them eat tax-cut cake!”)

.

.

2017 Election – Opening Gambits and Giveaways

You can tell it’s election year; the lolly-scramble (aka, hint of tax cuts) has begun;

.

.

Historical Context

Cutting taxes (and social services on-the-sly) is one of National’s mainstays when it comes to election promises. Bribes work best when a government has nothing left to offer.

Who can forget the infamous 2008 election campaign, where – despite the Global Financial Crisis firmly taking hold of the New Zealand economy – then-National Party leader, John Key promised tax cuts.

In January 2008;

“We will cut taxes, not just in election year, but in a regular programme of ongoing tax cuts.

[…]

And we will do all of this while improving the public services that Kiwis have a right to expect. ”

In March 2008, then Finance Minister, Michael Cullen warned against borrowing for tax cuts;

“ Those who would actively choose to drive New Zealand into further debt to pay for tax cuts lack real ambition for our economy…

[…]

Even before these challenges hit home John Key wants to increase our debt to at least 25 per cent of GDP. But he does not pretend he wants to borrow more to pay for more services and he does not really believe he needs to borrow more to pay for roads. He only wants to outspend Labour on tax cuts.

His plan would cost an extra $700 million a year in financing costs alone, around what the government has invested in new health services for each of the last two years.

But the real worry is that Mr Key’s pro-debt policy shows he does not take long-term challenges seriously. His risky deal for tax cuts today would leave the bill to our children and grandchildren tomorrow.”

Undeterred, Key pursued his irresponsible promises and in August 2008 announced to a gullible public;

National will fast track a second round of tax cuts and is likely to increase borrowing to pay for some of its spending promises.

Key made the incredible assertion that tax-cuts would not impact on government debt;

“So that will be extremely clear cut and rather hermetically sealed.”

Key’s claim of “hermetically sealing” tax cuts from the rest of government fiscal activity was never fully explained, and nor did the MSM ever challenge that unbelievable promise.

In October 2008, Key repeated his fantasy of affordable tax cuts;

“Our tax policy is therefore one of responsible reform… We have ensured that our package is appropriate for the current economic and fiscal conditions… This makes it absolutely clear that to fund National’s tax package there is no requirement for additional borrowing and there is no requirement to cut public services… National’s rebalancing of the tax system is self-funding and requires no cuts to public services or additional borrowing’ .”

The rest is history. National was elected to power on 8 November and tax cuts implemented in 2009 and 2010. Government borrowing and debt rocketed;

.

.

A third round scheduled for 2011 was cancelled as the budget blow-out caused – in-part – by unaffordable tax-cuts began to hit home even on a profligate National-led administration.

By May 2011, National was borrowing $380 million per week to fund it’s debt. Bill English and John Key seemed startled by the government’s deteriorating financial position;

Finance Minister Bill English said the Government’s financial position had deteriorated “significantly” since late 2008.

“The pre-election update in 2008 forecast that the deficit for this year would be $2.4 billion,” he said.

“It’s much more likely to be around $15b or $16b.”

That level of deficit, as NZPA has previously reported, will be the highest in New Zealand’s history and Mr English confirmed that today.

Prime Minister John Key confirmed the average weekly borrowing figure, which he said was unaffordable.

Michael Cullen’s warnings over unaffordable tax cuts seem to have been long-forgotten as collective amnesia over-took the National Party leadership.

Worse still, it was the rising army of unemployed who were to pay the fiscal bill for National’s profligacy;

More than three quarters of all beneficiaries will be forced to seek work or face cuts to their payments under sweeping recommendations from the Government’s Welfare Working Group… Working group chairwoman, economist Paula Rebstock, said the present high levels of welfare dependency meant major changes were needed. “ There are currently few incentives and little active support for many people reliant on welfare to move into paid work. Long term benefit dependency can be avoided if investments are well targeted and timely…” Social Development Minister Paula Bennett said the report was an opportunity to change the welfare system and would feed into Government work in the area.

Key indulged in National’s favourite activity when things went horribly wrong after his administration’s apalling policty-decisions. He blamed those at the bottom of the economic heap;

Prime Minister John Key says beneficiaries who resort to food banks do so out of their own “poor choices” rather than because they cannot afford food. “But it is also true that anyone on a benefit actually has a lifestyle choice. If one budgets properly, one can pay one’s bills. “And that is true because the bulk of New Zealanders on a benefit do actually pay for food, their rent and other things. Now some make poor choices and they don’t have money left.”

By 2016/17, National’s net debt had reached $66.3 billion. (Damn those beneficiaries’ “poor choices”.)

The Joy of Joyce’s Tax Bribe

On 8 February this year, Joyce announced aspects of this year’s coming Budget. Joyce dangled the tax-cut carrot in front of voters;

“It is also very important to remain mindful that the money the Government spends comes from hard working Kiwi families. We remain committed to reducing the tax burden on lower and middle income earners when we have the room to do so.”

On the same day, Joyce voiced concerns about New Zealand’s massive mountain of private debt;

“I have discussed DTIs with the Reserve Bank Governor, who remains concerned about the levels of debt in some households in the context of recent increases in house prices.”

Joyce has good reason to be nervous. As of this year, New Zealand’s household debt has reached stellar proportions;

.

.

Any further tax-cuts will not only be based on cuts to social services (health, education, housing, NGOs, etc), but may further fuel the housing bubble. This would raise the prospect of a monstrous three-headed creature of National’s making where;

- it would likely have to have to borrow to fund the tax-cuts,

- fuel an increase in private debt as tax-cuts are spent on a property-buying binge,

- as well as driving first-home buyers out of the market as housing-prices take off again.

Joyce voiced this concern on 8 February;

“The use of macro-prudential tools can be complex and affect different borrowers in different ways. I am particularly interested in what the impacts could be on first home buyers.”

So further tax cuts may have negative impacts that a fourth National administration would have to deal with if it wins the 23 Sept election.

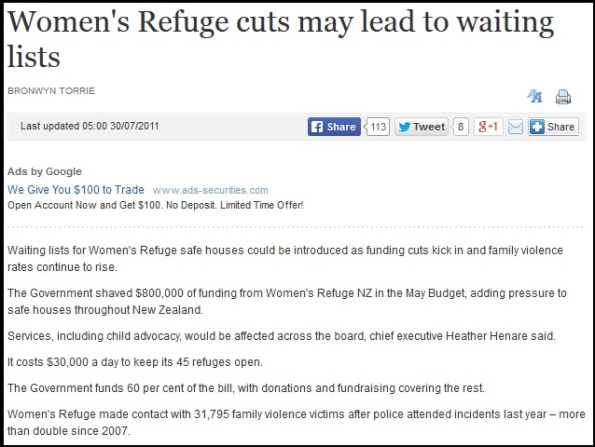

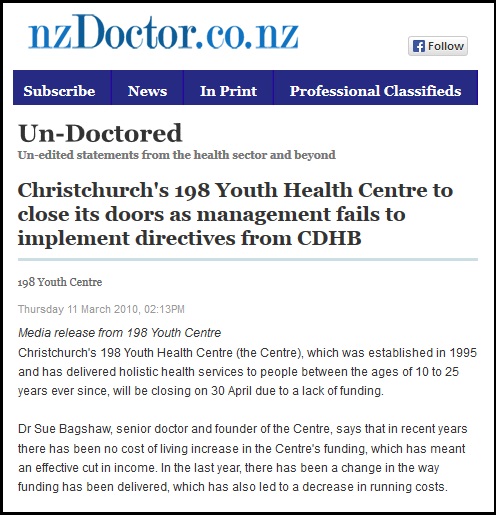

On top of which, New Zealanders would be faced with further cuts to social services and increasing user-pays in health and education. From our on-going housing crisis;

.

.

… to more user-pays in education;

.

.

…in healthcare;

.

.

… and the gutting of NGO services through budget-cuts;

.

.

When Kiwis take up National’s tax-cut bribes, they end up paying more, elsewhere.

But even slashing the budgets for the state sector and NGOs is insufficient to meet the multi-billion dollar price-tag for tax-cuts. National is desperately having to scramble to find money where-ever it can. So-called student loan “defaulters” are firmly in National’s eyesights;

Almost 57,000 student loan borrowers found in Australia

The agreement came into force in October and the details of around 10,000 New Zealanders were found in the first data match. The process has since been refined and a total of 56,897 people have now been located.

“These borrowers have a combined loan balance of $1.2 billion and $430 million of that is in default. Inland Revenue will now start chasing up these borrowers and taking action to get their student loan repayments back on track,” says Mr Joyce says.

Mr Woodhouse says “The data shows that more than half of these borrowers left New Zealand over five years ago, with nearly a quarter having been away for more than 10 years. A third of them have not returned to New Zealand in the past four years. One third of the group has had no contact with Inland Revenue, and 43% have not made a payment since they left New Zealand.

“It’s time these people did the right thing and met the obligations they signed up to when they took out their student loan,” Mr Woodhouse says.

Who else will National target to squeeze money out of?

What social services will National slash to fund tax-cuts?

What further user-pays will be implemented?

One further question; if National does not pay down our sovereign debt – how will the country cope with another global financial crisis and shock to our economy? As Joyce himself pointed out;

“ We need to keep paying down debt as a percentage of GDP. We’ve set a target of reducing net debt to around 20 per cent of GDP by 2020. That’s to make sure that we can manage any shocks that may come along in the future.”

When National took office from Labour, the previous Clark-Cullen government has prudently resisted National’s tantrum-like demands for tax cuts and instead paid down our sovereign debt. As former Dear Leader Key himself was forced to admit;

In 2005, as Leader of the Opposition;

“ Firstly let me start by saying that New Zealand does not face the balance sheet crisis of 1984, or even of the early 1990s. Far from having dangerously high debt levels, gross debt to GDP is around a modest 25 percent and net debt may well be zero by 2008. In other words, there is no longer any balance sheet reason to justify an aggressive privatisation programme of the kind associated with the 1980s Labour Government.”

In 2012*, as Prime Minister Key justified the partial sale of state-owned assets;

“ The level of public debt in New Zealand was $8 billion when National came into office in 2008. It’s now $53 billion, and it’s forecast to rise to $72 billion in 2016. Without selling minority shares in five companies, it would rise to $78 billion. Our total investment liabilities, which cover both public and private liabilities, are $150 billion – one of the worst in the world because of the high levels of private debt in New Zealand.”

(* No link available. Page removed from National Party website)

With our current debt of $66.3 billion, we no longer have a safety-buffer. That is the current dire state of our government books.

It is astonishing that Joyce has the nick-name of “Mr Fixit”, as he makes irresponsible hints of tax cuts to come.

Little wonder that Joyce’s unearned reputation as “Mr Fix It” was deconstructed by journalist and political analyst, Gordon Campbell;

The myth of competence that’s been woven around Steven Joyce – the Key government’s “Minister of Everything” and “Mr Fixit” – has been disseminated from high-rises to hamlets, across the country. For five years or more, news outlets have willingly (and non-ironically) promoted the legend of Mr Fixit…

[…]

Of late however, the legend has lost some of its lustre. More than anything, it has been his handling of the SkyCity convention deal that has confirmed a lingering Beltway suspicion that Joyce’s reputation for business nous has been something of a selfie, with his competence appearing to be inversely proportional to his sense of self-esteem. Matthew Hooton’s recent critique of Joyce in NBR – which was inspired by how the SkyCity convention deal had cruelly exposed Joyce’s lack of business acumen – got a good deal of traction for that reason. On similar grounds, Joyce’s penchant for (a) micro-managing and (b) the prioritising of issues in terms of their headline potential has resulted in his ministerial office becoming somewhat notorious around Parliament for (c) its congested inefficiency and for (d) a not-unrelated extent of staff burnout.

[…]

Not only is Joyce’s ministerial office renowned as an administrative bottleneck – where issues tend to be ranked in terms of their p.r. potential for the Minister – none of this seems to be in service of any wider goal or vision. As Mr Fixit, Joyce tends to be engaged in the equivalents of blown fuses and leaking taps – rather in the re-design of the political architecture. Joyce has simply never been – and has never pretended to be – a big picture kind of politician. He has been never someone with an abiding interest in – or the intellectual stamina for – systemic change.

The re-election of National this year – by any means necessary, whether beneficial to New Zealand or not, no matter what the social or financial costs – appears to be ‘Mr Fixit’s’ latest ‘DIY’ project.

And like most DIY budgets, wait for the blow out.

Just like 2009.

.

.

References

Interest.co.nz: Finance Minister says Government remains ‘committed to reducing the tax burden

Scoop media: Tax cuts still in the mix for Joyce’s first budget

Sharechat: Tax cuts still in the mix for Finance Minister Steven Joyce’s first budget

Radio NZ: Budget date set, tax cuts likely

NBR: Government hints at tax cuts in Budget 2017

Fairfax media: Joyce signals low and middle earners’ top rates target for tax cuts

NZ Herald: The Economy Hub – About those tax cuts… Steven Joyce, the big interview

NZ Herald: John Key – State of the Nation speech

Scoop media: Government will not borrow for tax cuts

NZ Herald: Nats to borrow for other spending – but not tax cuts

Guide2: National Party – Tax Policy

NZ Treasury: Financial Statements of the Government of New Zealand for the Year Ended 30 June 2010 – Debt

NBR: Tax cuts scrapped in budget

Interest.co.nz: Budget deficit worse than forecast; debt blows out by NZ$15.4 bln

NZ Herald: Govt borrowing $380m a week

Fairfax media: Extensive welfare shake-up needed – report

NZ Herald: Food parcel families made poor choices, says Key

NZ Treasury: Budget Economic and Fiscal Update 2016

Beehive: 2017 Budget to be presented on 25 May

Beehive: Finance Minister requests cost-benefit analysis on DTIs

NZ Herald: New Zealand residential property hits $1 trillion mark

Beehive: Almost 57,000 student loan borrowers found in Australia

Scoop media: John Key Speech – State Sector Under National

Werewolf: The Myth of Steven Joyce

Other Blogs

The Hand Mirror: A crack in the wall

Previous related blogposts

Letter to the editor: Setting it straight on user-pays in tertiary education

Letter to the Editor: tax cuts bribes? Are we smarter than that?

The Mendacities of Mr Key #3: tax cuts

The Mendacities of Mr Key # 19: Tax Cuts Galore! Money Scramble!

The Mendacities of Mr English – Social Services under National’s tender mercies

.

.

.

.

This blogpost was first published on The Daily Blog on 20 February 2017.

.

.

= fs =

The Mendacities of Mr Key # 19: Tax Cuts Galore! Money Scramble!

.

.

In troubled times, we are community

.

On 14 October, eight hours after two massive 7.8 earthquakes simultaneously rocked the entire country, our Dear Leader John Key made an impassioned (for him, it was impassioned) appeal to the people of Aotearoa on Radio NZ’s ‘Morning Report‘;

.

“The one thing I’d we’d just say to New Zealanders at the moment is stay close to your family and friends. Make sure you listen to the radio and listen to the best information that you’re getting. And if you do have certainly older neighbours or family, if you could go in and check up on them that would be most appreciated. Because there will be people feeling genuinely alone.“

.

It was an appeal to a sense of community that is rarely made by right-wing governments or their leaders. It was a tacit acknowledgement that No Man or Woman is an Island that that only by acting collectively can human beings survive and improve their own circumstances and for their children.

Unfortunately, a week later, Key’s sense-of-community-spirit was returned to it’s hermetically-sealed casket and re-buried alongside cryo-capsules containing New Zealand’s Once-Egalitarian-Spirit and International-Independent-Leadership-On-Moral Issues.

.

National dangles the “carrot”

.

On 21 November, Key announced that tax cuts were once again “on the table” and Little Leader/Finance Minister, Bill English confirmed it.

With a statement that was more convoluted than usual, Key said;

“We’ve identified from our own perspective if there was more money where would be the kinds of areas we want to go, not what is the make up … for instance, of a tax or family package, what is the make up of other expenditure we want?

Tax is one vehicle for doing that, it’s not always the most effective vehicle for doing that for particularly low income families.”

Tax could be effective higher up the income scale, but lower down it was not that effective because base rates were low or it was very expensive.

Over the fullness of time we’ll have to see whether we’ve got much capacity to move.