Archive

Mycoplasma bovis, foot and mouth, National Party, and other nasty germs

.

.

Intro

The Mycoplasma bovis crisis confronting New Zealand is a story that will be dissected and commented on for decades to come.

This was not simply a matter of a bacteria infecting cattle. This was a story on many levels; of flouted rules; a significant inadequacy of the “free market”; critical under-funding by National (no surprises there); and the best silver-lining that farmers could possibly hope for…

The ‘bovis’ hits the fan

22 July 2017: Mycoplasma bovis was first detected on dairy farms owned by the Van Leeuwen Dairy Group, near Waimate, in Canterbury. In what must rank as the Understatement of the Year, Ministry for Primary Industries (MPI) investigator, Kelly Buckle, announced;

”At the moment, we’re pretty confident it’s just on those two farms.”

By 1 August, a second dairy farm in South Canterbury had been confirmed with the infection. An ODT report stated;

The ministry was satisfied the containment measures in place were sufficient to control any spread of the disease from the properties involved.

By 29 May this year, the sobering reality of the outbreak turned earlier optimism of containment into a bleak joke;

The cull will involve 152,000 animals over 1-2 years – or an extra 126,000 on top of the planned cull to date.

[…]

The estimated costs of attempting to eradicate Mycoplasma Bovis [sic] are $886 million over 10 years, against an estimated cost of $1.2 billion to manage the disease over the long term and an estimated $1.3 billion in lost production from doing nothing.

At this point the Government believes that 37 farms have infected livestock and 192 farms in total will face stock culling – 142 in the first year.

But high-risk animal movements have been traced to 3000 farms and 858 are under surveillance.

The ease of spread of the micro-organism quickly revealed a fatal flaw in the administration of our bio-security systems.

NAIT – the system that farmers nobbled

As the infection was detected on one farm after another, it soon became apparent that dairy farmers had either ignored, or been slow to comply with the NAIT (National Animal Identification and Tracing) system of tracking farm animals.

.

.

As Alexa Cook reported for Radio NZ in December last year;

Under the National Animal Identification and Tracing (NAIT) system, all cattle and deer farmers must have stock tagged and registered, and also record and confirm any animals that are bought, sold or moved.

A March 2018 report from Radio NZ found that around half of the country’s farmers were flouting this critical process;

A review of NAIT found only 57 percent of farmers who record their animal movements, do so within the required 48 hours.

Agriculture Minister Damien O’Connor was not happy. He was moved to state the obvious;

“NAIT is an important part of our biosecurity net and it needs improvement.

Mycoplasma bovis is mostly spread through movement of infected cattle from farm to farm. This means cattle traceability between properties is critical to finding all affected animals, and stopping further infection”

O’Connor warned that farmers who ignored NAIT would face fines.

Even Federated Farmers was not impressed with the slackness shown toward NAIT. Waikato Federated Farmers meat and fibre chairperson, Chris Irons, was highly critical of his fellow farmers;

“Let’s be frank – the National Animal Identification and Tracing (NAIT) scheme is not working as well as it should, and the blame lies with farmers.

Yes, NAIT could be easier to use but that’s not an excuse for not keeping animal tracking data up to date.

There are a lot of farmers who say NAIT is waste of time and money. If you have that view then I’m sorry, but I don’t think you care about the farming industry and are probably guilty of not being compliant.

[…]

NAIT currently does a good job of tracking animals that are registered and all their movements recorded on the database. But the system is only as good as the data put into it.

Owners, sellers and third party buyers have to be diligent about recording cattle and deer movements on their NAIT accounts. The system is fit for purpose when the data is up to date, but falls down when it’s incomplete, or not entered at all.

If we have a fast moving outbreak it will be vital to have NAIT working so it’s up to all farmers to ensure they are compliant.”

Chris Irons was correct when he pointed out that “NAIT could be easier to use“. The system is clunky, with stock tags having to be manually scanned and then manually uploaded into the central system. The manual aspect of it makes the system unwieldy and easy to “set aside to do later” – if at all.

Full electronic automation would cost millions, and would raise the question of who would pay. This blogger understands MPI was never adequately budgeted for full automation.

It is unclear who would pay for NAIT to be upgraded; the Ministry or farmers?

By May this year, the full extent of farmers’ undermining of NAIT became apparent. Prime Minister Ardern did not mince her words;

“There was a system in place, it has failed abysmally and we are now picking up the pieces of that.

We want to make sure that first and foremost we deal with the issue at hand and that is Mycoplasma bovis and trying to pin down its spread and still focus on the possibility of eradication. The second question is: How do we prevent this from ever happening again?”

Biosecurity NZ’s spokesperson, Geoff Gwynn, spelled out the consequences of the failure to carry out NAIT processes;

“It’s a reality of New Zealand’s farming system that large numbers of animals are sold and moved across big distances.

This response is serving to underline just how much movement takes place and it is this, coupled with poor record keeping through NAIT that is making our job very challenging.”

In part, the spread of Mycoplasma bovis has been a crisis of farmers’ own making.

The “she’ll be right, mate” attitude simply will not cut it in an age of rapid international travel. Harmful micro-organisms and other pests can easily cross the planet and humanity’s artificial borders within days or even hours, on the back of our 21st century transport technology.

But perhaps the greatest irony is that whilst farmers had been lax sharing critical information on stock movements as per NAIT requirements – they were far less shy demanding information from MPI on what was being done to identify infected farms; eradication/containment of the microscopic invader; and compensation paid out post-haste for culled stock animals.

If farmers had complied with NAIT and provided stock transfer data in a timely and precise fashion, they might not now be in a position where they were braying for information from those same Ministry officials.

The dreaded disease whose name we dare to speak

Waikato Federated Farmers meat and fibre chairperson, Chris Irons, issued this stark warning to his fellow farmers;

“There’s too many farmers who are just ‘oh nah, just don’t want to do it’, but at the end of the day it’s got to be done because that’s the only way we’re going to be able to track any diseases.

If we get something faster than m.bovis – like foot and mouth or something – we’ve got to have a reliable system. At the moment the system is reliant on farmers doing their bit and having their records up to date.”

“Like foot and mouth or something“?!

Mycoplasma bovis is a nasty bug. There is little doubt in that. According to MPI, it is present in most other countries around the world. Only until last year, New Zealand was free of the disease. As MPI graphically described, it has multiple symptoms;

Major syndromes seen in other countries with Mycoplasma bovis include atypical mastitis in cows (both dry and in milk) – (the chance of this disease likely increases with increasing herd size), arthritis in cows and calves, atypical, difficult-to-treat pneumonia in calves, middle ear infection (otitis media) in calves, severe pneumonia of adult cows (usually rare), and abortion. All conditions are difficult to treat once the animal becomes sick.

Yet, Mycoplasma bovis is almost the agrarian version of the common cold when compared to a disease that every animal farmer must live in mortal fear of: foot and mouth (Aphthae epizooticae).

In a 2001 foot-and-mouth outbreak in Great Britain, farms were quarantined and isolated behind Police barriers;

.

.

Movement was curtailed;

.

.

Millions of stock animals were culled and incinerated on massive pyres;

.

Each of those cases meant a farm having all of its livestock killed and burned. By the time the last case was confirmed at Whygill Head Farm in Appleby, Cumbria, on 30 September 2001, more than six million sheep, cattle and pigs had been slaughtered.

.

The Guardian reported just some of the effects on British farmers and businesspeople;

The list of victims is long. At the head of it should be the nearly 3m animals slaughtered and burned, along with the 68,000 cows, sheep and pigs set to follow them on to the funeral pyres. Next on the list would be the clutch of farmers who, despite £125m already pledged in compensation, will be driven out of business by an epidemic that swept through their land as devastating as a tornado. After them, the hoteliers and restaurateurs who saw their livelihoods dry up as the world’s travellers declared Britain a medievally benighted no-go area.

The financial cost was horrendous; £3 billion to the public sector and £5 billion to the private sector.

Tourism income lost/displaced between £2.7 and £3.2 billion. It took nine months to bring foot-and-mouth under control and stop the spread.

Farmers who were not infected with foot and mouth, but still lost income through massive restrictions to livestock movement, were not compensated.

The invisible psychological effects were perhaps the worst;

The disease epidemic was a human tragedy, not just an animal one. Respondents’ reports showed that life after the foot and mouth disease epidemic was accompanied by distress, feelings of bereavement, fear of a new disaster, loss of trust in authority and systems of control, and the undermining of the value of local knowledge. Distress was experienced across diverse groups well beyond the farming community. Many of these effects continued to feature in the diaries throughout the 18 month period.

[…] The use of a rural citizens’ panel allowed data capture from a wide spectrum of the rural population and showed that a greater number of workers and residents had traumatic experiences than has previously been reported.

Despite the effects of Mycoplasma bovis, New Zealand’s meat and dairy exports are largely unimpeded.

That will not be the case if – or more likely – when foot-and-mouth reaches our shores. With tourism numbers at 3.3 million in 2015/16 and expected to reach 4.9 million visitors by 2023, it is only a matter of time when one individual carries the dreaded foot and mouth micro-organism into our country.

If 100% of New Zealand farmers are not 100% compliant with NAIT in the coming years, the nightmarish havoc wrought by a foot and mouth outbreak will be unlike anything Mycoplasma bovis has wrought.

It is a tough lesson, but the farming sector should be thankful of Mycoplasma bovis (and the person who inadvertently imported it). Whatever supernatural deities there might be have delivered a clear warning to us all.

Observe the rules. Follow the NAIT system.

No exceptions.

Or face worse consequences.

National, the Free Market and minimal-government

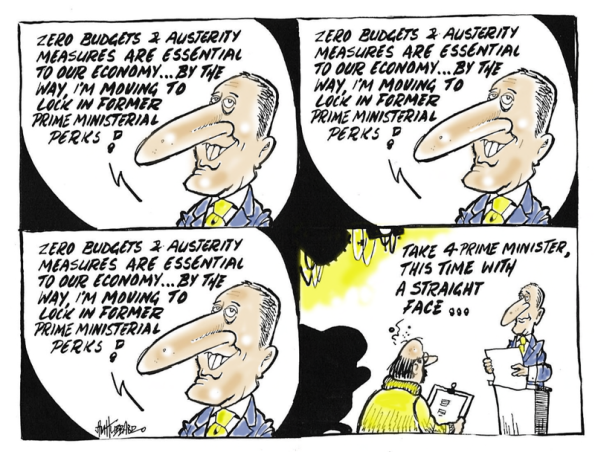

Remember this guy?

.

.

He must be feeling a bit of a right ‘wally’ right now.

As ‘Advantage‘ recently wrote for The Standard;

Remember those Morrinsville farmers who protested against our ‘communist’ Prime Minister? Those are the guys we are feeding our taxpayer dollars towards right now

A Herald report backed up the anonymous blogger’s observation;

The Government will cover 68 per cent costs and the dairy and beef industry bodies the remainder.

The estimated costs of attempting to eradicate Mycoplasma Bovis [sic] are $886 million over 10 years, against an estimated cost of $1.2 billion to manage the disease over the long term and an estimated $1.3 billion in lost production from doing nothing.

Perhaps this US cartoon best shows how those with a distrust of “big government” (or any government) in their lives suddenly have a remarkable Road-to-Damascus conversion when faced with a crisis beyond their abilities to manage;

.

.

Left to the ‘tender mercies’ of a small government, an unfettered free market, and minimal state involvement, how much could farmers expect as compensation for a disease outbreak and culling of their stocks?

Easy answer: nil. As in nothing.

They would be expected to buy their own insurance. User pays would be the rule.

Whether a farmer with an infectious disease would notify authorities (whether such “authorities” would even exist in a minimalist government is a moot point) without compensation, or any other personal benefit, would be an interesting question.

In a purist free market where everyone looks out for him/herself, what would be the incentive to act for the “greater good” of other people?

Fortunately we still have a State and the remnants of collective responsibility when faced with overwhelming circumstances.

Whether a person is a solo mother living in a State house or a farmer with a ten million dollar investment – the State exists to protect it’s citizens when faced with crisis beyond their coping abilities.

The next time farmers read a media story of a State house tenant unjustly turfed out of their home, or a welfare recipient who has been abused by WINZ until driven to suicide – they should pause for a moment. Perhaps their sympathies may now be just a little closer aligned with those at the bottom of the socio-economic heap.

National – the party of preference for most farmers – has said on multiple occasions that state assistance should be “targeted“; that tax-payers dollars should only go to those who are most-in-need (even though National then demonises those very same people-in-most-need).

In a free-market, small-government world, a minimal amount of state assistance might be channeled to the poorest of the poor. Just a barely sufficient amount to stave off starvation and prevent embarrassing piles of corpses from inconveniently cluttering up the streets. But state assistance to compensate farmers?

Forget it.

At election time, farmers should think carefully before ticking the Party box. They should ask themselves;

How small do they really want government to get?

In the meantime, our farming friend above should consider changing the text for his next sign;

.

.

A little appreciation goes a long way.

Vote Biosecurity

As the twin effects of the 2007/08 Global Financial Crisis and two tax cuts in 2009 and 2010 impacted on government tax revenue, National was forced to break one of its election promises. It cut back on spending and public services.

It soon became apparent that no part of the State sector would be untouched by National’s then-Finance Minister, Bill English, as Richard Wagstaff of the PSA explained;

The Public Service Association is concerned about the significant risks involved in cutting jobs at MAF Biosecurity, whose staff work on our borders protecting New Zealand’s multi-billion dollar agriculture sector from pests and diseases.

MAF Biosecurity has today announced that’s its disestablishing around 60 jobs by cutting 30 filled positions and disestablishing 30 vacant positions. MAF Biosecurity says the job cuts are in response to falling trade and passenger volumes.

“But the government is also responsible for these job losses as it cut the baseline funding for MAF Biosecurity by $1.9 million in the Budget delivered in May,” says PSA national secretary Richard Wagstaff.

“Our concern is that the New Zealand’s economy depends on our farming and horticulture industries that could be decimated if diseases like foot and mouth and fruit fly got into the country.”

“MAF Biosecurity staff work to prevent these diseases and pests from crossing our borders so it’s vital that these job cuts don’t weaken our defences in this area,” says Richard Wagstaff.

Richard Wagstaff’s stark warning became a grim reality as fruit flies, moths, the psa virus, and then Mycoplasma bovis crossed our weakened border controls.

It is difficult to make direct comparisons with some of the data from National’s Budgets. Categories were changed from the 2009 Budget to the 2010 Budget onward. Much of the budgetary allocations were “buried” with Vote Primary Industries.

However, it is clear that two overall categories can be compared;

- Border Clearance Services and Border Biosecurity Monitoring and Clearance

- The overall total of budgetary allocations to biosecurity which from 2012 onward were obtained from the Summaries of each document.

The figures appear to show a steady decline in biosecurity funding from 2008 (Labour’s Michael Cullen’s last budget) to 2014, of thirteen million dollars. This is not accounting for inflation, which would mean an even greater decline in funding levels.

.

Note A: From Budget 2012, Vote Biosecurity was merged with Vote Agriculture & Forestry, and Vote Fisheries into the Vote Primary Industries.

Note B: Linked references to Budget documents listed below..

.

Corresponding international visitor arrivals continued rising (with only a slight drop in 2009, post-GFC).

Annual imports fell post-2008,but regained steadily after 2011. By 2013, imports had all but returned to 2008 levels (not taking inflation into account).

What is clear is that biosecurity does not appear to have been adequately funded. National’s cost-cutting (until 2013 and 2014) must have impacted on our ability to monitor and prevent pest incursions.

This would appear to coincide with the appearance of several destructive pests recently;

- PSA virus in November 2010

- Queensland fruit fly in February 2015

- Red clover casebearer moth, late 2015

- Tau fly, January 2016

- Eucalyptus variegated beetle, March 2016

- Velvetleaf, March 2016

- Pea weevils, April 2016

- Culex sitiens mosquito, March 2018

Whatever “savings” National made by cutting back on biosecurity were, by definition, false economies. Once again, cuts to an essential state sector service inevitably created grave consequences.

This time for our farming sector.

The next time National promises tax cuts at election time and to make “efficiencies” to “do more with less“, this is a lesson that the farming sector should remember with some bitterness.

.

.

.

Those so-called “cost-savings” didn’t come cheap. A fact farmers should bear in mind when it comes time to cull herds exposed/infected with Mycoplasma bovis.

Acknowledgement: thank you to a certain scientist who gave her time to proof-read my article and offer constructive criticism.

.

.

.

References

Wikipedia: Mycoplasma bovis

NZ Herald: Confidence mycoplasma bovis outbreak contained

ODT: Another meeting as second farm infected

NZ Herald: MPI will face ‘don’t give a damn’ attitude on M. Bovis, farmer says

Radio NZ: Incomplete farm records slow tracking of cattle disease spread

Radio NZ: Farmers face checkpoints in effort to stop cattle disease

Fairfax media: NAIT responsibility – the buck stops with farmers

Radio NZ: M Bovis spread – Tracking system has ‘failed abysmally’ – PM

NewstalkZB: Farmer slams Govt over bovis communication

MPI: Two-page summary of Mycoplasma bovis

Wikipedia: 2001 United Kingdom foot-and-mouth outbreak

The Guardian: The news from Ground Zero – foot and mouth is winning

BBC: When foot-and-mouth disease stopped the UK in its tracks

The Guardian: A catalogue of failures that discredits the whole system

National Audit Office: The 2001 Outbreak of Foot and Mouth Disease

NCBI: Economic costs of the foot and mouth disease outbreak in the United Kingdom in 2001

MoBIE: New Zealand Tourism Forecasts 2017-2023

Radio NZ: Man still repaying debt from unnecessary HNZ meth eviction

Fairfax media: Aggressive prosecution focus at MSD preceded woman’s death, inquest told

National Party: Low income earners to subsidise homes for wealthy

National: Achievements – Social investment

NZ Herald: Food parcel families made poor choices, says Key

Mediaworks/Newshub: Labour – Key promised no job cuts, asset sales in 2008 speech

Fairfax media: Jobs expected to go in state sector cuts

Scoop media: Risks involved in cutting MAF Biosecurity jobs

NZ Herald: New Zealand fruit fly free after successful operation

MPI: Red clover casebearer moth

Mediaworks/Newshub: Crown opens case in kiwifruit claim over Psa virus outbreak

NZ Treasury: Budget 2008 – Vote Biosecurity

NZ Treasury: Budget 2009 – Vote Biosecurity

NZ Treasury: Budget 2010 – Vote Biosecurity

NZ Treasury: Budget 2011 – Vote Biosecurity

NZ Treasury: Budget 2012 – Vote Primary Industries (inclu Biosecurity)

NZ Treasury: Budget 2013 – Vote Primary Industries (inclu Biosecurity)

NZ Treasury: Budget 2014 – Vote Primary Industries (inclu Biosecurity)

NZ Treasury: Budget 2015 – Vote Primary Industries (inclu Biosecurity)

NZ Treasury: Budget 2016 – Vote Primary Industries (inclu Biosecurity)

NZ Treasury: Budget 2017 – Vote Primary Industries (inclu Biosecurity)

NZ Treasury: Budget 2018 – Vote Primary Industries (inclu Vote Biosecurity)

NZ Treasury: Budget 2012 – Introduction – Estimates of Appropriations 2012/13

Statistics NZ: Exports and imports hit new highs in 2017

Statistics NZ: International visitor arrivals to New Zealand – 2008 – 2018 (alt. link)

NZ Herald: Kiwifruit disease Psa explained

MPI: Pea weevil

MPI: Eucalyptus variegated beetle

Fairfax media: Velvetleaf, one of world’s worst weeds, confirmed on three Waikato farms

MPI: No further Tau flies found and restrictions now lifted

Radio NZ: English hints at further tax cuts

NZ Herald: Key pledges state service shake-up

Scoop media: Speech – John Key – Better Public Services

Additional

Wikipedia: Biosecurity in New Zealand

MPI: Keeping watch

Radio NZ: Failings in NZ’s stock tracking system (audio)

Radio NZ: Cattle and oysters – a catalogue of issues: Damien O’Connor (audio)

Radio NZ: One in five farmers ignoring safety regs – WorkSafe

Other Blogs

The Standard: It’s Time for a Cost-Benefit Analysis of Dairy Farming

Previous related blogposts

.

.

.

.

This blogpost was first published on The Daily Blog on 15 June 2018.

.

.

= fs =

Budget 2014 – Why we will soon owe $70 billion under this government…

.

Graphic courtesy of The Daily Blog

.

A few reasons why our debt skyrocketed from 2008 onwards…

1. The Global Financial Crisis, which reduced corporate turnover and export receipts, thereby lowering the company tax take;

2. Two tax cuts (2009 and 2010) reduced government revenue, thereby necessitating borrowing more from offshore to make up the difference. In essence, we borrowed from other peoples’ saving to put more money in our (mostly top incomer earners) pockets.

Using Parliament Library information, the Greens have estimated that this involved borrowing an extra couple of billion each year.

3. National could have kept Debt down by investing in job creation. Key’s cycleway project was promised to create 4,500 new jobs – it failed spectacularly.

Instead, job creation was largely left to “the market”, which itself was having to engage in mass redundancies for businesses to survive the economic downturn.

This meant more expenditure on unemployed which went from 3.4% in 2008 to 7.3% by 2012 (currently sitting at 6% for the last two Quarters).

Ironically, part of our current economic “boom” is predicated on the Christchurch re-build – evidence that had National engaged in a mass housing construction programme in 2009, after it held it’s mostly ineffectual “Jobs Summit”, we would have;

A. Maintained higher employment,

B. Paid out less in welfare,

C. Persuaded more New Zealanders to stay home and not go to Australia to find work,

D. Addressed the current housing crisis we now have.

As usual, National’s short-sightedness; irresponsible 2008 election year tax-cut bribes; and misguided reliance on market forces resulted in New Zealand borrowing more than we really needed to.

.

References

NZ Herald: Govt borrowing $380m a week

Scoop media: Govt’s 2010 tax cuts costing $2 billion and counting

NZ Parliament: Government Proposals—Cycleway and Nine-day Working Fortnight

NZ Herald: Cycleway jobs fall short

Statistics NZ: Employment and Unemployment – March 2008 Quarter

Statistics NZ: Household Labour Force Survey: September 2012 quarter

Fairfax NZ: Jobs summit ‘fails to deliver’

TVNZ News: OECD report shows housing crisis in NZ – Labour

TVNZ News: Christchurch rental crisis ‘best left to market’ – Govt

Additional

Fairfax media: Public debt climbs by $27m a day

Fairfax media: Budget 2014: The essential guide

Previous related blogposts

Can we do it? Bloody oath we can!

.

Above image acknowledgment: Francis Owen/Lurch Left Memes

.

.

= fs =

To intervene or not to intervene, that is the question…

.

To intervene, or not to intervene, that is the question:

Whether ’tis nobler in this government’s mind to suffer The slings and arrows of outrageous recessionary fortune,

Or to take arms against a global sea of economic troubles,

And by opposing end them? To be hands on, and interventionist…

(With apologies to The Bard…)

.

Farmers get it…

.

.

Rich families get it…

.

.

Kids from rich families get it…

.

.

Insurance companies get it…

.

.

Even cute, furry-footed Hobbits get it…

.

.

And more for the Precious…

.

.

Hell, practically everyone can get it…

.

.

Subsidies for everything and everyone…

But not, it seems, to assist struggling construction companies until the Christchurch re-build kicks in, in earnest, and they can trade their way out of difficulties,

.

.

In a brutally frank analysis of the industry, NZ Herald journalist Anne Gibson wrote this piece about other failed construction companies and the effect it was having throughout the country – see: Recession hammered building firms, say chiefs

Greg O’Sullivan, of Takapuna-based building consultants Prendos, said,

“The recession has hammered the industry to the ground. It becomes a very acrimonious environment. Builders are having to watch every penny to survive.”

Source: IBID

And it was all so unnecessary.

No government could not have prevented the recessionary effects of the Global Finance Crisis. But a more proactive government could have mitigated the harshest effects of the international recession with careful stimulation of the economy.

And by “stimulation” I do not refer to the wasteful, blunt-instrument-style tax cuts of 2009 and 2010. Those tax cuts added nothing to economic growth and only served to cut government revenue (see: Outlook slashes tax-take by $8b).

Thousands of jobs could have been saved. Thousands more jobs created.

A proactive government, with Ministers able to look ahead, would have immediatly implemented strategies to counter damaging recessionary effects;

- a dynamic building programme post-2009’s “Job Summit” (and I don’t mean Key’s wretched cycleway idea – see: Cycleway jobs fall short)

- increased investment, incentives, and subsidies for apprenticeships and other training/education for young people and other unemployed New Zealanders

- reform of tax laws which see inefficient investment in speculative house-buying/selling less attractive, and re-direct investment into productive industry

National should never have allowed our economy to get where it is now.

This is a government that is derelict in it’s duty, and for Steven Joyce and his cronies to carp on about “overseas investment” is a moronic cargo-cult mentality that simply defies understanding.

If New Zealand businesses leaders and Captains of Commerce still believe that National is a “prudent manager of the economy” – then going by the last four years and events in the 1990s – I promise you that you will get what you richly deserve if they are re-elected in 2014 (or earlier).

This isn’t governance. This is economic decline by a thousand cuts.

Expect things to get worse.

.

*

.

Other Blogs

Additional

NZ Herald: Collapse ‘gut wrenching’ for roofing business (9 Feb 2013)

NZ Herald: Rise and fall of a very modern businessman (9 Feb 2013)

NZ Herald: Brian Gaynor: Mainzeal collapse needs investigation (9 Feb 2013)

.

.

= fs =