Archive

Treasury on Rail. Let’s play a little game, shall we?

.

.

Treasury’s latest ‘brain fart’ was this amazing story, which I repost, verbatim, from a Radio NZ report;

Close down rail, advised the Treasury

.

In Budget documents released today the Treasury estimated the net social cost of supporting KiwiRail at between $55 million and $170 million a year.

In the paper the Treasury recommended the Government just fund KiwiRail for one more year while undertaking a comprehensive study to look at closing the rail company.

It said the study should be done publicly so that people were informed of the costs of running the rail network compared with any benefits it provided.

The Government rejected the idea.

Labour’s transport spokesperson Phil Twyford criticised the Treasury for even raising the suggestion.

“This proposal by Treasury for the Government to consider actually shutting down the rail network is just nuts and it shows that Treasury doesn’t really understand transport economics and they certainly don’t get rail.

“You know rail should be for decades and decades to come, it should be alongside the road system, the backbone of New Zealand’s transport system … To shut down, even to contemplate shutting down this valuable part of our nation’s infrastructure is barmy,” Mr Twyford said.

While government ministers rejected the idea initially they only intended providing money for KiwiRail for this financial year.

But a later paper reveals it agreed to a two-year funding commitment after the company expressed worries about its long-term planning if it had only one year of funding confirmed.

In its analysis the Treasury said rail had high fixed costs and it faced a challenge trying to reduce them.

It said the options for the business were to make relatively small changes to the existing network or significantly downsize it, including closing it altogether.

Another option was to shut down most of its operations but keep freight business for Auckland to Hamilton to Tauranga only as that part of the network carried most freight and covered most of its costs.

It warned KiwiRail posed considerable risk to the Government and was unlikely to ever be profitable.

“Treasury believes there is a net economic cost of continuing to fund rail at the levels required. The net social cost is estimated at between $55 million and $170 million per annum based on a national cost benefit analysis.

“Whilst some of the assumptions underlying analysis of this nature are subjective and some require further work to validate, Treasury believes that it will not change the conclusion that there is a net social cost of continuing to fund rail.”

It recommended a public study of the implications of shutting KiwiRail down so the Government could make the most informed choice possible.

Phil Twyford said he agreed there should be an in-depth study on the value of rail to the economy.

Mr Twyford said the fallacy in the Treasury thinking was that the rail system, including the rail tracks, should be run as a profit making business. Nowhere in the world did that happen.

He said the rail tracks were simply like the country’s roads and nobody expected the roads to make a profit.

A spokesman for Finance Minister Bill English said the Government had set aside $400 million for KiwiRail over the next two years.

“But before undertaking an investment of this size, it is appropriate that officials look at all options – including options for line closures.

“As we said in May, the Government is committed to a national rail network, but ongoing subsidies of around $200 million per year are unsustainable. The funding provided at the Budget gives the KiwiRail board a two-year window to identify savings and reduce the level of ongoing Crown funding required,” he said.

The craziness of this suggestion can best be illustrated if we make a few changes to the story, and re-post it;

Close down roads, advised the Treasury

.

In Budget documents released today the Treasury estimated the net social cost of supporting National Land Transport roading at $3.891 billion a year.

In the paper the Treasury recommended the Government just fund roading for one more year while undertaking a comprehensive study to look at closing the National Land Transport Programme.

It said the study should be done publicly so that people were informed of the costs of running the roading network compared with any benefits it provided.

The Government rejected the idea.

Labour’s transport spokesperson Phil Twyford criticised the Treasury for even raising the suggestion.

“This proposal by Treasury for the Government to consider actually shutting down the road network is just nuts and it shows that Treasury doesn’t really understand transport economics and they certainly don’t get roads.

“You know roads should be for decades and decades to come, it should be alongside the rail system, the backbone of New Zealand’s transport system … To shut down, even to contemplate shutting down this valuable part of our nation’s infrastructure is barmy,” Mr Twyford said.

While government ministers rejected the idea initially they only intended providing money for for this financial year.

But a later paper reveals it agreed to a two-year funding commitment after the company expressed worries about its long-term planning if it had only one year of funding confirmed.

In its analysis the Treasury said roading had high fixed costs and it faced a challenge trying to reduce them.

It said the options for the business were to make relatively small changes to the existing network or significantly downsize it, including closing it altogether.

Another option was to shut down most of its operations but keep freight business for Auckland to Hamilton to Tauranga only as that part of the highway network carried most freight and covered most of its costs.

It warned National Land Transport posed considerable risk to the Government and was unlikely to ever be profitable.

“Treasury believes there is a net economic cost of continuing to fund road at the levels required. The net social cost is estimated at $3.891 billion a year per annum based on a national cost benefit analysis.

“Whilst some of the assumptions underlying analysis of this nature are subjective and some require further work to validate, Treasury believes that it will not change the conclusion that there is a net social cost of continuing to fund roads.”

It recommended a public study of the implications of shutting National Land Transport down so the Government could make the most informed choice possible.

Phil Twyford said he agreed there should be an in-depth study on the value of roading to the economy.

Mr Twyford said the fallacy in the Treasury thinking was that the roading system, including the highways, should be run as a profit making business. Nowhere in the world did that happen.

He said the highways were simply like the country’s railways and nobody expected Kiwirail to make a profit.

A spokesman for Finance Minister Bill English said the Government had set aside $7.782 billion for roading over the next two years.

“But before undertaking an investment of this size, it is appropriate that officials look at all options – including options for highway closures.

“As we said in May, the Government is committed to a national road network, but ongoing subsidies of around $3.891 billion per year are unsustainable. The funding provided at the Budget gives the National Land Transport board a two-year window to identify savings and reduce the level of ongoing Crown funding required,” he said.

Barmy?

You bet.

The young folk at Treasury need to get out more often and engage in illicit drug use; binge drinking; and random sex. It would be no more pointless than some of the gormless ideas they come up with.

In case anyone thinks that Treasury’s idea is remotely “clever”, consider the number of passenger trips by rail each year;

Auckland: 13 million

Wellington: 11.9 million

Total: 24.9 million

That is nearly 25 million extra car-trips on the road in both cities.

It does not take a bright young thing employed by Treasury to quickly realise the impact that would have on our city roads. In brief; Auckland and Wellington would grind to a halt. Our economy would collapse within a week.

We should be looking at ways to maximise use of rail, not canning it. Anything that takes cars and trucks of our roads is a major benefit to our economy and environment.

Perhaps I was wrong and there is illicit drug taking amongst some Treasury boffins. Someone has been at the marijuana cookie-jar. What other explanation can there be for this bizarre idea?

Addendum1

Road

The largest element of the Vote is the funding for roading ($3,891 million or 91% of the total Vote). This is primarily the funding for the National Land Transport Programme which is funded from road tax revenue collected by the Crown ($3,014 million or 71% of the Vote).

.

.

.

References

Radio NZ: Close down rail, advised the Treasury

NZ Treasury: Vote Transport Overview

NZ Herald: Auckland rail passenger numbers top 13 million

Dominion Post: Record Wellington train use set to stave off fare increases

Previous related blogposts

Letter to the Editor – User Pays is not a very clever solution

.

.

.

This blogpost was first published on The Daily Blog on 11 July 2015.

.

.

= fs =

Government Minister sees history repeat – responsible for death

.

.

The last few weeks have produced some curious stories from the media, relating to the current government that, at first glance, have no common thread linking them.

Closer scrutiny yields a different perspective…

1 April 2009

National implements first round of tax cuts.

According to Dear Leader Key, the 2009 tax cuts cost the government $1 billion;

“…The tax cuts we have delivered today will inject an extra $1 billion into the economy over the coming year, thereby helping to stimulate the economy during this recession. More important, over the longer term these tax cuts will reward hard work and help to encourage people to invest in their own skills, in order to earn and keep more money.”

1 October 2010

National carries out second round of tax cuts.

According to information obtained from Parliamentary Library in May 2012, and released by the Greens, the 2010 tax cuts cost the country an additional $2 billion;

The Green Party has today revealed that the National Government has so far had to borrow an additional $2 billion dollars to fund their 2010 tax cut package for upper income earners.

New information prepared for the Green Party by the Parliamentary Library show that the estimated lost tax revenues from National’s 2010 tax cut package are between $1.6–$2.2 billion. The lost revenue calculation includes company and personal income tax revenues offset by increases in GST.

Cost of both tax cuts, in terms of lost revenue: $2.6 billion – $3.2 billion, per annum.

8 May 2014

Then-Minister for Housing, Nick Smith confirms in Parliament that National has been demanding multi-million dollar dividends from Housing New Zealand;

“The average dividend under the 5 years so far of this Government has been $88 million. The dividend this year is $90 million.”

The dividend payable does not include taxes paid by Housing NZ.

24 September 2014

Fonterra cuts payout to farmers for dairy milk solids by 70 cents to $5.30/kg milk solids.

6 October 2014

Dear Leader Key reveals that the international fall in dairy prices will affect the government’ tax revenue. Key states;

“It can have some impact because if that’s the final payout, the impact would be as large as $5 billion for the economy overall, and you would expect that to flow through to the tax revenue, both for the 14/15 year and the 15/16 year...”

Reported by TV3’s Brook Sabin on the same day;

“A big state-house sell-off is on the way, and up to $5 billion-worth of homes could be put on the block.

The shake-up of the Government’s housing stock will be a key focus for the next three years, with Finance Minister Bill English to lead it.

On the block is everything from a tiny 75 square metre two-bedroom state house in Auckland’s Remuera, on the market for $740,000, to a three-bedroom home in Taumarunui for just $38,000. Thousands more properties will soon hit the market.”

10 December 2014

Fonterra announced that payouts to farmers would drop from $5.30/kg of milk solids to $4.70/kg. A Fairfax report states;

The predicted payout could hurt the national economy for a couple of years, including tax revenue.

28 January

Dear Leader Key announced the sale of 1,000 to 2,000 state houses within the year, and suggested there might be further sales later.

30 April

Fonterra announces further reduction of milk solid payout to farmers from $4.70/kg milk solids to $4.50/kg of milk solids.

6 May

National announced that it’s entire stock of 370 state houses in Invercargill, and 1,250 in Tauranga, would be put on the market to be sold off.

22 May

National’s 2015 Budget included;

- Dumping the $1,000 Kiwisaver ‘kick-start’ government contribution

- $684 million deficit for 2014/2015

- a new travel tax on arriving/departing airport travellers

- extension of a telecommunications tax to fund government’s rural broadband expansion programme

31 May

A story in the NZ Herald by Lynley Bilby reported that schools throughout the country were cutting back on their activities due to funding constraints;

Financially strapped secondary schools are cutting back on classroom activities, dropping field trips, ditching science experiments and even removing courses after a crackdown on parent donation rules.

[…]

In one case a secondary school had to abandon an NCEA Level 2 biology field trip to the beach because it could not afford to hire a bus.

The science teacher had to apply to the New Zealand Qualifications Authority to alter the data collection assessment so the students would not fail.

Another school was forced to alter its science curriculum by reducing experiments to trim costs.

One school said it had done away with activities outside the school gates, including a sea kayaking standard for year 12 physical education students.

Principals reported outdoor education programmes, food, hospitality and technology courses could be affected by the funding guidelines.

[…]

The recently released Budget saw the Government fund school operational grants to the tune of $1.32 billion for the 2015/16 financial year.

But the NZSPC [New Zealand Secondary Principals’ Council] said that was not enough to meet costs, particularly for low decile schools.

It is apparent that state funding of education is inadequate, and schools are either having to make drastic cuts to “classroom activities, dropping field trips, ditching science experiments and even removing courses” – or raise “voluntary donations” from parents. Those “donations” and fundraising events by parents and teachers raised more than $357 million in 2012, an increase of $16 million from 2011.

Nearly a third of a billion dollars – that is the shortfall of full funding of education in this country.

1 June

National announced the launch of so-called “social bonds“, where;

…the Government will pay a return to investors, determined by whether or not agreed social targets have been achieved.

The Government said social bonds were about the private and public sector organisations operating together to fund and deliver services.

This year’s Budget set aside $28.8 million to fund what is essentially contracting out some mental-health services to private investors. As Health Minister, Dr Jonathan Coleman explained in Parliament the next day;

” One of the benefits of social bonds is that they protect service providers by shifting financial risk away from the providers and on to investors who provide the funding and who are better placed to absorb risk…

[…]

…social bonds are an exciting financial instrument with the potential to revitalise social policy delivery and inject private sector funding and innovation into the sector.”

Note the term used by Dr Coleman (quoting from a Dept of Internal Affairs report); “financial instruments”. According to investopedia.com, a “financial instrument is defined as;

A real or virtual document representing a legal agreement involving some sort of monetary value. In today’s financial marketplace, financial instruments can be classified generally as equity based, representing ownership of the asset, or debt based, representing a loan made by an investor to the owner of the asset.

[…]

Financial instruments can be thought of as easily tradeable packages of capital, each having their own unique characteristics and structure. The wide array of financial instruments in today’s marketplace allows for the efficient flow of capital amongst the world’s investors.

In effect, funding for mental health services is being transferred from the State – the traditional source – to private investors. Plainly put – National is seeking investment funding for mental health services.

These so-called “social bonds” appear to be a continuation of privatisation-by-stealth.

Interestingly, the right-wing think-tank, ‘New Zealand Initiative‘ (formerly the Business Roundtable and NZ Institute) published a report in March advocating the use of social bonds, and calling for the government to implement them. Three months later, National did precisely that.

As the government’s tax revenue was slashed by between $2.6 billion – $3.2 billion, per annum, after the 2009 and 2010 tax cuts, National’s tax-take and expenditure was further put under pressure by the 2007/08 Global Financial Crisis; the resulting Great Recession; rising unemployment; tumbling dairy pay-outs; and the Christchurch re-build.

National’s much heralded prediction of a $372 million Budget surplus this year collapsed into a massive $684 million deficit – a turn-around of nearly a billion dollars.

A billion dollars – the cost of the 2009 tax cuts.

But added to the fiscal deficit is another deficit; the hidden social costs which New Zealanders are slowly, belatedly, waking up to.

Community organisations are winding back, or closing down completely;

.

.

.

.

State assets such as housing and schools are suffering a lack of maintenance, the likes of which we have seen only in Third World nations. The recent case of Northland College in Kaikohe revealed a badly run-down facility that was so delapidated that police asked to use them for training simulations because they represented the closest thing available to a “ghetto environment”, according to school principal, Jim Luders.

Luders’ description of his school is hard to believe in 21st century New Zealand;

“The conditions are appalling. They’re unsafe. There’s water leaks, mould, asbestos in parts. It’s without doubt the worst school stock in New Zealand.

I would challenge any school to send in photos that are worse.”

.

.

Back in 2008, an ERO report highlighted the poor state of Northland College. Seven years later, the problem remains unchanged.

New Zealand’s State housing does not fare better. TVNZ’s Corin Dann wrote this piece on 24 March, which should have raised alarm bells throughout the nation (it did not);

The Finance Minister is signalling a deferred maintenance bill for the country’s state houses of $1.2 billion will have to be met by the government in future.

Community housing providers looking to buy state houses off the government say they believe Housing New Zealand has failed to carry around $1.2 billion in maintenance on state houses.

[…]

Mr English says the lack of maintenance on state houses is concerning and that in the long run the government will need to invest the $1.2 billion dollars in state houses to get them up to scratch.

[…]

When asked why Housing New Zealand had not spent as much money as it should have on maintenance, Mr English put the blame partly on the previous Labour government saying they had chosen to build new state houses rather than fix up old ones.

However, when pressed he conceded that “looking back everyone could have performed better”.

$1.2 billion dollars. Half the cost of the 2010 tax cuts.

Which, in part, explained why the Salvation Army assessed National’s offer to buy some State houses – and promptly ran a mile. As the SA’s spokesperson, Major Campbell Roberts stated, with crystal clarity;

“We would be faced with significant maintenance issues, houses which have got the wrong tenants … we would also need to do extensive development.

We would be putting so much resource into this that we could not actually put resource into anything else.

We can’t guarantee that we would be able to improve things for the state tenants, which is exactly what we would want to do by taking [the properties] over at this stage, on our own.”

Community Housing Aotearoa director, Scott Figenshow, was even more to the point;

“Our members are very concerned about the families they work with, and are only interested if they can do a better job than Housing New Zealand. At the moment the sums simply don’t stack up.

Last month the Government confirmed $1.2 billion of deferred maintenance on the state housing stock. Why would a provider want to purchase a liability?”

Figenshow suggested, instead, that Government reinvest the $220 million it was forecast to receive in tax and dividends from Housing NZ, back into much needed maintenance and upgrades.

For two year old Emma-Lita Bourne, tenant of a State house in Otara, South Auckland, the situation is academic. She died last August living in an environment that was clearly not conducive for human health and well-being;

Two-year-old Emma-Lita Bourne died in Auckland’s Starship Hospital in August last year following a brain haemorrhage.

She had been taken to hospital with a fever, which turned out to be a form of pneumonia.

In his findings, released on Thursday, coroner Brandt Shortland said pneumonia played a part in Emma-Lita’s death and the Housing New Zealand home in Otara where her family lived may have been to blame for her ill-health.

Other children in the family also became sick while the family was living there, with one suffering from rheumatic fever.

[…]

In May 2014, Emma-Lita’s family had been fast-tracked up the waiting list to be transferred to a better state house, because of the rheumatic fever risk.

Although they’re now living in a different home, the move didn’t happen before Emma-Lita’s death.

Housing Minister Nick Smith said the government’s policy to fast-track those at risk of rheumatic fever into better homes has helped 270 families.

As Radio NZ reported Coroner Brandt Shortland’s findings;

“In my view, the house unfortunately was unhealthy for this family.

I am of the view the condition of the house at the time being cold and damp during the winter months was a contributing factor to Emma-Lita’s health status.”

Housing NZ’s general manager of tenancy services, Kay Read, accepted the likelihood of a link;

“Our responsibility is to provide warm, safe and dry housing and, from the reports in this situation, it appears that we’ve failed.”

The above Radio NZ story features photos of another Housing NZ property also in a delapidated condition, with mould and condensation streaming down the walls. The property is tenanted.

Interviewed on Radio NZ’s ‘Morning Report‘, Minister for Housing, Bill English, denied that money was the core problem of run-down Housing NZ properties;

“They’ve done a very large scale programme – insulated every house that it can, which is 48,000 houses over the last four or five years.

It’s got to deal with the same limitations of process as everybody else, it’s got to get consents, it’s got to find a workforce, but it’s not short of money to do the job.”

English’s assurance that Housing NZ “not short of money to do the job” appears to be contradicted by Housing NZ’s 2013/14 Annual Report;

The responsive repairs programme, which includes work on vacant properties, is dependent on demand, which was higher than expected in 2013/14. Consequently, the budget was overspent due to higher volumes of work orders. The average cost per work order was also higher as a result of more comprehensive repairs and upgrades being carried out on vacant properties. To mitigate this overspend, we deliberately reduced the planned maintenance programme, which decreased the percentage of maintenance spend on planned activity. [p28]

Furthermore, on page 36 of the 2013/14 Annual Report, Repairs and Maintenance is given as $220 million for the period.

This is $1 billion less than the $1.2 billion quoted by Bill English to TVNZ’s Corin Dann on 24 March, this year.

Whilst clouded in waffle, English admitted that “the system” (ie; government and Housing NZ) was responsible for this little girl’s death;

“Regardless of the cause it’s a tragedy for this family. It appears that while the system worked to some extent, we’ve got to test whether it was responsive enough quickly enough to the very real needs of this family.

They didn’t really have the option of ordering a higher grade of insulation for the house.

We’ve got a strong focus on organising the government services around vulnerable families – and this is a vulnerable family – rather than expecting those vulnerable families to find their way around various government departments.

This type of case should illustrate I think to the people making public policy, including us, that we’ve got some way to go yet to be as responsive as we should be when there’s serious issues going on in this family.”

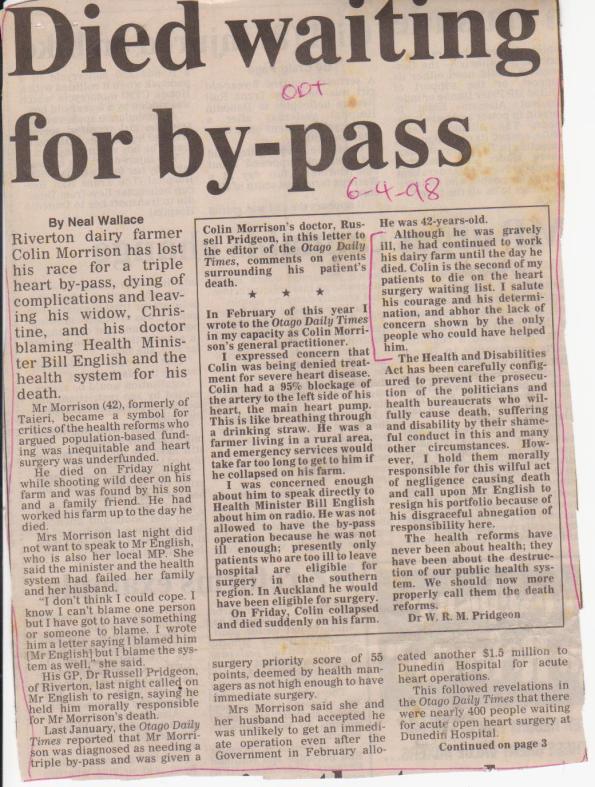

Unfortunately, this is not the first time that New Zealanders have died for lack of adequate state funding of social services. For Minister Bill English, this is no doubt a matter of déjà vu, bringing back memories of late Northlander, Rau Williams, and late Southland farmer, Colin Morrison;

.

.

The 6 April 1998 ‘Otago Daily Times’ story stated;

Riverton dairy farmer Colin Morrison (42) has lost his race for a triple heart by-pass, dying of complications and leaving his widow, Christine, and his doctor blaming Health Minister Bill English and the health system for his death.

[…]

Mrs Morrison last night did not want to speak to Mr English, who is also her local MP. She said the minister and the health system had failed her family and her husband.

“I don’t think I could cope. I know I can’t blame one person but I have got to have something or someone to blame. I wrote him a letter saying I blamed him [Mr English] but I blame the system as well”, she said.

His GP, Dr Russell Pridgeon, of Riverton, last night called on Mr English to resign, saying he held him morally responsible for Mr Morrison’s death.

A month later, then-Health Minister Bill English conceded that his government’s “booking system” was a failure – but not before others died on his watch as Health Minister;

.

.

Bill English did not resign, though National were swept from office the following year by Helen Clark’s Labour-led coalition.

English is now Minister for Housing.

And once again, people are dying.

.

.

.

Addendum1

The National government does not have money to spend on refurbishing state housing, but it does have money for other projects;

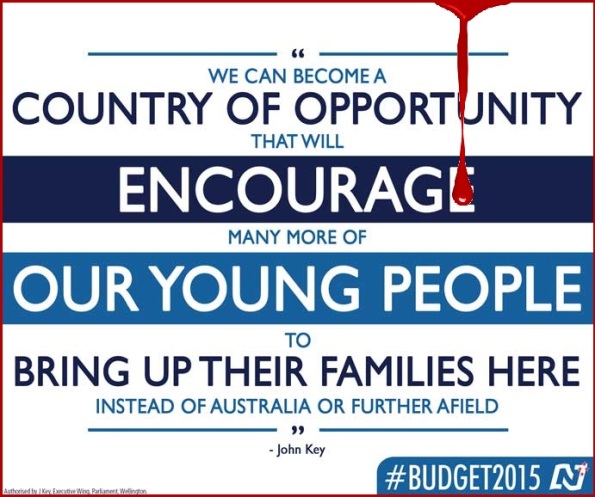

.

.

Addendum2

The National government does not have money to spend on refurbishing state housing, but it does have money for other projects;

.

.

Addendum3

The National government does not have money to spend on refurbishing state housing, but it does have money for other projects;

.

.

.

.

References

Parliament: Hansards – Tax Cuts – Implementation

Scoop media: Govt’s 2010 tax cuts costing $2 billion and counting

Parliament: Hansards – Housing, Affordable—Progress and Management of Housing New Zealand

Agrimoney.com: Dairy rout spurs $4bn cut to Fonterra milk payout

Hive News: Treasury re-crunching Budget numbers for low Fonterra payout

TV3 News: State housing sell-off worth $5B

Fairfax media: Slashed Fonterra payout will affect all NZers

Radio NZ: PM states housing intentions

Otago Daily Times: Fonterra cuts dairy payout forecast

Radio NZ: Tauranga, Invercargill state houses to be sold

Radio NZ: Budget 2015 – What you need to know

Fairfax media: International airfares will rise new departure tax

Radio NZ: Telecommunications tax will hit consumers

NZ Herald: Secondary schools to slash spending

Radio NZ: Social bond system to target mental health

Parliament: Hansards – 5. Mental Health Services—Social Bonds

Investopedia.com: Financial Instrument

NBR: Roundtable and NZ Institute morph into new libertarian think tank

NZ Intiative: Social Impact Bonds

Government Economics Networks: The case for social bonds: A new way of financing and delivering social services

Fairfax media: Budget 2014 – The essential guide

Dominion Post: Women’s Refuge cuts may lead to waiting lists

NZ Herald: Govt funding cuts reduce rape crisis support hours

TV1 News: ‘Devastating news for vulnerable Kiwis’ – Relationships Aotearoa struggling to stay afloat

Fairfax media: Government may let Relationships Aotearoa fold

TV1 News: Relationships Aotearoa hanging on at ‘awful’ 11th hour

Radio NZ: Counselling service rejects claim it’s badly run

NZ Herald: Northland College students stuck with ‘worst classrooms in New Zealand’

Radio NZ: Northland ‘slum’ school fix-up very slow

TV1 News: English concerned by State House deferred maintenance bill

Radio NZ: Salvation Army won’t buy state houses

Fairfax media: Salvation Army says no to state houses

NZCity: Girl’s death should spur action – Greens

Radio NZ: Damp state house linked to child death

Radio NZ: State housing criticism valid, says English

Housing NZ: 2013/14 Annual Report

Radio NZ: English responds to criticism of state houses (Alt. Link) (audio)

Dunedin Star: Death – the Northland Way

NZPA: English agrees system flawed

TV1 News: Government accused of wasting $11.5 million on wealthy Saudi farmer

NZ Herald: PM defends $30m payout to Rio Tinto

NZ Herald: John Key defends cost of flag referendums

Additional information

Mana News: Housing under neoliberalism

NBR: Matthew Hooton – Gulf games fail to deliver

NBR: Matthew Hooton – Flying sheep endanger McCully

NZ Herald: Bryce Edwards – Political roundup – The bizarre ‘bribery’ and flying sheep scandal

NZ Herald: Dita De Boni – Kiwis hoodwinked over state housing

Radio NZ: Demand increasing on schools to fund out classroom activities

Radio NZ: Government hikes up Housing NZ dividend almost 20 percent (audio)

Previous related blogposts

“It’s fundamentally a fairness issue”- Peter Dunne

Housing; broken promises, families in cars, and ideological idiocy (Part Tahi)

Housing; broken promises, families in cars, and ideological idiocy (Part Rua)

Housing; broken promises, families in cars, and ideological idiocy (Part Toru)

The cupboard is bare, says Dear Leader

.

.

.

This blogpost was first published on The Daily Blog on 6 June 2015.

.

.

= fs =

The Mendacities of Mr Key # 13: Kiwisaver – another broken promise

.

.

In the past, when governments broke promises, they were clumsy, heavy-handed, and were punished at the polls.

Political parties and their strategists have learned from those mistakes. Now, when promises are broken, they are done gradually, by incremental steps. So when the media picks up on it and reports, the public barely notices nor cares.

One such recent broken promise was National’s dumping of the Kiwisaver $1,000 kick-start government contribution, revealed in this year’s Budget.

On 9 July 2008, Key gave a hint as to National’s intentions toward Kiwisaver;

“There won’t be radical changes. There will be some modest changes to KiwiSaver. We will announce that pretty soon.”

On 8 October 2008 – precisely one month before the general election that year – Bill English outlined National’s policy toward Kiwisaver if they became government;

National is proposing three changes to KiwiSaver. These changes will make KiwiSaver fairer, more affordable for current and future members, and more enduring in the long-term.

The three changes National is planning are:

• First, a reduction in the minimum contributions demanded of employees.

At the moment, most KiwiSaver members are required to contribute 4% of their income to KiwiSaver. In return, they receive a contribution from their employer equal to 1% of their income. As an interim measure, Labour has allowed some KiwiSaver members to make a more affordable contribution, of 2%. In return they receive an equal contribution from their employer.

National thinks this 2 +2 arrangement is fair and affordable. We disagree with Labour’s plans to ramp-up KiwiSaver over the next three years.

National will make KiwiSaver a 2+2 scheme. Once this is bedded down, however, we will consider offering an alternative 3+3 scheme option, as and when economic conditions permit.

Let me stress that those who want to contribute more than 2% of their wages to KiwiSaver will still have that option. And employers who want to match contributions beyond 2% will still have that option, too.

• Second, National will remove the tax credit that is currently paid to employers whose staff are enrolled in KiwiSaver. This will have no effect on the amount of money that goes into New Zealanders’ KiwiSaver accounts.

This subsidy was a transitional tool but it creates a complex money-go-round. It simply doesn’t meet National’s test for effective, disciplined government spending.

I note that the net effect for employers will be small, once they take into account the lower minimum contribution rate.

• Finally, National will repeal recent legislation which effectively discriminates against some employees who can’t afford to join KiwiSaver.

However, we will keep a safeguard in place, by amending the KiwiSaver Act to make it explicit that no employee can have their gross taxable pay reduced as a consequence of joining KiwiSaver.

National believes that these three changes to KiwiSaver will make it a fairer, more affordable and more enduring savings scheme.

No mention of cutting the $1,000 kickstart contribution by government.

In fact, National made no mention whatsoever of removing the $,1000 kickstart contribution at the last election. Claire Trevett at the NZ Herald wrote this informative piece on the issue;

A broken promise is when someone reneges on something they promised to do or not do.

If you were silent, say, about axing the $1000 kickstart payment for new KiwiSaver members, it is not a broken promise, strictly speaking.

But it is an act of bad faith, especially when it happens in the first Budget following an election in which kickstart payments were not mentioned.

The amount of tinkering and tampering with the KiwiSaver scheme since it was announced in 2005 is incredible.

Most of Labour’s changes served to benefit the saver at the expense of the public purse. Not surprising seeing as it began the scheme.

And most of National’s tampering has reduced benefits to the saver and helped the public purse.

Very few other media commentators and columnists have taken National to task for what is undeniably a blatant election broken promise.

Cutting the $1,000 kick-start contribution is short-sighted. Even English had to admit on TV3’s ‘The Nation‘, on 23 May;

“…and New Zealand savings rates are now— have been positive for five years for the first time in decades.”

Our improved saving record has not come about because of anything National has done (despite English’s insistence). In fact, National has undermined every effort to improve this country’s dismal savings record.

In 1975, the then-Muldoon-led National government dumped the previous Labour government’s superannuation savings-policy. This cost our nation an estimated $278 billion (according to Infometrics and the Financial Services Council).

The 2014 Infometrics report calculated that;

“… a worker on the average wage would have saved $256,000 in the scheme over the past 40 years.”

But Muldoon could not wait to get his meddling hands on the scheme, and like many things he touched, it died.

The same applies to the current Kiwisaver scheme.

The current Key-led National government’s piece by piece gutting of Kiwisaver – ongoing since 2008 – confirms that no superannuation savings scheme is safe from that party’s political interference.

In this instance, removing the $1,000 kick-start contribution is a direct consequence of National’s ill-conceived tax cuts in 2009 and 2010, which left a gaping hole in National’s taxation-revenue.

In effect, New Zealanders continue to pay for those two unaffordable tax-cuts, whether by cutting back on government services such as bio-security; under-funding social organisations such as Relationships Aotearoa; increasing government user-charges such as Family Court fees, medical prescriptions; taxing children; introducing new taxes, etc, etc, etc.

National was so desperate to win the 2008 general election that despite the Global Financial Crisis, it proceeded with tax cuts that we simply could not afford.

National must now cut every form of expenditure it thinks it can get away with, if it is to escape the prospect of another Budget deficit next year.

We are the ones paying for what, essentially, was an election bribe.

On this occasion, though, our children will end up paying as well.

Addendum1

For more invaluable information, refer to Audrey Young’s excellent piece in the Herald, Why axing kickstart is an act of bad faith.

.

.

.

.

.

.

References

Radio NZ: PM defends scrapping of KiwiSaver kickstart

NBR: Key signals ‘modest changes’ to KiwiSaver

Wikipedia: 2008 General Election

Bill English: National’s Economic Management Plan

NZ Herald: Why axing kickstart is an act of bad faith

Fairfax media: Compulsory super ‘would be worth $278b’

Scoop media: National Reveals Biosecurity Cuts

NZ Family Violence Clearinghouse: Changes signalled to funding of community organisations; Relationships Aotearoa may close

Scoop media: Vulnerable children at risk from Family Court fees increase

NZ Herald: Prescription fees increase

NZ Herald: Budget 2012 ‘Paper boy tax’ on small earnings stuns Labour

Fairfax media: International airfares will rise new departure tax

Additional

NZ Herald: National denies it misled voters over taxes

Previous related blogposts

Regret at dumping compulsory super – only 37 years too late

Did National knowingly commit economic sabotage post-2008?

Budget 2013: Suffer the little children… to starve

The Mendacities of Mr Key # 12: No More Asset Sales (Kind of)

.

.

.

.

This blogpost was first published on The Daily Blog on 27 May 2015.

.

.

= fs =

Latest Roy Morgan poll – wholly predictable results and no reason to panic

.

.

The latest Roy Morgan poll reports a surge in support for National – up 8.5% to 54% – one of the highest rises since October 2011, according to Australian-based the polling company.

Labour and the Greens have suffered a corresponding drop in support;

National: 54% (+ 8.5%)

Labour: 25.5% (-2%)

Green Party: 10.5% (- 3%)

NZ First: NZ First 6% (- 2.5%)

Maori Party: 1% (-0.5%)

ACT: 1% (n/c)

United Future: nil (n/c)

Mana Party: nil (n/c)

Conservative Party: 1% (n/c)

Undecideds were up one percentage-point to 5%.

However, the results should be seen in the context that the poll was conducted in the lead up to, and during, the 2015 Budget, delivered on 21 May.

In fact, National’s polling rises during each Budget event, only to drop back down as media attention and political hype subsides. The charts below show the correlation between Budget events and the days/weeks leading up to each Budget Night, where National drip-feeds positive news stories to the public, via media;

.

.

.

The ‘spike’ in National’s support will begin to abate, as on previous occassions.

As housing prices continue to escalate, and child poverty continues to be a major problem in our society, the public will once again focus on what – if anything – National is doing to alleviate them.

On top of which will be a growing feeling that if English fails to deliver a Budget surplus next year, then National’s talk of tax cuts becomes more and more an absurdity. This seems more than likely according to various commentators, as next year’s surplus has already been pared back from $565 million to $176 million.

National got away with promises of tax cuts in 2008, even as the Global Financial Crisis was impacting on our economy. But at that stage, the Great Recession had not yet hit with full force. Unemployment in 2008 was still only 4.3% and the Clark-led Labour government had paid down most of the country’s sovereign debt.

By contrast, unemployment is now at 5.8% and the country is around $65 billion in debt. (Net core crown debt is forecast to be $61.7 billion by 30 June, up $1.7 billion from last year.)

Faced with the Four Horsemen of the Fiscal Apocalyspse of another Budget deficit; higher debt; broken promise of tax cuts; and a runaway housing crisis in Auckland – National’s undeserved reputation as a “prudent manager of the economy” begins to look every bit as shabby as what Muldoon left the country.

By 2017, even a Budget event may not be sufficient to give National a boost in the polls.

.

.

.

References

Roy Morgan Poll: May 25 2015

NBR: Budget 2015 – NZ credit ratings unaffected by government’s 2015 budget

Additional

Fairfax media: Budget 2015 – An idiot’s guide

.

.

.

.

This blogpost was first published on The Daily Blog on 26 May 2015.

.

.

= fs =

The cupboard is bare, says Dear Leader

.

.

Prime Minister John Key is lowering expectations about measures to combat child poverty in this week’s budget.

Mr Key says there’ll be “some support” for those suffering material deprivation.

“But you’d appreciate that there’s a limited amount of resources that we’ve got in very tight financial conditions,” he told reporters on Monday.

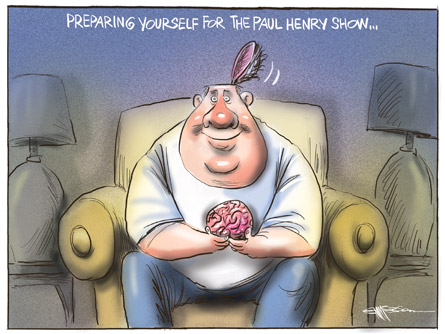

Key has driven home the lack of “resources” (ie; money) in this year’s budget. On the Paul Henry show – that great bastion of critical thinking –

.

.

– Key was his usual relaxed self as he casually informed his host;

“We don’t have a lot of money. But again what I’d say to you is that we already do a lot, but there could be more we could do.”

And just to drive home the point, again casually;

“When you go to a Budget, you don’t have a lot of cash – and we haven’t, because we’ve been wanting to get the books in order.”

Of course National doesn’t “have a lot of money“.

Remember the tax cuts that Key promised during the 2008 general election? That was the money National gave away in 2009 and 2010.

2008 was election year, and National’s aspiring leader, John Key, was pulling out all stops to win. His promises of tax cuts were the lynch-pin of National’s campaign strategy.

On 2 August 2008, National announced;

National will fast track a second round of tax cuts and is likely to increase borrowing to pay for some of its spending promises, the party’s leader John Key says.

But Mr Key said the borrowing would be for new infrastructure projects rather than National’s quicker and larger tax cuts which would be “hermetically sealed” from the debt programme.

The admission on borrowing comes as National faces growing calls to explain how it will pay for its promises, which include the larger faster tax cuts, a $1.5 billion broadband plan and a new prison in its first term.

On 26 September 2008, the Herald reported;

GDP shrank 0.2 per cent in the June quarter, confirming what everyone already knew – that the country is in recession. The smaller than expected June quarter decline followed a fall of 0.3 per cent in the three months to March, so the country now meets the common definition of recession: two consecutive quarters of economic contraction.

Undeterred by the country entering into recession, on 6 October 2008, Key promised;

John Key has defended his party’s planned program of tax cuts, after Treasury numbers released today showed the economic outlook has deteriorated badly since the May budget. The numbers have seen Treasury reducing its revenue forecasts and increasing its predictions of costs such as benefits. Cash deficits – the bottom line after all infrastructure funding and payments to the New Zealand Superannuation Fund are made – is predicted to blow out from around $3 billion a year to around $6 billion a year.

With a looming election only a month away, on 14 October 2008, National maintained it’s commitment to tax-cuts;

National will not slash spending at a time when people are looking to the government for a sense of security. In developing our economic management plan, we have concentrated on the fundamentals of the economy, and particularly on laying the foundations for a future increase in productivity.

National’s rebalancing of the tax system is self-funding and requires no cuts to public services or additional borrowing.

Over the next term of government the total cost of National’s personal tax cuts is balanced by the revenue savings from:

• Changes to KiwiSaver.

• Discontinuing the R&D tax credit.

• Replacing Labour’s proposed tax cuts.Overall, our fiscal policy does not result in any requirement for additional borrowing over the medium term.

National won the election on 8 November 2008.

By 6 March 2009, the Global Financial Crisis had crashed New Zealand’s economy;

Budget deficit worse than forecast; debt blows out by NZ$15.4 bln

The New Zealand government’s operating balance before gains and losses (OBEGAL) for the seven months ended January 31 was NZ$600 million, which was NZ$800 million below the pre-election update and NZ$300 million below December forecasts, Treasury said. Tax revenue and receipts during the period were NZ$500 million lower than the pre-election forecast. Meanwhile, Treasury also disclosed a NZ$15.4 billion rise in Gross Sovereign Issued Debt to NZ$45.4 billion (25.3% of GDP) from the pre-election forecast. This included fresh Reserve Bank bill issuance to mop up the liquidity from lending to the banks against securitised mortgages.

Despite falling tax revenue, and increased borrowing by the government, the tax cuts went ahead regardless. First, on 1 April 2009. The second trance on 1 October 2010.

The cost of these tax cuts was in the billions.

According to Key, the 2009 tax cuts cost the government $1 billion;

“…The tax cuts we have delivered today will inject an extra $1 billion into the economy over the coming year, thereby helping to stimulate the economy during this recession. More important, over the longer term these tax cuts will reward hard work and help to encourage people to invest in their own skills, in order to earn and keep more money.”

And according to information obtained from Parliamentary Library, and released by the Greens, the 2010 tax cuts cost the country an additional $2 billion;

The Green Party has today revealed that the National Government has so far had to borrow an additional $2 billion dollars to fund their 2010 tax cut package for upper income earners.

New information prepared for the Green Party by the Parliamentary Library show that the estimated lost tax revenues from National’s 2010 tax cut package are between $1.6–$2.2 billion. The lost revenue calculation includes company and personal income tax revenues offset by increases in GST.

All up, National gave away an estimated $3 billion – per year – in tax cuts.

That is why John Key has reneged on his promise – made on 22 September 2014, on TV3’s ‘Campbell Live‘ – that his third term would be spent combating child poverty.

No money.

Not only will National abandon any serious work to alleviate growing child poverty in this Country of Plenty, but it seems that the viability of community organisations doing invaluable work are threatened by chronic under-funding.

These community groups are often the ones on the front-line, picking up the pieces after government programmes are cut back or cancelled entirely. Even as our Brave New Free-Market World widens the wealth-gap even further, year after year.

Since National came to office in 2008, their cuts to community organisations has been systematic and dire.

From Women’s Refuge;

.

.

Then it was the turn of Rape Crisis;

.

.

To medical clinics serving our most vulnerable, in-need youth;

.

.

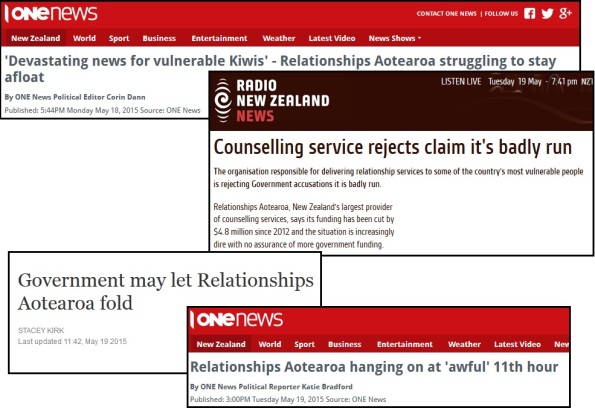

A Radio NZ report on 19 May revealed that yet another community organisation has become the latest victim of National’s mania to starving community organisations of funding;

.

.

Relationships Aotearoa is facing closure as Radio NZ outlined on 19 May;

Relationships Aotearoa, New Zealand’s largest provider of counselling services, says its funding has been cut by $4.8 million since 2012 and the situation is increasingly dire with no assurance of more government funding.

The organisation posted a $271,000 deficit for the year ended 30 June 2014.

[…]

Relationships Aotearoa spokesman John Hamilton said since 2012 its funding from government agency contracts had fallen by $4.8 million – a fall of about 37 percent from $13.1m to a forecast $8.2m.

“There’s been no grants or injections to the bottom line … there’s been no CPI increase for MSD services for seven years but there has been increasingly complex demands in reporting requirements.”

Mr Hamilton said the situation was increasingly dire and more than 120 staff and 60 contractors would potentially lose their jobs if went goes under.

A funding cut of $4.8 million…

A deficit last year of $271,000…

Staff cuts of 46…

When interviewed on Radio NZ’s Morning Report, Minister Anne Tolley’s outright denial of any cuts to Relationship Aotearoa’s funding – despite evidence presented to her – left seasoned journalist and interviewer, Guyon Espiner, frustrated with her moronic semantics game-playing;

.

.

Tolley’s exercise in word-games beggars belief and if she thinks any intelligent person listening to her comments gave credence to her obvious avoidance-tactics, then she is delusional. There is a world of difference between Radio NZ’s critical audience – and those who stare stupified and lobotimised at ‘X Factor‘/’My Kitchen Rules‘/’The Block‘.

As Key lamented,

“We don’t have a lot of money. But again what I’d say to you is that we already do a lot, but there could be more we could do.”

“When you go to a Budget, you don’t have a lot of cash – and we haven’t, because we’ve been wanting to get the books in order.”

Though there is always cash for really important things that “matter to New Zealanders”.

Things like corporate welfare;

.

.

Or like a flag referendum – $26 – $27 million;

.

.

And even spending $6 million of taxpayer’s money to build a sheep farm for a Saudi millionaire;

.

.

Key will always find money for things that matter to his government.

Child poverty just doesn’t happen to be one of them.

.

.

References

NZCity News: PM lowering expectations on child poverty

NZCity News: Child poverty targeted in budget

TV3 News: Child poverty targeted in Budget – John Key

NZ Herald: Nats to borrow for other spending – but not tax cuts

NZ Herald: Recession confirmed – GDP falls

NZ Herald: Key – $30b deficit won’t stop Nats tax cuts

Jo Goodhew MP for Rangitata: Newsletter #41

Interest.co.nz: Budget deficit worse than forecast; debt blows out by NZ$15.4 bln

Parliament: Hansards – Tax Cuts – Implementation

Scoop media: Govt’s 2010 tax cuts costing $2 billion and counting

Dominion Post: Women’s Refuge cuts may lead to waiting lists

NZ Herald: Govt funding cuts reduce rape crisis support hours

TV1 News: ‘Devastating news for vulnerable Kiwis’ – Relationships Aotearoa struggling to stay afloat

Fairfax media: Government may let Relationships Aotearoa fold

TV1 News: Relationships Aotearoa hanging on at ‘awful’ 11th hour

Radio NZ: Counselling service rejects claim it’s badly run

Radio NZ – Morning Report: Min. Tolley responds to potential collapse of counselling (alt. link) (audio)

NZ Herald: PM defends $30m payout to Rio Tinto

NZ Herald: John Key defends cost of flag referendums

TV1 News: NZ Government gifts $6m to offended Saudi businessman

Other blogs

Local Bodies: Government Kills Relationships Aotearoa

Previous related blogposts

“It’s fundamentally a fairness issue”- Peter Dunne

.

.

.

.

This blogpost was first published on The Daily Blog on 20 May 2015.

.

.

= fs =